PLEASE HELP WITH THESE 2 QUESTIONS, will always give good rating 1)

2)

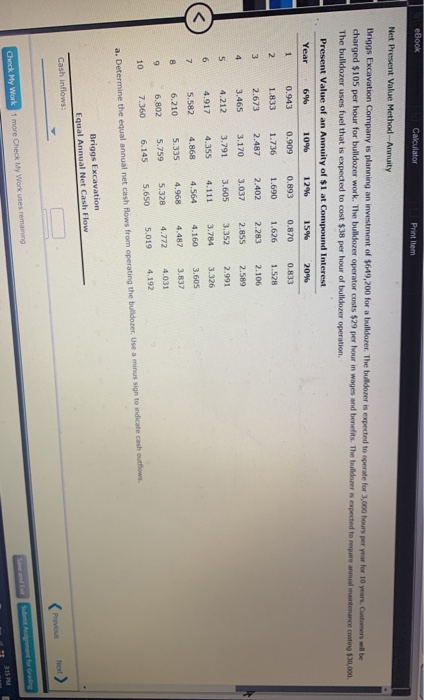

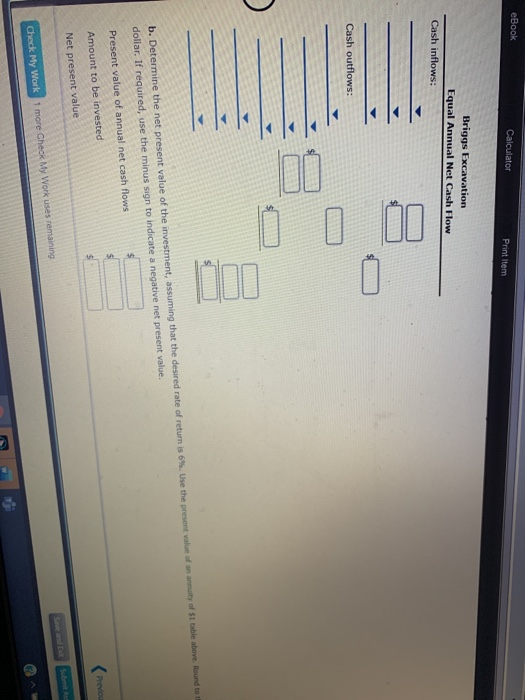

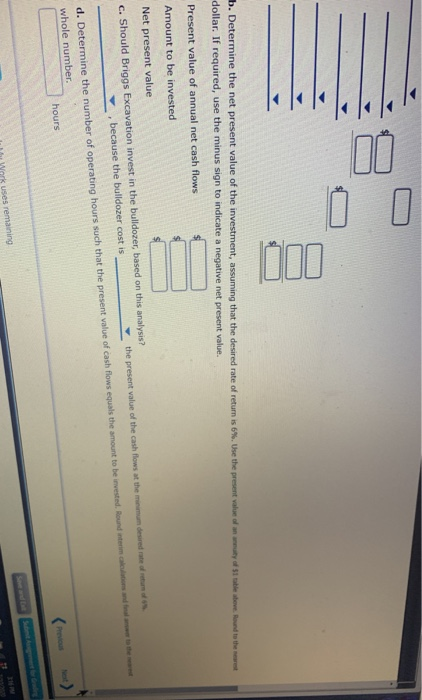

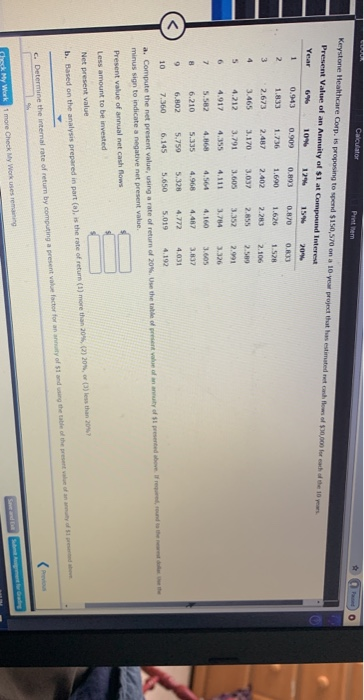

eBook Calculator Print Item Net Present Value Method Annuity Year Briggs Excavation Company is planning an investment of $649,200 for a bulldozer. The bulldozer is expected to operate for 3,000 hours per year for 10 years. Oustomers will be charged $105 per hour for bulldozer work. The bulldozer operator costs $29 per hour in wages and benefits. The bulldozer is expected to require annual maintenance costing $30,000 The bulldozer uses fuel that is expected to cost $38 per hour of bulldozer operation. Present Value of an Annuity of $1 at Compound Interest 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2. 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.352 2.991 6 4.917 4.355 4.111 3.784 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 6.802 9 5.759 4.772 5.328 4.031 7.360 10 5.650 4.192 5.019 6.145 a. Determine the equal annual net cash flows from operating the bulldozer. Use a minus sign to indicate cash outflows. Briggs Excavation Equal Annual Net Cash Flow Cash inflows: Check My Work 1 more Check My Work uses remaining 15 PM eBook Calculator Print Item Briggs Excavation Equal Annual Net Cash Flow Cash inflows: a Cash outflows: b. Determine the net present value of the investment, assuming that the desired rate of return is 6%. Use the present value of an annuity of $1 table above. Round tot dollar. If required, use the minus sign to indicate a negative net present value. Present value of annual net cash flows S Amount to be invested $ Net present value Check My Work 1 more Check My Work uses remaining 10 IOD b. Determine the net present value of the investment, assuming that the desired rate of return is 6%. Use the present value of any of the found to the rest dollar. If required, use the minus sign to indicate a negative net present value. Present value of annual net cash flows Amount to be invested Net present value c. Should Briggs Excavation invest in the bulldozer, based on this analysis? because the bulldozer cost is the present value of the cash flows at the momum desired rate of d. Determine the number of operating hours such that the present value of cash flows equals the amount to be invested, Round interim whole number hours ork uses remaining 2.991 Calculator Keystone Healthcare Corp. is proposing to spend $150,570 on a 10 year proyed that has estimated the flow of $30,000 for each of 10 Present Value of an Annuity of $1 at Compound Interest Year 107 154 2014 0.13 0.909 0.83 0.870 0.83 2 1.736 1.600 1.626 1.528 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.352 6 4.917 4.111 3.784 3.326 7 5.582 4.568 4.564 4.160 3.605 8 6.210 5.335 4.965 4.487 3.837 . 