Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with this problem and show the steps to solve!!! Thank you 4) Suppose that you have $50,000 set aside that you have available

Please help with this problem and show the steps to solve!!! Thank you

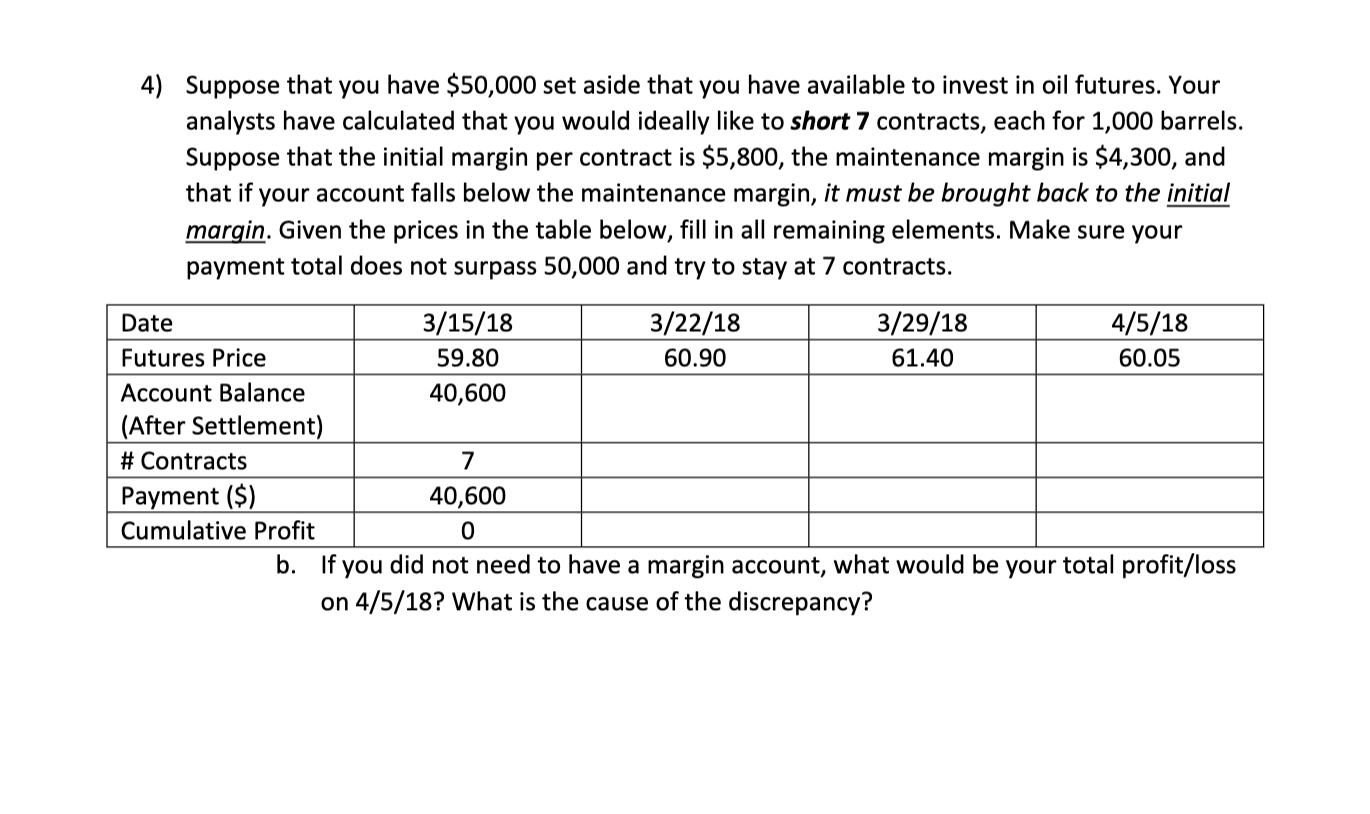

4) Suppose that you have $50,000 set aside that you have available to invest in oil futures. Your analysts have calculated that you would ideally like to short 7 contracts, each for 1,000 barrels. Suppose that the initial margin per contract is $5,800, the maintenance margin is $4,300, and that if your account falls below the maintenance margin, it must be brought back to the initial margin. Given the prices in the table below, fill in all remaining elements. Make sure your payment total does not surpass 50,000 and try to stay at 7 contracts. Date 3/15/18 3/22/18 3/29/18 4/5/18 Futures Price 59.80 60.90 61.40 60.05 Account Balance 40,600 (After Settlement) # Contracts 7 Payment ($) 40,600 Cumulative Profit 0 b. If you did not need to have a margin account, what would be your total profit/loss on 4/5/18? What is the cause of the discrepancy? 4) Suppose that you have $50,000 set aside that you have available to invest in oil futures. Your analysts have calculated that you would ideally like to short 7 contracts, each for 1,000 barrels. Suppose that the initial margin per contract is $5,800, the maintenance margin is $4,300, and that if your account falls below the maintenance margin, it must be brought back to the initial margin. Given the prices in the table below, fill in all remaining elements. Make sure your payment total does not surpass 50,000 and try to stay at 7 contracts. Date 3/15/18 3/22/18 3/29/18 4/5/18 Futures Price 59.80 60.90 61.40 60.05 Account Balance 40,600 (After Settlement) # Contracts 7 Payment ($) 40,600 Cumulative Profit 0 b. If you did not need to have a margin account, what would be your total profit/loss on 4/5/18? What is the cause of the discrepancyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started