Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with these last 2! Like many college students, Elaine applied for and got a credit card that has an annual percentage rate (APR)

please help with these last 2!

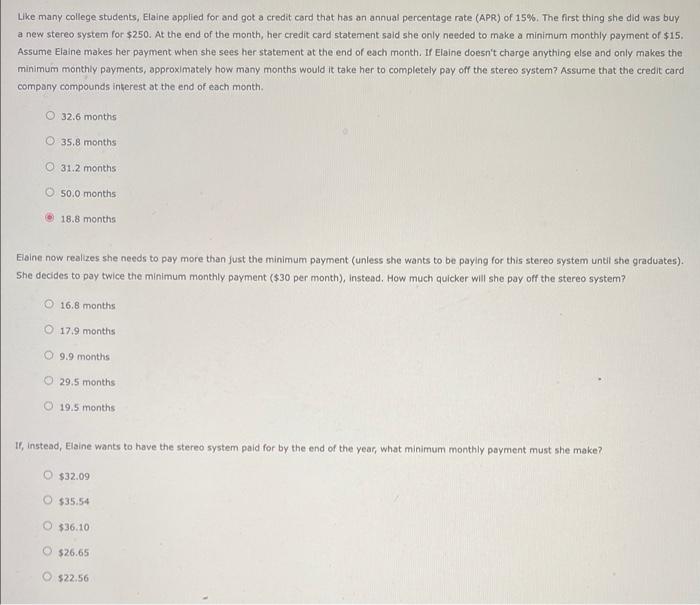

Like many college students, Elaine applied for and got a credit card that has an annual percentage rate (APR) of 15%. The first thing she did was buy a new stereo system for $250. At the end of the month, her credit card statement said she only needed to make a minimum monthly payment of $15. Assume Elaine makes her payment when she sees her statement at the end of each month. If Elaine doesn't charge anything else and only makes the minimum monthly payments, approximately how many months would it take her to completely pay off the stereo system? Assume that the credit card company compounds interest at the end of each month O 32.6 months O 35,8 months O 31.2 months 50.0 months 18.8 months Elaine now realizes she needs to pay more than just the minimum payment (unless she wants to be paying for this stereo system until she graduates). She decides to pay twice the minimum monthly payment ($30 per month), instead. How much quicker will she pay off the stereo system? 16.8 months 17.9 months O 9.9 months 29.5 months 19.5 months IT, Instead, Elaine wants to have the stereo system paid for by the end of the year, what minimum monthly payment must she make? $32.09 O $35.54 O $36.10 $26.65 $22.56

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started