Answered step by step

Verified Expert Solution

Question

1 Approved Answer

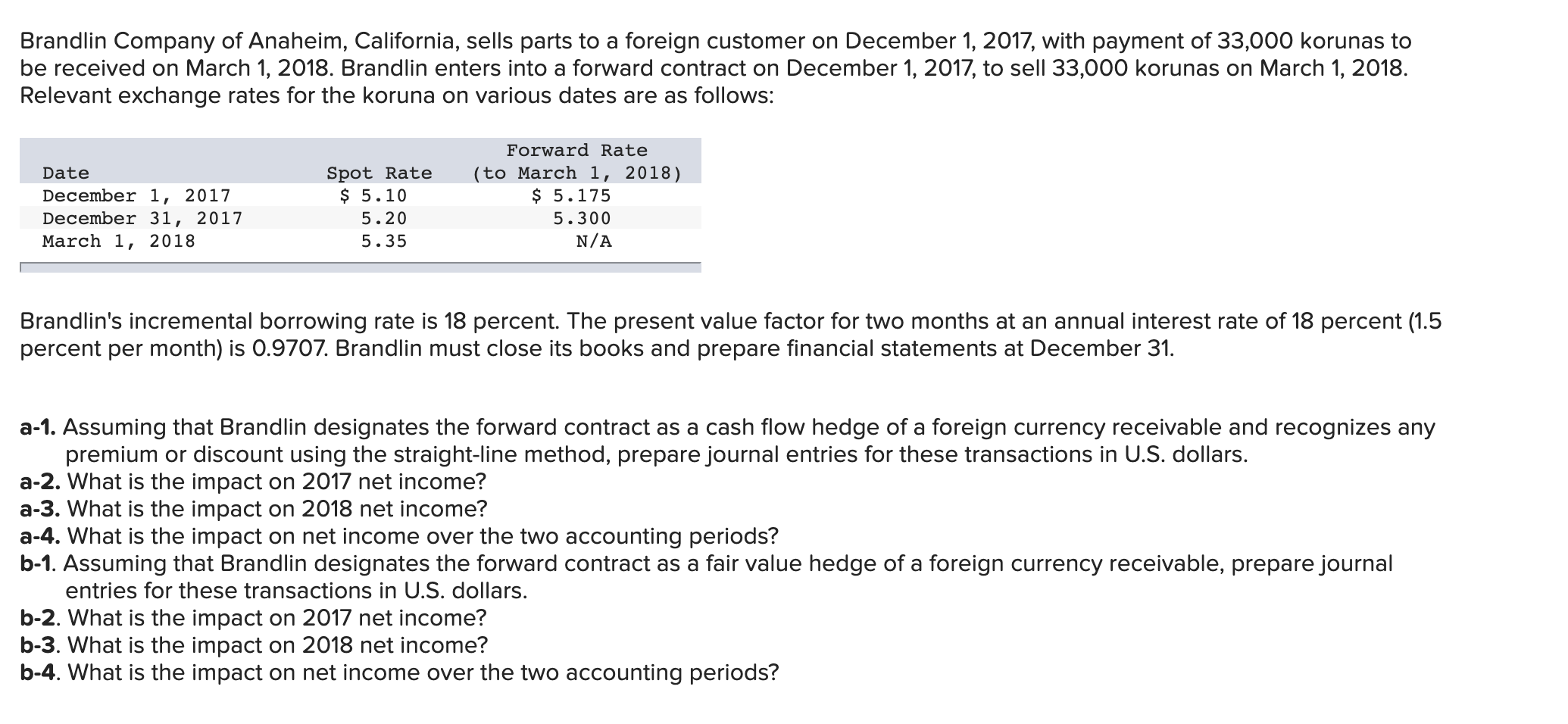

Please Help With This Question! (Please note, it's one question with several parts) Brandlin Company of Anaheim, California, sells parts to a foreign customer on

Please Help With This Question! (Please note, it's one question with several parts)

