PLEASE HELP WITH THE LAST QUESTION

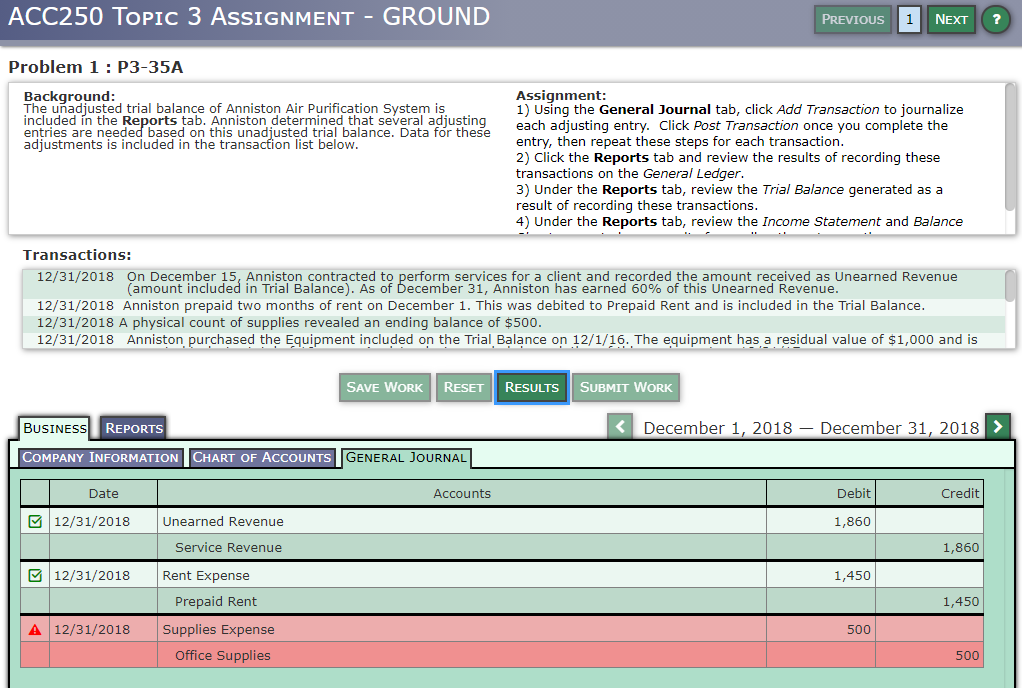

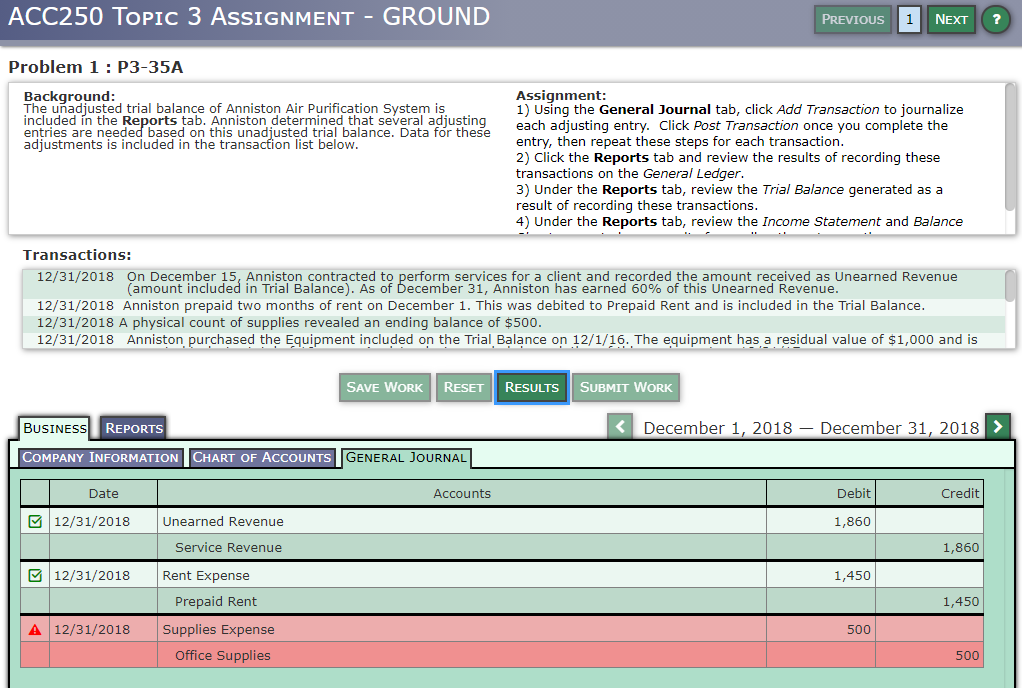

Problem 1 : P3-35A

Background:

