Please help with these two questions. I will thumbs up your answer! Thanks!

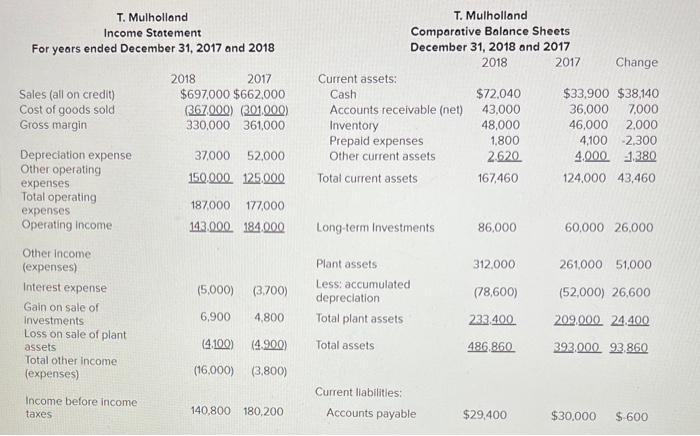

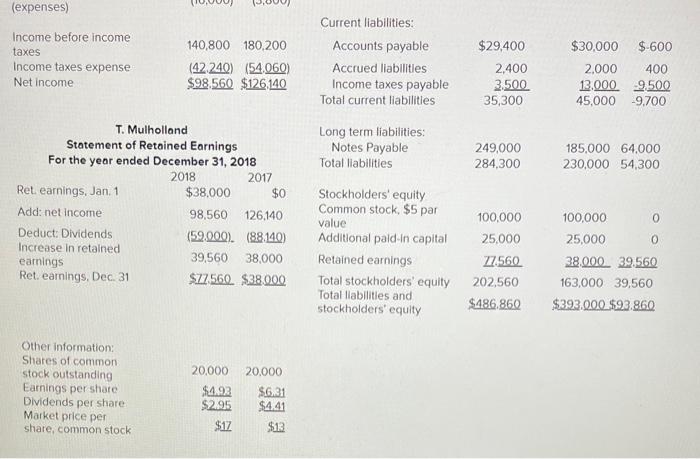

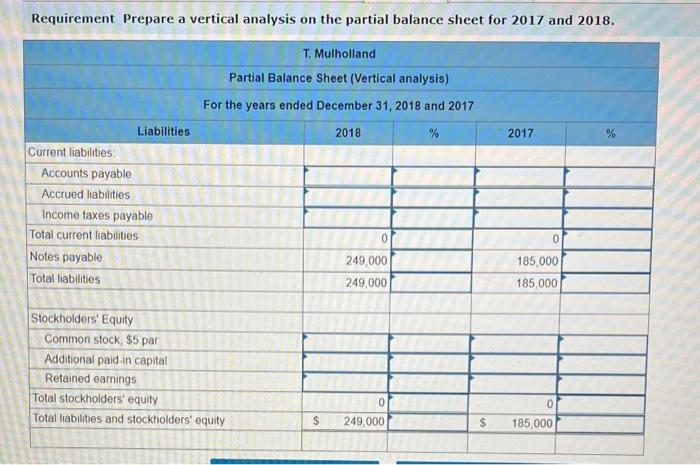

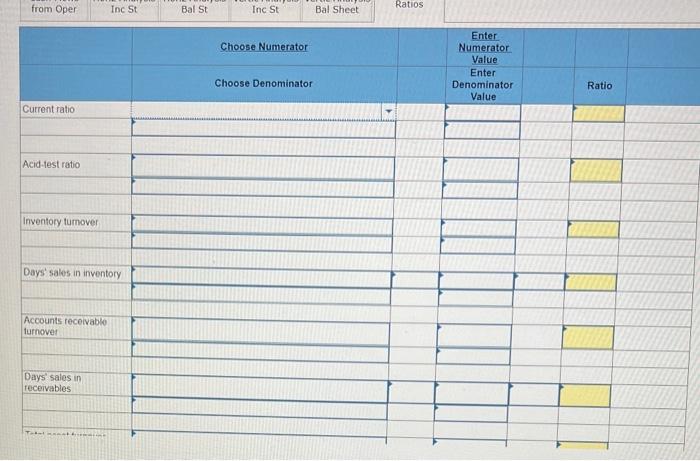

T. Mulholland Income Statement For years ended December 31, 2017 and 2018 Sales (all on credit) Cost of goods sold Gross margin Depreciation expense Other operating expenses Total operating expenses Operating income Other Income (expenses) Interest expense Gain on sale of Investments Loss on sale of plant assets Total other income (expenses) Income before income taxes 2018 2017 $697,000 $662,000 (367,000) (301,000) 330,000 361,000 37,000 52,000 150.000 125.000 187,000 177,000 143.000 184.000 (5,000) (3,700) 6,900 4,800 (4.100) (4.900) (16,000) (3,800) 140,800 180,200 Current assets: Cash Accounts receivable (net) Inventory Prepaid expenses Other current assets T. Mulholland Comparative Balance Sheets December 31, 2018 and 2017 2018 2017 Total current assets Long-term Investments Plant assets Less: accumulated depreciation Total plant assets Total assets Current liabilities: Accounts payable $72,040 43,000 48,000 1,800 2.620 167,460 86,000 312,000 (78,600) 233.400 486,860 $29,400 Change $33,900 $38,140 36,000 46,000 7,000 2,000 4,100 -2,300 4.000 1.380 124.000 43,460 60,000 26,000 261,000 51,000 (52,000) 26,600 209.000 24.400 393.000 93,860 $30,000 $-600 (expenses) Income before income taxes Income taxes expense Net income T. Mulholland Statement of Retained Earnings For the year ended December 31, 2018 2018 2017 Ret. earnings, Jan. 1 Add: net income Deduct: Dividends Increase in retained earnings Ret. earnings, Dec. 31 Other information: Shares of common stock outstanding