Please help with this accounting problem.

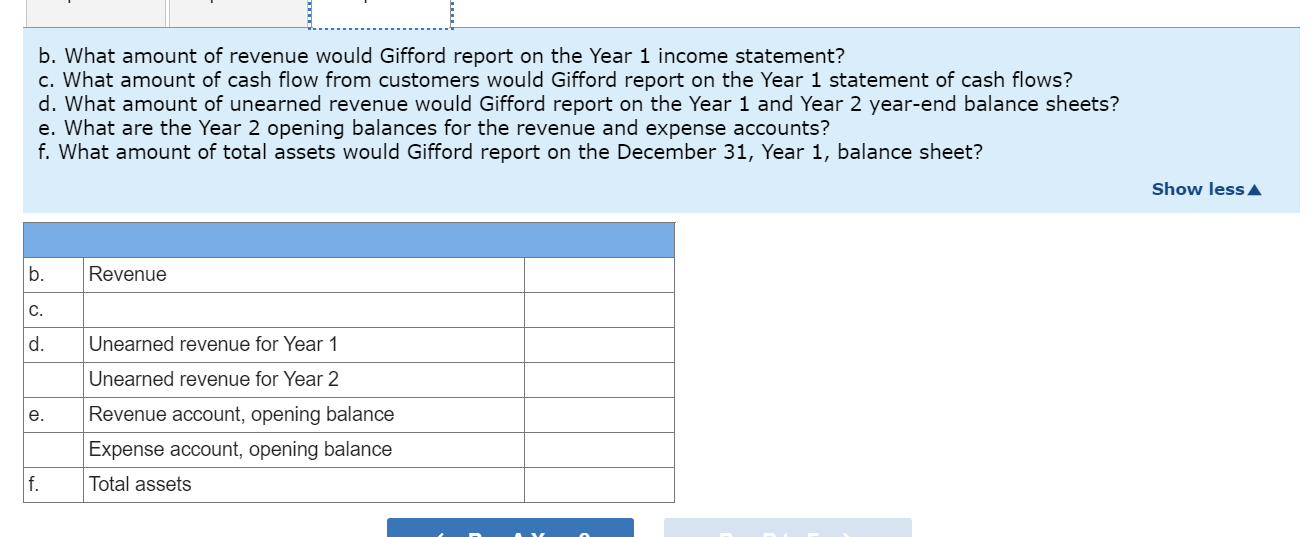

This is the outline for the last part.

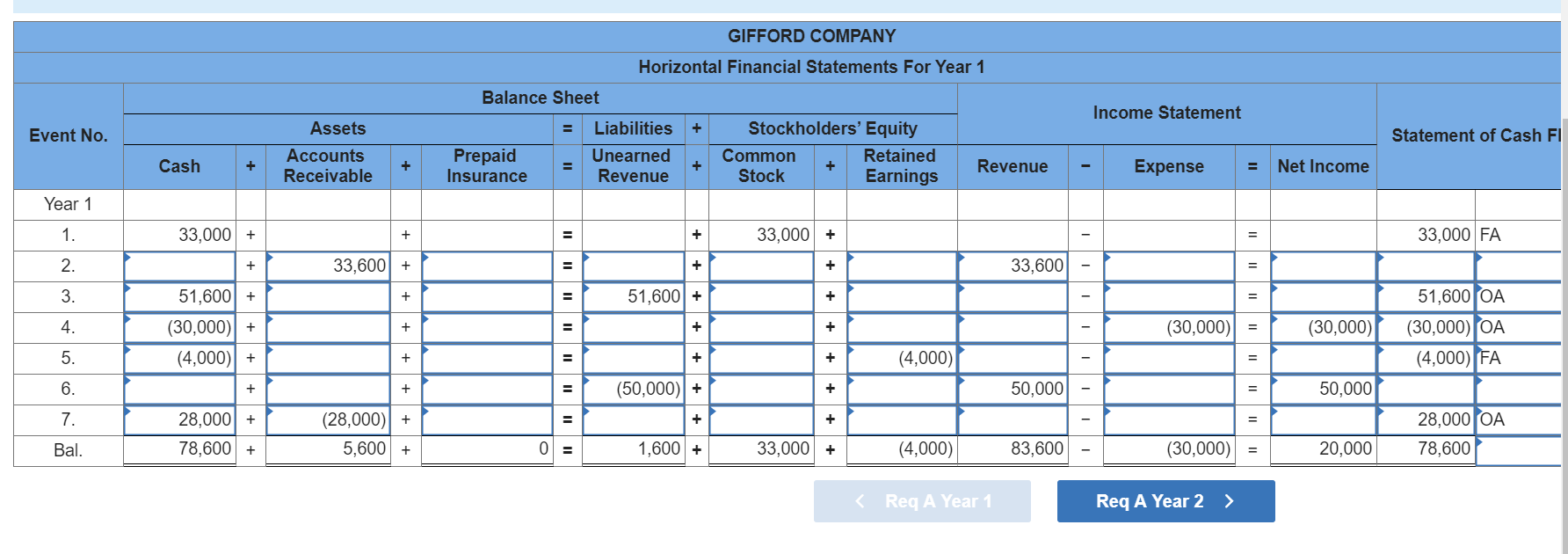

