Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help Work needed for these questions prefer in excel format (: if job P included 20 units what was its unit product cost. Required

Please help Work needed for these questions prefer in excel format (:

if job P included 20 units what was its unit product cost.

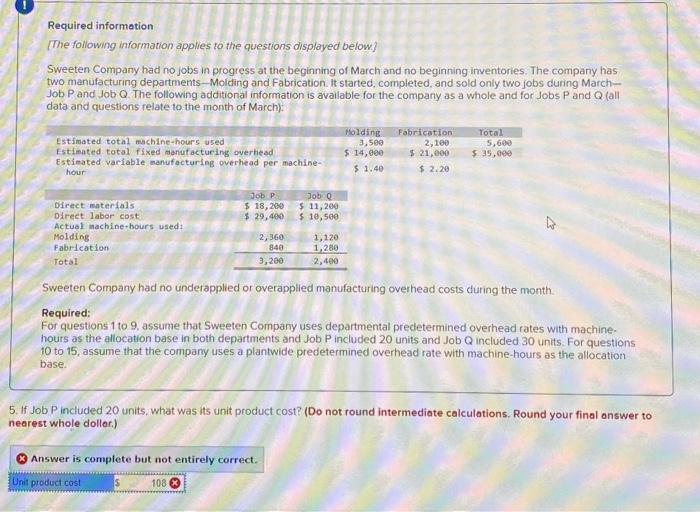

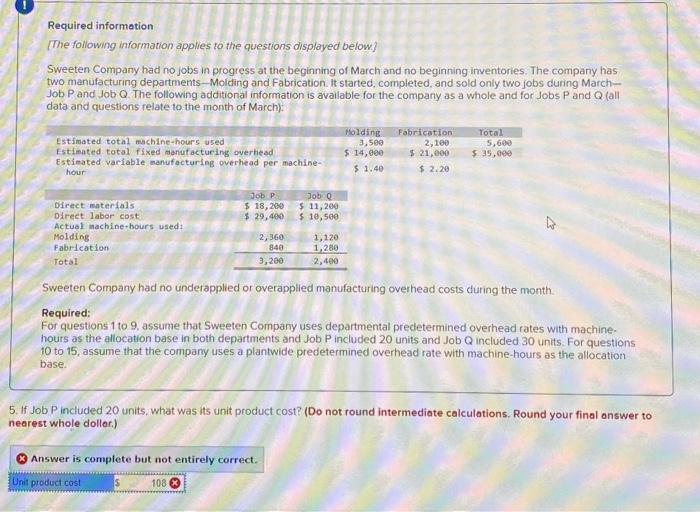

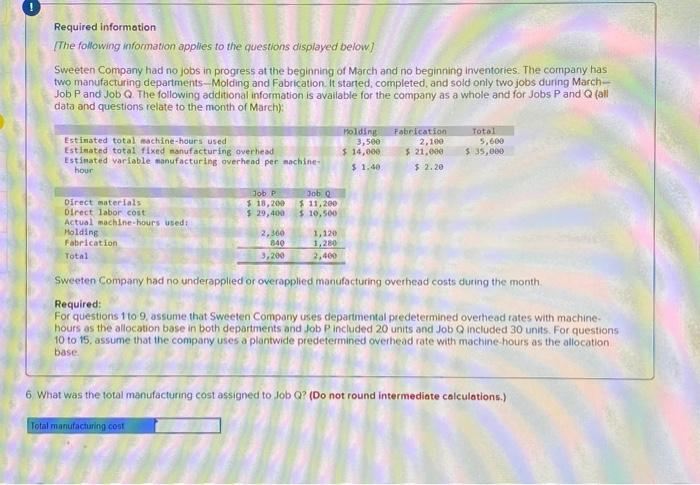

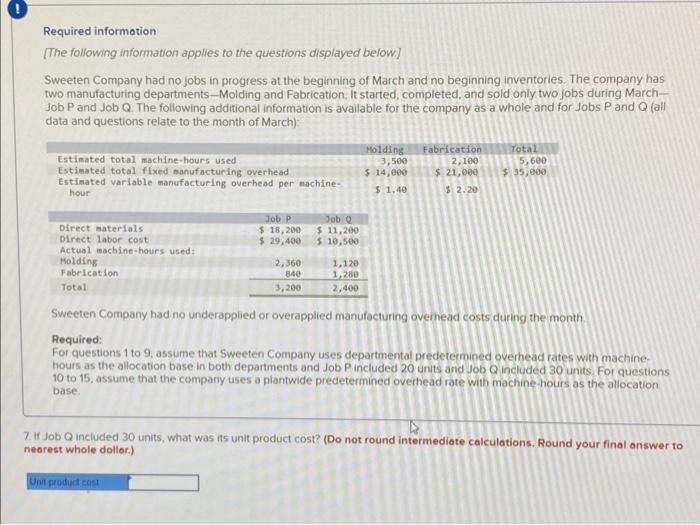

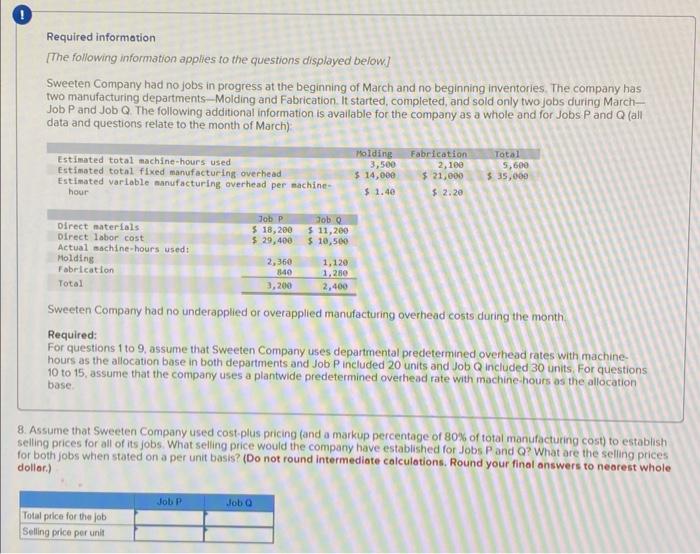

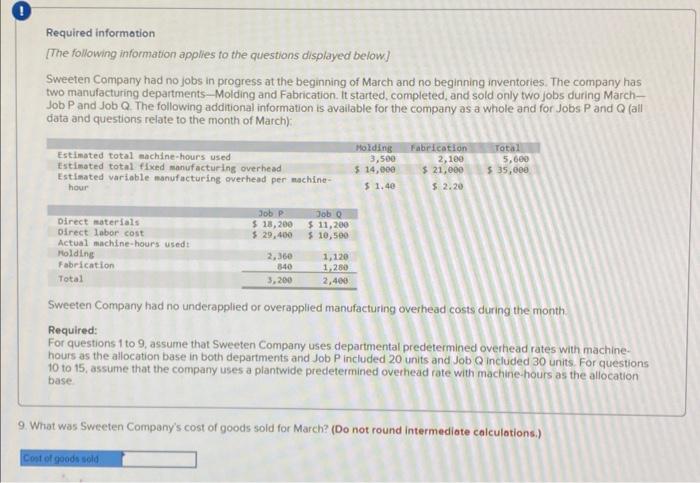

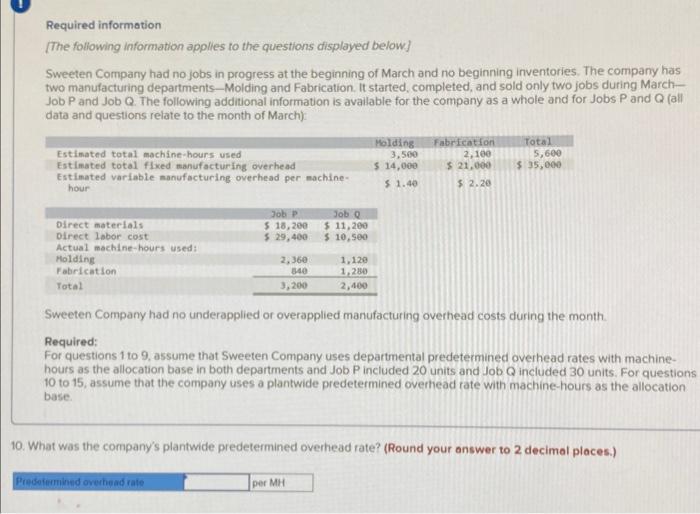

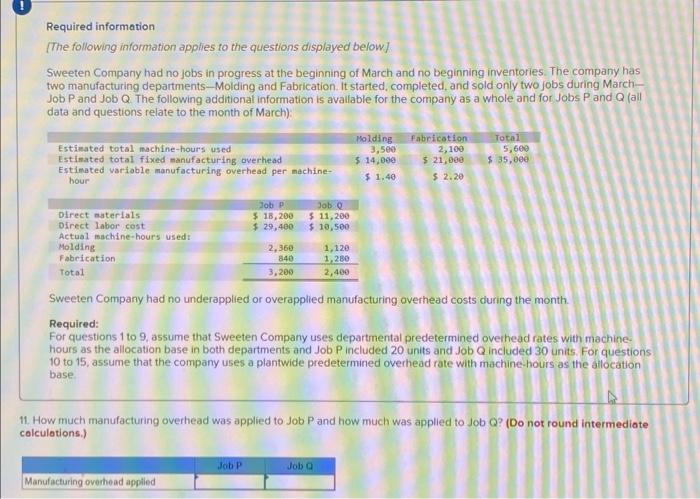

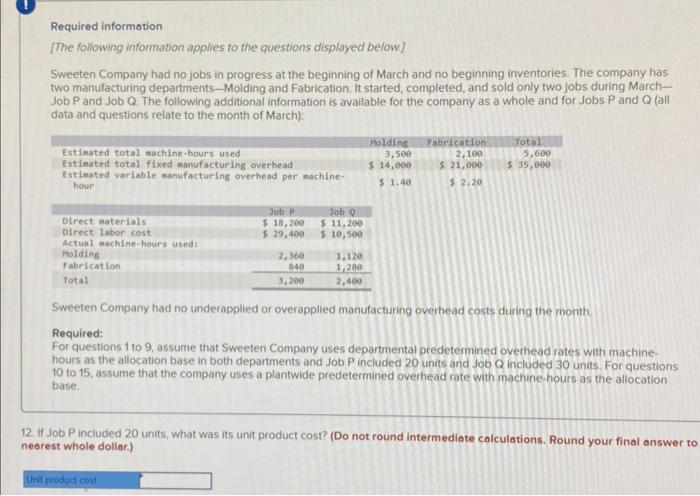

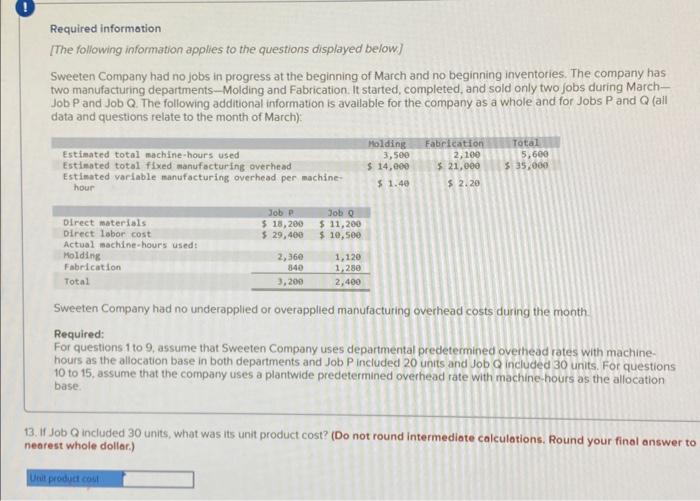

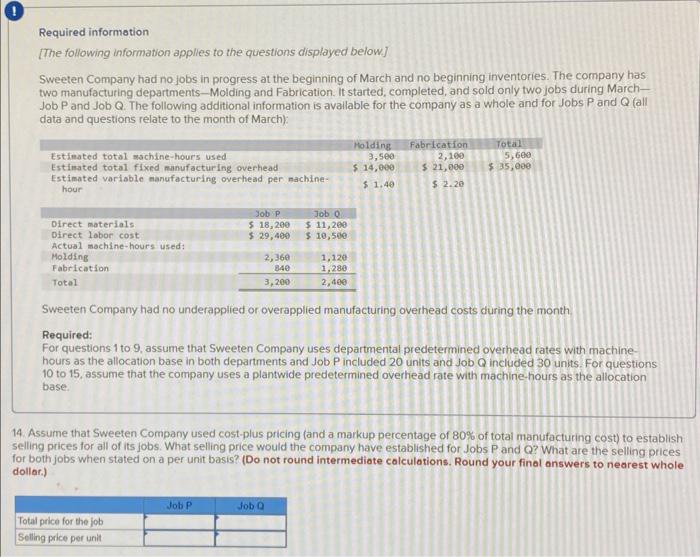

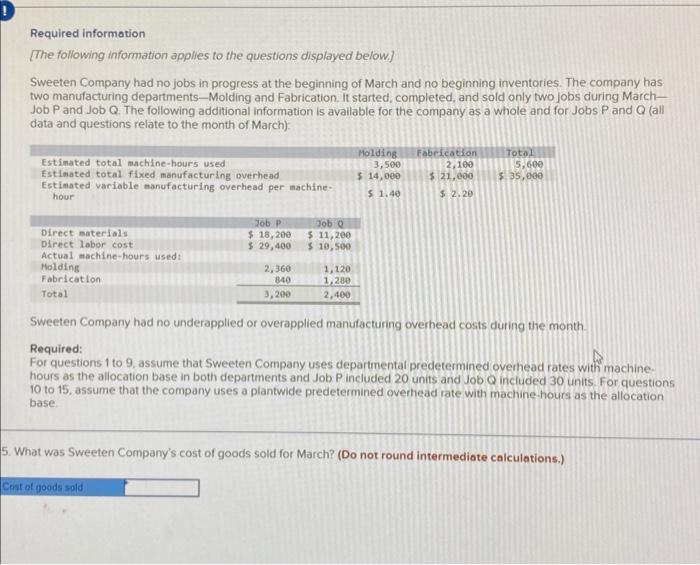

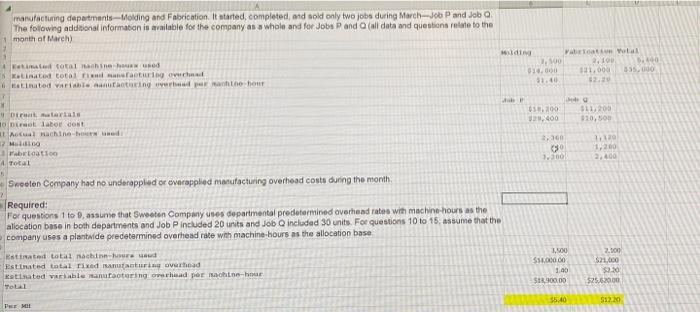

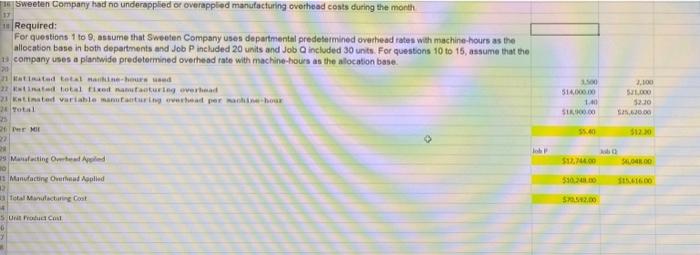

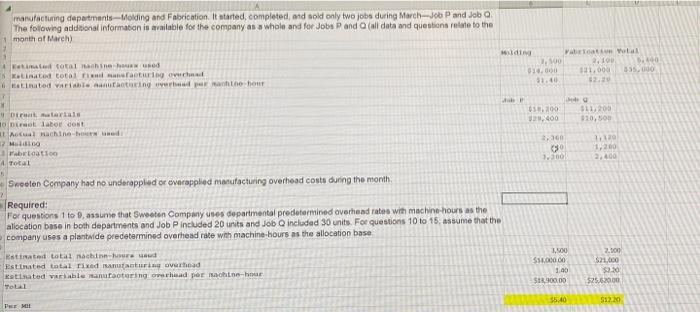

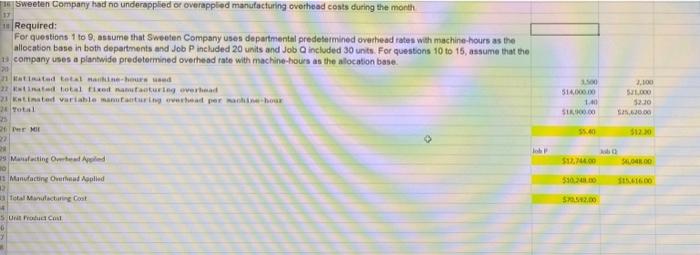

Required information [The following information applies to the questions displayed below] Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments - Molding and Fabrication. It started, completed, and sold only two jobs during MarchJob P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1 to 9 , assume that Sweeten Company uses departmental predetermined overhead rates with machine. hours as the allocation base in both departments and Job P included 20 units and Job Q included 30 units. For questions 10 to 15, assume that the company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. 5. If Job P included 20 units, what was its unit product cost? (Do not round intermediate calculations. Round your final answer to hearest whole dollar.) Answer is complete but not entirely correct. Required information [The following information applies to the questions displayed below] Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments-Molding and Fabrication. It