Question

Please help with this case : To develop pro forma statements that could assist in the valuation of the firm, Roy made the following assumptions,

Please help with this case :

To develop pro forma statements that could assist in the valuation of the firm, Roy made the following assumptions, based on his experience at PBM:

1. Pretax operating profit equals 13.5 percent of sales.

2. Taxes computed using 30 percent combined (state and federal) tax rate.

3. Additional net working capital investment equal to $8,.150 in 1993 and thereafter 16.9 percent of incremental sales.

4. Capital investment requirements equal to $25,000 in 1993, $30,000 in 1994, $40,000 in 1995, $60,000 both in 1996 and 7997, and $70,000 per year thereafter. These capital outlays are needed to replace and recondition vehicles, sweepers, carpet cleaning equipment, and equipment and furnishings used in the main company office.

5.Annual depreciation was expected to total $5,000 in 1993, $11,000 in 1994, $20,000 in 7995, $45,000 in7996, and $70,000 per year thereafter.

6. If the acquisition is completed, the effective date will be January 1,1993.

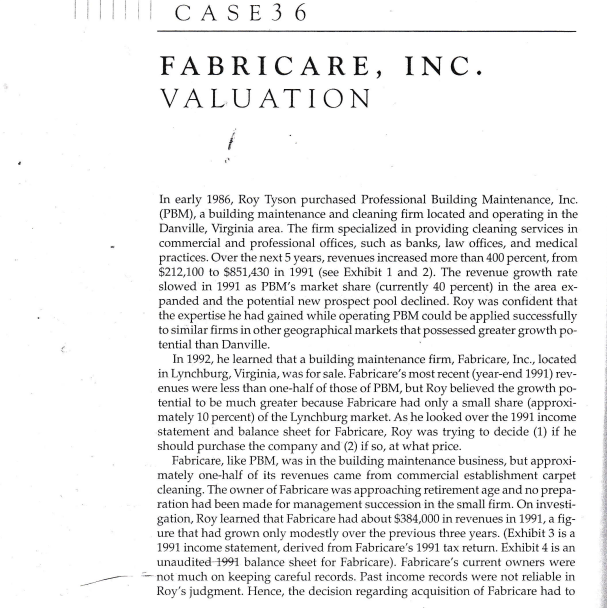

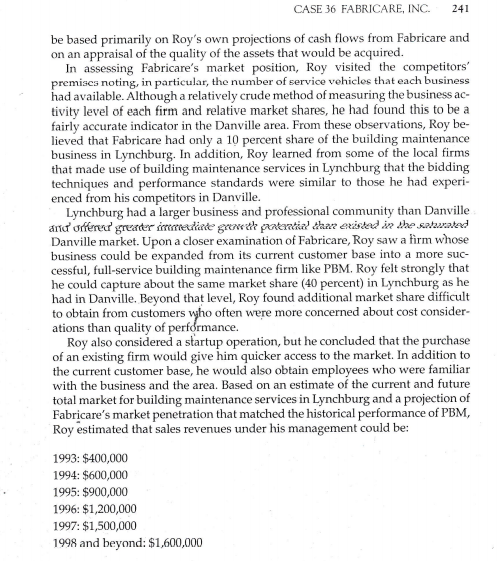

I! CASE 36 FABRICARE, INC. VALUATION In early 1986, Roy Tyson purchased Professional Building Maintenance, Inc. (PBM), a building maintenance and cleaning firm located and operating in the Danville, Virginia area. The firm specialized in providing cleaning services in commercial and professional offices, such as banks, law offices, and medical practices. Over the next 5 years, revenues increased more than 400 percent, from $212,100 to $851,430 in 1991 (see Exhibit 1 and 2). The revenue growth rate slowed in 1991 as PBM's market share (currently 40 percent) in the area ex- panded and the potential new prospect pool declined. Roy was confident that the expertise he had gained while operating PBM could be applied successfully to similar firms in other geographical markets that possessed greater growth po- tential than Danville. In 1992, he learned that a building maintenance firm, Fabricare, Inc., located in Lynchburg, Virginia, was for sale. Fabricare's most recent year-end 1991) rev- enues were less than one-half of those of PBM, but Roy believed the growth po- tential to be much greater because Fabricare had only a small share (approxi- mately 10 percent) of the Lynchburg market. As he looked over the 1991 income statement and balance sheet for Fabricare, Roy was trying to decide (1) if he should purchase the company and (2) if so, at what price. Fabricare, like PBM, was in the building maintenance business, but approxi- mately one-half of its revenues came from commercial establishment carpet cleaning. The owner of Fabricare was approaching retirement age and no prepa- ration had been made for management succession in the small firm. On investi- gation, Roy learned that Fabricare had about $384,000 in revenues in 1991, a fig- ure that had grown only modestly over the previous three years. (Exhibit 3 is a 1991 income statement, derived from Fabricare's 1991 tax return. Exhibit 4 is an unaudited 1991 balance sheet for Fabricare). Fabricare's current owners were - not much on keeping careful records. Past income records were not reliable in Roy's judgment. Hence, the decision regarding acquisition of Fabricare had to 241 CASE 36 FABRICARE, INC. be based primarily on Roy's own projections of cash flows from Fabricare and on an appraisal of the quality of the assets that would be acquired. In assessing Fabricare's market position, Roy visited the competitors' premises noting, in particular, the number of service vehicles that each business had available. Although a relatively crude method of measuring the business ac- tivity level of each firm and relative market shares, he had found this to be a fairly accurate indicator in the Danville area. From these observations, Roy be- lieved that Fabricare had only a 10 percent share of the building maintenance business in Lynchburg. In addition, Roy learned from some of the local firms that made use of building maintenance services in Lynchburg that the bidding techniques and performance standards were similar to those he had experi- enced from his competitors in Danville. Lynchburg had a larger business and professional community than Danville andorfere greater immediate great patentia dar existed in the sancted Danville market. Upon a closer examination of Fabricare, Roy saw a firm whose business could be expanded from its current customer base into a more suc- cessful, full-service building maintenance firm like PBM. Roy felt strongly that he could capture about the same market share (40 percent) in Lynchburg as he had in Danville. Beyond that level, Roy found additional market share difficult to obtain from customers who often were more concerned about cost consider- ations than quality of performance. Roy also considered a startup operation, but he concluded