Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with this tax return problem. i am lost and I will very gladly upvote!! Miguel and Sotia Arroyo are married and five at

please help with this tax return problem. i am lost and I will very gladly upvote!!

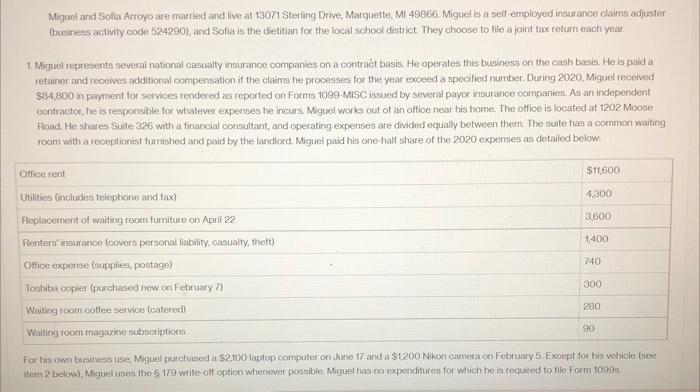

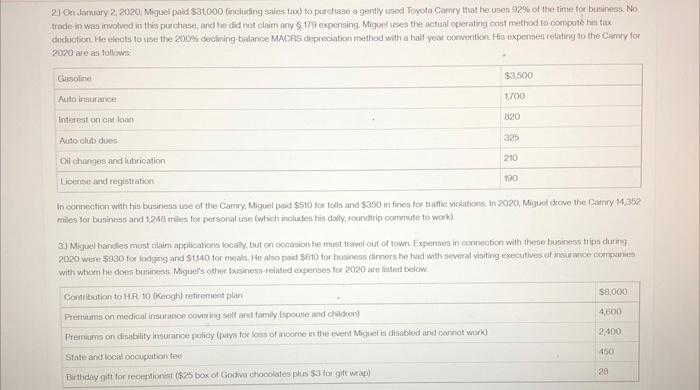

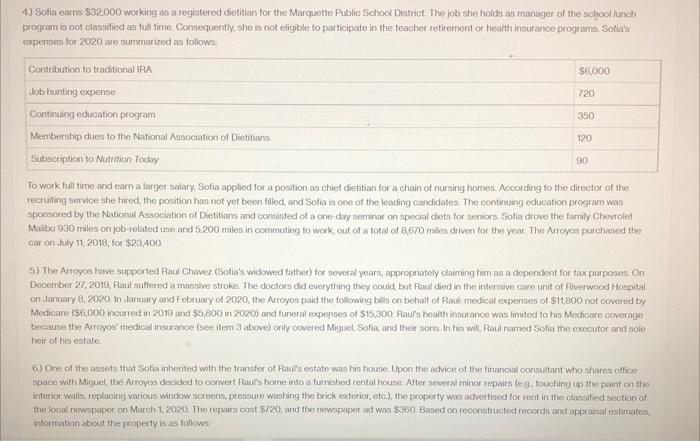

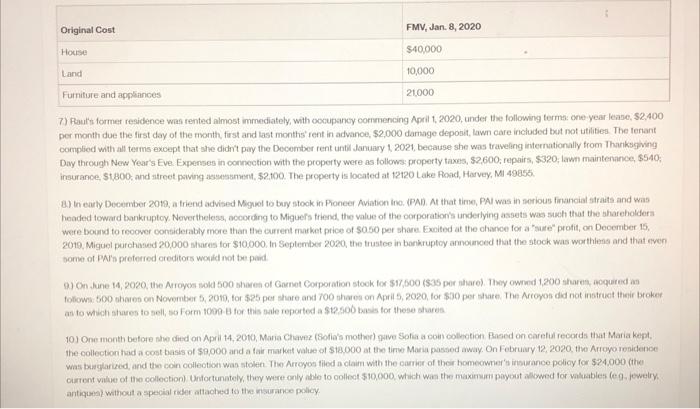

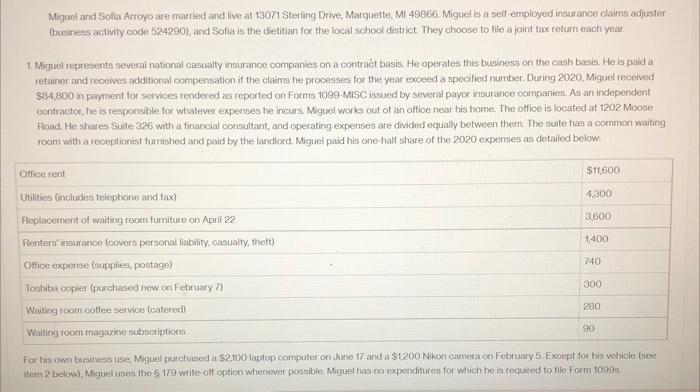

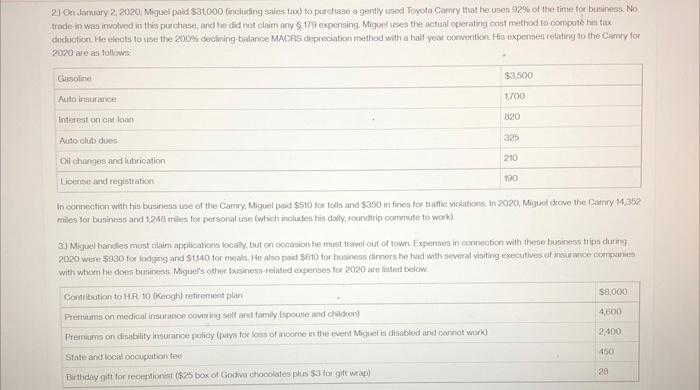

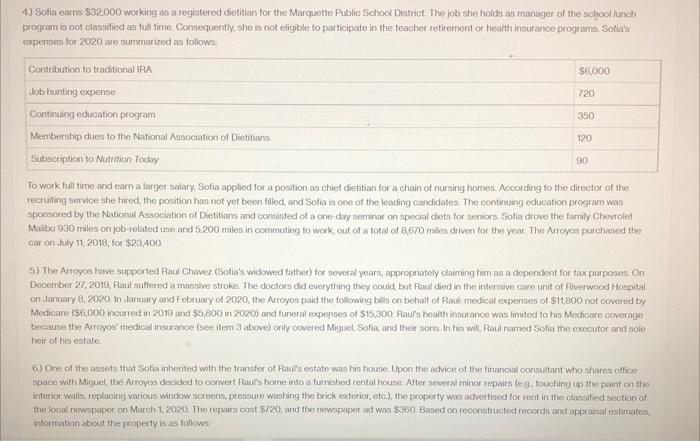

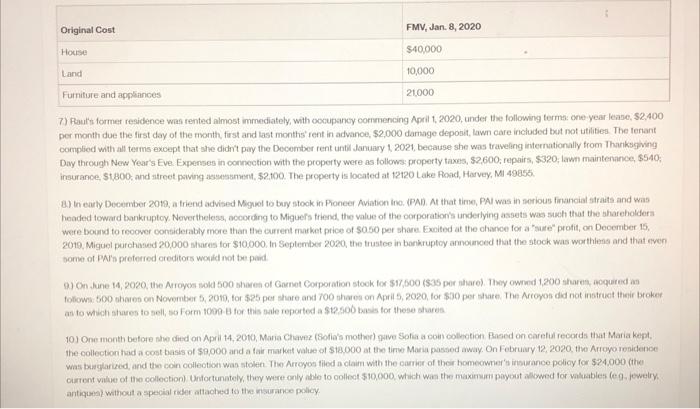

Miguel and Sotia Arroyo are married and five at 13071 Sterling Drive, Marquette, Mi 49866 . Miguel is a self-employed insurance olaims adjuster (business activity code 524290 ), and Sofia is the dietitian for the local school district. They choose to file a joint tax return each year. 1. Miguel represents several national casualty insurance companies on a contract basis. He operates this business on the cash basis. He is paid a retainer and recetves additional compensation if the claims he processes for the year exceed a specilied number. During 2020, Miguel received $84,800 in payment for services rendered as reported on Forms 1099 - MISC issued by several payor insurance companies. As an independent contractor, he is responsible for whatever expenises he incurs. Miguel works out of an olfice near his home. The office is tocated at 1202 Moose: Foad. He shares Suite 326 with a financial consultant, and operating expenses are divided equally between thern. The suite has a common waiting room with a receptionist furnished and paid by the landlord. Miguel paid his one-half share of the 2020 expenses as detailied below: For his cwn business use, Miguel purchased a $2,100 laptop computer on thune 17 and a \$1,200 Nikon catmera cai February 5 . Except for his vehicle (se: item 2 below). Mrguel uses the \& 179 write-off option whenever possible Miguel has po expenditures for which he is required to file Form tog9s. 2.) On lamiary 2 2020, Migued paid $31,000 (incluting sales tax) to purchasge a gently usod Topota Carnry that he usen 92% of the time for buainess. No trade-in wag involved in this purchase, and he did not clitt any 5.179 expensing, Miguel uses the actual operating ocist rnethod to compens his tax. 2000 are as follows: In eonnection wath his business use of the Camry. Miguel paid $510 tor toxls and $350 in fines for tratfia vioditions. In 2020, Miguot drove the Camry t4, 350? miles for buginess and 1,248 miles for personal tse (which ireludes his daily, roundtrip comvite to work). 3.) Miguel handes most olaim applications iocaly, but on oocasion he must travol out of town, Expenses in ocrineobicn with these busiresss tripn duting 2020 were $330 for lodging and $1.40 for meals. He also paid $610 for business dinners he hud with several visiting executhes of insurarice poxt paritis With whom he doers buainests. Miguel's other business telated expenses for 2020 are ligted below. 