Question: Please help with these. Answer True or False for each! Thanks! 1) when using annual worth analysis with mutually exclusive alternatives baving unequal lives, always

Please help with these. Answer True or False for each! Thanks!

Please help with these. Answer True or False for each! Thanks!

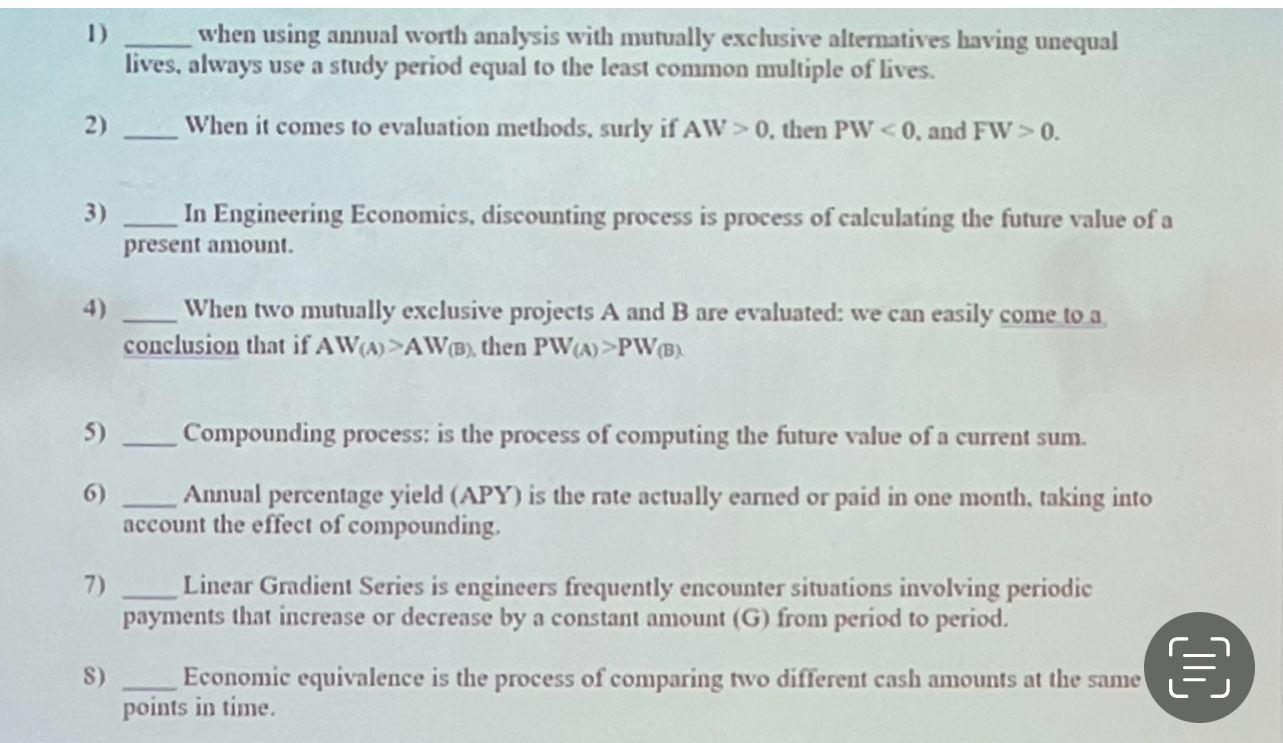

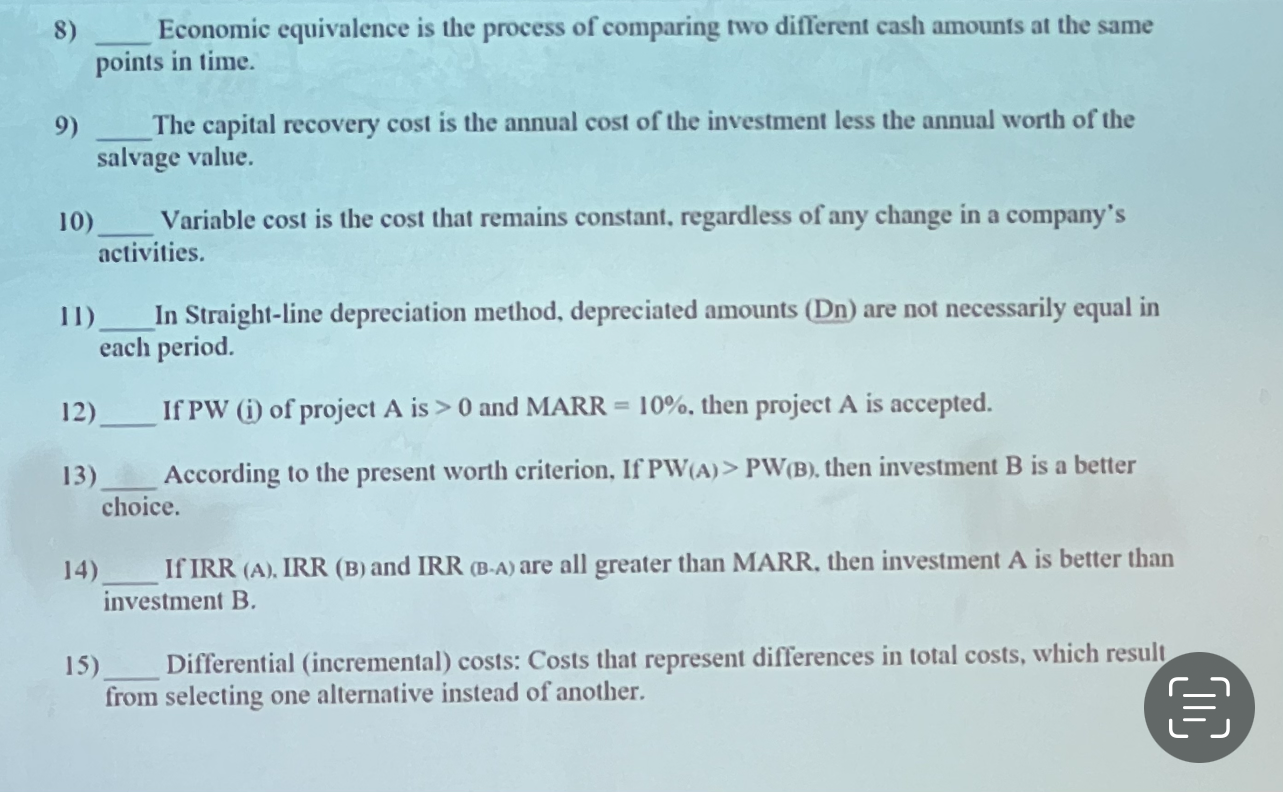

1) when using annual worth analysis with mutually exclusive alternatives baving unequal lives, always use a study period equal to the least common multiple of lives. 2) When it comes to evaluation methods, surly if AW > 0, then PW 0. 3) In Engineering Economics, discounting process is process of calculating the future value of a present amount. 4) When two mutually exclusive projects A and B are evaluated; we can easily come to a conclusion that if AWA)>AWB), then PW (A)>PWB) 5) Compounding process: is the process of computing the future value of a current sum. Annual percentage yield (APY) is the rate actually eamed or paid in one month, taking into account the effect of compounding, 7) Linear Gradient Series is engineers frequently encounter situations involving periodic payments that increase or decrease by a constant amount (G) from period to period. S) Economic equivalence is the process of comparing two different cash amounts at the same points in time. TIL 8) Economic equivalence is the process of comparing two different cash amounts at the same points in time. 9) The capital recovery cost is the annual cost of the investment less the annual worth of the salvage value. 10) Variable cost is the cost that remains constant, regardless of any change in a company's activities. 11) In Straight-line depreciation method, depreciated amounts (Dn) are not necessarily equal in each period. 12) If PW (i) of project A is > 0 and MARR = 10%, then project A is accepted. 13) According to the present worth criterion, If PW(A)> PW(B). then investment B is a better choice. 