Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with those questions QUESTION THREE Hardax Limited (Ltd) is a company operating presented to you 125 in the hardware industry. The following information

Please help with those questions

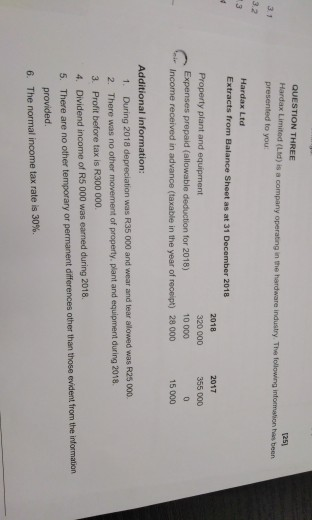

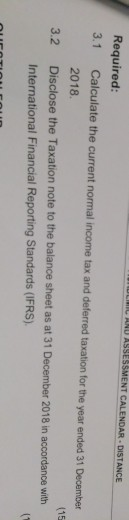

QUESTION THREE Hardax Limited (Ltd) is a company operating presented to you 125 in the hardware industry. The following information has 3 1 3.2 13 Hardax Ltd Extracts from Balance Sheet as at 31 December 2018 2018 320 000 10 000 2017 Property plant and equiprment 355 000 Expenses prepaid (allowable deduction for 2018) Income received in advance (taxable in the year of receipt) 28 000 15 000 Additional information: 1. During 2018 depreciation was R35 000 and wear and tear allowed was R25 000 2. There was no other movement of property, plant and equipment during 2018 3. Profit before tax is R300 000. 4. Dividend income of RS 000 was earmed during 2018 5. There are no other temporary or permanent differences other than those evident from the information provided The normal income tax rate is 30%. 6. LITC ANU ASSESSMENT CALENDAR . DISTANCE Required: 3.1 Calculate the current normal income tax and deferred taxation for the year ended 31 December 2018. Disclose the Taxation note to the balance sheet as at 31 December 2018 in accordance with International Financial Reporting Standards (FRS) (15 3.2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started