started, completed, and sold only two jobs during MarchJob P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1 to 9 , assume that Sweeten Compony uses departmental predetermined overhead rates with machinehours as the allocation base in both departments and Job P included 20 units and Job Q included 30 units. For questions 10 to t5, assume that the compary uses a plontwide predetermined overhead rate with machine.hours as the allocation base. 6. What was the total manufacturing cost assigned to Job Q ? (Do not round intermediate calculations.) Required information [The following information applies to the questions displayed below.] Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments - Molding and Fabrication, it started, completed, and sold only two jobs during MarchJob P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): Sweeten Company had no underapplied or overapplied manufocturing overhead costs during the month. Required: For questions 1 to 9 , assume that Sweeten Company uses departmental predetermined overhead rates with machinehours as the allocation base in both departments and Job P included 20 units and Job Q included 30 units. For questions 10 to 15. assume that the company uses a plantwide predetermined overhead rote with machine-hours as the allocation base. . If Job Q included 30 units, what was its unit product cost? (Do not round intermediate calculations. Round your final answer to heorest whole dollor.) Required information [The following information applies to the questions displayed below] Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments - Molding and Fabrication. It started, completed, and sold only two jobs during MarchJob P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March) Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1 to 9 , assume that Sweeten Company uses departmental predetermined overhead rates with machinehours as the allocation base in both departments and Job P included 20 units