Answered step by step

Verified Expert Solution

Question

1 Approved Answer

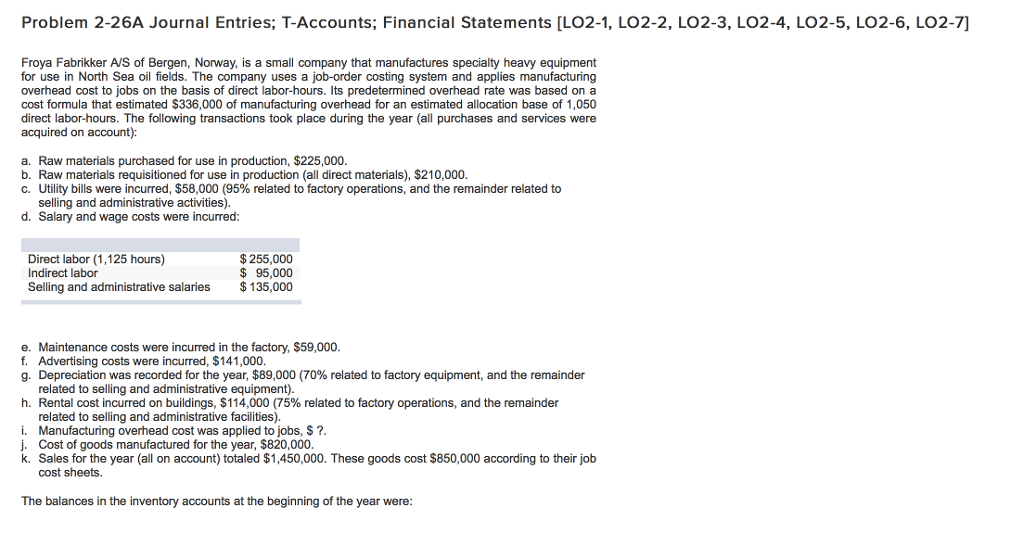