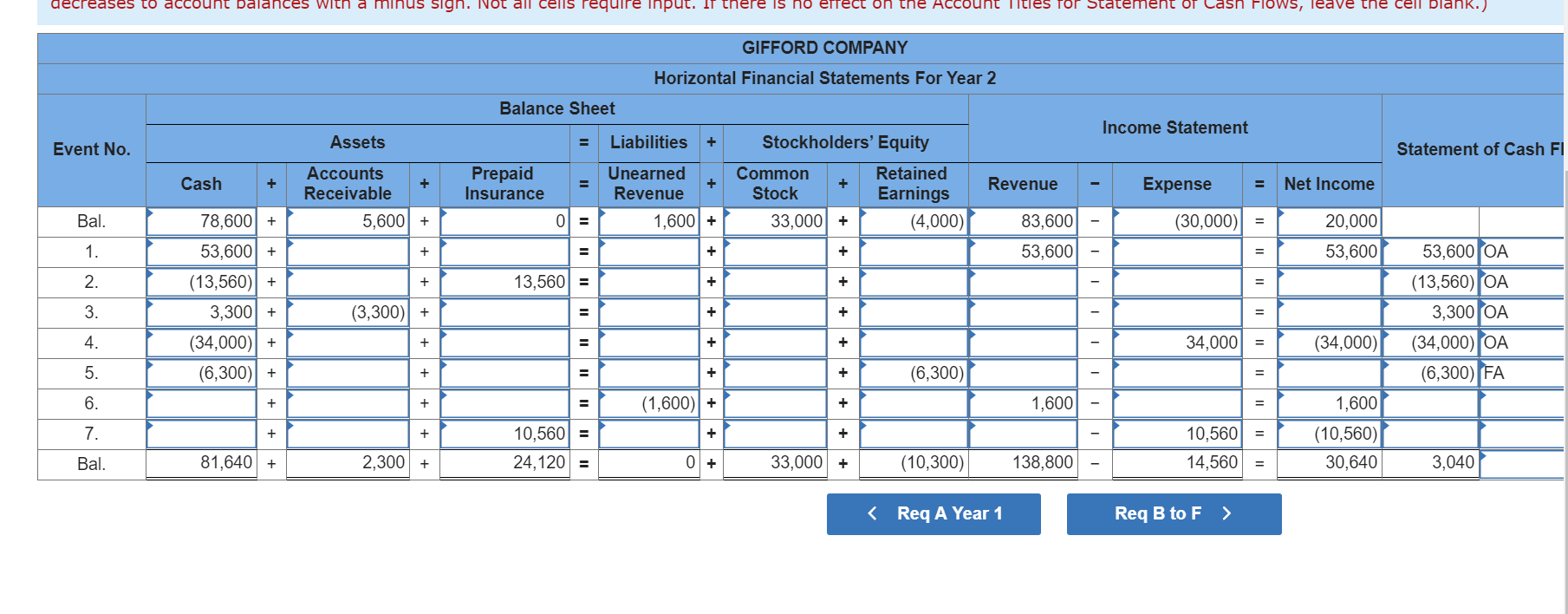

And here are the outlines for the first two parts. My numbers are wrong but this is how they want it.