and Job Q included 30 units. For questions 10 to 15, assume that the company uses a plantwide predetermined overhead rate with machine hours as the allocation base. 8. Assume that Sweeten Company used cost-plus pricing (and a markup percentage of 80% of total manufacturing cost) to establish selling prices for all of its jobs. What selling price would the company have established for Jobs P and Q ? What are the selling prices (or both jobs when stated on a per unit basis? (Do not round intermediate calculations. Round your final answers to neorest whole dollor.) Required informotion [The following information applies to the questions displayed below] Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments - Molding and Fabrication. It started, completed, and sold only two jobs during MarchJob P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1 to 9, assume that Sweeten Company uses departmental predetermined overhead rates with machinehours as the allocation base in both departments and Job P included 20 units and Job Q included 30 units. For questions 10 to 15 , assume that the company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. 9. What was Sweeten Company's cost of goods sold for March? (Do not round intermediate calculations.) Required information [The following information applies to the questions displayed below] Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments-Molding and Fabrication. It started, completed, and sold only two jobs during MarchJob P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1 to 9 , assume that Sweeten Company uses departmental predetermined overhead rates with machinehours as the allocation base in both departments and Job P included 20 units and Job Q included 30 units. For questions 10 to 15, assume that the company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. What was the company's plantwide predetermined overhead rate? (Round your answer to 2 decimal places.) Required information [The following information applies to the questions displayed below]. Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments - Molding and Fabrication. It started, completed, and sold only two jobs during MarchJob P and Job Q. The following additional information is avallable for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1 to 9, assume that Sweeten Company uses departmental predetermined overhead rates with machinehours as the allocation base in both departments and Job P included 20 units and Job Q included 30 units. For questions 10 to 15 , assume that the company uses a plantwide predetermined overhead rate with machine-hours as the ailocation base. How much manufacturing overhead was applied to Job P and how much was applied to Job Q? (Do not round intermediate alculotions.) Required information [The following information applies to the questions displayed below.] Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments - Molding and Fabrication. It started, completed, and sold only two jobs during MarchJob P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1 to 9, assume that Sweeten Company uses departmental predetermined overhead rates with machinehours as the allocation base in both departments and Job P included 20 units and Job Q included 30 units. For questions 10 to 15 , assume that the company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. 2. If Job P included 20 units, what was its unit product cost? (Do not round intermediate calculations. Round your final answer tc heorest whole dollar.) Required information [The following information applies to the questions displayed below] Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments-Molding and Fabrication. It started, completed, and sold only two jobs during MarchJob P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (ail data and questions relate to the month of March): Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1 to 9 , assume that Sweeten Company uses departmental predetermined overhead rates with machinehours as the allocation base in both departments and Job P included 20 units and Job Q included 30 units. For questions 10 to 15, assume that the company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. If Job Q included 30 units, what was its unit product cost? (Do not round intermediate calculations. Round your final answer to earest whole dollar.) Required informotion [The following information applies to the questions displayed below.] Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments-Molding and Fabrication. It started, completed, and sold only two jobs during MarchJob P and Job Q. The following additional information is avallable for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1 to 9 , assume that Sweeten Company uses departmental predetermined overhead rates with machinehours as the allocation base in both departments and Job P included 20 units and Job Q included 30 units. For questions 10 to 15 , assume that the company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. Assume that Sweeten Company used cost-plus pricing (and a markup percentage of 80% of total manufacturing cost) to establish alling prices for all of its jobs. What selling price would the company have established for Jobs P and Q ? What are the selling prices ir both jobs when stated on a per unit basis? (Do not round intermediate colculations. Round your final answers to nearest whole Required information [The following information applies to the questions displayed below.] Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments-Molding and Fabrication. It started, completed, and sold only two jobs during MarchJob P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1 to 9 , assume that Sweeten Company uses departmental predetermined overhead rates with machine-: hours as the allocation base in both departments and Job P included 20 units and Job Q