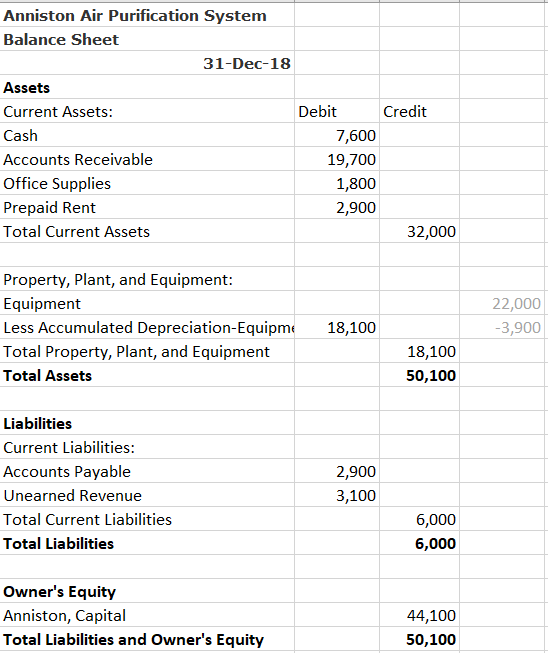

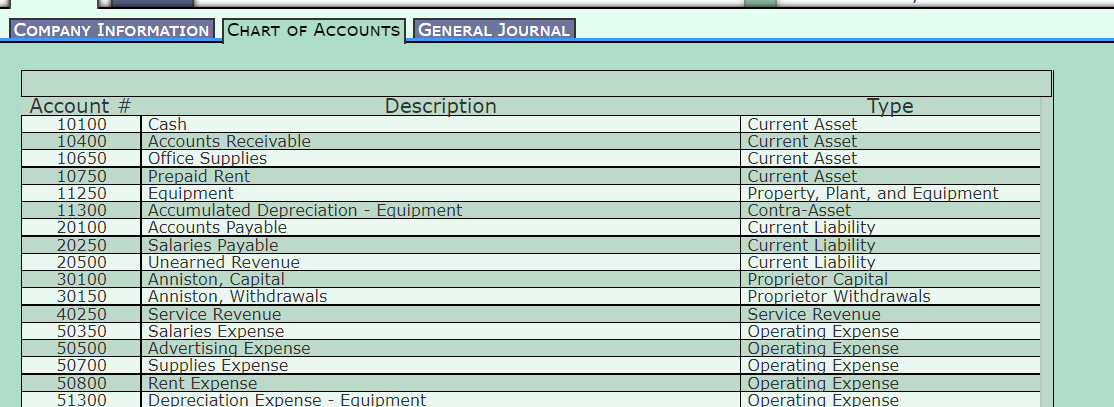

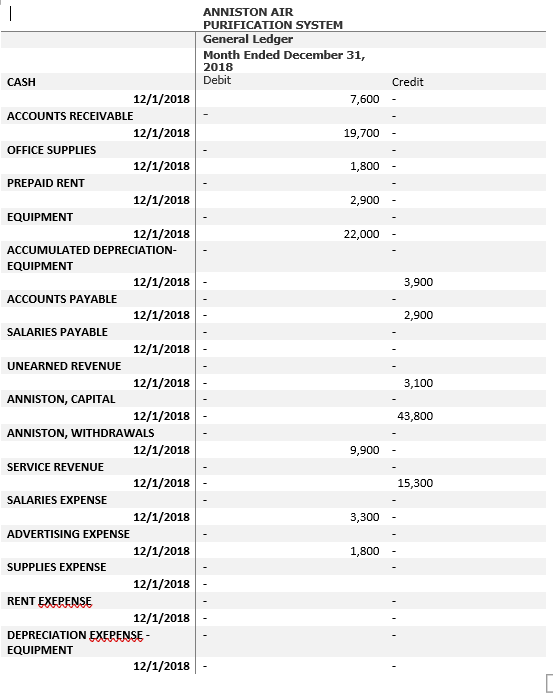

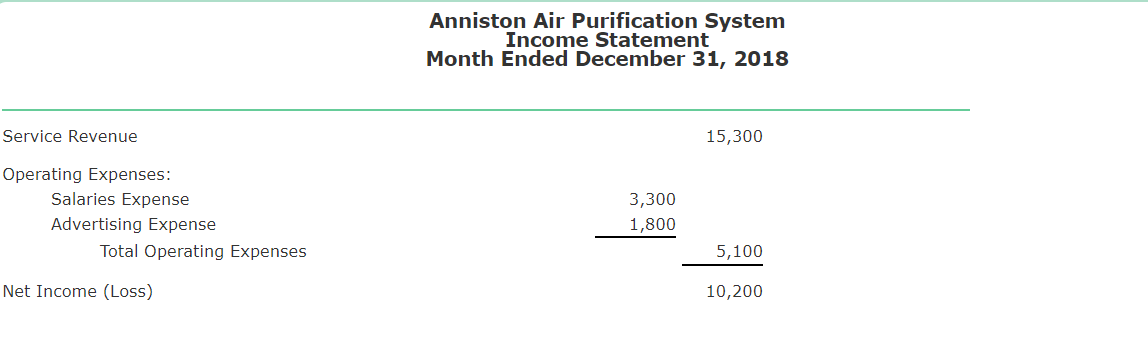

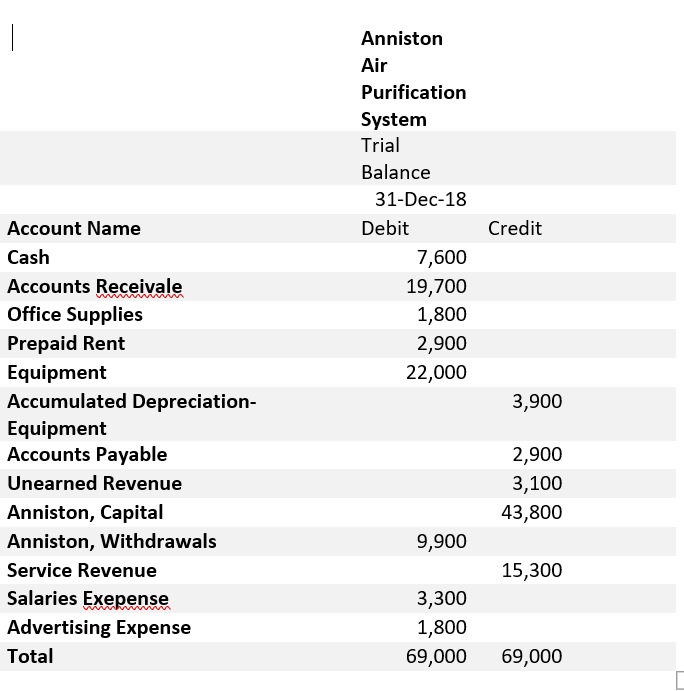

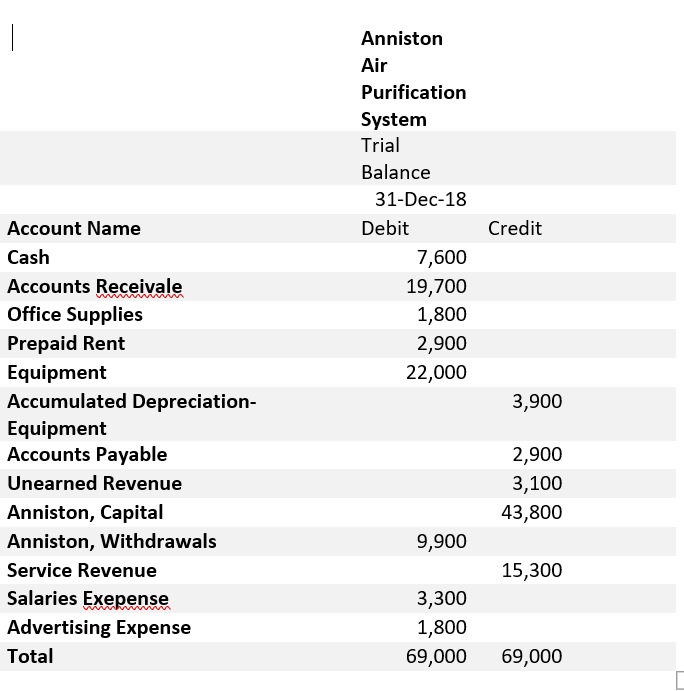

The unadjusted trial balance of Anniston Air Purification System is included in the Reports tab. Anniston determined that several adjusting entries are needed based on this unadjusted trial balance. Data for these adjustments is included in the transaction list below.

Assignment:

12/31/2018

On December 15, Anniston contracted to perform services for a client and recorded the amount received as Unearned Revenue (amount included in Trial Balance). As of December 31, Anniston has earned 60% of this Unearned Revenue.

12/31/2018

Anniston prepaid two months of rent on December 1. This was debited to Prepaid Rent and is included in the Trial Balance.

12/31/2018

A physical count of supplies revealed an ending balance of $500.

12/31/2018

Anniston purchased the Equipment included on the Trial Balance on 12/1/16. The equipment has a residual value of $1,000 and is expected to last a total of 10 years. Anniston last recorded depreciation of this equipment on 12/31/17.

12/31/2018

Anniston received a bill for December's online advertising, $1,100. Anniston will not pay the bill until January (Anniston uses Accounts Payable for unpaid advertising).

12/31/2018

Anniston pays its employees on Monday for the previous week's wages. Its employees earn $3,500 for the five-day workweek. December 31 falls on a Wednesday this year.

12/31/2018

On October 1, Anniston agreed to provide a four-month air system check beginning that day. The customer agreed to pay a total of $3,400 at the end of the four month service contract. As of December 31, Anniston has completed all work as necessary, but has not recorded any revenue to date.

