Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with this past paper on consolidation Please also include full working out, Thank you Question 1 The statements of financial position as at

Please help with this past paper on consolidation

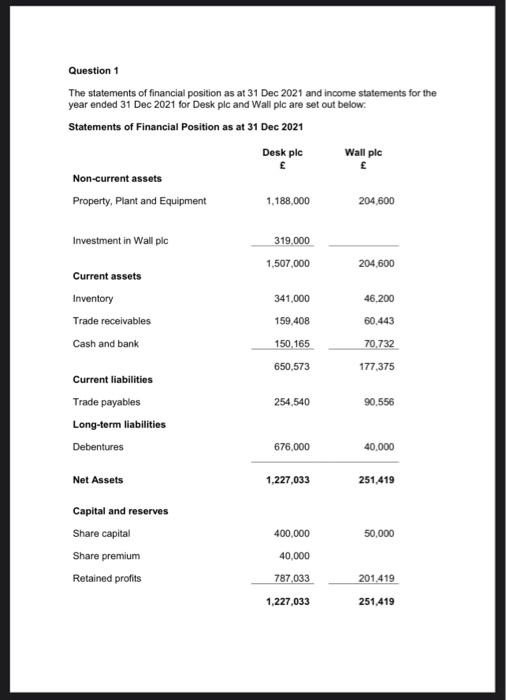

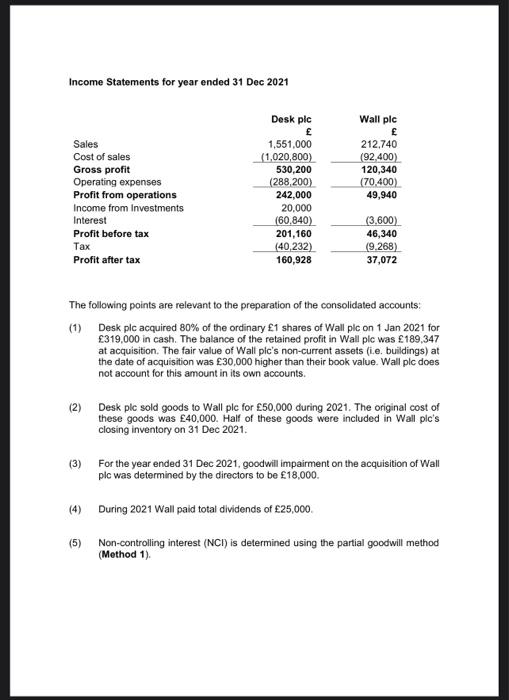

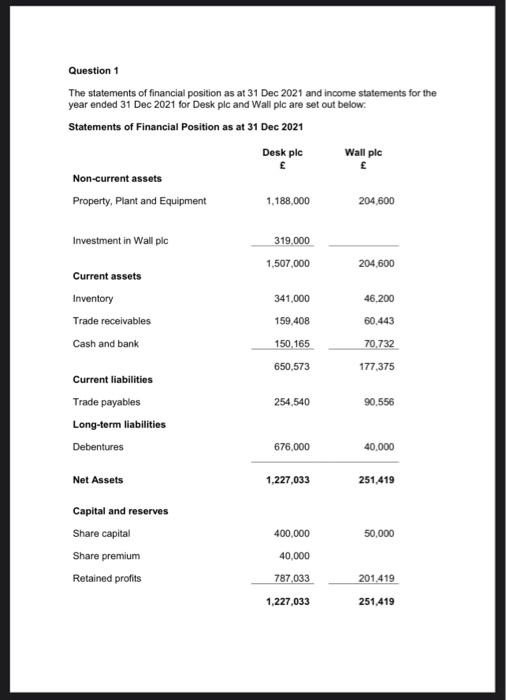

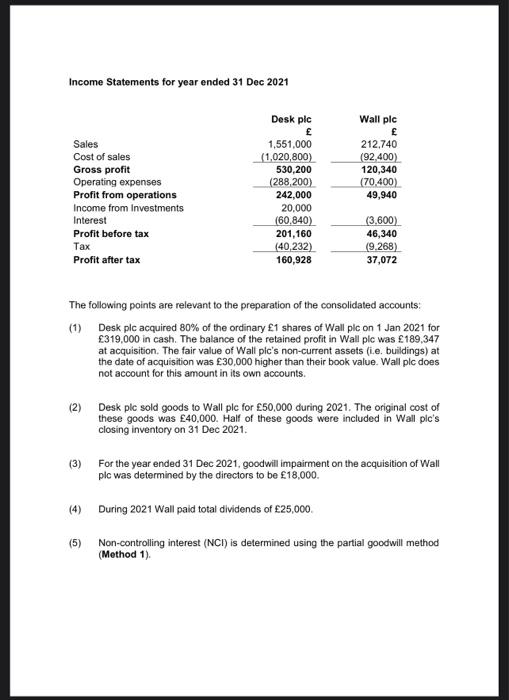

Question 1 The statements of financial position as at 31 Dec 2021 and income statements for the year ended 31 Dec 2021 for Desk plc and Wall plc are set out below. Statements of Financial Position as at 31 Dec 2021 Desk plc Wall plc Non-current assets Property, Plant and Equipment 1,188,000 204,600 Investment in Wall plc 319.000 1.507.000 204,600 Current assets Inventory Trade receivables Cash and bank 341,000 159.408 150,165 650,573 46.200 60.443 70.732 177,375 254,540 90.556 Current liabilities Trade payables Long-term liabilities Debentures 676,000 40,000 Net Assets 1,227,033 251,419 50,000 Capital and reserves Share capital Share premium Retained profits 400,000 40,000 787,033 1,227,033 201.419 251,419 Income Statements for year ended 31 Dec 2021 Desk plc E 1,551,000 (1,020,800) 530,200 (288, 200) 242,000 20,000 (60.840) 201,160 (40,232) 160,928 Wall plc 212.740 (92.400) 120,340 (70.400) 49,940 Sales Cost of sales Gross profit Operating expenses Profit from operations Income from Investments Interest Profit before tax Tax Profit after tax (3.600) 46,340 (9.268) 37,072 The following points are relevant to the preparation of the consolidated accounts: (1) Desk plc acquired 80% of the ordinary 1 shares of Wall pic on 1 Jan 2021 for 319,000 in cash. The balance of the retained profit in Wall plc was 189,347 at acquisition. The fair value of Wall pic's non-current assets (ie, buildings) at the date of acquisition was 30,000 higher than their book value. Wall plc does not account for this amount in its own accounts. (2) 2 Desk plc sold goods to Wall ple for 50,000 during 2021. The original cost of these goods was 40,000. Half of these goods were included in Wall ple's closing inventory on 31 Dec 2021. (3) For the year ended 31 Dec 2021. goodwill impairment on the acquisition of Wall plc was determined by the directors to be 18,000. (4) During 2021 Wall paid total dividends of 25,000 (5) Non-controlling interest (NCT) is determined using the partial goodwill method (Method 1). Required: Part A: Prepare consolidated statement of financial position (CSFP) as at 31 Dec 2021 and consolidated income statement (CIS) for the year ended 31 Dec 2021. Show clearly all supporting workings. (80 marks) Part B: Discussion Question: Critically discuss the pre and post-acquisition reserves of