Answered step by step

Verified Expert Solution

Question

1 Approved Answer

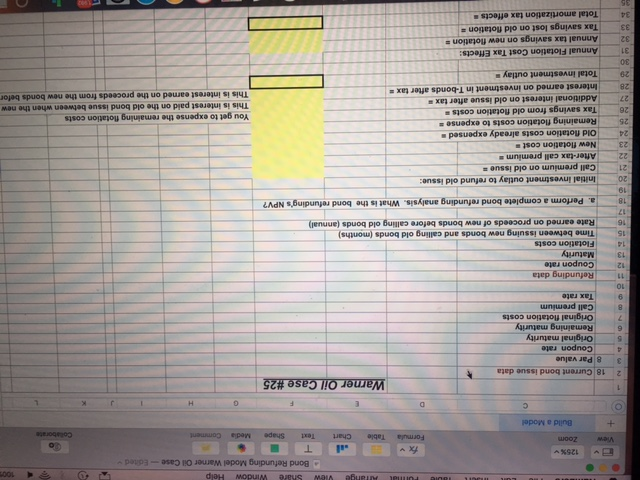

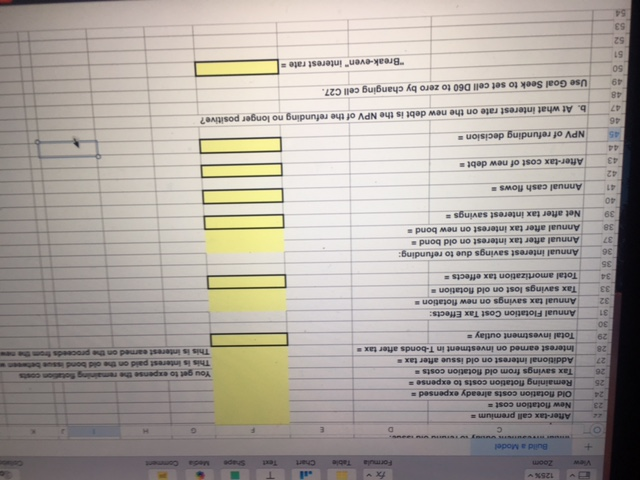

Please help with this case study (Warner Oil Company Case 25). Please use the bond refunding model given below (provide excel formulas). Also, provide a

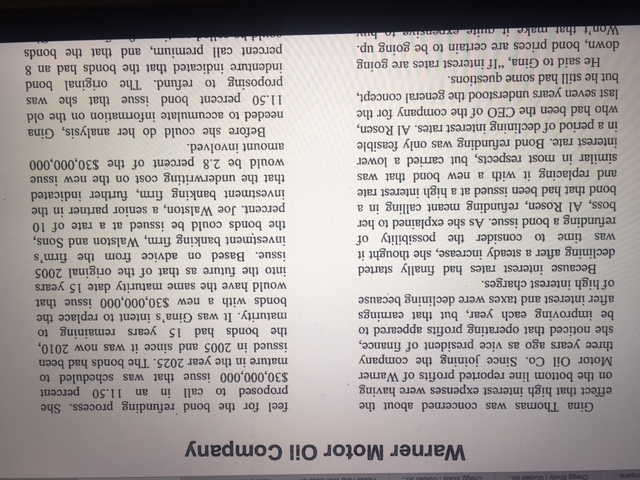

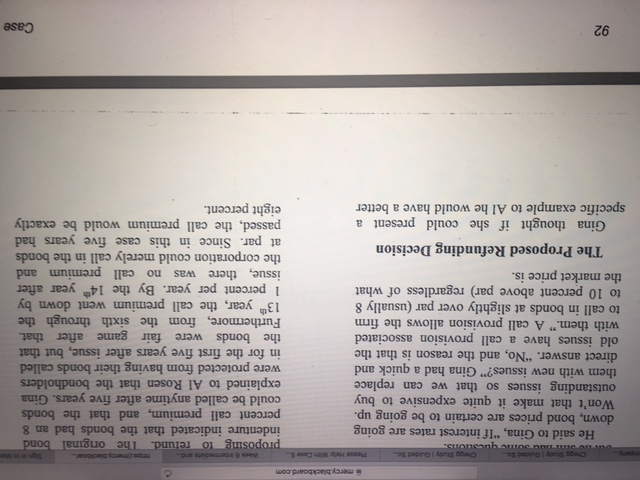

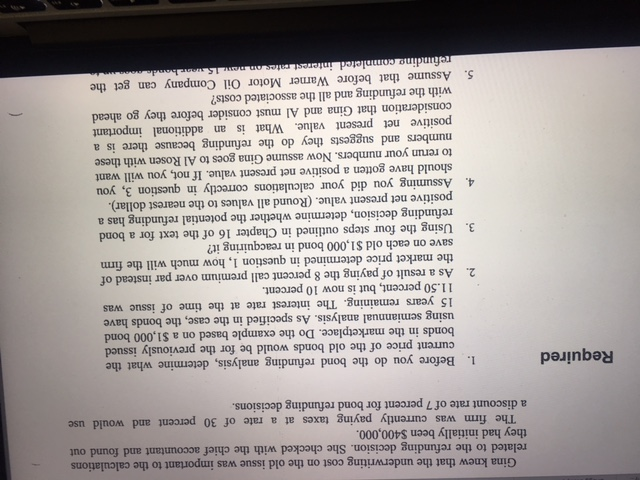

Please help with this case study (Warner Oil Company Case 25). Please use the bond refunding model given below (provide excel formulas). Also, provide a complete write up and not just the calculations. See case below and thank you so much for your help!

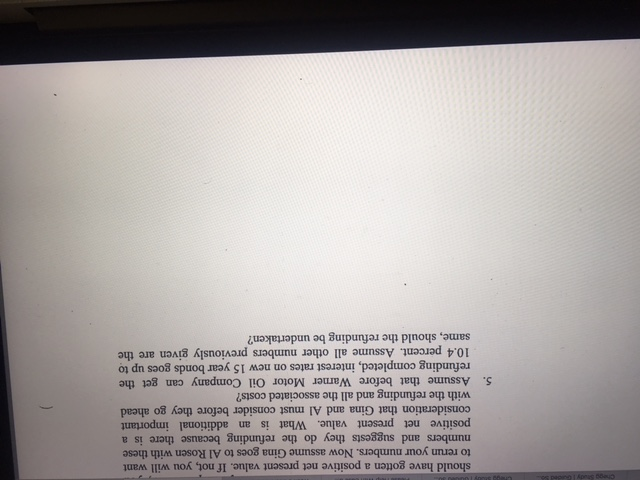

P.S. Show an analysis of what would happen if the current rates went from 10.0% up to 10.4%.

Bond refunding model

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started