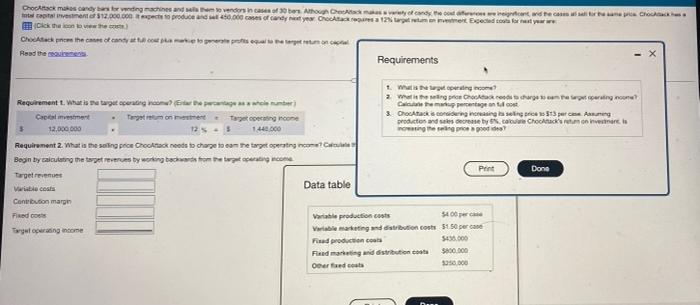

please help with this problem. req 2&3.

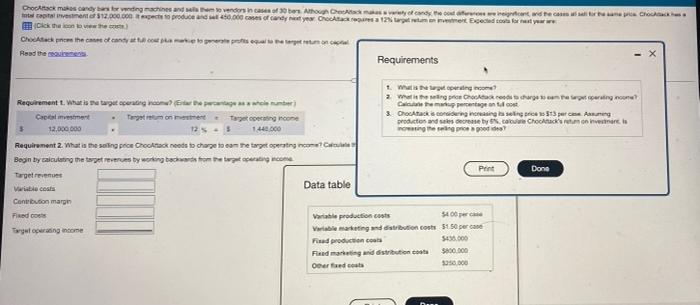

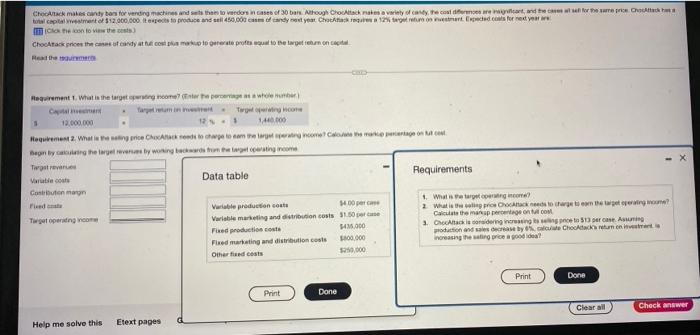

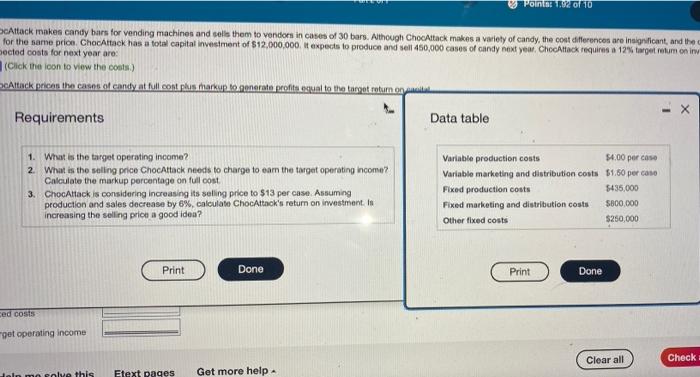

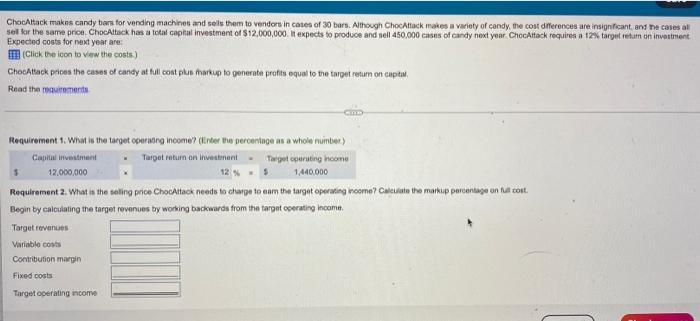

ChocAttack makes candy bars for vending machines and sells them to vendors in cases of 30 bers. Although ChecAtack makes a variety of candy the cost differences wereigntcant, and the case total capital investment of $12.000.000 a expects to produce and set 450,000 cases of candy next year ChocAtack requires a 12% target retum on vestment Expected costs for next year an Click the loon to view the cos) ChocAtack pnces the cases of candy at full col pa makip to generate profts equal Read the requirements Requirement 1. What is the target operating income? (the p Capital investment Target retum on vestment 12% 12,000,000 Requirement 2. What is the selling price Chocktack needs to charge to eam the target operating income? Calcul Begin by calculating the target revenues by working backwards from the target operating income Target revenues Variable costs Contribution margin target return on capa Fixed cos Target operating income age as a whole number) Target operating income S 1,440,000 Data table Requirements 1. What is the target operating 2. What is the price ChooAtack coads to charge to eam the target operating income? Calculate the markup percentage on tul cost 3. ChocAtack is considering increasing its selling price to 313 per ces Asuming production and sales decrease by 6%, calculate ChocAtack's retum on investan is increasing the swing price a good idea? Print price Chockack Variable production costs $400 perce Variable marketing and distribution costs $1.50 per case Fixed production costs $435.000 Fixed marketing and distribution costs $800.000 Other fed costs $350,000 Done ChocAtack makes candy bars for vending machines and sets them to vendors in cases of 30 bars. Although ChocAttack makes a variety of candy, the cost differences are significant, and the cases at se for the same price. Chock total capital westment of $12,000,000 It expects to produce and sell 450,000 cases of candy next year ChocAtack requires a 12% teget return on investment. Expected costs for next year are Co the con to view the costs) ChocAttack prices the cases of candy at tut cost plus markup to generate profts equal to the target return on capital Read the reme Requirement 1. What is the target operating income? (Enter the percentage as a whole number) Capitalment Target ni Target operating income 12,000,000 Requirement 2. What is the saling price ChocAttack needs to charge to eam the target operating income? Calculate the marke pentage on tut cest Begin by calculating the largel revenues by working backwards from the target operating income Data table Tags revenues Variable costs Contribution magn Fixed t Target operating income Help me solve this Etext pages Variable production costs Variable marketing and distribution costs Fixed production costs Fixed marketing and distribution costs Other fixed costs Print Done $400 perce $1.50 percase $435.000 $800,000 $250,000 Requirements 1. What is the target operating income? 