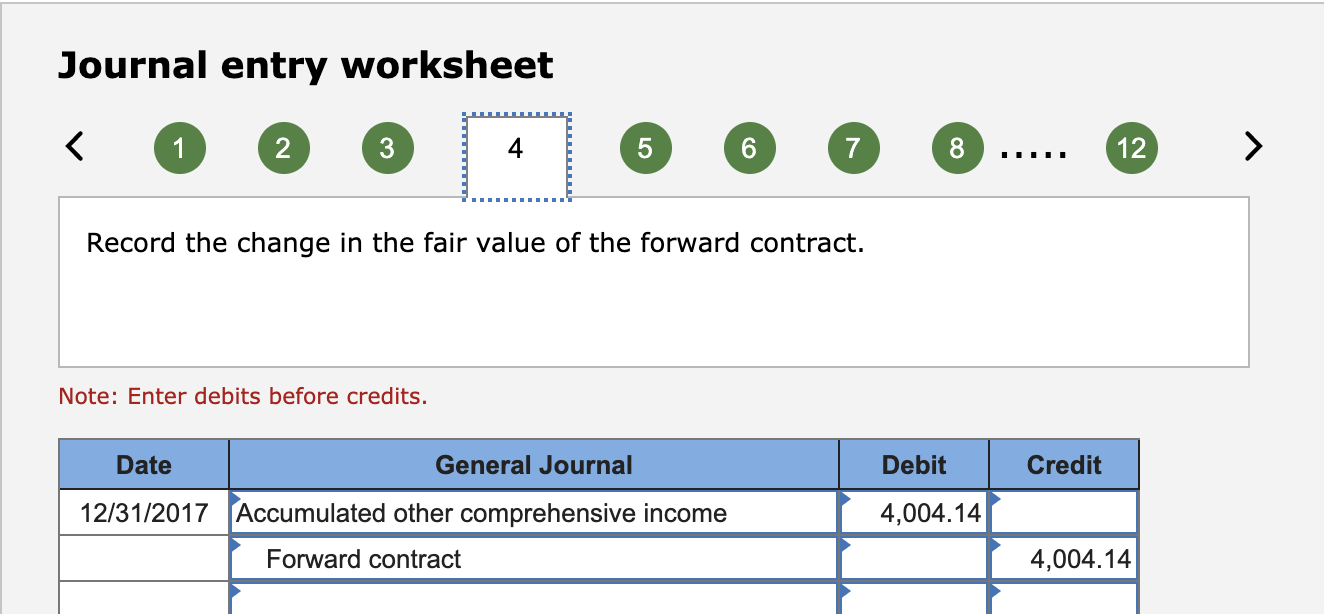

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

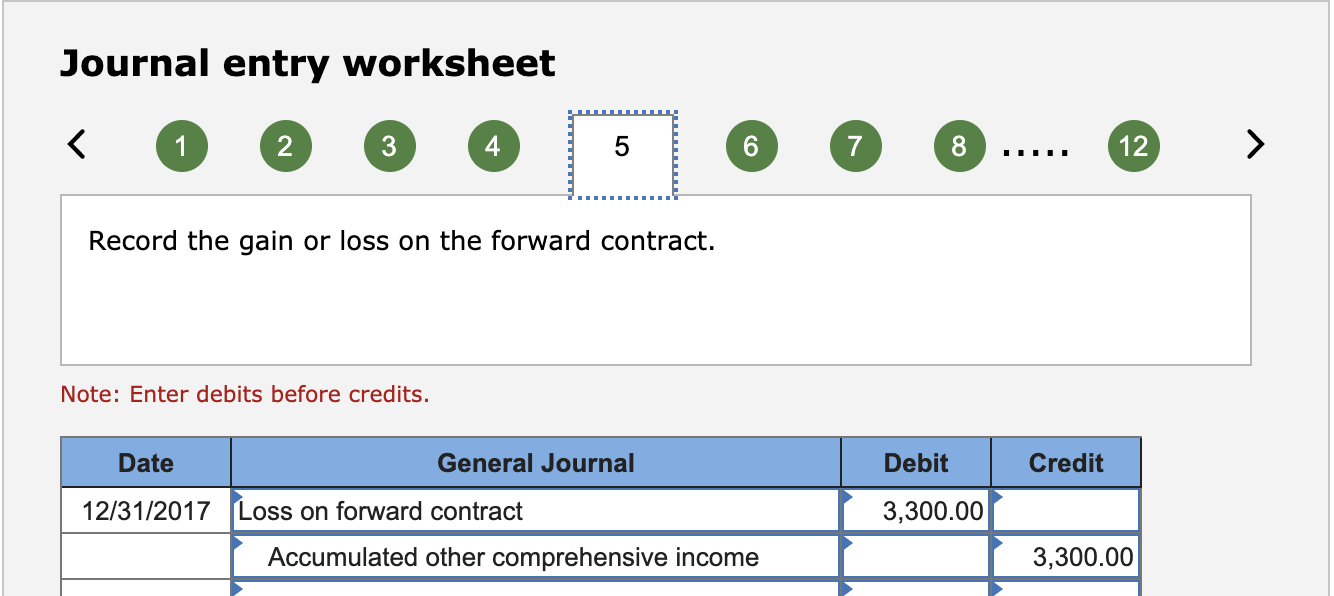

Step: 2

