Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with the graph. Where do I plot? For the bottom question, the options are as follows. 1. equals, is more than, is less

Please help with the graph. Where do I plot?

For the bottom question, the options are as follows.

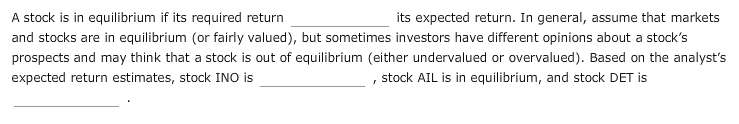

1. equals, is more than, is less than.

2. in equilibrium, undervalued, overvalued.

3. in equilibrium, undervalued, overvalued.

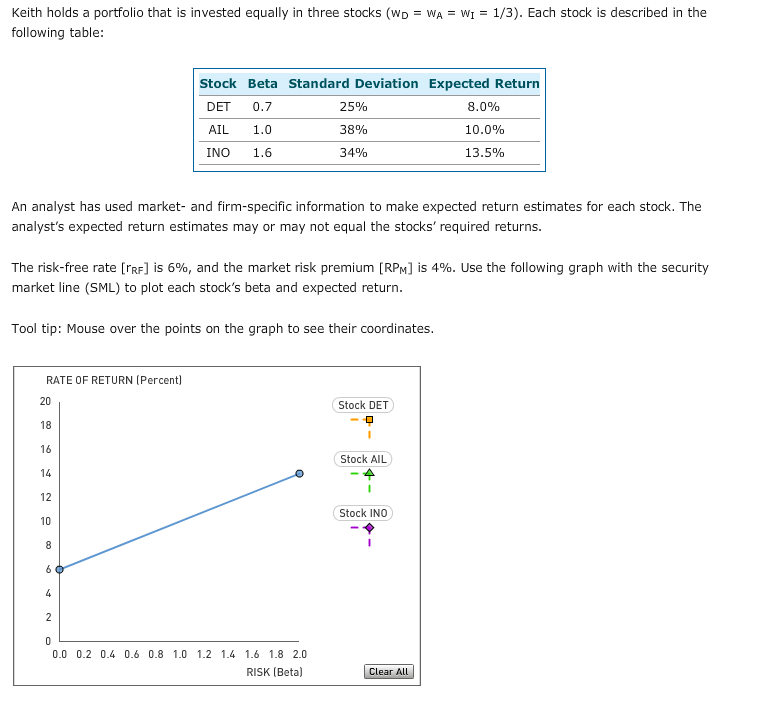

Keith holds a portfolio that is invested equally in three stocks (wD = wA = w-1/3). Each stock is described in the following table Stock Beta Standard Deviation Expected Return DET 0.7 AIL 1.0 INO 1.6 25% 38% 34% 8.0% 10.0% 13.5% An analyst has used market- and firm-specific information to make expected return estimates for each stock. The analyst's expected return estimates may or may not equal the stocks' required returns. The risk-free rate [Rr] is 6%, and the market risk premium RPn] is 4%. Use the following graph with the security market line (SML) to plot each stock's beta and expected return Tool tip: Mouse over the points on the graph to see their coordinates RATE OF RETURN (Percent 20 18 16 Stock DET Stock AIL 12 Stock INO 10 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 2.0 RISK (Beta) Clear ALL A stock is in equilibrium if its required return and stocks are in equilibrium (or fairly valued), but sometimes investors have different opinions about a stock's prospects and may think that a stock is out of equilibrium (either undervalued or overvalued). Based on the analyst's expected return estimates, stock INO is its expected return. In general, assume that markets ,stock AIL is in equilibrium, and stock DET isStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started