Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with this Finance problem. Thank you for your time! Your firm is considering expanding its line of soft drinks as a result of

Please help with this Finance problem. Thank you for your time!

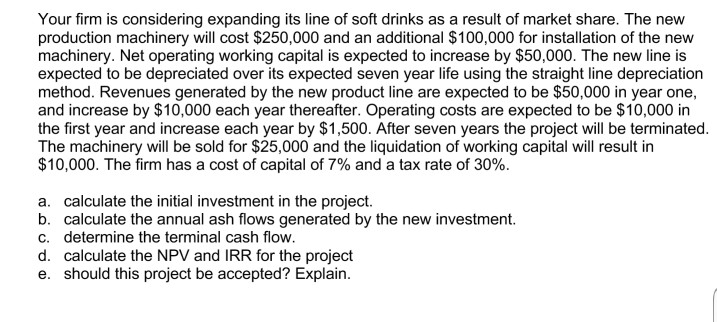

Your firm is considering expanding its line of soft drinks as a result of market share. The new production machinery will cost $250,000 and an additional $100,000 for installation of the new machinery. Net operating working capital is expected to increase by $50,000. The new line is expected to be depreciated over its expected seven year life using the straight line depreciation method. Revenues generated by the new product line are expected to be $50,000 in year one, and increase by $10,000 each year thereafter. Operating costs are expected to be $10,000 in the first year and increase each year by $1,500. After seven years the project will be terminated The machinery will be sold for $25,000 and the liquidation of working capital will result in $10,000. The firm has a cost of capital of 7% and a tax rate of 30% a. calculate the initial investment in the project. b. calculate the annual ash flows generated by the new investment c. determine the terminal cash flow d. calculate the NPV and IRR for the project e. should this project be accepted? ExplainStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started