Earnings per share Dividends per share 140,800 180,200 (42.240) (54,060) $98.560 $126,140 Market price per share, common stock $38,000 98,560 126,140 (59.000) (88.140) 39,560 38,000 $77.560 $38.000 $0 20,000 20,000 $4.93 $6.31 $2.95 $4.41 $13 $17 Current liabilities: Accounts payable Accrued liabilities Income taxes payable Total current liabilities Long term liabilities: Notes Payable Total liabilities Stockholders' equity Common stock, $5 par value Additional paid-in capital Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $29,400 2,400 3.500 35,300 249,000 284,300 100,000 25,000 77,560 202,560 $486.860 $30,000 $-600 2,000 400 13,000 -9.500 45,000 -9.700 185,000 64,000 230,000 54,300 100,000 25,000 0 38.000 39.560 163,000 39,560 $393.000 $93.860 Requirement Prepare a vertical analysis on the partial balance sheet for 2017 and 2018. T. Mulholland. Partial Balance Sheet (Vertical analysis) For the years ended December 31, 2018 and 2017 2018 Current liabilities: Liabilities. Accounts payable Accrued liabilities Income taxes payable Total current liabilities Notes payable Total liabilities Stockholders' Equity Common stock, $5 par Additional paid-in capital Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ 0 249,000 249,000 249,000 % S 2017 0 185,000 185,000 0 185,000 from Oper Current ratio Acid-test ratio Inventory turnover Days' sales in inventory Accounts receivable turnover Inc St. Days' sales in receivables Bal St Inc St Choose Numerator Choose Denominator Bal Sheet Ratios Enter Numerator Value Enter Denominator Value Ratio Days' sales in receivables Total asset turnover Debt-to-equity ratio Profit margin Return on total assets i Return on common stockholders' equity Price/earnings ratio (P/E) Dividend yield