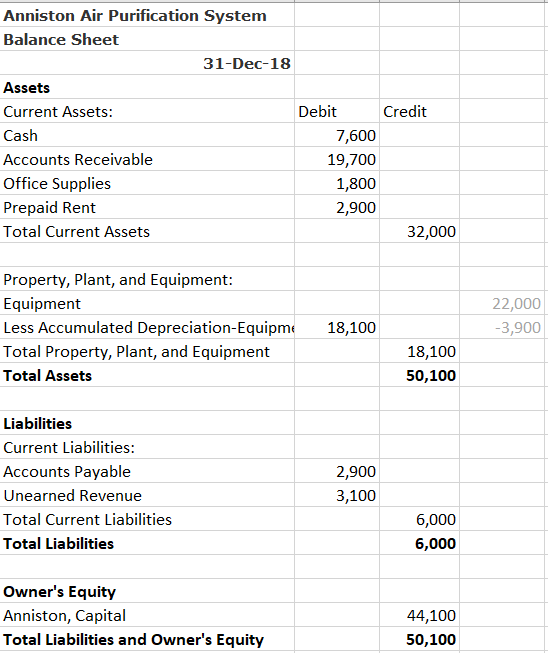

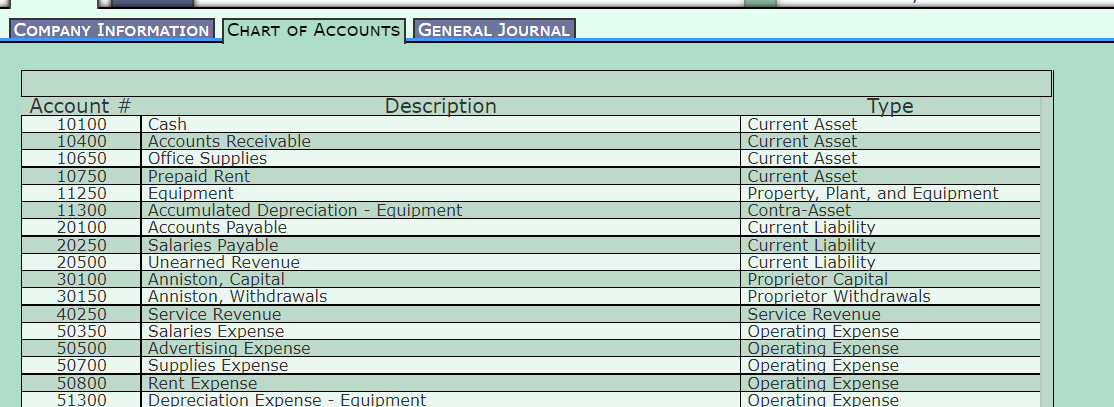

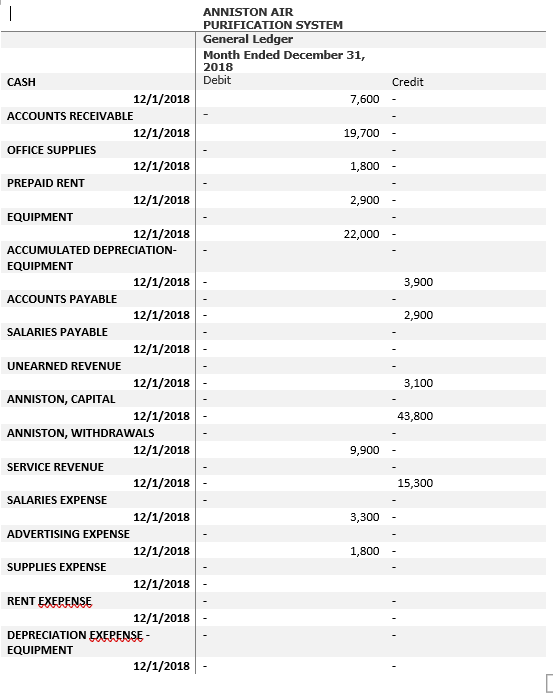

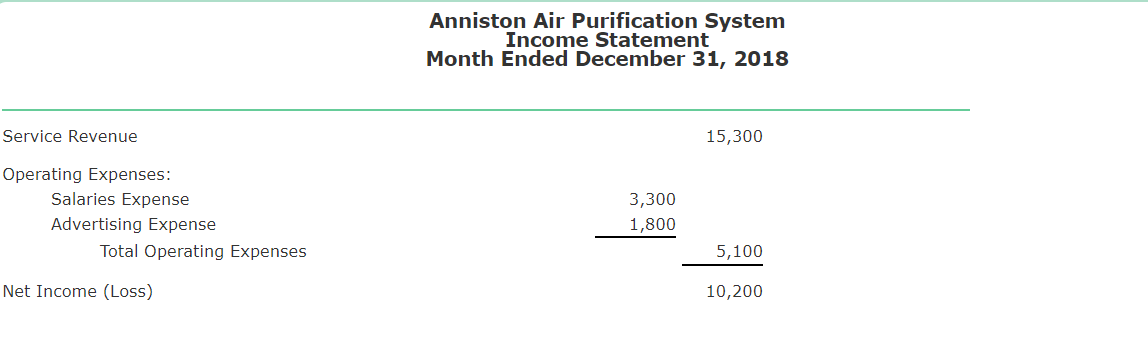

Anniston Air Purification System Balance Sheet 31-Dec-18 Assets Current Assets: Cash Accounts Receivable Office Supplies Prepaid Rent Total Current Assets Debit Credit 7,600 19,700 1,800 2,900 32,000 Property, Plant, and Equipment: Equipment Less Accumulated Depreciation-Equipm Total Property, Plant, and Equipment Total Assets 22,000 -3,900 18,100 18,100 50,100 Liabilities Current Liabilities: Accounts Payable Unearned Revenue Total Current Liabilities Total Liabilities 2,900 3,100 6,000 6,000 Owner's Equity Anniston, Capital Total Liabilities and Owner's Equity 44,100 50,100 COMPANY INFORMATION CHART OF ACCOUNTS I GENERAL JOURNAL Account # 10100 10400 10650 10750 11250 11300 20100 20250 20500 30100 30150 40250 50350 50500 50700 50800 51300 Description Cash Accounts Receivable Office Supplies Prepaid Rent Equipment Accumulated Depreciation Equipment Accounts Payable Salaries Payable Unearned Revenue Anniston, Capital Anniston, Withdrawals Service Revenue Salaries Expense Advertising Expense Supplies Expense Rent Expense Depreciation Expense Equipment Current Asset Current Asset Current Asset Current Asset Property, Plant, and Equipment Contra-Asset Current Liability Current Liability Current Liability Proprietor Capital Proprietor Withdrawals Service Revenue Operating Expense Operating Expense Operating Expense Operating Expense