Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with this, thank you!! The following data represent selected information from the comparative income statement and balance sheet for Hot Rolled Corporation for

Please help with this, thank you!!

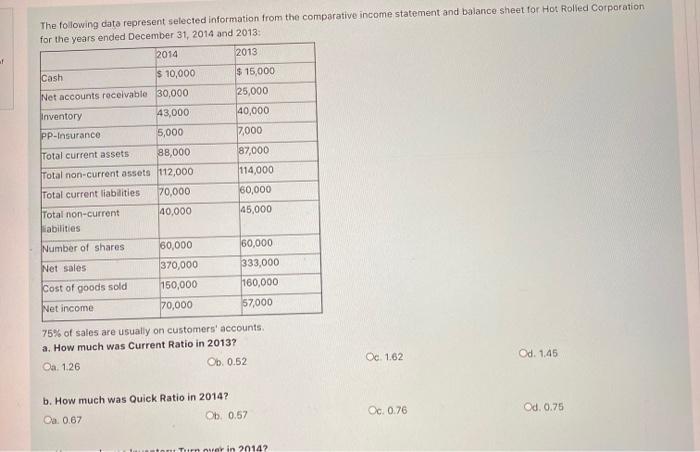

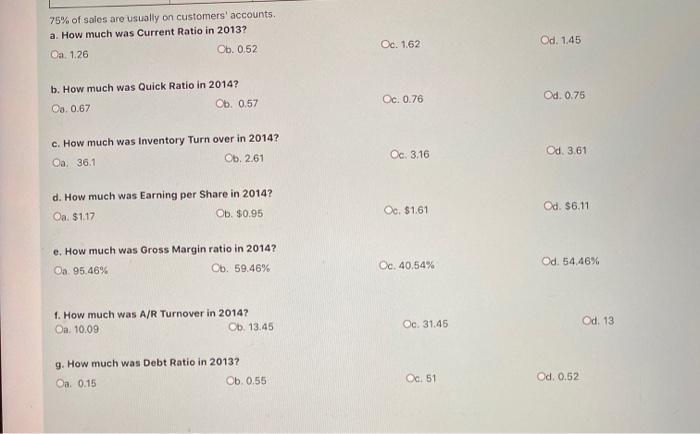

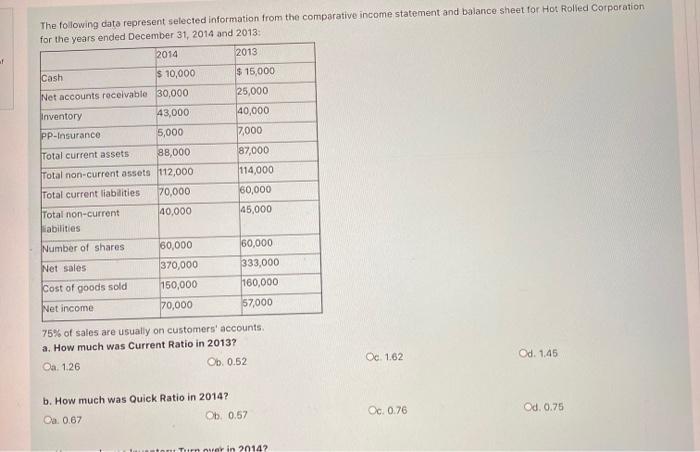

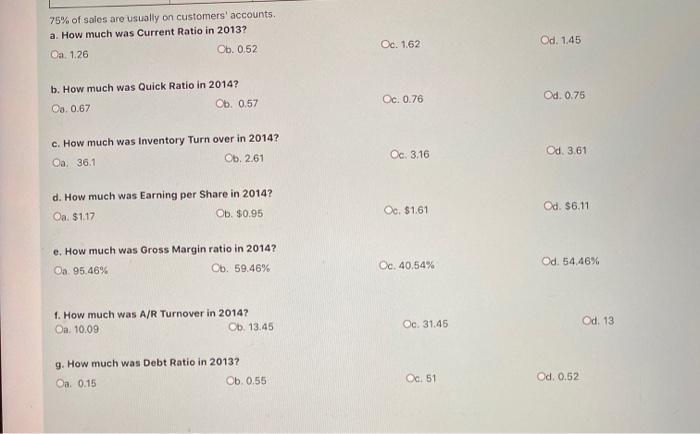

The following data represent selected information from the comparative income statement and balance sheet for Hot Rolled Corporation for the years ended December 31, 2014 and 2013: 2014 2013 $ 15,000 25,000 40,000 17000 Cash $ 10,000 Net accounts receivable 30,000 Inventory 43,000 Pp-Insurance 5,000 Total current assets 88,000 Total non-current assets 112,000 Total current liabilities 70,000 Total non-current 40,000 abilities 87,000 114,000 60,000 45,000 Number of shares 60,000 Net sales 60,000 333,000 160,000 57,000 370,000 150,000 70,000 Cost of goods sold Net income 75% of sales are usually on customers' accounts a. How much was Current Ratio in 2013? Oa 1.26 Ob. 0.52 Od 1.62 Od. 1.45 b. How much was Quick Ratio in 2014? Ca 0.67 Ob 0.57 Od 0.76 Od. 0.75 Thirn er in 2014? 75% of sales are usually on customers' accounts. a. How much was Current Ratio in 2013? Ca. 1.26 Ob. 0.52 Oc. 1.62 Od. 1.45 b. How much was Quick Ratio in 2014? Oa. 0.67 Ob. 0.57 Oc. 0.76 Od 0.75 c. How much was Inventory Turn over in 2014? Oa. 36.1 Ob. 2.61 Oc: 3.16 Od. 3.61 d. How much was Earning per Share in 2014? Oa. $1.17 Ob. $0.95 Oo. $1.61 Od $6.11 e. How much was Gross Margin ratio in 2014? Oa 95.46% Ob. 59.46% Oc. 40.54% Od. 54.46% 1. How much was A/R Turnover in 2014? Oa. 10.09 Ob. 13.45 Oc. 31.45 Od. 13 9. How much was Debt Ratio in 2013? Oa: 0.15 Ob. 0.55 Oc51 Od 0.52

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started