Answered step by step

Verified Expert Solution

Question

1 Approved Answer

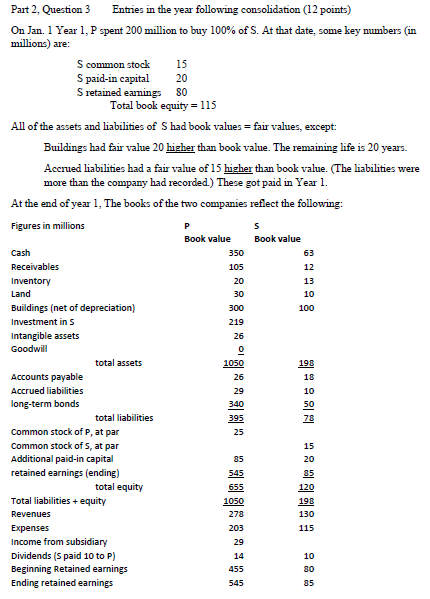

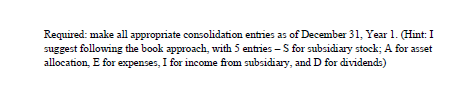

Please help with this question. Part 2, Question 3 Enties in the year following consolidation (12 points) On Jan. 1 Year 1, P spent 200

Please help with this question.

Part 2, Question 3 Enties in the year following consolidation (12 points) On Jan. 1 Year 1, P spent 200 million to buy 100% of S. At that date, some key numbers (in millions) are: S common stock S paid-in capital S retained eamings 15 20 80 Total book equity-115 All of the assets and liabilities of S had book valuesfair values, except: Buildings had fair value 20 higher than book value. The remaining life is 20 years. Accrued liabilities had a fair value of 15 higher than book value. (The liabilities were more than the company had recorded.) These got paid in Year 1 At the end of year 1, The books of the two companies reflect the following: Figures in millions Book value Book value 13 30 Buildings (net of depreciation) Investment in S Intangible assets 219 26 total assets Accounts payable Accrued liabilities long-term bonds 26 395 78 Common stock of P, at par Common stock of s, at par Additional paid-in capital retained earnings (ending) 25 15 total equity Total liabilitiesequity 273 115 Income from subsidiary Dividends (S paid 10 to P) Beginning Ending retained earnings Retained earningsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started