that the purchase of an existing firm would give him quicker access to the market. In addition to the current customer base, he would also obtain employees who were familiar with the business and the area. Based on an estimate of the current and future total market for building maintenance services in Lynchburg and a projection of Fabricare's market penetration that matched the historical performance of PBM, Roy estimated that sales revenues under his management could be: 1993: $400,000 1994: $600,000 1995: $900,000 1996: $1,200,000 1997: $1,500,000 1998 and beyond: $1,600,000 I! CASE 36 FABRICARE, INC. VALUATION In early 1986, Roy Tyson purchased Professional Building Maintenance, Inc. (PBM), a building maintenance and cleaning firm located and operating in the Danville, Virginia area. The firm specialized in providing cleaning services in commercial and professional offices, such as banks, law offices, and medical practices. Over the next 5 years, revenues increased more than 400 percent, from $212,100 to $851,430 in 1991 (see Exhibit 1 and 2). The revenue growth rate slowed in 1991 as PBM's market share (currently 40 percent) in the area ex- panded and the potential new prospect pool declined. Roy was confident that the expertise he had gained while operating PBM could be applied successfully to similar firms in other geographical markets that possessed greater growth po- tential than Danville. In 1992, he learned that a building maintenance firm, Fabricare, Inc., located in Lynchburg, Virginia, was for sale. Fabricare's most recent year-end 1991) rev- enues were less than one-half of those of PBM, but Roy believed the growth po- tential to be much greater because Fabricare had only a small share (approxi- mately 10 percent) of the Lynchburg market. As he looked over the 1991 income statement and balance sheet for Fabricare, Roy was trying to decide (1) if he should purchase the company and (2) if so, at what price. Fabricare, like PBM, was in the building maintenance business, but approxi- mately one-half of its revenues came from commercial establishment carpet cleaning. The owner of Fabricare was approaching retirement age and no prepa- ration had been made for management succession in the small firm. On investi- gation, Roy learned that Fabricare had about $384,000 in revenues in 1991, a fig- ure that had grown only modestly over the previous three years. (Exhibit 3 is a 1991 income statement, derived from Fabricare's 1991 tax return. Exhibit 4 is an unaudited 1991 balance sheet for Fabricare). Fabricare's current owners were - not much on keeping careful records. Past income records were not reliable in Roy's judgment. Hence, the decision regarding acquisition of Fabricare had to 241 CASE 36 FABRICARE, INC. be based primarily on Roy's own projections of cash flows from Fabricare and on an appraisal of the quality of the assets that would be acquired. In assessing Fabricare's market position, Roy visited the competitors' premises noting, in particular, the number of service vehicles that each business had available. Although a relatively crude method of measuring the business ac- tivity level of each firm and relative market shares, he had found this to be a fairly accurate indicator in the Danville area. From these observations, Roy be- lieved that Fabricare had only a 10 percent share of the building maintenance business in Lynchburg. In addition, Roy learned from some of the local firms that made use of building maintenance services in Lynchburg that the bidding techniques and performance standards were similar to those he had experi- enced from his competitors in Danville. Lynchburg had a larger business and professional community than Danville andorfere greater immediate great patentia dar existed in the sancted Danville market. Upon a closer examination of Fabricare, Roy saw a firm whose business could be expanded from its current customer base into a more suc- cessful, full-service building maintenance firm like PBM. Roy felt strongly that he could capture about the same market share (40 percent) in Lynchburg as he had in Danville. Beyond that level, Roy found additional market share difficult to obtain from customers who often were more concerned about cost consider- ations than quality of performance. Roy also considered a startup operation, but he concluded that the purchase of an existing firm would give him quicker access to the market. In addition to the current customer base, he would also obtain employees who were familiar with the business and the area. Based on an estimate of the current and future total market for building maintenance services in Lynchburg and a projection of Fabricare's market penetration that matched the historical performance of PBM, Roy estimated that sales revenues under his management could be: 1993: $400,000 1994: $600,000 1995: $900,000 1996: $1,200,000 1997: $1,500,000 1998 and beyond: $1,600,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started