14) If IRR (A), IRR (B) and IRR (B-A) are all greater than MARR, then investment A is better than investment B. 15) Differential (incremental) costs: Costs that represent differences in total costs, which result from selecting one alternative instead of another. E 1) when using annual worth analysis with mutually exclusive alternatives baving unequal lives, always use a study period equal to the least common multiple of lives. 2) When it comes to evaluation methods, surly if AW > 0, then PW 0. 3) In Engineering Economics, discounting process is process of calculating the future value of a present amount. 4) When two mutually exclusive projects A and B are evaluated; we can easily come to a conclusion that if AWA)>AWB), then PW (A)>PWB) 5) Compounding process: is the process of computing the future value of a current sum. Annual percentage yield (APY) is the rate actually eamed or paid in one month, taking into account the effect of compounding, 7) Linear Gradient Series is engineers frequently encounter situations involving periodic payments that increase or decrease by a constant amount (G) from period to period. S) Economic equivalence is the process of comparing two different cash amounts at the same points in time. TIL 8) Economic equivalence is the process of comparing two different cash amounts at the same points in time. 9) The capital recovery cost is the annual cost of the investment less the annual worth of the salvage value. 10) Variable cost is the cost that remains constant, regardless of any change in a company's activities. 11) In Straight-line depreciation method, depreciated amounts (Dn) are not necessarily equal in each period. 12) If PW (i) of project A is > 0 and MARR = 10%, then project A is accepted. 13) According to the present worth criterion, If PW(A)> PW(B). then investment B is a better choice. 14) If IRR (A), IRR (B) and IRR (B-A) are all greater than MARR, then investment A is better than investment B. 15) Differential (incremental) costs: Costs that represent differences in total costs, which result from selecting one alternative instead of another. E

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts