Answered step by step

Verified Expert Solution

Question

1 Approved Answer

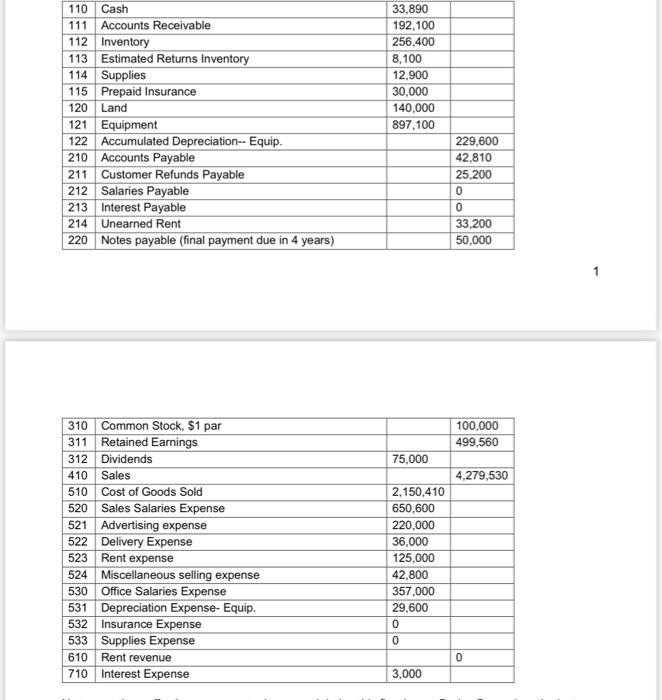

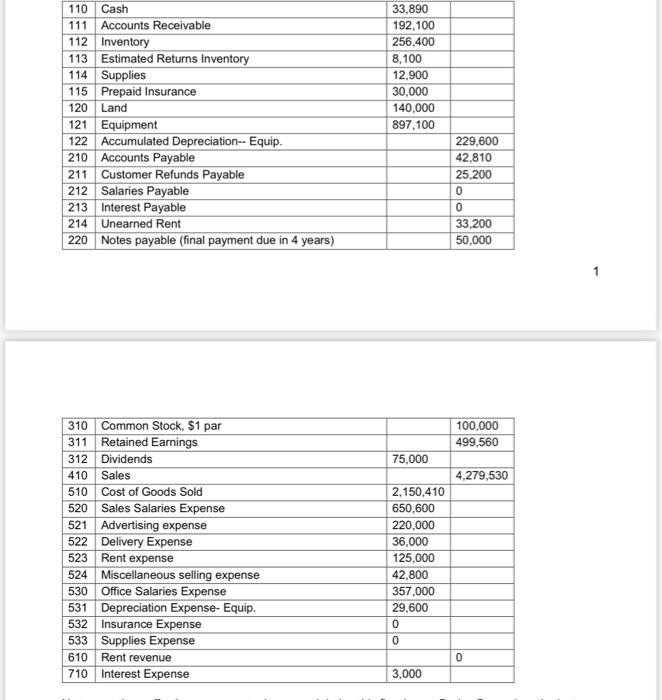

please help with the unadjusted and adjusted trial balances asap. I got different values for debits and credits. begin{tabular}{|l|l|l|l|} hline 110 & Cash & 33,890

please help with the unadjusted and adjusted trial balances asap. I got different values for debits and credits.