4) Sotia earns 532.000 working as a registered dietitian for the Marquette Publie Sehool Digtrict. The job she holds as manager of the sohool funch program is not classified as full time. Consequently, she is not eligible to participate in the teacher retirement or health insurance programa. Sofia'st expenses for 2020 are surmarized as follows: To work full time and earn a larger salary. Sofia applied for a pasition as chief dietitian for a chain of nursing homess. Acoording to the director of the recruiting service she hired, the position has not yet been filled, and Sotia is one of the leading candidates. The continuing education program was sponsored by the National Association of Dietatians and constisted of a one-chay sementar on 3pecial diets for seniors, Sotia drowe the family Chevrolet Malibu 930 miles on job-related use and 5,200 miles in commuting to work, out of a fotal of 8,670 miles driven for the yoar. The Arroyos purchased the car on July 11,2018, for $23,400 5) The Arroyos have suppotted Raul Chavez (Sotia's widowed father) for several yoars, appropriately claiming him as a dependent for tax purposeg. On December 27, 2019, Flat suttered a massive stroke. The doctors did everything they could, but Flual diod in the intensive care unit of Fiverwood Hospital Medicare ($5,000 incurred in 2019 and $5,800 in 2020) and funeral expenses of $15,300. Fauly health insurance was fimitod to his Medieare coverage because the Arroyos medicati insuarance (tase item 3 above) only covered Miguel, Sofia, and their sons in his will, Raul narned Sofia the executor and sole heir of his-estate: 6.) Oree of the assets that Solis inherited with the transfer of Renilly estate was his houlie, Upon the achice of the finanocial consultant who shares office space with Miguel, the Arroyce decided to comert Fawi's botne into a furnshed rerital house. After soverat minor repairs feg. fouching up the paint on the interior walls, replacing various window scroens, pressure washing the brick exteriof, etc), the property was achuatised for rent in the claisified seotion of the focal newspaper ori March 1,2020. The repsiirs cost \$720, and the newspkiper ad was $360. Based on reconstructed reoorda and apprainal tatienaters, infortration about the property is as follows: 7) Foul's formet residence was rented almost immediately, with oocupancy correnencing April 1, 2020, under the following terma: one year lease, S2,400 per month due the first day of the rwonth, first and last months' rent in advanoe, $2,000 darnage deposit, lawn care iricluded but not utilities. The teriant complied with all terms except that ahe didn't pay the December rent until January 1 . 2021, because she was traveling internationally from Thariksgiving Day through New Year's Eve. Expenses in oonneetion with the property were as follows: property taxes, $2.600, repairs, $320; lawn maintenarice, 3540 ; insuranoe, 51800 , and ritreet pawing assessmyent, $2.100. The property is located at t2120 Lake Pond, Harvey, Mi 4905 . 8.) In eacty Docember 2019, a triend advised Mignol to tury stock in Proneer Aviation ino, (PAD). At that tirne, PAl was in norious firkancial strats and was headed toward bankruptoy. Nevertheless, according to Miguefs friend, the value of the oerporation's underlying assets was sasch that the ahareholdera were bound to reoover contiderably more than the current matket price of $0.00 per share. Excited at the charice for a "sare" profit, on December 15 , 2019. Miguel purchamed 20,000 stwares for $10,000. In Seplember 2020 , the trustee in bonkruptoy anthounced that the stock was worthlens and that men bonke of PAl's preterred oreditors wonfid not bet paid. an to whech stuees to selli, so form 10098 for this sale reported a $1 ? Sob tasis tor these shares. 