6.102 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. Compute the net present value, using a rate of return of 20%. Use the table of present value of an annuty of presented here. Freund the minus sign to indicate a negative net present value Present value of annual net cash flows Less amount to be invested Net present value b. Based on the analysis prepared in part (a), is the rate of return (1) more than 20% 20%, less than 2017 c. Determine the internal rate of return by computing a present value factor for any of 51 and the title of the Check My Work 1 more Check My Work uses remang eBook Calculator Print Item Net Present Value Method Annuity Year Briggs Excavation Company is planning an investment of $649,200 for a bulldozer. The bulldozer is expected to operate for 3,000 hours per year for 10 years. Oustomers will be charged $105 per hour for bulldozer work. The bulldozer operator costs $29 per hour in wages and benefits. The bulldozer is expected to require annual maintenance costing $30,000 The bulldozer uses fuel that is expected to cost $38 per hour of bulldozer operation. Present Value of an Annuity of $1 at Compound Interest 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2. 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.352 2.991 6 4.917 4.355 4.111 3.784 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 6.802 9 5.759 4.772 5.328 4.031 7.360 10 5.650 4.192 5.019 6.145 a. Determine the equal annual net cash flows from operating the bulldozer. Use a minus sign to indicate cash outflows. Briggs Excavation Equal Annual Net Cash Flow Cash inflows: Check My Work 1 more Check My Work uses remaining 15 PM eBook Calculator Print Item Briggs Excavation Equal Annual Net Cash Flow Cash inflows: a Cash outflows: b. Determine the net present value of the investment, assuming that the desired rate of return is 6%. Use the present value of an annuity of $1 table above. Round tot dollar. If required, use the minus sign to indicate a negative net present value. Present value of annual net cash flows S Amount to be invested $ Net present value Check My Work 1 more Check My Work uses remaining 10 IOD b. Determine the net present value of the investment, assuming that the desired rate of return is 6%. Use the present value of any of the found to the rest dollar. If required, use the minus sign to indicate a negative net present value. Present value of annual net cash flows Amount to be invested Net present value c. Should Briggs Excavation invest in the bulldozer, based on this analysis? because the bulldozer cost is the present value of the cash flows at the momum desired rate of d. Determine the number of operating hours such that the present value of cash flows equals the amount to be invested, Round interim whole number hours ork uses remaining 2.991 Calculator Keystone Healthcare Corp. is proposing to spend $150,570 on a 10 year proyed that has estimated the flow of $30,000 for each of 10 Present Value of an Annuity of $1 at Compound Interest Year 107 154 2014 0.13 0.909 0.83 0.870 0.83 2 1.736 1.600 1.626 1.528 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.352 6 4.917 4.111 3.784 3.326 7 5.582 4.568 4.564 4.160 3.605 8 6.210 5.335 4.965 4.487 3.837 . 6.102 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. Compute the net present value, using a rate of return of 20%. Use the table of present value of an annuty of presented here. Freund the minus sign to indicate a negative net present value Present value of annual net cash flows Less amount to be invested Net present value b. Based on the analysis prepared in part (a), is the rate of return (1) more than 20% 20%, less than 2017 c. Determine the internal rate of return by computing a present value factor for any of 51 and the title of the Check My Work 1 more Check My Work uses remang