Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with this question! thanks so much . 39. Based on the sensitivity analysis table that I provided for you, what is the approximate

please help with this question! thanks so much .

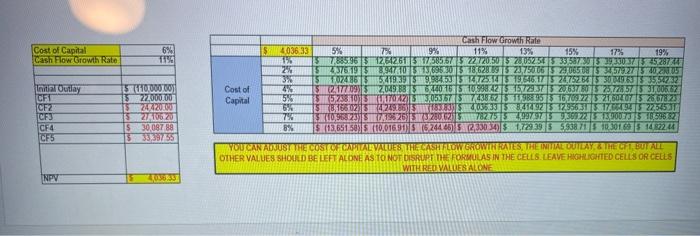

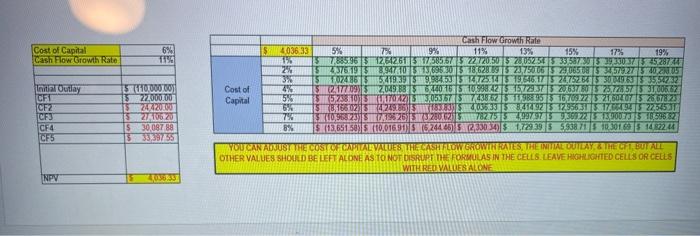

39. Based on the sensitivity analysis table that I provided for you, what is the approximate breakeven WACC for the project if all else were equal? 1. 7.25% 2. 8% 3. 7.9% 4. 8.24% 40. Based on the sensitivity analysis table that I provided for you, what would be the NPV of the project if the WACC is 7%, and what happens when the WACC increases by 2%? 1. $4,036.33; The NPV is zero 2. $782.75; The NPV turns negative 3. $4,578.23; The NPV increases 4. $707.45; The NPV is indeterminable Cost of Capital Cash Flow Growth Rate 6% 11% InitiatOutlay CFT CFZ TOFU CF4 CF5 5 10 000 3 2700000 15 24A2000 52710620 5 30,087 88 $33,39755 Cash Flow Growth Rale S4036 33 5% 7% 9% 11% 13% 15% 17% 19% 19% 157885.96 5 1264261E17.585.57Z2720.50 5. ZE0750 53358730329330373 25.287 25 152437695394740ES695301 5186280952079005523065085 335792752005 3% 151028615 54193991904.5J 15 14725.745 79.546.175 28.7525615 301935 35567327 Cost of %% 5 21770935 2,049 885 88016 50.988.22 15729373 206370575,778575 3100667 Capital 54 55,23805 TUTTOAZ 53,05357517438625119889575 1670372215 21,60LOT 15 2867823 68 787650254249.86 1183.83315 40353358,4189275 17956311517475 22,54501 1509032319526511202782754997973 3002273.900751999682 8% 18,65150) 016915524445) E2300205 1,729395953871503010S 12 YOU CAN ADJUST THE COSTUPCAPITAL VALUES TRETCASHFLOW GROWTR RATES, THE INITIALE UUTAYEFI BUTALE OTHER VALUES SHOULD BE LEFT ALONE AS TO NOT DISRUPT THE FORMULAS IN THE CELLS. LEAVE HIGHLIGHTED CELLS OR CELLS WITH REVALES ALONE NPV 15

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started