10) One moeth betore nhe dited on Aprii 14,20t0, Maria Chavez (isofia's mother) give Solia a coin colleotion. Pased on carefix records that Maria kept. Was basglarieed, and then con colleotion was stolen. Ther Arroyos filed a claim with the carrier of their homeontier't insurance policy for $2.4000 (the) antiqueal withoxit a special ruder aftached to tive wisuratice policy. 11.) In her we, Maria Chaver (see item 10) left Sotia a vacant lot on Wright Street Maria had paid \$15,000 for the property. and it had a value of $19,000 When she died Maria had purchased the lot because it was adjacent to Northern Michigan University property and she expected the sohool to eventually expand the campis. By 2020, it has become clear that the university did not have the funds to expand the campris. Consequently, on July t, 2020, Solia sold the lot for $19,000. Not included in this price are unpead property taxes (and interest on the unpaid taxes) of $700 on the lot, which the puich aser assumed and later paid. Solia received a Form 1099 - B as documentation for this transaction which did not report the basis of this property. 12) Every year acound Christmas, Miguel recoives cards trom various car repair facilties and car dealerships that express thanks for his businesa referrals during the year, Mary of these cards include cash. Miguel has no asrangement, contractual or otherwise, that requires any compensation for the referrals he makes. Conoerned about the bagality of ruch "gitts." Miguel consulted an attorney about the matter a few years ago. Without passing judgment an the status of the payors, the attorney found that Miguel's acoeptance of the puyments does not violate state of local luw. Miguel sinoerely believes that the payments he recenes hwe no elfect on the referrals he makes. During December 2020, Mgued recelved cards containing $7,200. One additional card containing $900 was delayed in the mall, and Migovel did not recelve it untid dinkary 4, 2021. 13.) During a suntry weekent in June, the Arroyos held a garage sale to dispose of unwanted furniture, appliances, books, bicycles, clothes, and one boat (including trailet). Proceeds from the sale totaled $9,200 The estimated basis of the items sold is $25,500. Al sold assets had been used by the Arroyos for personal purposes. 14) In addition to the receipts presiously noted, the Arroyos received the following amounts during 2020 . 15] Payments made for 2020 expenditures not mentioned elsewhere are ss follows: 2020, they paid the pledges for 2018 through 2020 . During 2020, the Arroyos drove the Malitu 270 milles for medioal purposes fog trips to the hospital, doetot and dentist offices) and 320 miles delivering meals to the poor for Meals -on Wheets, a quastind eharity. to the thes for future college expenties, tharge does not have a job. 17.) Sofias Form W2 retlects wages of \$32.000. Appropriate amounts for Social Secuity and Medioare tavos were deducted inoome tax with hioldings those ary rdealings in virtual currencies. Prelevant Social Socurity sumbers are noted bebow. Requirements: Fill out an ingome tax return (with all appropriate forris and soheduba) for the Amroyos for 2020 following these.guidelines. Make neoessary assumptionis for info not given in the protilem but noeded to complete the return. - The taxpayors are preparing their own return (i.e, no