Operating Expense | ANNISTON AIR PURIFICATION SYSTEM General Ledger Month Ended December 31, 2018 Debit 7,600 Credit 19,700 1,800 2,900 22,000 3,900 2,900 CASH 12/1/2018 ACCOUNTS RECEIVABLE 12/1/2018 OFFICE SUPPLIES 12/1/2018 PREPAID RENT 12/1/2018 EQUIPMENT 12/1/2018 ACCUMULATED DEPRECIATION- EQUIPMENT 12/1/2018 ACCOUNTS PAYABLE 12/1/2018 SALARIES PAYABLE 12/1/2018 UNEARNED REVENUE 12/1/2018 ANNISTON, CAPITAL 12/1/2018 ANNISTON, WITHDRAWALS 12/1/2018 SERVICE REVENUE 12/1/2018 SALARIES EXPENSE 12/1/2018 ADVERTISING EXPENSE 12/1/2018 SUPPLIES EXPENSE 12/1/2018 RENT EXEPENSE 12/1/2018 DEPRECIATION EXEPENSE - EQUIPMENT 12/1/2018 3,100 43,800 9,900 15,300 3,300 1,800 Anniston Air Purification System Income Statement Month Ended December 31, 2018 Service Revenue 15,300 Operating Expenses: Salaries Expense Advertising Expense Total Operating Expenses 3,300 1,800 5,100 Net Income (Loss) 10,200 1 Anniston Air Purification System Trial Balance 31-Dec-18 Debit 7,600 19,700 1,800 2,900 22,000 Credit 3,900 Account Name Cash Accounts Receivale Office Supplies Prepaid Rent Equipment Accumulated Depreciation- Equipment Accounts Payable Unearned Revenue Anniston, Capital Anniston, Withdrawals Service Revenue Salaries Exepense Advertising Expense Total 2,900 3,100 43,800 9,900 15,300 3,300 1,800 69,000 69,000 ACC250 TOPIC 3 ASSIGNMENT - GROUND PREVIOUS 1 NEXT ? Problem 1: P3-35A Background: The unadjusted trial balance of Anniston Air Purification System is included in the Reports tab. Anniston determined