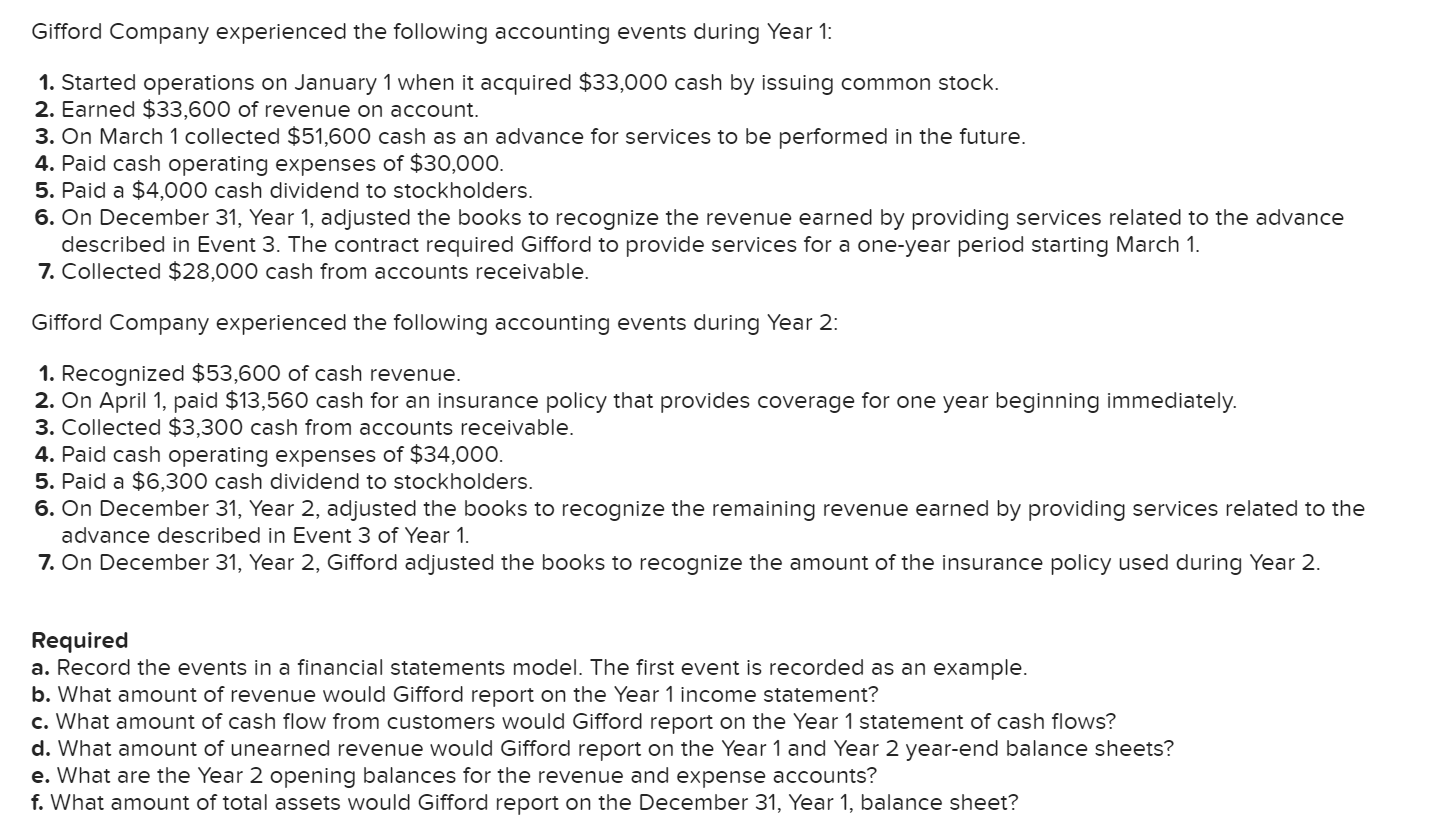

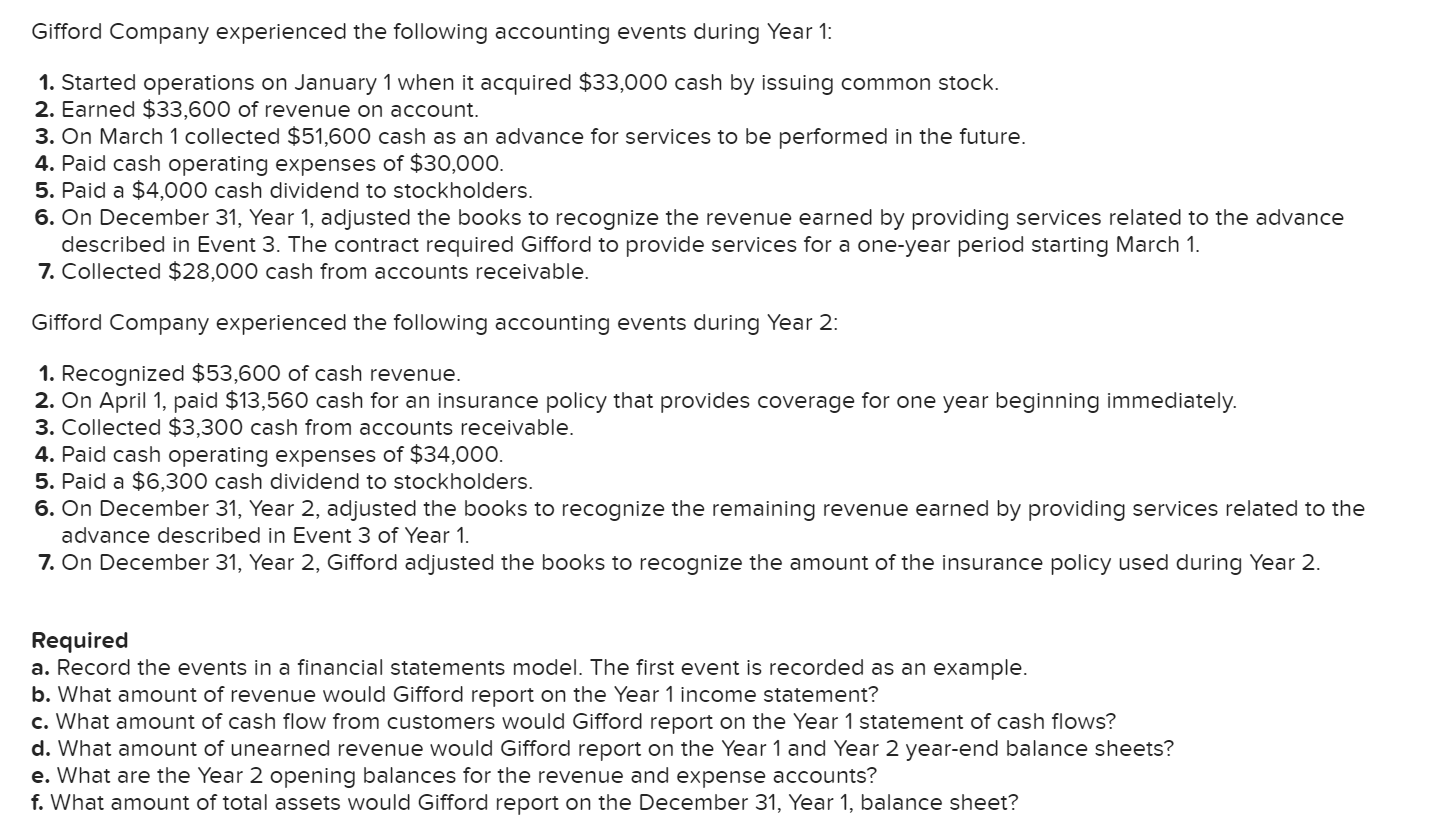

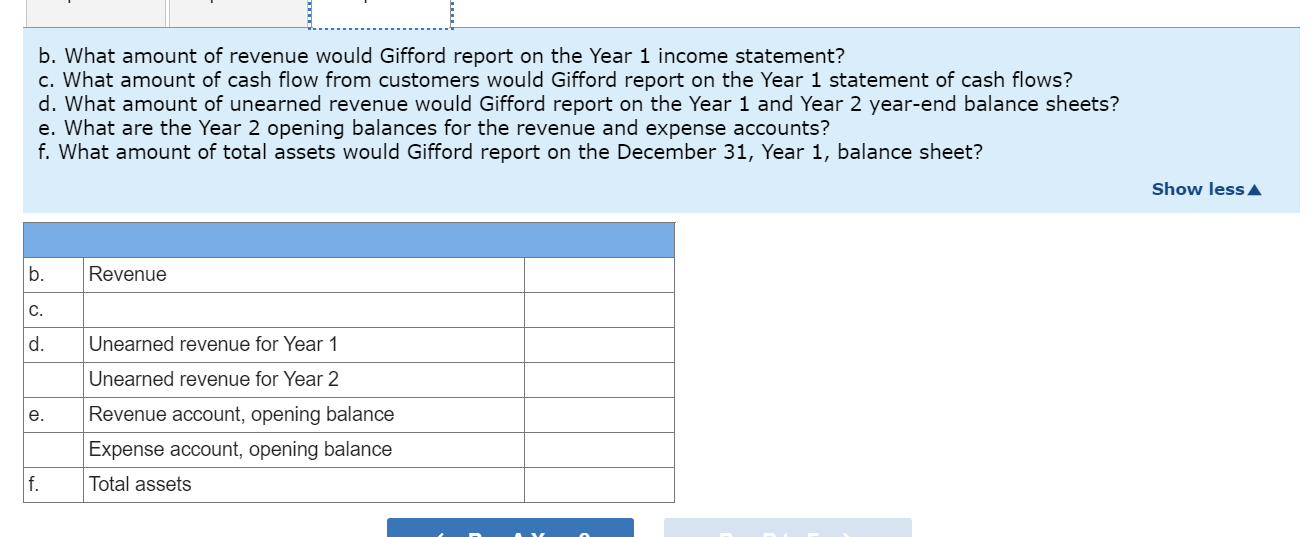

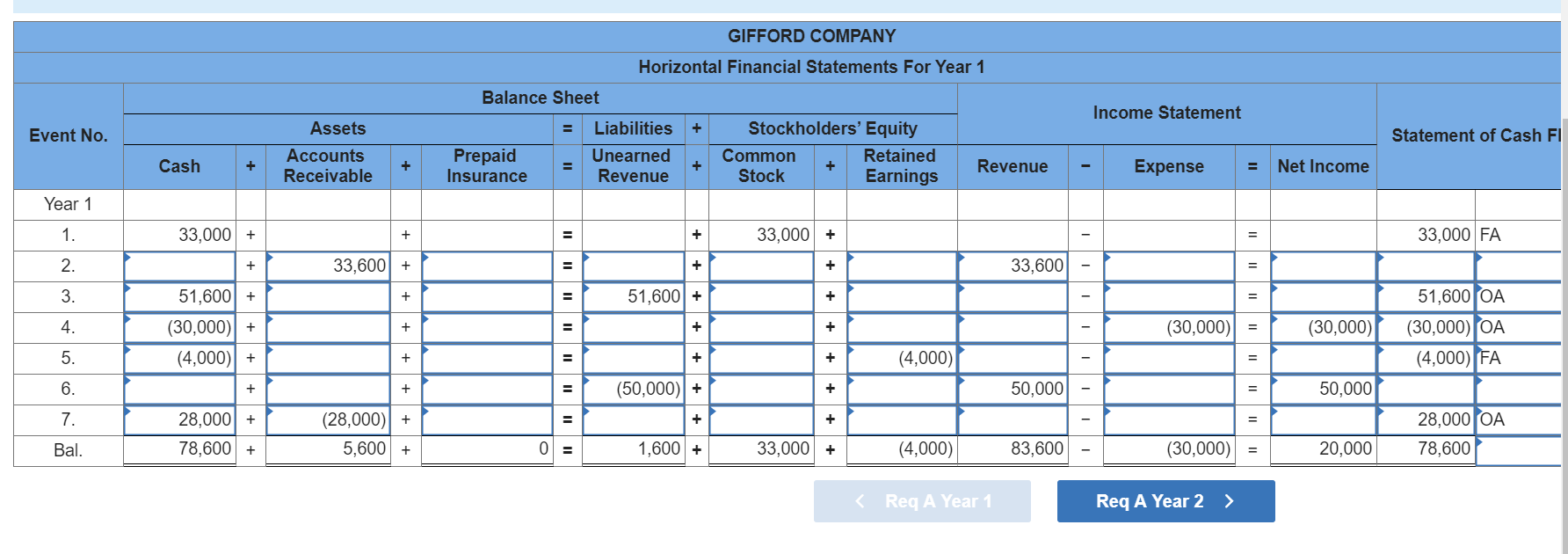

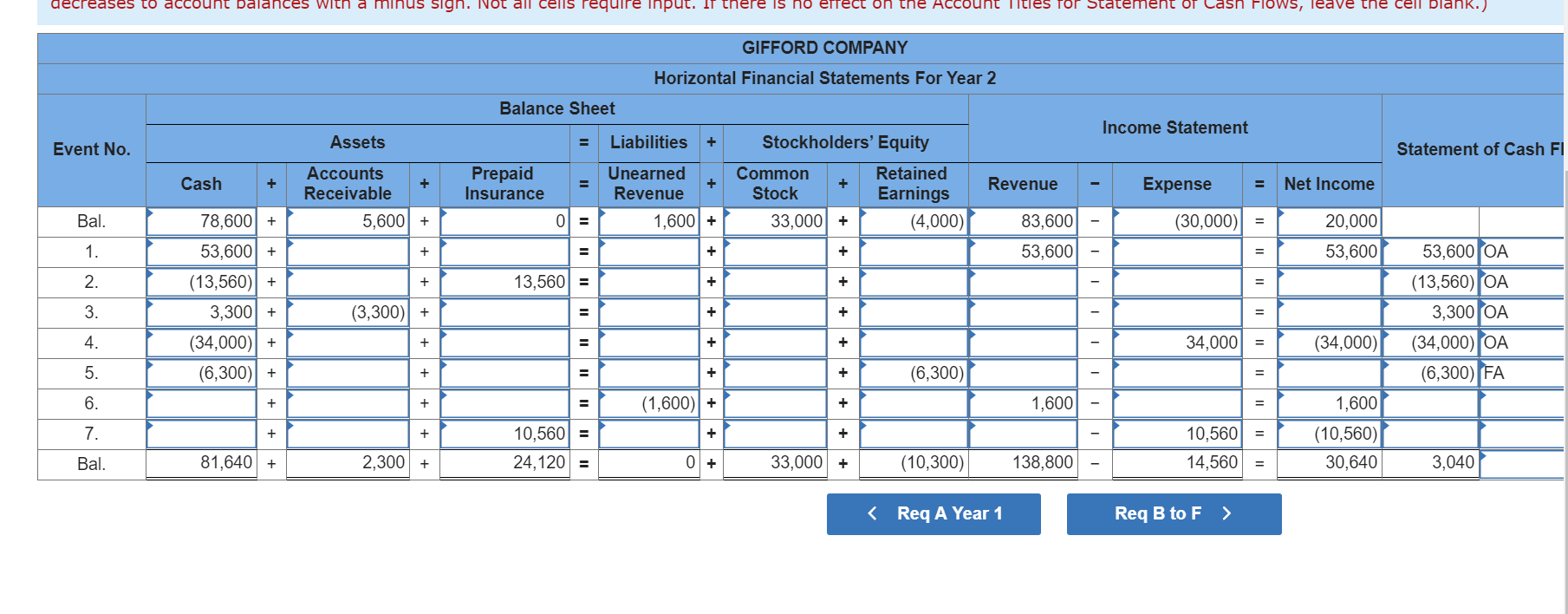

Gifford Company experienced the following accounting events during Year 1: 1. Started operations on January 1 when it acquired $33,000 cash by issuing common stock. 2. Earned $33,600 of revenue on account. 3. On March 1 collected $51,600 cash as an advance for services to be performed in the future. 4. Paid cash operating expenses of $30,000. 5. Paid a $4,000 cash dividend to stockholders. 6. On December 31, Year 1, adjusted the books to recognize the revenue earned by providing services related to the advance described in Event 3. The contract required Gifford to provide services for a one-year period starting March 1. 