preparer is irwolved). - If agy tefiand is due, the Arroyon want a refund check mailed to them. - The Antoyos had iteriezed deducticas from AGa for 2019 of $26700, of which $1,500 was for stale and local inoome tak: - The Artuyos da noy want to contritute to the Presickential Election Curypuign Fund Miguel and Sotia Arroyo are married and five at 13071 Sterling Drive, Marquette, Mi 49866 . Miguel is a self-employed insurance olaims adjuster (business activity code 524290 ), and Sofia is the dietitian for the local school district. They choose to file a joint tax return each year. 1. Miguel represents several national casualty insurance companies on a contract basis. He operates this business on the cash basis. He is paid a retainer and recetves additional compensation if the claims he processes for the year exceed a specilied number. During 2020, Miguel received $84,800 in payment for services rendered as reported on Forms 1099 - MISC issued by several payor insurance companies. As an independent contractor, he is responsible for whatever expenises he incurs. Miguel works out of an olfice near his home. The office is tocated at 1202 Moose: Foad. He shares Suite 326 with a financial consultant, and operating expenses are divided equally between thern. The suite has a common waiting room with a receptionist furnished and paid by the landlord. Miguel paid his one-half share of the 2020 expenses as detailied below: For his cwn business use, Miguel purchased a $2,100 laptop computer on thune 17 and a \$1,200 Nikon catmera cai February 5 . Except for his vehicle (se: item 2 below). Mrguel uses the \& 179 write-off option whenever possible Miguel has po expenditures for which he is required to file Form tog9s. 2.) On lamiary 2 2020, Migued paid $31,000 (incluting sales tax) to purchasge a gently usod Topota Carnry that he usen 92% of the time for buainess. No trade-in wag involved in this purchase, and he did not clitt any 5.179 expensing, Miguel uses the actual operating ocist rnethod to compens his tax. 2000 are as follows: In eonnection wath his business use of the Camry. Miguel paid $510 tor toxls and $350 in fines for tratfia vioditions. In 2020, Miguot drove the Camry t4, 350? miles for buginess and 1,248 miles for personal tse (which ireludes his daily, roundtrip comvite to work). 3.) Miguel handes most olaim applications iocaly, but on oocasion he must travol out of town, Expenses in ocrineobicn with these busiresss tripn duting 2020 were $330 for lodging and $1.40 for meals. He also paid $610 for business dinners he hud with several visiting executhes of insurarice poxt paritis With whom he doers buainests. Miguel's other business telated expenses for 2020 are ligted below. 4) Sotia earns 532.000 working as a registered dietitian for the Marquette Publie Sehool Digtrict. The job she holds as manager of the sohool funch program is not classified as full time. Consequently, she is not eligible to participate in the teacher retirement or health insurance programa. Sofia'st expenses for 2020 are surmarized as follows: To work full time and earn a larger salary. Sofia applied for a pasition as chief dietitian for a chain of nursing homess. Acoording to the director of the recruiting service she hired, the position has not yet been filled, and Sotia is one of the leading candidates. The continuing education program was sponsored by the