Answered step by step

Verified Expert Solution

Question

1 Approved Answer

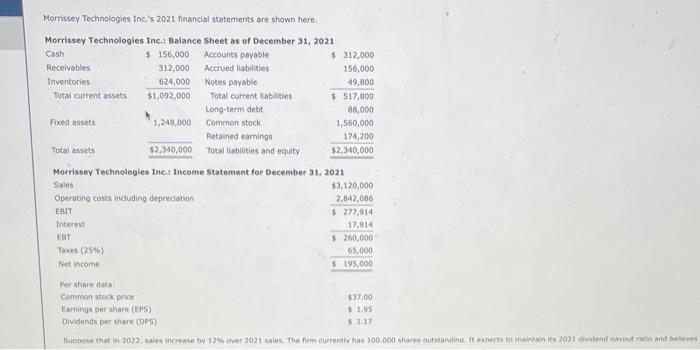

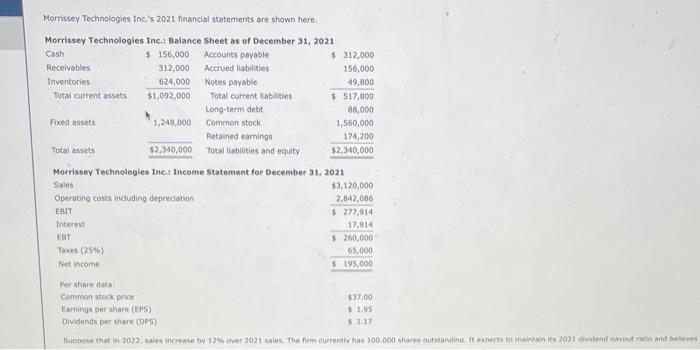

please help with work Morrissey Technologies Inci's 2021 financial statements are shown here. Morrissey Technologies Inc, Balance Sheet as of December 31, 2021 Morrissey Technologles

please help with work

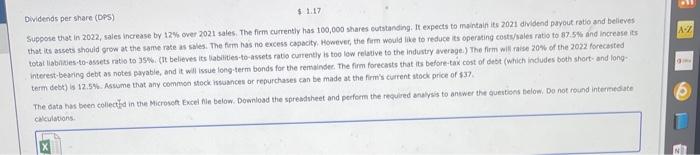

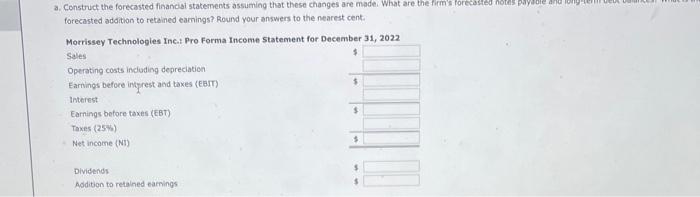

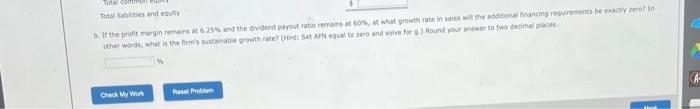

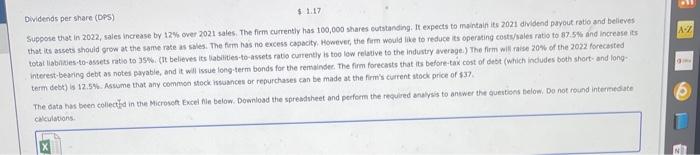

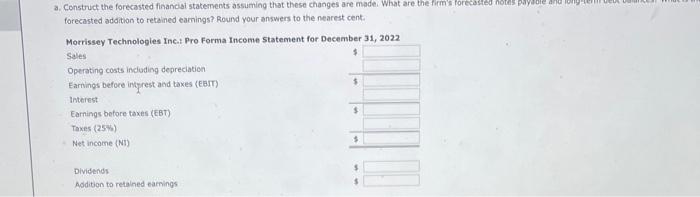

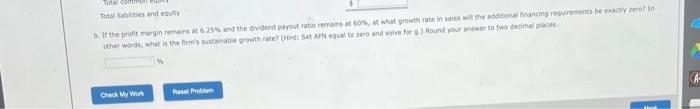

Morrissey Technologies Inci's 2021 financial statements are shown here. Morrissey Technologies Inc, Balance Sheet as of December 31, 2021 Morrissey Technologles Inc.1 Income Statement for December 31, 2021 Sugpose that in 2022, sales increase by 12% orer 2021 sales. The firm currentiy has t00,000 shares cutstandhg. It expects to maintain its 2021 dividend payout ratie and believes that its ascets shouid grow at the same rate as sales. The fum has no excess capacity. However, the firm would like to reduce its operating costejales ratio to 87.5% and increase its interest-beming debt as notes payable, and it wil issue long.4erm bonds for the remaindec. The firm forecasts that its before-tax cost of dest (which indudes both short- and long-: term debt) is 12.5\%. Aswme that any comroo sock issuances or repurchases can be made at the firri's current tock price of $37. cheulations. Construct ihe forecasted financisi stakements assumino that these changes are made. What are the firtis fore forecasted addition to retained eamings? Round your answers to the nearest cent; Assets Canh Receivables Inventories Total current assets Fixed assets Total assets Liabilies and Equity Acceunts payable Aocrued Habiesies Notes payable Total currem llabakies Long-term deht fotai liabilties Common Mock Hetaned earing? Tokal rervimen equity Total istilities and equity Total sabitives and equty Morrissey Technologies Inci's 2021 financial statements are shown here. Morrissey Technologies Inc, Balance Sheet as of December 31, 2021 Morrissey Technologles Inc.1 Income Statement for December 31, 2021 Sugpose that in 2022, sales increase by 12% orer 2021 sales. The firm currentiy has t00,000 shares cutstandhg. It expects to maintain its 2021 dividend payout ratie and believes that its ascets shouid grow at the same rate as sales. The fum has no excess capacity. However, the firm would like to reduce its operating costejales ratio to 87.5% and increase its interest-beming debt as notes payable, and it wil issue long.4erm bonds for the remaindec. The firm forecasts that its before-tax cost of dest (which indudes both short- and long-: term debt) is 12.5\%. Aswme that any comroo sock issuances or repurchases can be made at the firri's current tock price of $37. cheulations. Construct ihe forecasted financisi stakements assumino that these changes are made. What are the firtis fore forecasted addition to retained eamings? Round your answers to the nearest cent; Assets Canh Receivables Inventories Total current assets Fixed assets Total assets Liabilies and Equity Acceunts payable Aocrued Habiesies Notes payable Total currem llabakies Long-term deht fotai liabilties Common Mock Hetaned earing? Tokal rervimen equity Total istilities and equity Total sabitives and equty

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started