Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with wuestion 17 and 18 23 17 in cell ranges 184.188, 190:195, 198:1101 and 1103:1110, by using absolute cell references to the given

please help with wuestion 17 and 18

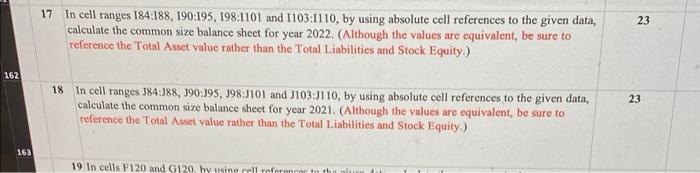

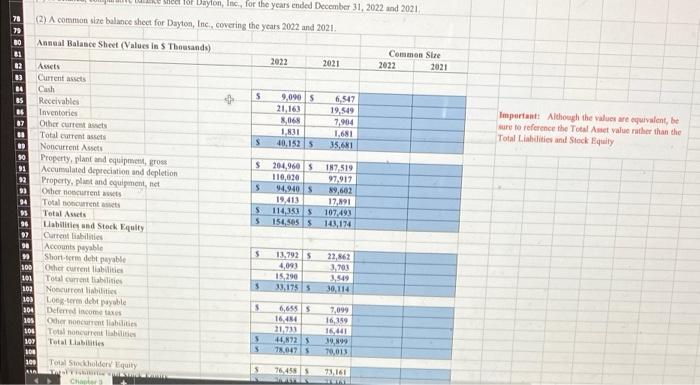

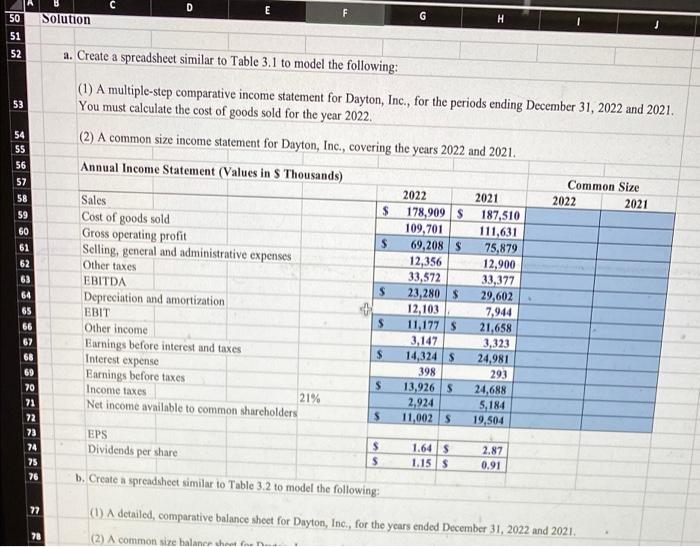

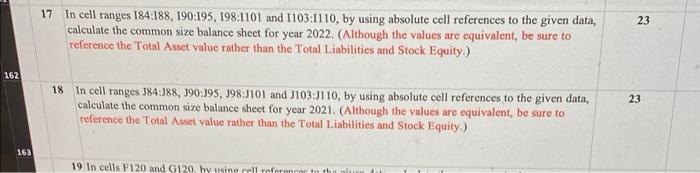

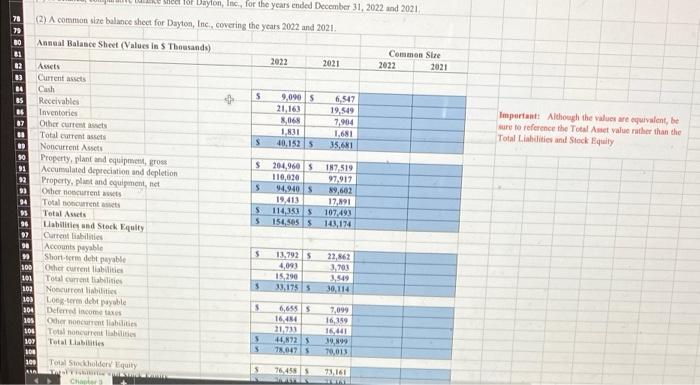

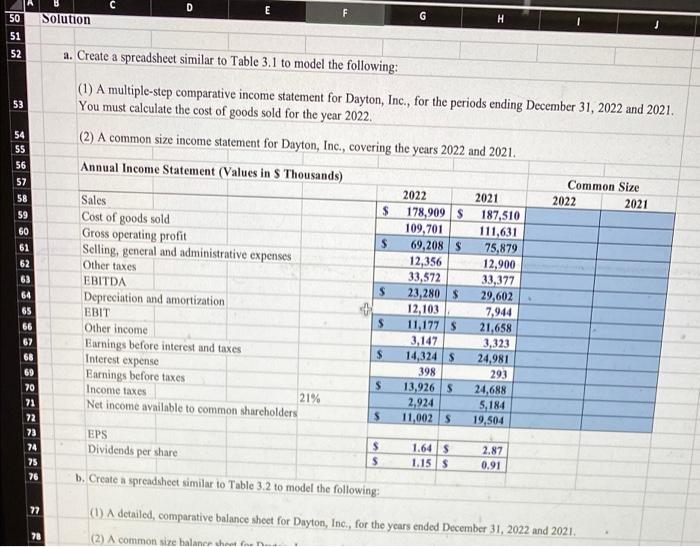

23 17 in cell ranges 184.188, 190:195, 198:1101 and 1103:1110, by using absolute cell references to the given data, calculate the common size balance sheet for year 2022. (Although the values are equivalent, be sure to reference the Total Asset value rather than the Total Liabilities and Stock Equity.) 162 23 18 In cell ranges 184:188, 190:195, 198:J101 and J103.9110, by using absolute cell references to the given data, calculate the common size balance sheet for year 2021. (Although the values are equivalent, be sure to reference the Total Asset value rather than the Total Liabilities and Stock Equity) 263 19 In cells F120 and 120 hy isine cell reference to the Sied for Daylon, Inc., for the years ended December 31, 2022 and 2021 (2) A common size balance sheet for Dayton, Inc., covering the years 2022 and 2021 Annual Balance Sheet (Values in S Thousands) EBBS 2022 2021 Common Stre 2022 2021 9,000 21.163 8,068 1,831 40.1525 6,547 19.549 7,964 1.681 35,681 Important: Although the values are equivalente sure to reference the Total Aset value rather than the Total Liabilities and Stock Equity S $ 5 Assets Current assets Cash Receivables Inventories Other currentes Total current Noncurrent Assets Property, plant and equipment, grow Accumulated depreciation and depletion Property, plant and equipment, het Other current wat Total current Total Assets Liabilities and Stock Equity 07 Current liabilities 90 Accounts payable Short term debt payable 100 Other current liabilities 101 Total current liabilities 102 No current liabilities 193 Loom det Nyable 304 Deferences 205 Other noncontabilities 106 Total current liabilities 192 Total Liabilities 101 105 Total Stockholder Equity IN Chat 204,9605 110,020 94,940 s 19,413 114,3513 154,565 5 187,519 97,917 89,602 17,191 107.493 143, 174 S 5 5 13,7925 4,083 15,290 33.175 22,862 3.703 3.549 30,114 3 