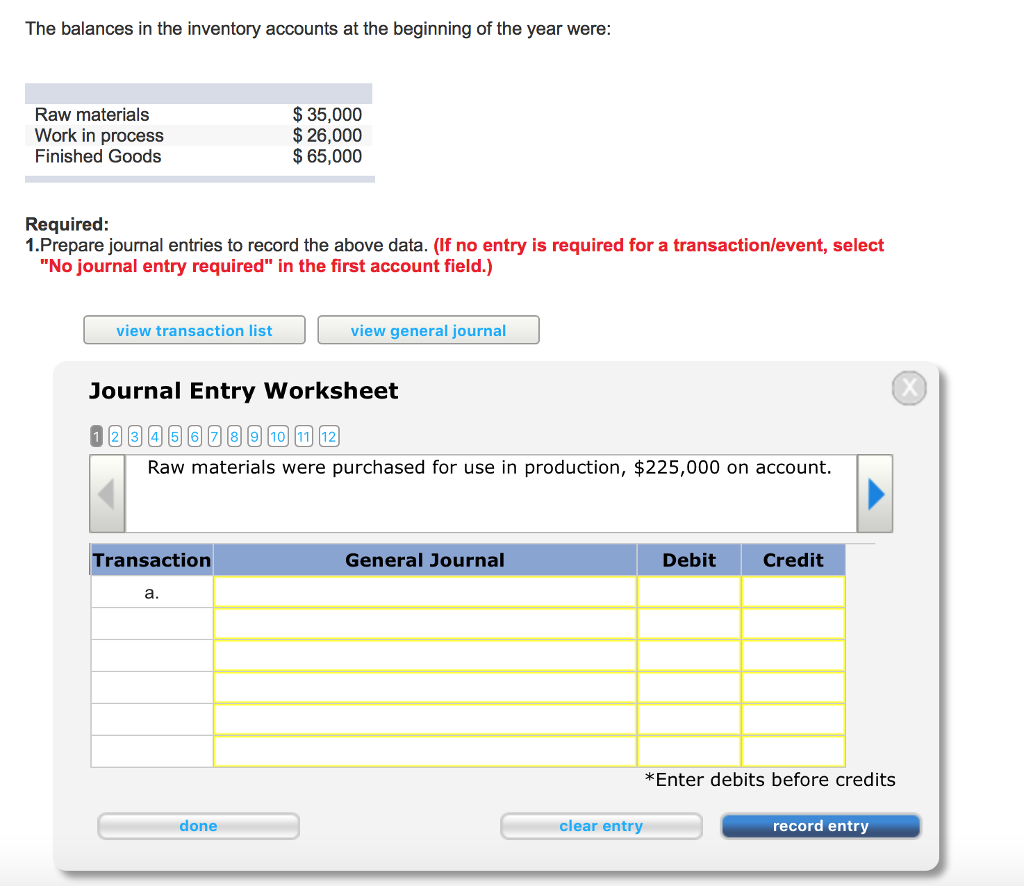

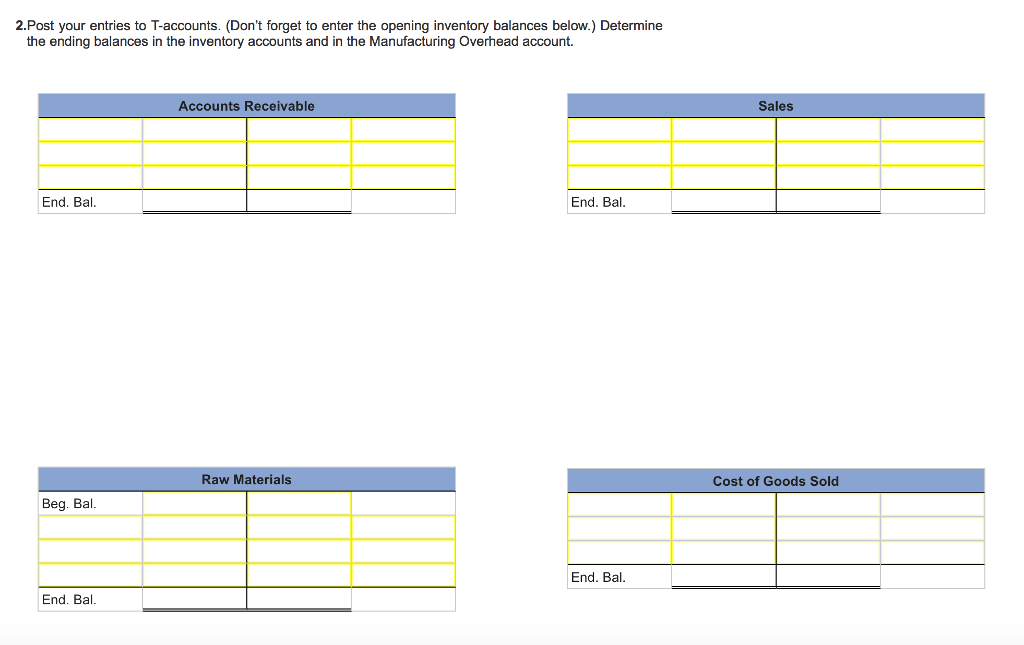

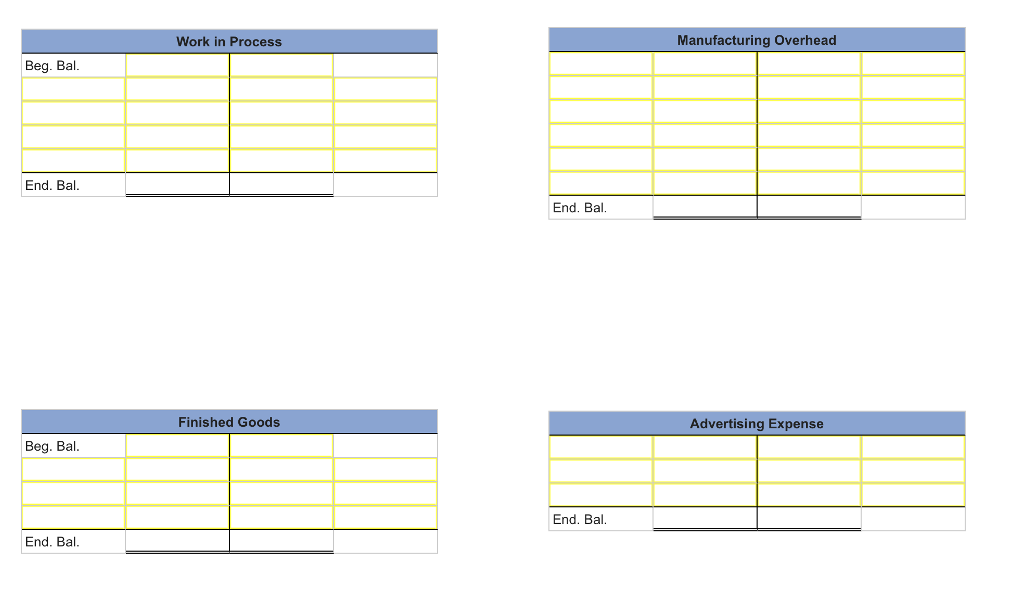

