Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with this and show work so I can understand it. Thank you! 8.5.7 1) Snow Bank offers a savings account that pays 1.71%

Please help with this and show work so I can understand it. Thank you!

8.5.7

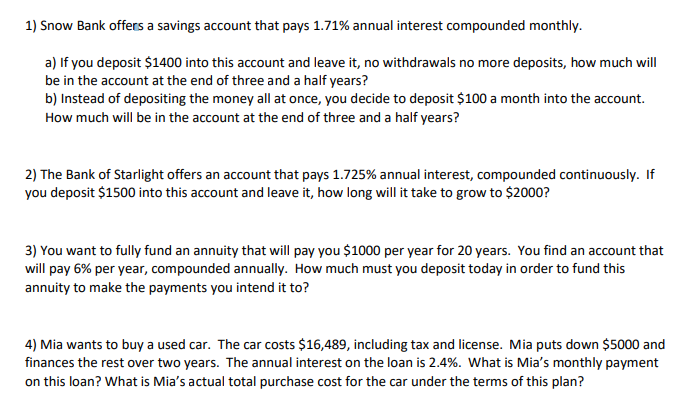

1) Snow Bank offers a savings account that pays 1.71% annual interest compounded monthly. a) If you deposit $1400 into this account and leave it, no withdrawals no more deposits, how much will be in the account at the end of three and a half years? b) Instead of depositing the money all at once, you decide to deposit $100 a month into the account. How much will be in the account at the end of three and a half years? 2) The Bank of Starlight offers an account that pays 1.725% annual interest, compounded continuously. If you deposit $1500 into this account and leave it, how long will it take to grow to $2000? 3) You want to fully fund an annuity that will pay you $1000 per year for 20 years. You find an account that will pay 6% per year, compounded annually. How much must you deposit today in order to fund this annuity to make the payments you intend it to? 4) Mia wants to buy a used car. The car costs $16,489, including tax and license. Mia puts down $5000 and finances the rest over two years. The annual interest on the loan is 2.4%. What is Mia's monthly payment on this loan? What is Mia's actual total purchase cost for the car under the terms of this plan? 1) Snow Bank offers a savings account that pays 1.71% annual interest compounded monthly. a) If you deposit $1400 into this account and leave it, no withdrawals no more deposits, how much will be in the account at the end of three and a half years? b) Instead of depositing the money all at once, you decide to deposit $100 a month into the account. How much will be in the account at the end of three and a half years? 2) The Bank of Starlight offers an account that pays 1.725% annual interest, compounded continuously. If you deposit $1500 into this account and leave it, how long will it take to grow to $2000? 3) You want to fully fund an annuity that will pay you $1000 per year for 20 years. You find an account that will pay 6% per year, compounded annually. How much must you deposit today in order to fund this annuity to make the payments you intend it to? 4) Mia wants to buy a used car. The car costs $16,489, including tax and license. Mia puts down $5000 and finances the rest over two years. The annual interest on the loan is 2.4%. What is Mia's monthly payment on this loan? What is Mia's actual total purchase cost for the car under the terms of this plan Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started