National Association of Dietatians and constisted of a one-chay sementar on 3pecial diets for seniors, Sotia drowe the family Chevrolet Malibu 930 miles on job-related use and 5,200 miles in commuting to work, out of a fotal of 8,670 miles driven for the yoar. The Arroyos purchased the car on July 11,2018, for $23,400 5) The Arroyos have suppotted Raul Chavez (Sotia's widowed father) for several yoars, appropriately claiming him as a dependent for tax purposeg. On December 27, 2019, Flat suttered a massive stroke. The doctors did everything they could, but Flual diod in the intensive care unit of Fiverwood Hospital Medicare ($5,000 incurred in 2019 and $5,800 in 2020) and funeral expenses of $15,300. Fauly health insurance was fimitod to his Medieare coverage because the Arroyos medicati insuarance (tase item 3 above) only covered Miguel, Sofia, and their sons in his will, Raul narned Sofia the executor and sole heir of his-estate: 6.) Oree of the assets that Solis inherited with the transfer of Renilly estate was his houlie, Upon the achice of the finanocial consultant who shares office space with Miguel, the Arroyce decided to comert Fawi's botne into a furnshed rerital house. After soverat minor repairs feg. fouching up the paint on the interior walls, replacing various window scroens, pressure washing the brick exteriof, etc), the property was achuatised for rent in the claisified seotion of the focal newspaper ori March 1,2020. The repsiirs cost \$720, and the newspkiper ad was $360. Based on reconstructed reoorda and apprainal tatienaters, infortration about the property is as follows: 7) Foul's formet residence was rented almost immediately, with oocupancy correnencing April 1, 2020, under the following terma: one year lease, S2,400 per month due the first day of the rwonth, first and last months' rent in advanoe, $2,000 darnage deposit, lawn care iricluded but not utilities. The teriant complied with all terms except that ahe didn't pay the December rent until January 1 . 2021, because she was traveling internationally from Thariksgiving Day through New Year's Eve. Expenses in oonneetion with the property were as follows: property taxes, $2.600, repairs, $320; lawn maintenarice, 3540 ; insuranoe, 51800 , and ritreet pawing assessmyent, $2.100. The property is located at t2120 Lake Pond, Harvey, Mi 4905 . 8.) In eacty Docember 2019, a triend advised Mignol to tury stock in Proneer Aviation ino, (PAD). At that tirne, PAl was in norious firkancial strats and was headed toward bankruptoy. Nevertheless, according to Miguefs friend, the value of the oerporation's underlying assets was sasch that the ahareholdera were bound to reoover contiderably more than the current matket price of $0.00 per share. Excited at the charice for a "sare" profit, on December 15 , 2019. Miguel purchamed 20,000 stwares for $10,000. In Seplember 2020 , the trustee in bonkruptoy anthounced that the stock was worthlens and that men bonke of PAl's preterred oreditors wonfid not bet paid. an to whech stuees to selli, so form 10098 for this sale reported a $1 ? Sob tasis tor these shares. 10) One moeth betore nhe dited on Aprii 14,20t0, Maria Chavez (isofia's mother) give Solia a coin colleotion. Pased on carefix records that Maria kept. Was basglarieed, and then con colleotion was stolen. Ther Arroyos filed a claim with the carrier of their homeontier't insurance policy for $2.4000 (the) antiqueal withoxit a special ruder aftached to tive wisuratice policy. 