7. Collected $28,000 cash from accounts receivable. Gifford Company experienced the following accounting events during Year 2: 1. Recognized $53,600 of cash revenue. 2. On April 1, paid $13,560 cash for an insurance policy that provides coverage for one year beginning immediately. 3. Collected $3,300 cash from accounts receivable. 4. Paid cash operating expenses of $34,000. 5. Paid a $6,300 cash dividend to stockholders. 6. On December 31, Year 2, adjusted the books to recognize the remaining revenue earned by providing services related to the advance described in Event 3 of Year 1. 7. On December 31, Year 2, Gifford adjusted the books to recognize the amount of the insurance policy used during Year 2. Required a. Record the events in a financial statements model. The first event is recorded as an example. b. What amount of revenue would Gifford report on the Year 1 income statement? c. What amount of cash flow from customers would Gifford report on the Year 1 statement of cash flows? d. What amount of unearned revenue would Gifford report on the Year 1 and Year 2 year-end balance sheets? e. What are the Year 2 opening balances for the revenue and expense accounts? f. What amount of total assets would Gifford report on the December 31, Year 1, balance sheet? b. What amount of revenue would Gifford report on the Year 1 income statement? c. What amount of cash flow from customers would Gifford report on the Year 1 statement of cash flows? d. What amount of unearned revenue would Gifford report on the Year 1 and Year 2 year-end balance sheets? e. What are the Year 2 opening balances for the revenue and expense accounts? f. What amount of total assets would Gifford report on the December 31, Year 1, balance