Answered step by step

Verified Expert Solution

Question

1 Approved Answer

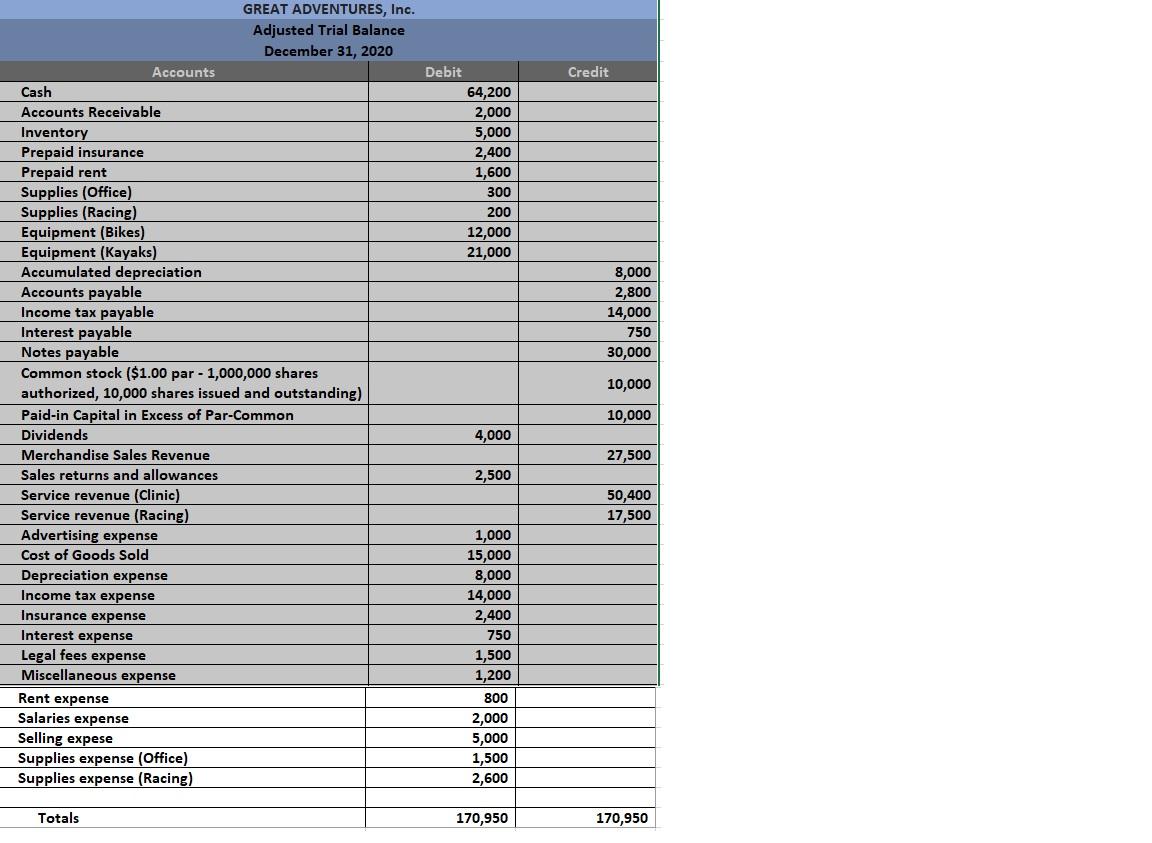

Please help with the Statement of Cash Flows. Please use the following adjusted Trial Balance for Great Adventures, Inc. to complete this assignment. Assume that

Please help with the Statement of Cash Flows.

Please use the following adjusted Trial Balance for Great Adventures, Inc. to complete this assignment. Assume that Great Adventures, Inc. began its operations on January 1, 2020. There were no identifiable transactions in 2019. You are asked to prepare the following statements utilizing the Excel file included with this assignment description. Note that the Excel file contains a separate tab for each statement:

Statement of Cash Flows for the year ending December 31, 2020

Credit Debit 64,200 2,000 5,000 2,400 1,600 300 200 12,000 21,000 8,000 2,800 14,000 750 30,000 GREAT ADVENTURES, Inc. Adjusted Trial Balance December 31, 2020 Accounts Cash Accounts Receivable Inventory Prepaid insurance Prepaid rent Supplies (Office) Supplies (Racing) Equipment (Bikes) Equipment (Kayaks) Accumulated depreciation Accounts payable Income tax payable Interest payable Notes payable Common stock ($1.00 par - 1,000,000 shares authorized, 10,000 shares issued and outstanding) Paid-in Capital in Excess of Par-Common Dividends Merchandise Sales Revenue Sales returns and allowances Service revenue (Clinic) Service revenue (Racing) Advertising expense Cost of Goods Sold Depreciation expense Income tax expense Insurance expense Interest expense Legal fees expense Miscellaneous expense Rent expense Salaries expense Selling expese Supplies expense (Office) Supplies expense (Racing) 10,000 10,000 4,000 27,500 2,500 50,400 17,500 1,000 15,000 8,000 14,000 2,400 750 1,500 1,200 800 2,000 5,000 1,500 2,600 Totals 170,950 170,950

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started