Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE HELP WITH THESE THREE QUESTIONS! THUMBS UP GUARANTEED!!! 1 2 3 a. Click to select --> (Net income / Net loss) which is right?

PLEASE HELP WITH THESE THREE QUESTIONS! THUMBS UP GUARANTEED!!!

1

2

3

a. "Click to select" --> (Net income / Net loss) which is right?

THANKS!!!

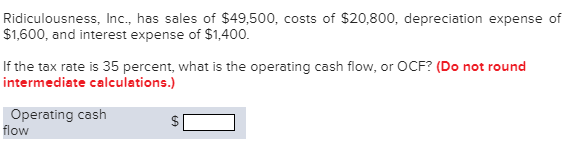

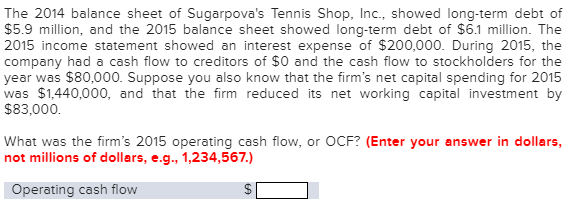

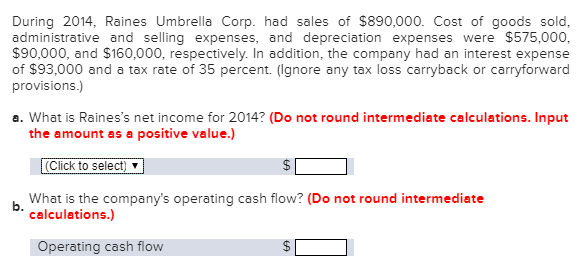

Ridiculousness, Inc., has sales of $49,500, costs of $20,800, depreciation expense of $1,600, and interest expense of $1,400. If the tax rate is 35 percent, what is the operating cash flow, or OCF? (Do not round intermediate calculations.) Operating cash flow O The 2014 balance sheet of Sugarpova's Tennis Shop, Inc., showed long-term debt of $5.9 million, and the 2015 balance sheet showed long-term debt of $6.1 million. The 2015 income statement showed an interest expense of $200,000. During 2015, the company had a cash flow to creditors of $0 and the cash flow to stockholders for the year was $80,000. Suppose you also know that the firm's net capital spending for 2015 was $1,440,000, and that the firm reduced its net working capital investment by $83,000. What was the firm's 2015 operating cash flow, or OCF? (Enter your answer in dollars, not millions of dollars, e.g., 1,234,567.) Operating cash flow During 2014, Raines Umbrella Corp. had sales of $890,000. Cost of goods sold, administrative and selling expenses, and depreciation expenses were $575,000, $90,000, and $160,000, respectively. In addition, the company had an interest expense of $93,000 and a tax rate of 35 percent. (Ignore any tax loss carryback or carryforward provisions.) a. What is Raines's net income for 2014? (Do not round intermediate calculations. Input the amount as a positive value.) (Click to select) $C What is the company's operating cash flow? (Do not round intermediate calculations.) Operating cash flow $DStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started