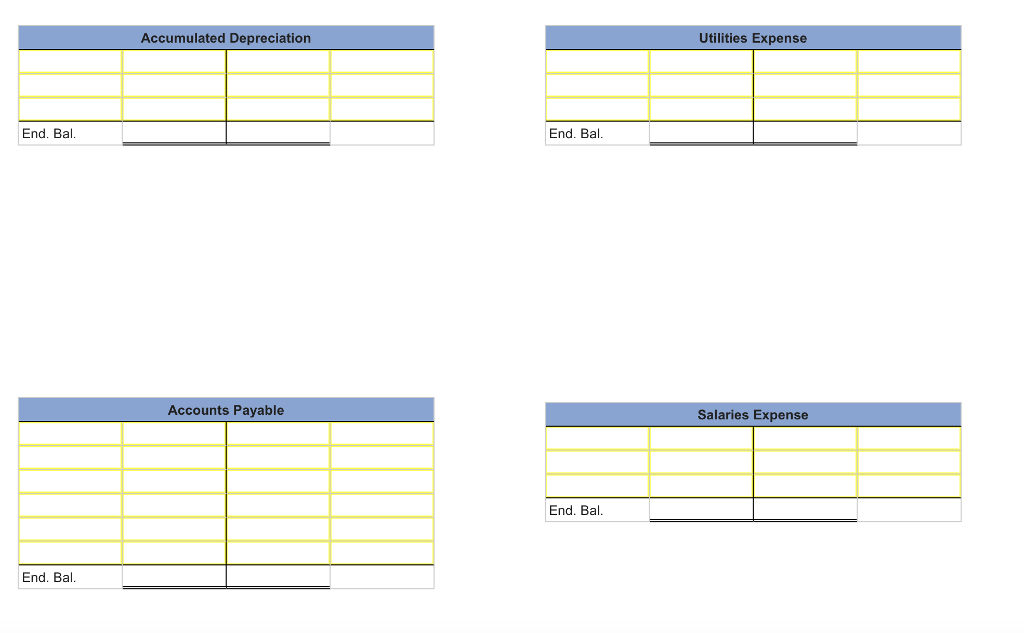

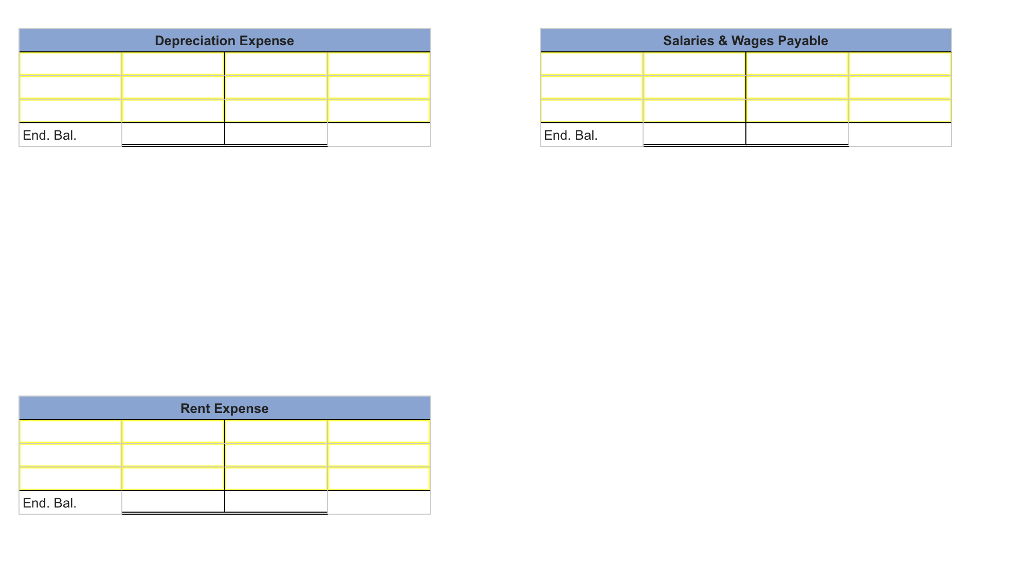

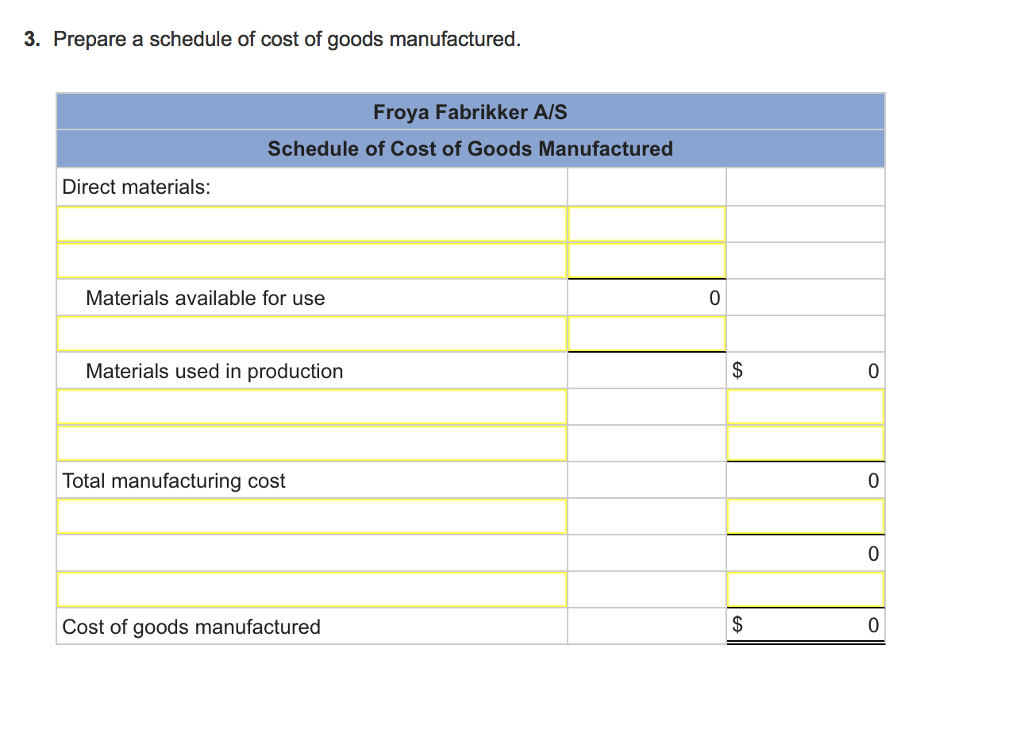

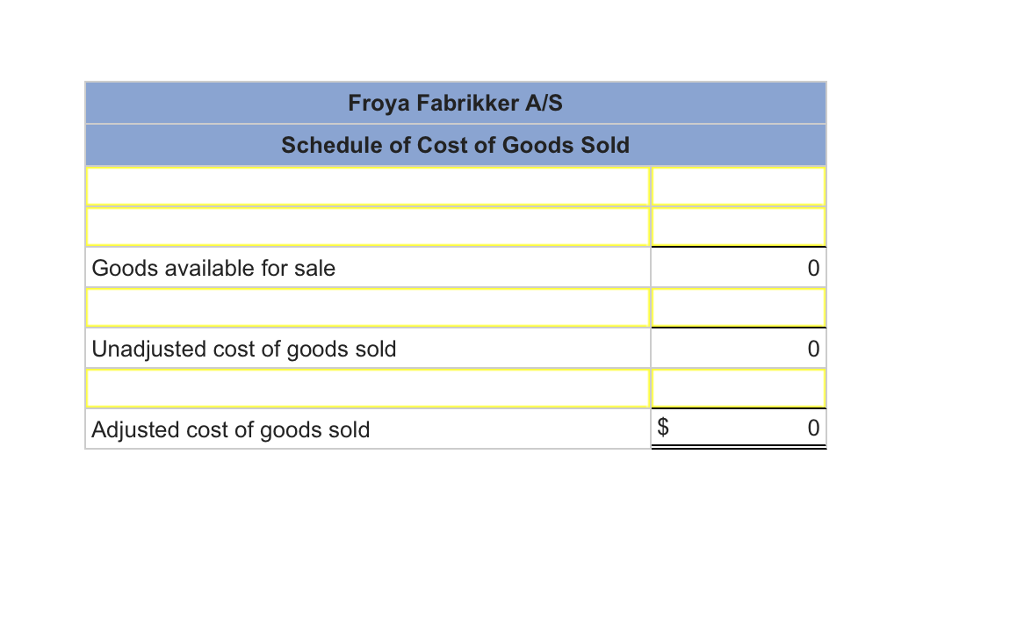

