Answered step by step

Verified Expert Solution

Question

1 Approved Answer

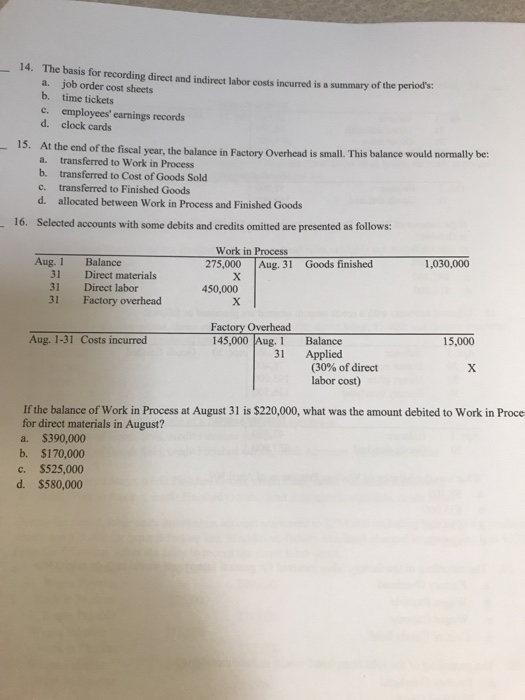

14. The basis for recording direct and indirect labor costs incurred is a summary of the period's: a. job order cost sheets b. time

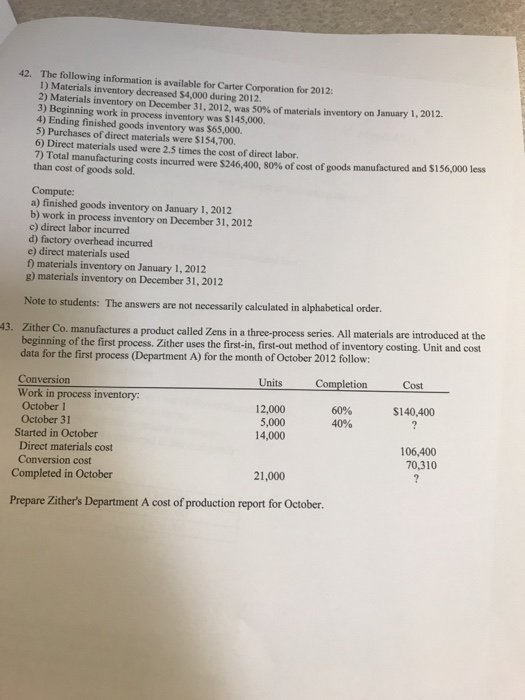

14. The basis for recording direct and indirect labor costs incurred is a summary of the period's: a. job order cost sheets b. time tickets employees' earnings records C. d. clock cards 15. At the end of the fiscal year, the balance in Factory Overhead is small. This balance would normally be: a. transferred to Work in Process b. transferred to Cost of Goods Sold C. transferred to Finished Goods d. allocated between Work in Process and Finished Goods 16. Selected accounts with some debits and credits omitted are presented as follows: Aug. 1 31 31 31 Balance Direct materials Direct labor Factory overhead Aug. 1-31 Costs incurred Work in Process C. $525,000 d. $580,000 275,000 X 450,000 X Aug. 31 Goods finished Factory Overhead 145,000 Aug. 1 31 Balance Applied (30% of direct labor cost) 1,030,000 15,000 X If the balance of Work in Process at August 31 is $220,000, what was the amount debited to Work in Proce for direct materials in August? a. $390,000 b. $170,000 42. The following information is available for Carter Corporation for 2012: 1) Materials inventory decreased $4,000 during 2012. 2) Materials inventory on December 31, 2012, was 50% of materials inventory on January 1, 2012. 3) Beginning work in process inventory was $145,000. 4) Ending finished goods inventory was $65,000. 5) Purchases of direct materials were $154,700. 6) Direct materials used were 2.5 times the cost of direct labor. 7) Total manufacturing costs incurred were $246,400, 80% of cost of goods manufactured and $156,000 less than cost of goods sold. Compute: a) finished goods inventory on January 1, 2012 b) work in process inventory on December 31, 2012 c) direct labor incurred d) factory overhead incurred e) direct materials used f) materials inventory on January 1, 2012 g) materials inventory on December 31, 2012 Note to students: The answers are not necessarily calculated in alphabetical order. 43. Zither Co. manufactures a product called Zens in a three-process series. All materials are introduced at the beginning of the first process. Zither uses the first-in, first-out method of inventory costing. Unit and cost data for the first process (Department A) for the month of October 2012 follow: Units Conversion Work in process inventory: October 1 October 31 12,000 5,000 14,000 Completion 60% 40% Started in October Direct materials cost Conversion cost Completed in October 21,000 Prepare Zither's Department A cost of production report for October. Cost $140,400 ? 106,400 70,310 ?

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Answer Ans The correct option for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started