Please help with this accounting question cant seem to solve it.

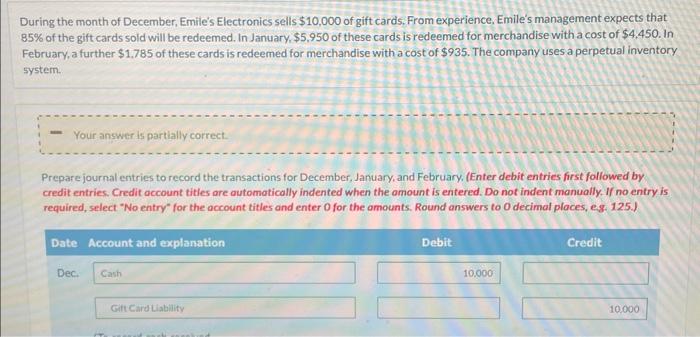

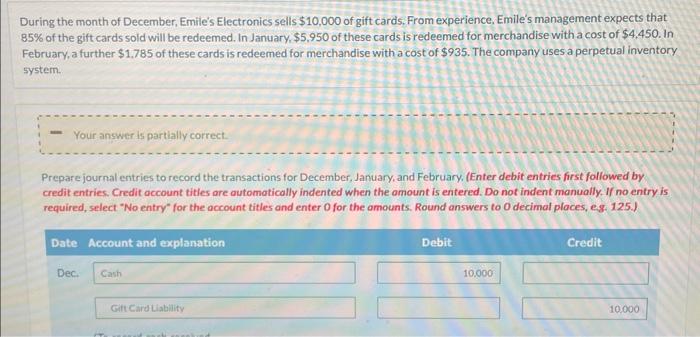

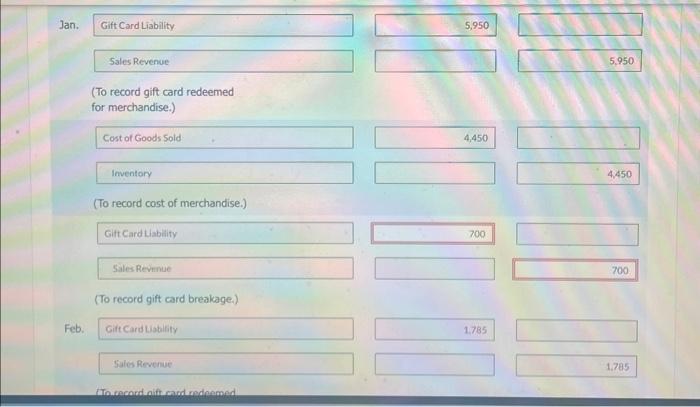

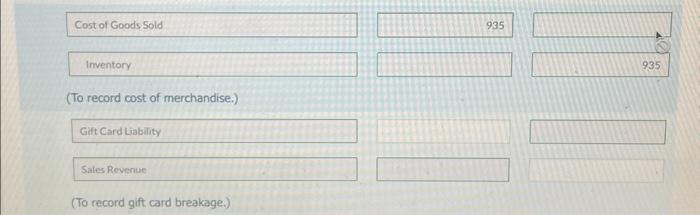

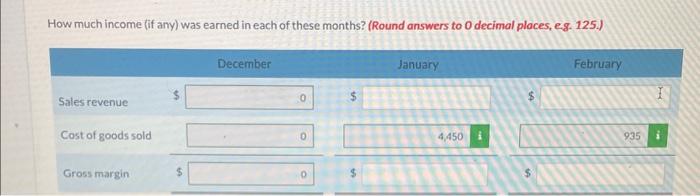

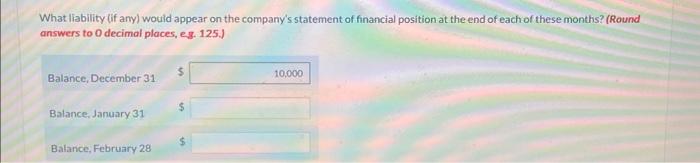

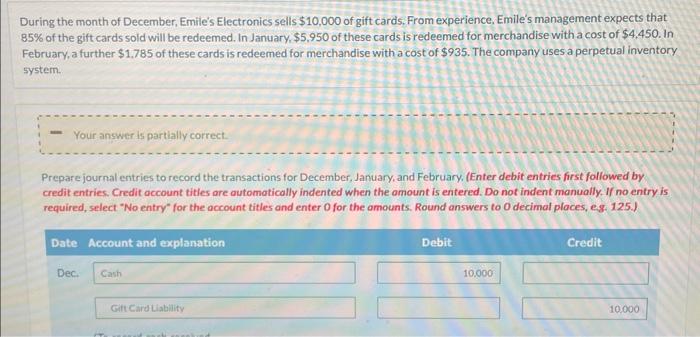

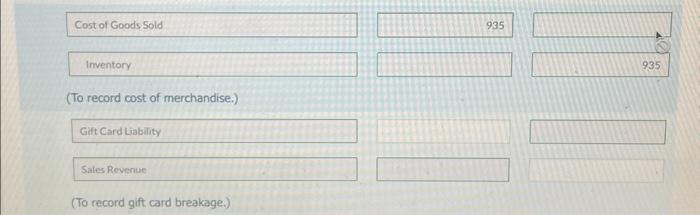

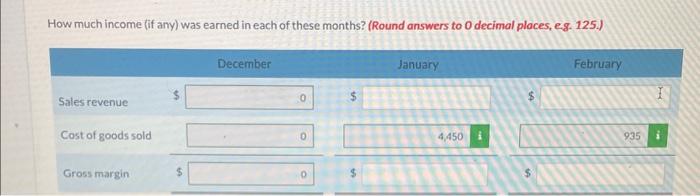

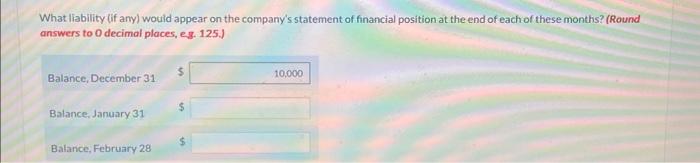

During the month of December, Emile's Electronics sells $10,000 of gift cards. From experience. Emile's management expects that 85% of the gift cards sold will be redeemed. In January, $5,950 of these cards is redeemed for merchandise with a cost of $4,450. In February, a further $1,785 of these cards is redeemed for merchandise with a cost of $935. The company uses a perpetual inventory system. Prepare journal entries to record the transactions for December, January, and February. (Enter debit entries first followed by credit entries. Credit account tities are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, eg. 125.) Jan. Gift Card Liability 5,950 Sales Revenue (To record gift card redeemed for merchandise.) Cost of Goods Sold Inventory (To record cost of merchandise.) Gitt Card Llability (To record gift card breakage.) Feb. Gitt Card tiablity Sales Revenue Cost of Goods 5old Inventory (To record cost of merchandise.) Gift Card Liability Sales Revenue (To record gift card breakage.) How much income (if any) was earned