5 6,655 16,484 21.733 44,172 73,0475 7.099 16.159 16,441 39,899 70,013 5 5 ANA 76.455 MEN 73.161 E F Solution G H 50 51 52 a. Create a spreadsheet similar to Table 3.1 to model the following: 53 (1) A multiple-step comparative income statement for Dayton, Inc., for the periods ending December 31, 2022 and 2021. You must calculate the cost of goods sold for the year 2022. (2) A common size income statement for Dayton, Inc., covering the years 2022 and 2021. 54 55 56 57 58 Annual Income Statement (Values in S Thousands) Common Size 2022 2021 59 $ S 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 Sales Cost of goods sold Gross operating profit Selling, general and administrative expenses Other taxes EBITDA Depreciation and amortization EBIT Other income Earnings before interest and taxes Interest expense Earnings before taxes Income taxes 21% Net income available to common shareholders 2022 2021 178,909 S 187,510 109,701 111,631 69,208 75,879 12,356 12,900 33,572 33,377 23,280$ 29,602 12,103 7.944 11,177 $ 21,658 3,147 3,323 14,324 s 24,981 398 13,926 S 24,688 5,184 11,002 S 19,504 S S 293 $ 2.924 $ EPS Dividends per share $ $ 1.645 1.15$ 2.87 0.91 b. Create a spreadsheet similar to Table 3.2 to model the following: 77 A detailed, comparative balance sheet for Dayton, Inc., for the years ended December 31, 2022 and 2021 78 (2) A common size balance shown 23 17 in cell ranges 184.188, 190:195, 198:1101 and 1103:1110, by using absolute cell references to the given data, calculate the common size balance sheet for year 2022. (Although the values are equivalent, be sure to reference the Total Asset value rather than the Total Liabilities and Stock Equity.) 162 23 18 In cell ranges 184:188, 190:195, 198:J101 and J103.9110, by using absolute cell references to the given data, calculate the common size balance sheet for year 2021. (Although the values are equivalent, be sure to reference the Total Asset value rather than the Total Liabilities and Stock Equity) 263 19 In cells F120 and 120 hy isine cell reference to the Sied for Daylon, Inc., for the years ended December 31, 2022 and 2021 (2) A common size balance sheet for Dayton, Inc., covering the years 2022 and 2021 Annual Balance Sheet (Values in S Thousands) EBBS 2022 2021 Common Stre 2022 2021 9,000 21.163 8,068 1,831 40.1525 6,547 19.549 7,964 1.681 