that several adjusting entries are needed based on this unadjusted trial balance. Data for these adjustments is included in the transaction list below. Assignment: 1) Using the General Journal tab, click Add Transaction to journalize each adjusting entry. Click Post Transaction once you complete the entry, then repeat these steps for each transaction. 2) Click the Reports tab and review the results of recording these transactions on the General Ledger. 3) Under the Reports tab, review the Trial Balance generated as a result of recording these transactions. 4) Under the Reports tab, review the Income Statement and Balance Transactions: 12/31/2018 On December 15, Anniston contracted to perform services for a client and recorded the amount received as Unearned Revenue (amount included in Trial Balance). As of December 31, Anniston has earned 60% of this Unearned Revenue. 12/31/2018 Anniston prepaid two months of rent on December 1. This was debited to Prepaid Rent and is included in the Trial Balance. 12/31/2018 A physical count of supplies revealed an ending balance of $500. 12/31/2018 Anniston purchased the Equipment included on the Trial Balance on 12/1/16. The equipment has a residual value of $1,000 and is SAVE WORK RESET RESULTS SUBMIT WORK BUSINESS REPORTS COMPANY INFORMATION CHART OF ACCOUNTS GENERAL JOURNAL Date Accounts Debit Credit 12/31/2018 Unearned Revenue 1,860 Service Revenue 1,860 12/31/2018 1,450 1,450 Rent Expense Prepaid Rent Supplies Expense Office Supplies A 12/31/2018 500 500