2. What is the sling price ChocAttack needs to charge to earn the target operating moome? Calculate the manap percentage on tull cost 3. ChocAttack is considering increasing its selling price to 513 per case. Assuming production and sales decrease by 6%, calculate ChocAttack's return on investment is increasing the saling price a good idea? Print Done Clear all Check answer OcAttack makes candy bars for vending machines and sells them to vendors in cases of 30 bars. Although ChocAttack makes a variety of candy, the cost differences are insignificant, and the c for the same price. ChocAttack has a total capital investment of $12,000,000. It expects to produce and sell 450,000 cases of candy next year. ChocAttack requires a 12% target return on inv pected costs for next year are: (Click the icon to view the costs.) cAttack prices the cases of candy at full cost plus mharkup to generate profits equal to the target return on ital Requirements 1. 2. 3. What is the target operating income? What is the selling price ChocAttack needs to charge to earn the target operating income? Calculate the markup percentage on full cost ChocAttack is considering increasing its selling price to $13 per case. Assuming production and sales decrease by 6%, calculate ChocAttack's return on investment. Is increasing the selling price a good idea? ced costs get operating income Print dein mo solve this Etext pages Done Get more help. Points: 1.92 of 10 Data table Variable production costs $4.00 per case Variable marketing and distribution costs $1.50 per case Fixed production costs Fixed marketing and distribution costs Other fixed costs Print Done $435,000 $800,000 $250,000 Clear all X Check a ChocAttack makes candy bars for vending machines and sells them to vendors in cases of 30 bars. Although ChocAttack makes a variety of candy, the cost differences are insignificant, and the cases all sell for the same price. ChocAttack has a total capital investment of $12,000,000. It expects to produce and sell 450,000 cases of candy next year ChocAttack requires a 12% target return on investment Expected costs for next year are: (Click the icon to view the costs.) ChocAttack prices the cases of candy at full cost plus mharkup to generate profits equal to the target return on capital, Read the requirements Requirement 1. What is the target operating income? (Enter the percentage as a whole number) Capital investment 12,000,000 Requirement 2. What is the selling price ChocAttack needs to charge to eam the target operating income? Calculate the markup percentage on full cost. Begin by calculating the target revenues by working backwards from the target operating income. Target revenues Variable costs Contribution margin Fixed costs Target operating income Target return on investment Target operating income 1,440,000 12 %$