Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with those questions and do the T-account like the problem on the paper (clearly). Watson Manufacturing Company employs a job order cost accounting

Please help with those questions and do the T-account like the problem on the paper (clearly).

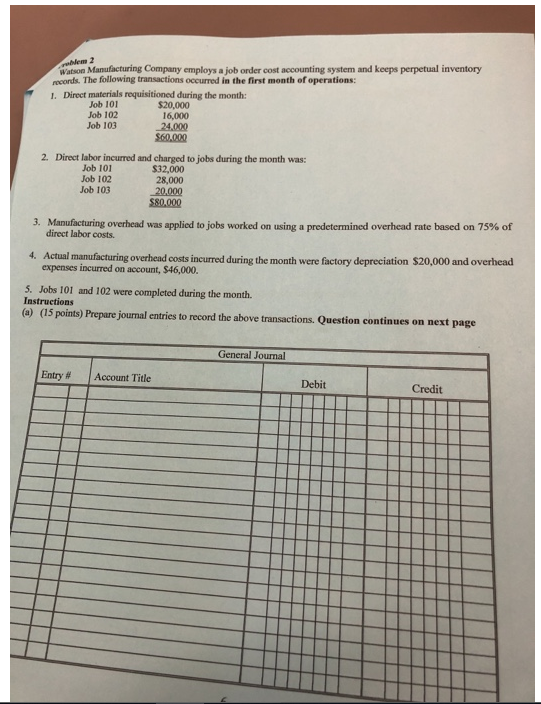

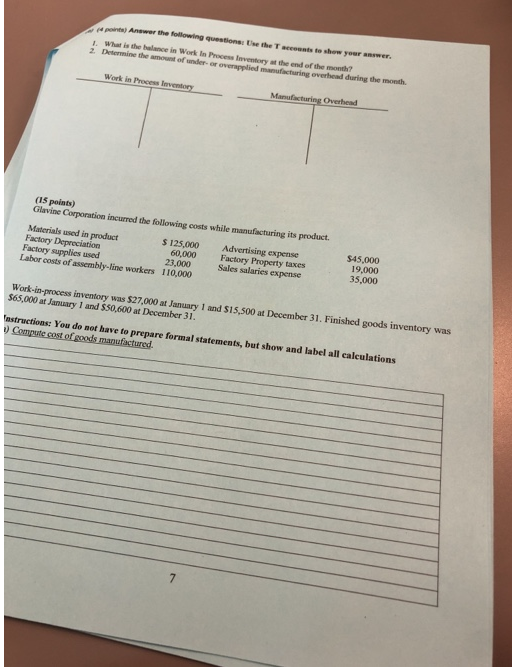

Watson Manufacturing Company employs a job order cost accounting system and keeps perpetual inventory records. The following transactions occurred in the first month of operations: 1. Direct materials requisitioned during the month: Job 101 Job 102 Job 103 $20,000 16,000 24,.000 2. Direct labor incurred and charged to jobs during the month was: Job 101 Job 102 Job 103 $32,000 28,000 20,000 3. Manufacturing overhead was applied to obs worked on using a predetermined overhead rate based on 75% of direct labor costs. 4. Actual manufacturin g overhead costs incurred during the month were factory depreciation $20,000 and overhead expenses incurred on account, $46,000. 5. Jobs 101 and 102 were completed during the month. Instructions (e) (15 points) Prepare journal entries to record the above transactions. Question continues on next page General Journal Entry # Account Title Debit Credit pointa) Answer the following questions: Use the T accounts to show your answer. What is the balance in Work In Process Inventory at the end of the month? Determine the amount of under- 2. or overapplied manufacturing overhead during the month. o Work in Process Inventory (15 points) Materials used in product Factory Depreciation Factory supplies used Labor costs of assembly-line workers Glavine Corporation incurred the following costs while manufacturing its product. s 125,000 23,000 Advertising expense Factory Property taxes Sales salaries expense $45,000 19,000 35,000 60,000 110,000 Work-in-process inventory was $27,000 at January 1 and $15,500 at December 31. Finished goods inventory was $65,000 at January 1 and $50,600 at December 31. astructions: You do not have to prepare formal statements, but show and label all calculationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started