a subsidiary and the accounting treatment in the consolidation process. Provide a numerical example to reinforce your discussion (20 marks) Total: 100 marks Question 1 The statements of financial position as at 31 Dec 2021 and income statements for the year ended 31 Dec 2021 for Desk plc and Wall plc are set out below. Statements of Financial Position as at 31 Dec 2021 Desk plc Wall plc Non-current assets Property, Plant and Equipment 1,188,000 204,600 Investment in Wall plc 319.000 1.507.000 204,600 Current assets Inventory Trade receivables Cash and bank 341,000 159.408 150,165 650,573 46.200 60.443 70.732 177,375 254,540 90.556 Current liabilities Trade payables Long-term liabilities Debentures 676,000 40,000 Net Assets 1,227,033 251,419 50,000 Capital and reserves Share capital Share premium Retained profits 400,000 40,000 787,033 1,227,033 201.419 251,419 Income Statements for year ended 31 Dec 2021 Desk plc E 1,551,000 (1,020,800) 530,200 (288, 200) 242,000 20,000 (60.840) 201,160 (40,232) 160,928 Wall plc 212.740 (92.400) 120,340 (70.400) 49,940 Sales Cost of sales Gross profit Operating expenses Profit from operations Income from Investments Interest Profit before tax Tax Profit after tax (3.600) 46,340 (9.268) 37,072 The following points are relevant to the preparation of the consolidated accounts: (1) Desk plc acquired 80% of the ordinary 1 shares of Wall pic on 1 Jan 2021 for 319,000 in cash. The balance of the retained profit in Wall plc was 189,347 at acquisition. The fair value of Wall pic's non-current assets (ie, buildings) at the date of acquisition was 30,000 higher than their book value. Wall plc does not account for this amount in its own accounts. (2) 2 Desk plc sold goods to Wall ple for 50,000 during 2021. The original cost of these goods was 40,000. Half of these goods were included in Wall ple's closing inventory on 31 Dec 2021. (3) For the year ended 31 Dec 2021. goodwill impairment on the acquisition of Wall plc was determined by the directors to be 18,000. (4) During 2021 Wall paid total dividends of 25,000 (5) Non-controlling interest (NCT) is determined using the partial goodwill method (Method 1). Required: Part A: Prepare consolidated statement of financial position (CSFP) as at 31 Dec 2021 and consolidated income statement (CIS) for the year ended 31 Dec 2021. Show clearly all supporting workings. (80 marks) Part B: Discussion Question: Critically discuss the pre and post-acquisition reserves of a subsidiary and the accounting treatment in the consolidation process. Provide a numerical example to reinforce your discussion (20 marks) Total: 100 marks Please also include full working out, Thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started