Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with this question Ivanhoe Ltd., which has a calendar year end, entered into an equipment lease on June 1, 2023, with Cullumber Financing

Please help with this question

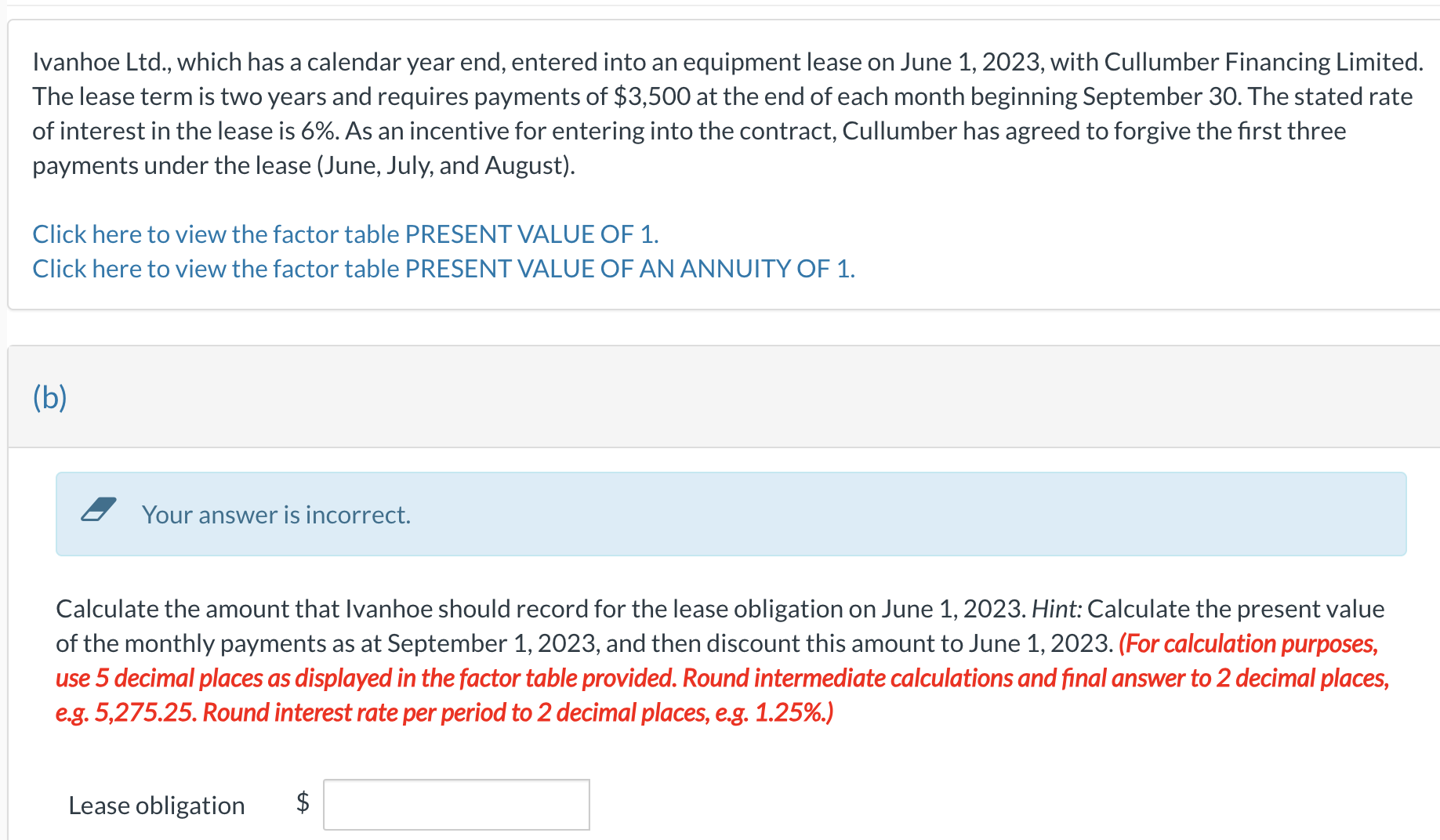

Ivanhoe Ltd., which has a calendar year end, entered into an equipment lease on June 1, 2023, with Cullumber Financing Limited. The lease term is two years and requires payments of $3,500 at the end of each month beginning September 30 . The stated rate of interest in the lease is 6%. As an incentive for entering into the contract, Cullumber has agreed to forgive the first three payments under the lease (June, July, and August). Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. (b) Your answer is incorrect. Calculate the amount that Ivanhoe should record for the lease obligation on June 1, 2023. Hint: Calculate the present value of the monthly payments as at September 1, 2023, and then discount this amount to June 1, 2023. (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round intermediate calculations and final answer to 2 decimal places, e.g. 5,275.25. Round interest rate per period to 2 decimal places, e.g. 1.25\%.)

Ivanhoe Ltd., which has a calendar year end, entered into an equipment lease on June 1, 2023, with Cullumber Financing Limited. The lease term is two years and requires payments of $3,500 at the end of each month beginning September 30 . The stated rate of interest in the lease is 6%. As an incentive for entering into the contract, Cullumber has agreed to forgive the first three payments under the lease (June, July, and August). Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. (b) Your answer is incorrect. Calculate the amount that Ivanhoe should record for the lease obligation on June 1, 2023. Hint: Calculate the present value of the monthly payments as at September 1, 2023, and then discount this amount to June 1, 2023. (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round intermediate calculations and final answer to 2 decimal places, e.g. 5,275.25. Round interest rate per period to 2 decimal places, e.g. 1.25\%.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started