11.) In her we, Maria Chaver (see item 10) left Sotia a vacant lot on Wright Street Maria had paid \$15,000 for the property. and it had a value of $19,000 When she died Maria had purchased the lot because it was adjacent to Northern Michigan University property and she expected the sohool to eventually expand the campis. By 2020, it has become clear that the university did not have the funds to expand the campris. Consequently, on July t, 2020, Solia sold the lot for $19,000. Not included in this price are unpead property taxes (and interest on the unpaid taxes) of $700 on the lot, which the puich aser assumed and later paid. Solia received a Form 1099 - B as documentation for this transaction which did not report the basis of this property. 12) Every year acound Christmas, Miguel recoives cards trom various car repair facilties and car dealerships that express thanks for his businesa referrals during the year, Mary of these cards include cash. Miguel has no asrangement, contractual or otherwise, that requires any compensation for the referrals he makes. Conoerned about the bagality of ruch "gitts." Miguel consulted an attorney about the matter a few years ago. Without passing judgment an the status of the payors, the attorney found that Miguel's acoeptance of the puyments does not violate state of local luw. Miguel sinoerely believes that the payments he recenes hwe no elfect on the referrals he makes. During December 2020, Mgued recelved cards containing $7,200. One additional card containing $900 was delayed in the mall, and Migovel did not recelve it untid dinkary 4, 2021. 13.) During a suntry weekent in June, the Arroyos held a garage sale to dispose of unwanted furniture, appliances, books, bicycles, clothes, and one boat (including trailet). Proceeds from the sale totaled $9,200 The estimated basis of the items sold is $25,500. Al sold assets had been used by the Arroyos for personal purposes. 14) In addition to the receipts presiously noted, the Arroyos received the following amounts during 2020 . 15] Payments made for 2020 expenditures not mentioned elsewhere are ss follows: 2020, they paid the pledges for 2018 through 2020 . During 2020, the Arroyos drove the Malitu 270 milles for medioal purposes fog trips to the hospital, doetot and dentist offices) and 320 miles delivering meals to the poor for Meals -on Wheets, a quastind eharity. to the thes for future college expenties, tharge does not have a job. 17.) Sofias Form W2 retlects wages of \$32.000. Appropriate amounts for Social Secuity and Medioare tavos were deducted inoome tax with hioldings those ary rdealings in virtual currencies. Prelevant Social Socurity sumbers are noted bebow. Requirements: Fill out an ingome tax return (with all appropriate forris and soheduba) for the Amroyos for 2020 following these.guidelines. Make neoessary assumptionis for info not given in the protilem but noeded to complete the return. - The taxpayors are preparing their own return (i.e, no preparer is irwolved). - If agy tefiand is due, the Arroyon want a refund check mailed to them. - The Antoyos had iteriezed deducticas from AGa for 2019 of $26700, of which $1,500 was for stale and local inoome tak: - The Artuyos da noy want to contritute to the Presickential Election Curypuign Fund