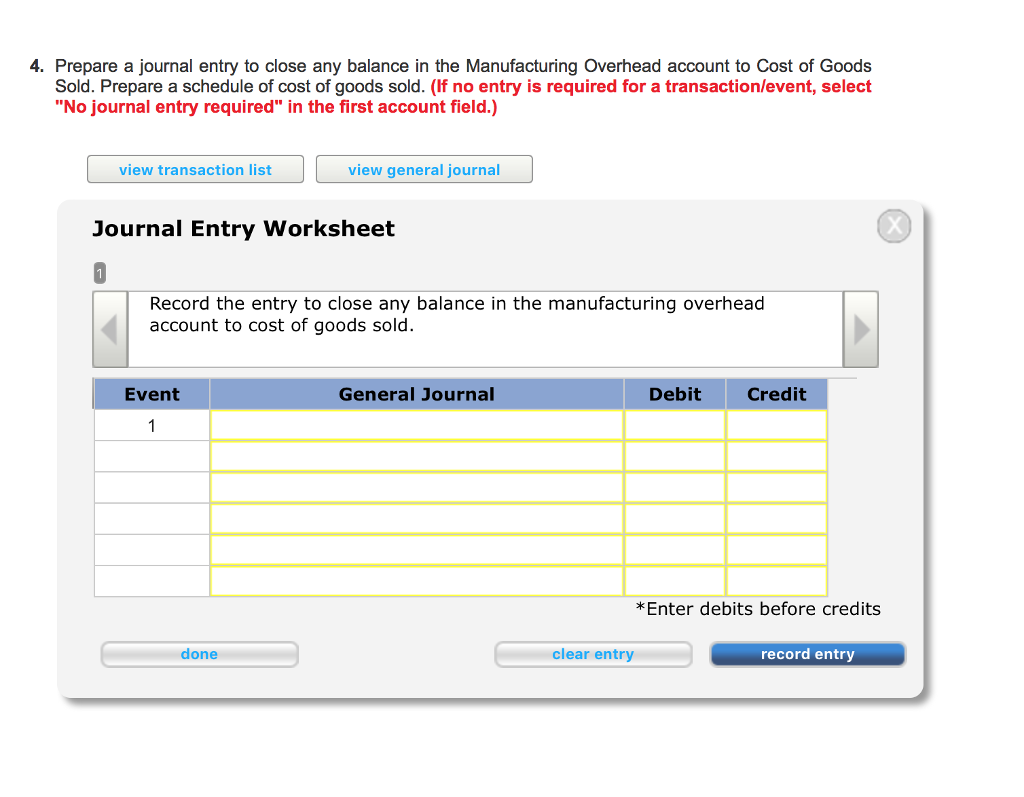

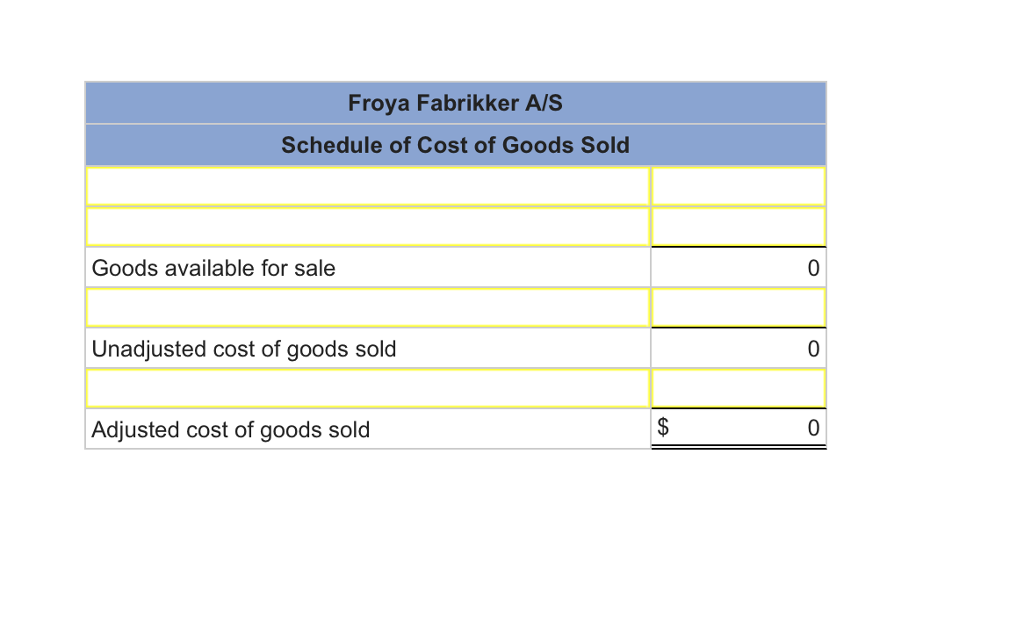

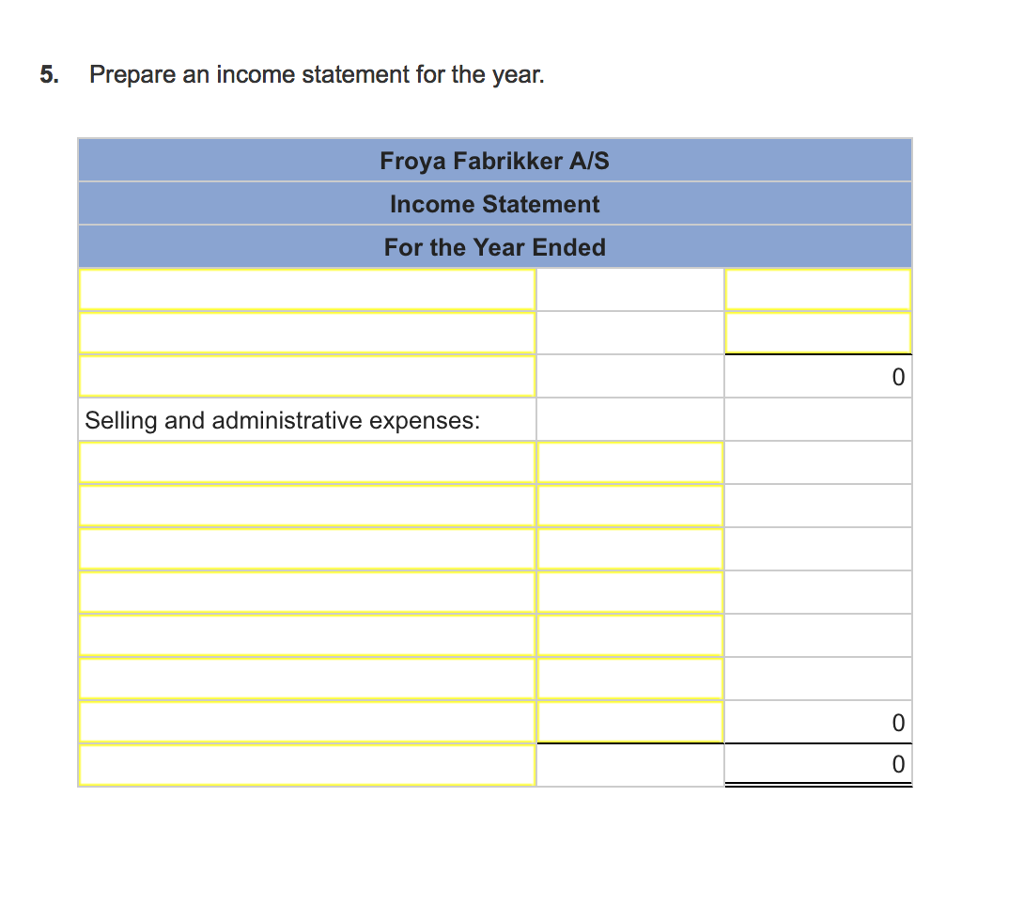