included 30 units. For questions 10 to 15 , assume that the company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. What was Sweeten Company's cost of goods sold for March? (Do not round intermediate calculations.) manufacturing depotmants - Molding and Fabrication. It started, completed, and sold only two jobs during March-Job P and Job Q. The followng additional informasion is available fox the company as a whole and for Jobs P and Q (all data and quesbiens retale to the month at Wareh) Katimalied total manine-lonedz uped Xotiaacol cocol final anderagtiuripg overhna.l Diraet. matarials Diraet lator dest. Rocual nachine-triestr uasil Madisting Fabordostson forar 1 Skeelen Cempany had no underappled or evarappled manufacturing overhead costs durng the month. Required: Fer questions 1 to 9 , assume that Sweeten Campany uses departmental predetermined ouerhead rates with machine-hours as the allocation base in both departments and Job P included 20 units and Job Q incliaded 30 units. For questions 10 to 15 , assume that the compeny uses a plantaide predetermined overhead rate with machine hours as the allocation base Estivated total nachtnh-hroure yated Estinated tatat rixid ranutacturiag overthead Kstinated vartable manuraotaring omorhead por machtne-hner. 7oter Prer: yer Sweeten Company had no underappled or overappled manufacturing ovorhead costs during the month: Required: For questions 1 to 9 , assume that Sweeten Company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments and Job P inchuded 20 units and Job Q included 30 unts For questons 10 to 15 , assume that the company uses a plantwife predetermined overhead rate with machine-hours as the alocation base. Katimitad tet-al mankine-haure lased Kntinated variable mantanturing overhead per mankine -hour total Perr Mir Meualeving Onterat Avpled Menutacting Overtheat Applied Tetal Mundbctaring Coor Unal frohua Cou

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started