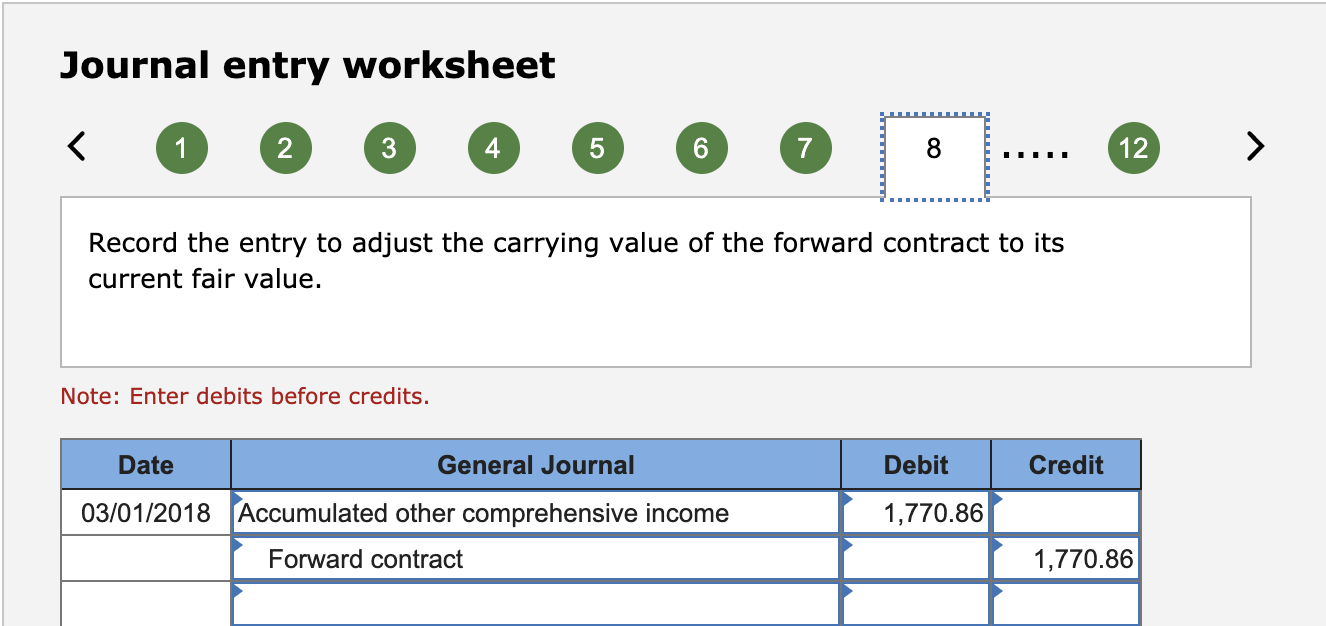

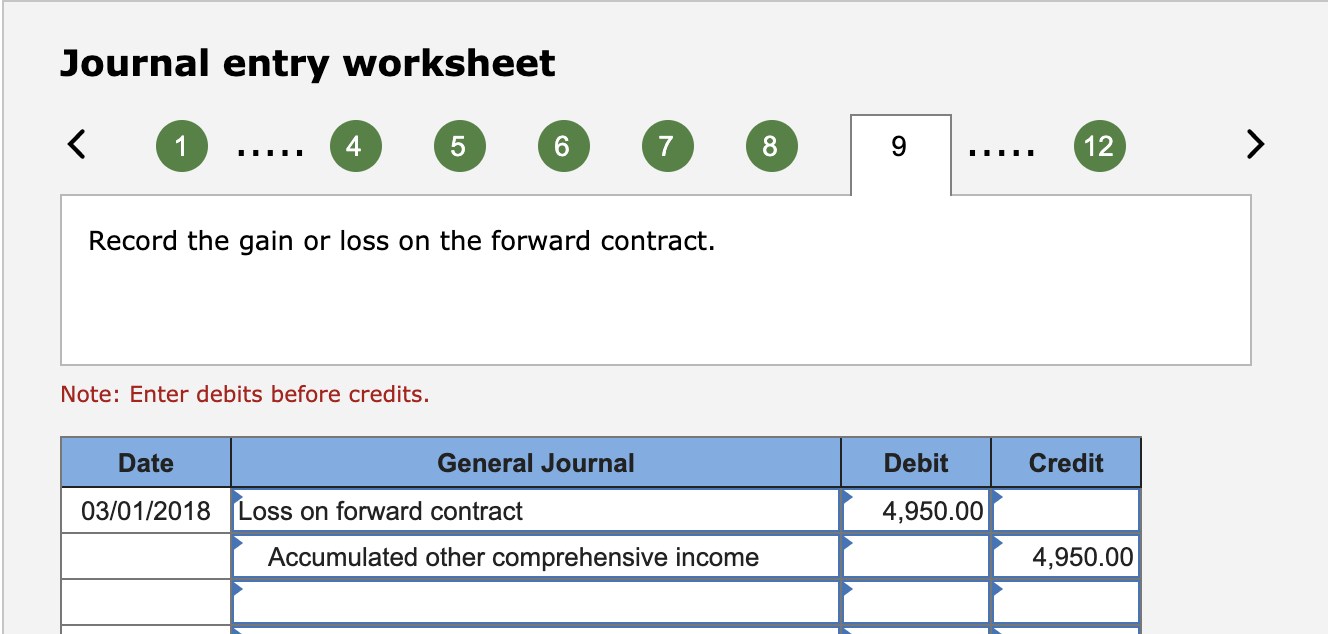

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started