35,681 Important: Although the values are equivalente sure to reference the Total Aset value rather than the Total Liabilities and Stock Equity S $ 5 Assets Current assets Cash Receivables Inventories Other currentes Total current Noncurrent Assets Property, plant and equipment, grow Accumulated depreciation and depletion Property, plant and equipment, het Other current wat Total current Total Assets Liabilities and Stock Equity 07 Current liabilities 90 Accounts payable Short term debt payable 100 Other current liabilities 101 Total current liabilities 102 No current liabilities 193 Loom det Nyable 304 Deferences 205 Other noncontabilities 106 Total current liabilities 192 Total Liabilities 101 105 Total Stockholder Equity IN Chat 204,9605 110,020 94,940 s 19,413 114,3513 154,565 5 187,519 97,917 89,602 17,191 107.493 143, 174 S 5 5 13,7925 4,083 15,290 33.175 22,862 3.703 3.549 30,114 3 5 6,655 16,484 21.733 44,172 73,0475 7.099 16.159 16,441 39,899 70,013 5 5 ANA 76.455 MEN 73.161 E F Solution G H 50 51 52 a. Create a spreadsheet similar to Table 3.1 to model the following: 53 (1) A multiple-step comparative income statement for Dayton, Inc., for the periods ending December 31, 2022 and 2021. You must calculate the cost of goods sold for the year 2022. (2) A common size income statement for Dayton, Inc., covering the years 2022 and 2021. 54 55 56 57 58 Annual Income Statement (Values in S Thousands) Common Size 2022 2021 59 $ S 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 Sales Cost of goods sold Gross operating profit Selling, general and administrative expenses Other taxes EBITDA Depreciation and amortization EBIT Other income Earnings before interest and taxes Interest expense Earnings before taxes Income taxes 21% Net income available to common shareholders 2022 2021 178,909 S 187,510 109,701 111,631 69,208 75,879 12,356 12,900 33,572 33,377 23,280$ 29,602 12,103 7.944 11,177 $ 21,658 3,147 3,323 14,324 s 24,981 398 13,926 S 24,688 5,184 11,002 S 19,504 S S 293 $ 2.924 $ EPS Dividends per share $ $ 1.645 1.15$ 2.87 0.91 b. Create a spreadsheet similar to Table 3.2 to model the following: 77 A detailed, comparative balance sheet for Dayton, Inc., for the years ended December 31, 2022 and 2021 78 (2) A common size balance shown

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started