Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLease help with these problem struggling here. Thank you Question 1 (4 points) Say you need the Euro a year from now and to avoid

PLease help with these problem struggling here. Thank you

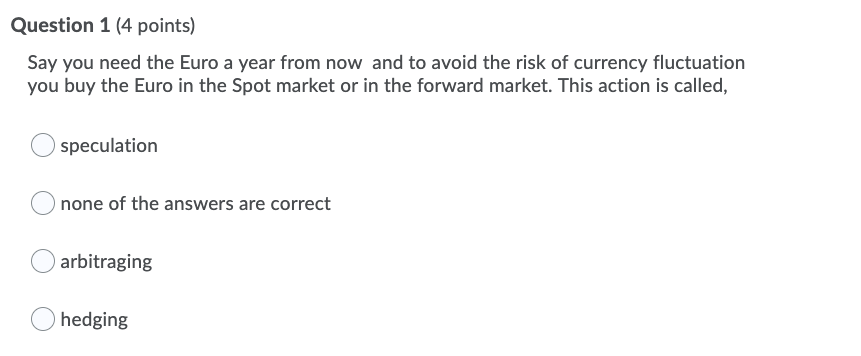

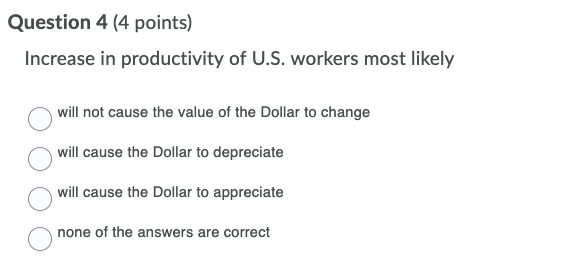

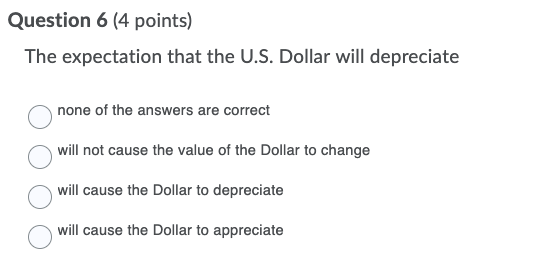

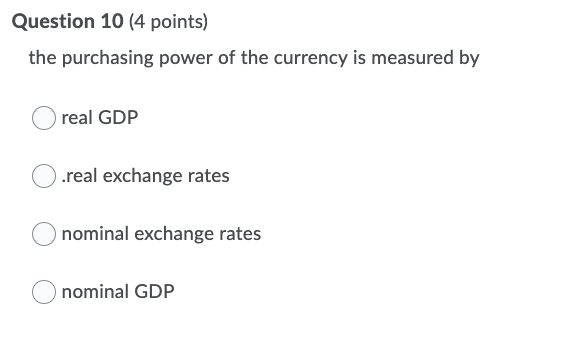

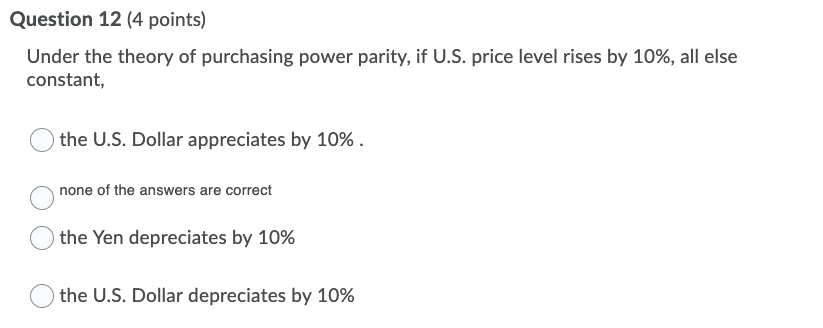

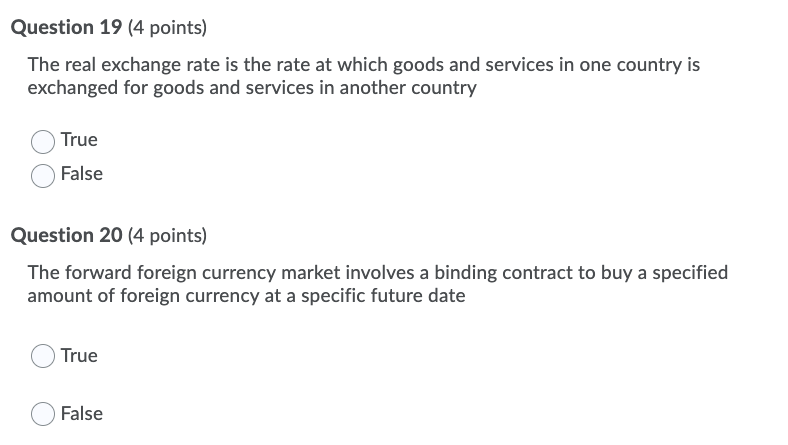

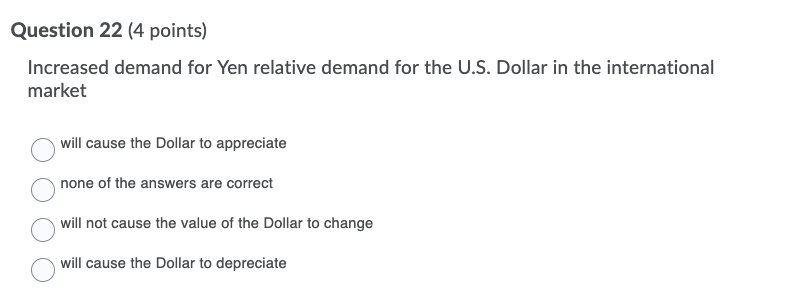

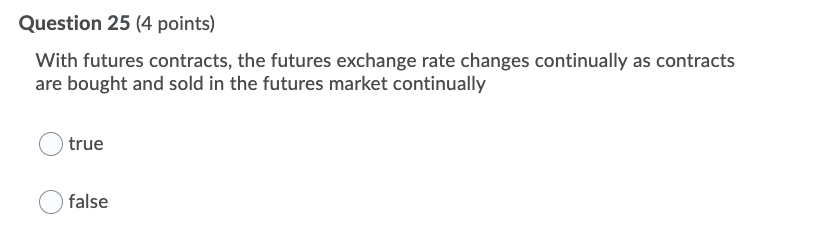

Question 1 (4 points) Say you need the Euro a year from now and to avoid the risk of currency fluctuation you buy the Euro in the Spot market or in the forward market. This action is called, Ospeculation O none of the answers are correct arbitraging O hedging Question 4 (4 points) Increase in productivity of U.S. workers most likely will not cause the value of the Dollar to change will cause the Dollar to depreciate will cause the Dollar to appreciate O O none of the answers are correct Question 6 (4 points) The expectation that the U.S. Dollar will depreciate none of the answers are correct will not cause the value of the Dollar to change will cause the Dollar to depreciate will cause the Dollar to appreciate Question 10 (4 points) the purchasing power of the currency is measured by Oreal GDP O.real exchange rates O nominal exchange rates nominal GDP Question 12 (4 points) Under the theory of purchasing power parity, if U.S. price level rises by 10%, all else constant, the U.S. Dollar appreciates by 10%. none of the answers are correct the Yen depreciates by 10% the U.S. Dollar depreciates by 10% Question 19 (4 points) The real exchange rate is the rate at which goods and services in one country is exchanged for goods and services in another country True False Question 20 (4 points) The forward foreign currency market involves a binding contract to buy a specified amount of foreign currency at a specific future date True False Question 22 (4 points) Increased demand for Yen relative demand for the U.S. Dollar in the international market will cause the Dollar to appreciate none of the answers are correct will not cause the value of the Dollar to change will cause the Dollar to depreciate Question 25 (4 points) With futures contracts, the futures exchange rate changes continually as contracts are bought and sold in the futures market continually Otrue falseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started