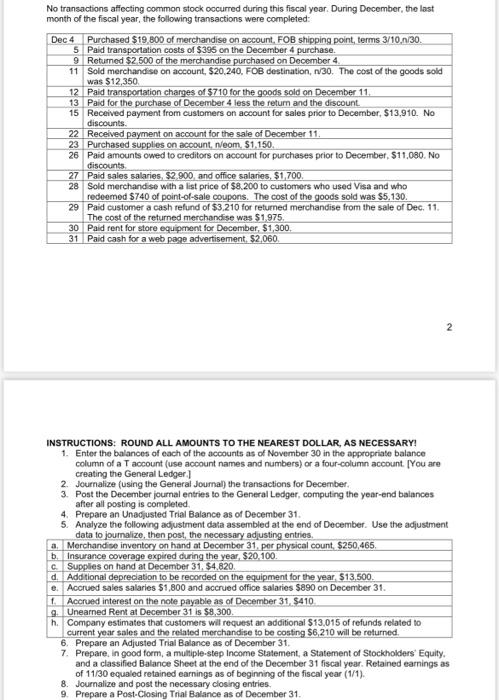

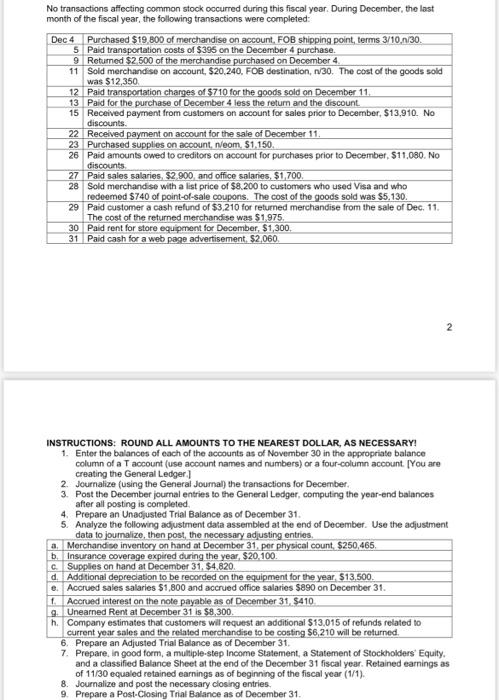

\begin{tabular}{|l|l|l|l|} \hline 110 & Cash & 33,890 & \\ \hline 111 & Accounts Receivable & 192,100 & \\ \hline 112 & Inventory & 256,400 & \\ \hline 113 & Estimated Returns Inventory & 8,100 & \\ \hline 114 & Supplies & 12,900 & \\ \hline 115 & Prepaid Insurance & 30,000 & \\ \hline 120 & Land & 140,000 & \\ \hline 121 & Equipment & 897,100 & \\ \hline 122 & Accumulated Depreciation- Equip. & & 229,600 \\ \hline 210 & Accounts Payable & & 42,810 \\ \hline 211 & Customer Refunds Payable & & 25,200 \\ \hline 212 & Salaries Payable & & 0 \\ \hline 213 & Interest Payable & & 33,200 \\ \hline 214 & Unearned Rent & & 50,000 \\ \hline 220 & Notes payable (final payment due in 4 years) & & 0 \\ \hline \end{tabular} 1 \begin{tabular}{|l|l|l|l|} \hline 310 & Common Stock, \$1 par & & 100,000 \\ \hline 311 & Retained Earnings & & 499,560 \\ \hline 312 & Dividends & 75,000 & \\ \hline 410 & Sales & & 4,279,530 \\ \hline 510 & Cost of Goods Sold & 2,150,410 & \\ \hline 520 & Sales Salaries Expense & 650,600 & \\ \hline 521 & Advertising expense & 220,000 & \\ \hline 522 & Delivery Expense & 36,000 & \\ \hline 523 & Rent expense & 125,000 & \\ \hline 524 & Miscellaneous selling expense & 42,800 & \\ \hline 530 & Office Salaries Expense & 357,000 & \\ \hline 531 & Depreciation Expense- Equip. & 29,600 & \\ \hline 532 & Insurance Expense & 0 & \\ \hline 533 & Supplies Expense & 0 & \\ \hline 610 & Rent revenue & & 0 \\ \hline 710 & Interest Expense & 3,000 & \\ \hline \end{tabular} No transactions affecting common stock occurred during this fiscal year. During December, the lost month of the fiscal year, the following transactions were completed: 2 INSTRUCTIONS: ROUND ALL AMOUNTS TO THE NEAREST DOLLAR, AS NECESSARY! 1. Enter the balances of each of the accounts as of November 30 in the appropriate balance column of a T account (use account names and numbers) or a four-column account. [You are creating the General Ledger.] 2. Journalize (using the General Joumal) the transactions for December. 3. Post the December journal entries to the General Ledger, computing the year-end baiances after all posting is completed. 4. Prepare an Unadjusted Trial Balance as of December 31. 5. Analyze the following adjustment data assembled at the end of December. Use the adjustment data to joumalize, then post, the necessary adjusting entries. a. Merchandise inventory on hand at December 31, per physical count, $250,465. b. Insurance coverage expired during the year, $20,100. c. Supples on hand at December 31,$4,820. d. Addtional depreciation to be recorded on the equipment for the year, $13,500. e. Accrued sales salaries $1,800 and accrued office salaries $890 on December 31 . f. Accrued interest on the note payable as of December 31,$410. g. Unearned Rent at December 31 is $8,300. h. Company estimates that customers wil request an additional $13,015 of refunds related to current year sales and the related merchandise to be costing $6,210 will be returned. 6. Prepare an Adjusted Trial Balance as of December 31. 7. Prepare. in good form, a multiple-step Income Statement, a Statement of Stockholders' Equity. and a classified Balance Sheet at the end of the December 31 fiscal year. Retained earnings as of 11/30 equaled retained earnings as of beginning of the fiscal year (1/1). 8. Journalize and post the necessary closing entries. 9. Prepare a Post-Closing Trial Balance as of December 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started