Question

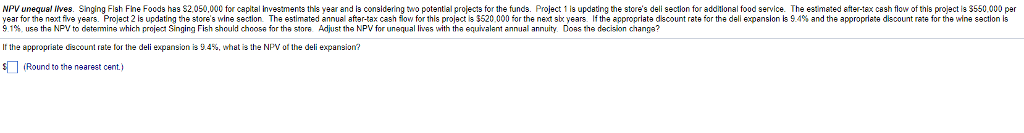

Please help with this NPV problem. The questions for the problem are: If the appropriate discount rate for the deli expansion is 9.4?%, what is

Please help with this NPV problem. The questions for the problem are:

If the appropriate discount rate for the deli expansion is 9.4?%, what is the NPV of the deli? expansion

If the appropriate discount rate for the wine section is 9.1?%, what is the NPV of the wine? section?

Based on the? NPV, Singing Fish Fine Foods should pick the _____ project?

What is the adjusted NPV equivalent annual annuity of the deli? expansion?

What is the adjusted NPV equivalent annual annuity of the wine? section?

Based on the adjusted? NPV, Singing Fish Fine Foods should pick the ____ project?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started