in each of these months? (Round answers to 0 decimal ploces, eg. 125. ) What liability (if any) would appear on the company's statement of financial position at the end of each of these months? (Round answers to 0 decimal places, e.3. 125.) During the month of December, Emile's Electronics sells $10,000 of gift cards. From experience. Emile's management expects that 85% of the gift cards sold will be redeemed. In January, $5,950 of these cards is redeemed for merchandise with a cost of $4,450. In February, a further $1,785 of these cards is redeemed for merchandise with a cost of $935. The company uses a perpetual inventory system. Prepare journal entries to record the transactions for December, January, and February. (Enter debit entries first followed by credit entries. Credit account tities are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, eg. 125.) Jan. Gift Card Liability 5,950 Sales Revenue (To record gift card redeemed for merchandise.) Cost of Goods Sold Inventory (To record cost of merchandise.) Gitt Card Llability (To record gift card breakage.) Feb. Gitt Card tiablity Sales Revenue Cost of Goods 5old Inventory (To record cost of merchandise.) Gift Card Liability Sales Revenue (To record gift card breakage.) How much income (if any) was earned in each of these months? (Round answers to 0 decimal ploces, eg. 125. ) What liability (if any) would appear on the company's statement of financial position at the end of each of these months? (Round answers to 0 decimal places, e.3. 125.)