sheet? Show less Revenue Unearned revenue for Year 1 Unearned revenue for Year 2 e. Revenue account, opening balance Expense account, opening balance Total assets f. GIFFORD COMPANY Horizontal Financial Statements For Year 1 Income Statement + Event No. Balance Sheet Liabilities Prepaid Unearned Insurance Revenue Assets Accounts Receivable Statement of Cash FI Stockholders' Equity Common Retained Stock Earnings Cash + + + Revenue Expense II Net Income Year 1 1. 33,000 + + + 33,000 + 33,000 FA 2. + 33,600 + + 33,600 3. + = 51,600 + + = 4. 51,600 + (30,000) + (4,000)| + + + (30,000) (30,000) 51,600 OA (30,000) (OA (4,000) FA 5. + = + + + + + + (4,000) 6. + + (50,000)| + + 50,000 = 50,000 7. + + 28,000 + 78,600 + (28,000) + 5,600 + 28,000 OA 78,600 Bal. 0 = 1,600 + 33,000 + (4,000) 83,600 (30,000) 20,000 decreases to account balances with a minus sign. Not all cells require input. If there is no errect on the Account Titles for Statement of Cash Flows, leave the cell blank.) GIFFORD COMPANY Horizontal Financial Statements For Year 2 Balance Sheet Income Statement Event No. Assets Liabilities + Statement of Cash FI Cash + + Prepaid Insurance = + Stockholders' Equity Common Retained Stock Earnings 33,000| + (4,000) Revenue Accounts Receivable 5,600 + Expense Net Income Unearned + Revenue 1,600| + Bal. 0] = 83,600 (30,000) 20.000 1. + = + + 53,600 = 53,600 2. + 13,560] = + + 78,600 + 53,600 + (13,560) + 3,300 + (34,000) + (6,300)| + 3. (3,300)| + = + + + 53,600 (OA (13,560) OA 3,300 (OA (34,000) OA (6,300) FA 4. + + 34,000 (34,000) . 5. + + (6,300) + + + + 6. + (1,600) + + 1,600 = 7. + + + 10,560 = 24,120 = 10,560 14,560 = 1,600 (10,560) 30,640 Bal. 81,640 + 2,300 + + 33,000 + (10,300) 138,800 3,040