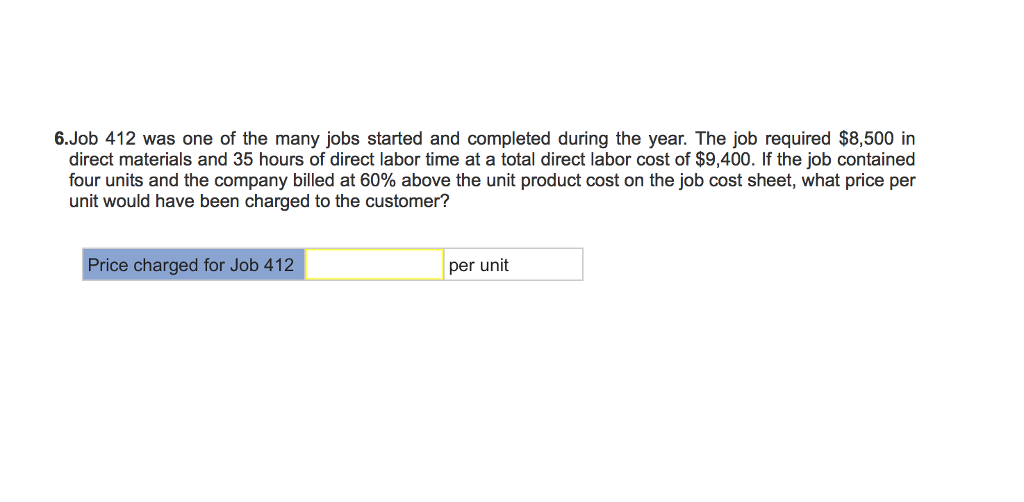

please help with this problem, im so sorry its so long Problem 2-26A Journal Entries, T-Accounts; Financial Statements [LO2-1, LO2-2, LO2-3, LO2-4, LO2-5, LO2-6, LO2-7]

please help with this problem, im so sorry its so long

please help with this problem, im so sorry its so long

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started