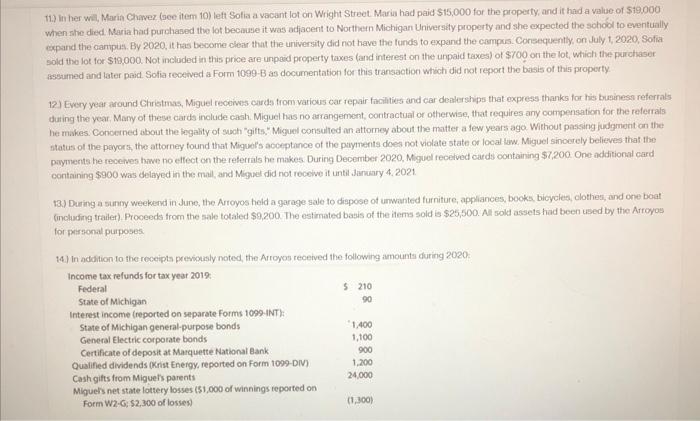

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

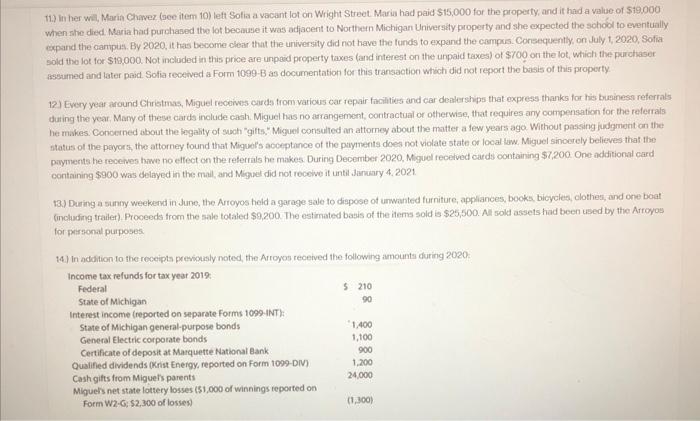

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

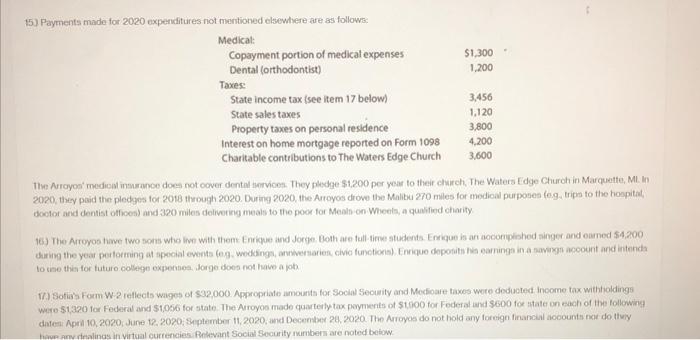

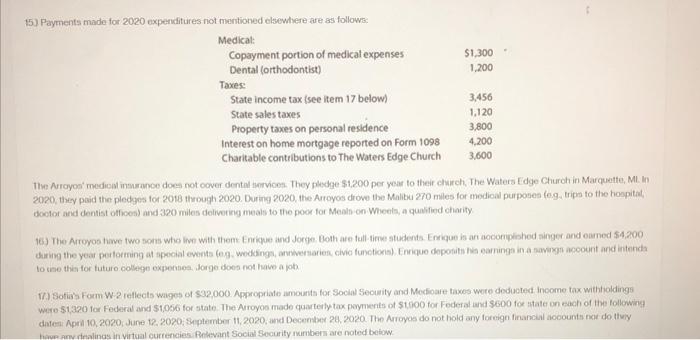

Get the answers you need in no time with our AI-driven, step-by-step assistance

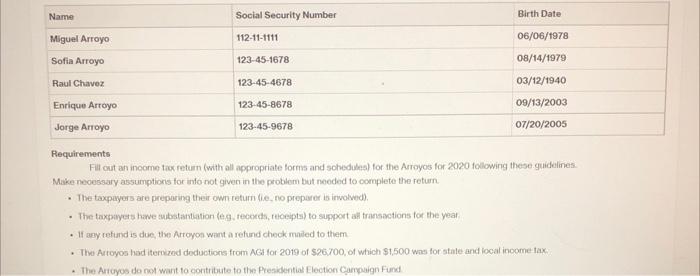

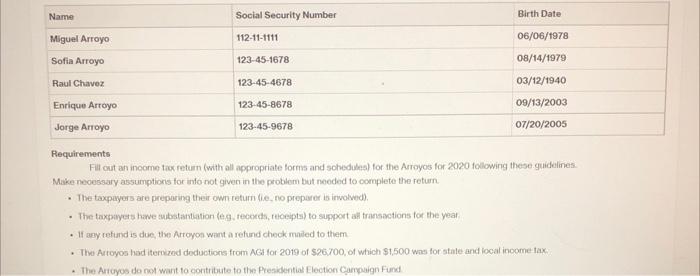

Get Started