Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with this with the Excel template that has been provided to you. Valley Past Inc., uses the weighted average method for process costing.

please help with this with the Excel template that has been provided to you.

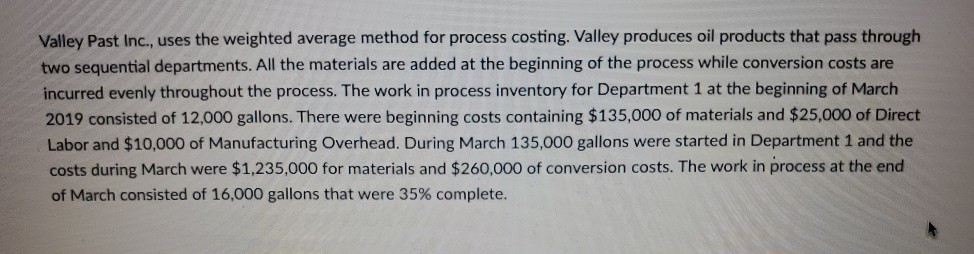

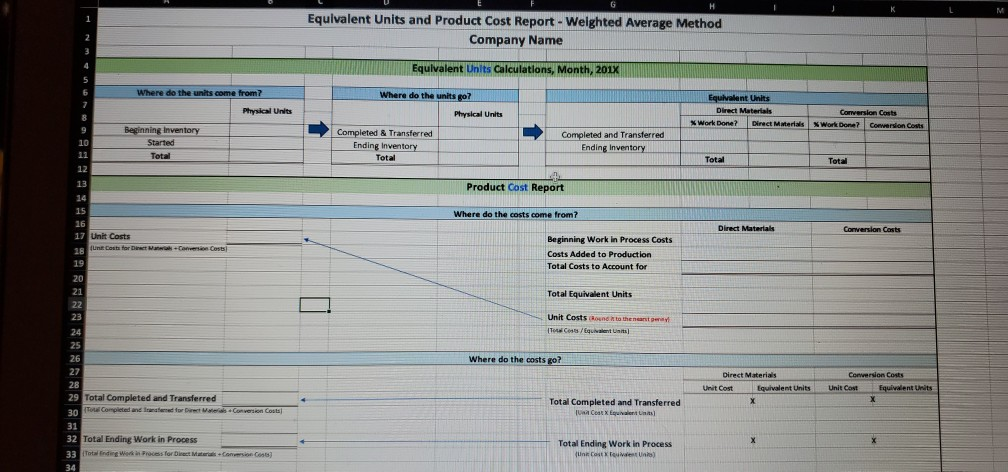

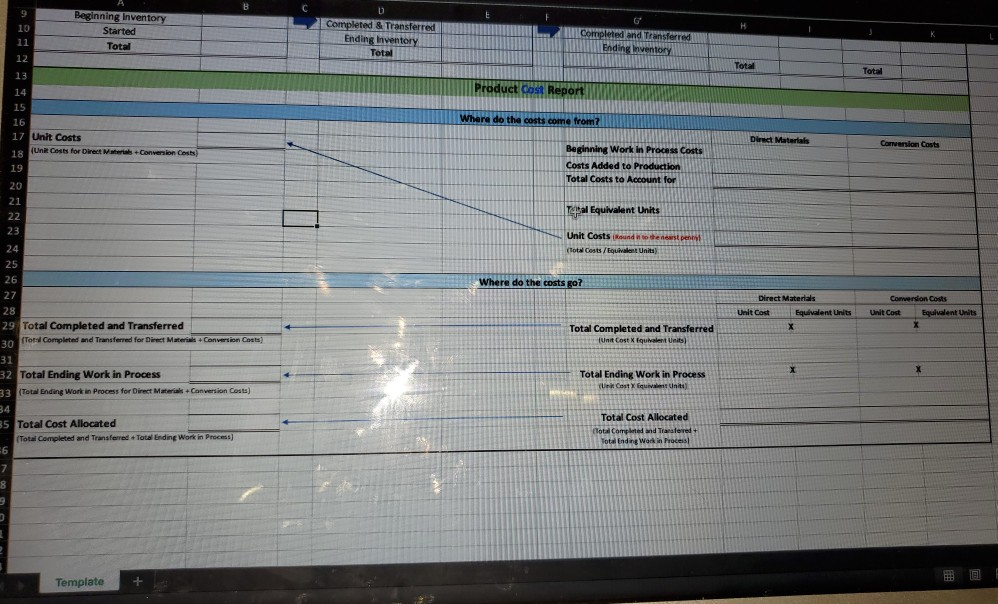

Valley Past Inc., uses the weighted average method for process costing. Valley produces oil products that pass through two sequential departments. All the materials are added at the beginning of the process while conversion costs are incurred evenly throughout the process. The work in process inventory for Department 1 at the beginning of March 2019 consisted of 12,000 gallons. There were beginning costs containing $135,000 of materials and $25,000 of Direct Labor and $10,000 of Manufacturing Overhead. During March 135,000 gallons were started in Department 1 and the costs during March were $1,235,000 for materials and $260,000 of conversion costs. The work in process at the end of March consisted of 16,000 gallons that were 35% complete. M 1 Equivalent Units and Product Cost Report - Weighted Average Method Company Name 2 3 4 Equivalent Units Calculations, Month, 2017 5 Where do the units go? Physical Units Equivalent Units Direct Materials Work Done? Direct Me Conversion Costs * Work Done? Conwersion costs Completed & Transferred Ending Inventory Total Completed and Transferred Ending Inventory Total Total 6 Where do the units come from? Physical Units 8 Beginning Inventory 10 Started 11 Total 12 13 14 15 16 17 Unit Costs 18 funt.Cauta for Directories Costs] 19 Product Cost Report Where do the costs come from? Direct Materials Conversion Costs Beginning Work in Process Costs Costs Added to Production Total Costs to Account for 20 21 22 23 Total Equivalent Units Unit Costs Cound to the east ITC/Equines Where do the costs go? 24 25 26 27 28 29 Total Completed and Transferred 30 TOL Completed and latered for Directors Conversion Costa 31 32 Total Ending Work in Process 33 Total Ending Process for Direct Mater Casino 34 Direct Materials Unit Cost Equivalent Units X Conversion Costs Unit Cost Equivalent Units X Total Completed and Transferred Coat X Equivalent Limits] x Total Ending Work in Process (Un Costine) E 9 10 11 12 Beginning Inventory Started Total D Completed & Transferred Ending Inventory Total Completed and Transferred Ending Inventory Total 13 Total Product Cost Report Where do the costs come from? 14 15 16 17 Unit Costs 18 (Una Costs for Direct Mertas Conversion Costs) 19 Direct Materials Conversion Costs Beginning Work In Process Costs Costs Added to Production Total Costs to Account for 20 21 22 23 Tal Equivalent Units Unit Costs and to the spent (Total Costs / Equivalent Units) Where do the costs go? Direct Materials Unit Cost Equivalent Units X Conversion Costs Unit Cost Equivalent Units X Total Completed and Transferred Unit Cost X Equivalent Units) 24 25 26 27 28 . 29 Total Completed and Transferred 30 (Tot Completed and Transferred for Direct Materials + Conversion Costa) 31 32 Total Ending Work in Process 33 Total Ending Work in Process for Direct Materials Conversion Costa) 34 35 Total Cost Allocated (Total Completed and Transferred + Total Ending Work in Process) 6 7 8 X Total Ending Work in Process (Unit Cost fquivalent Total Cost Allocated Total Completed Transferred Total inding Work in Proces TemplateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started