Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE HELP! You are a manager of a large firm, and your bonus depends on achieving a positive variance between the budgeted costs and the

PLEASE HELP!

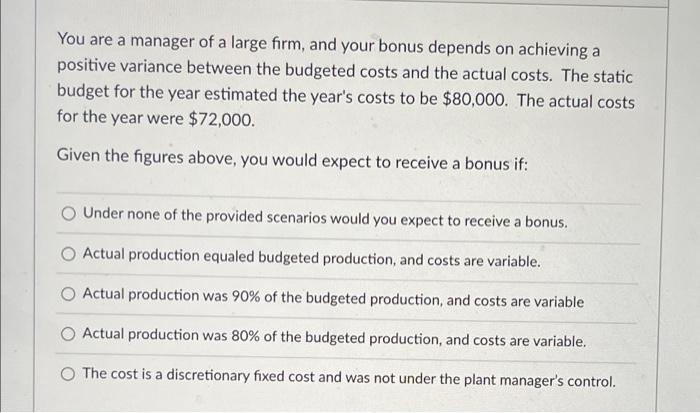

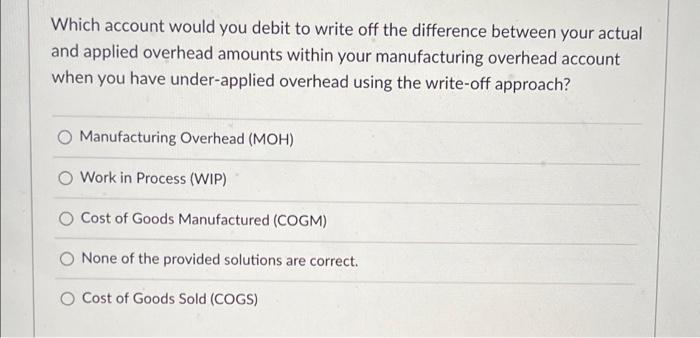

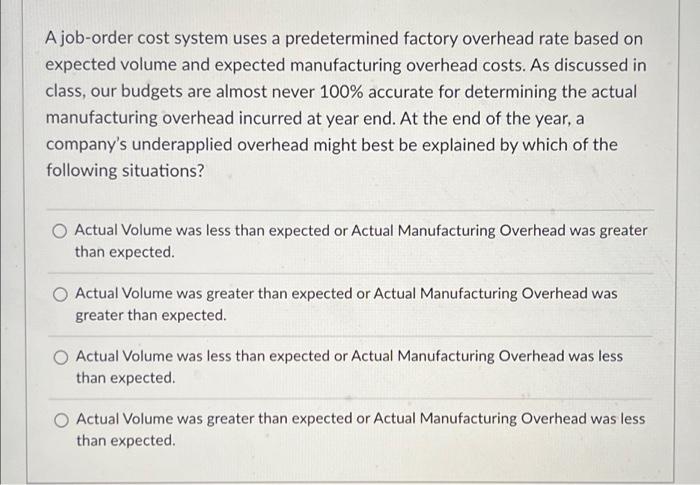

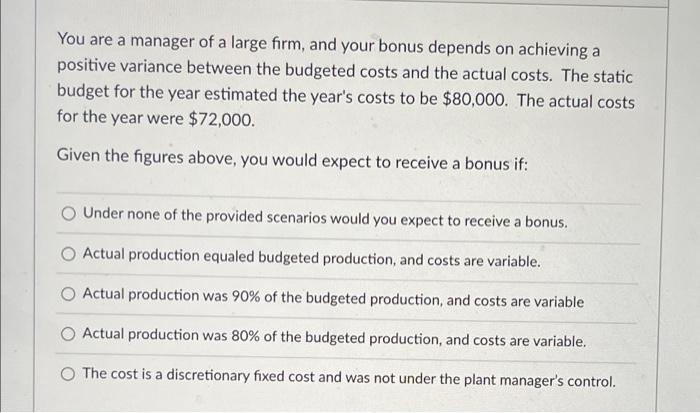

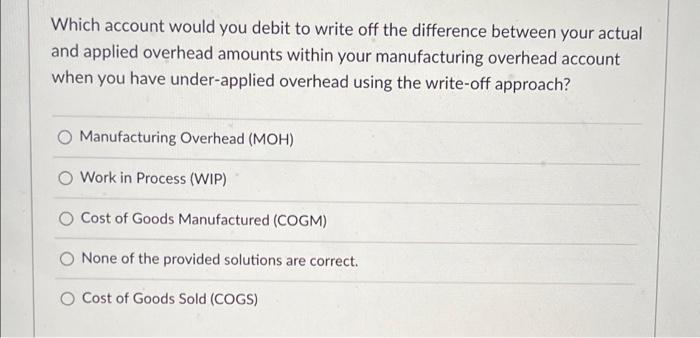

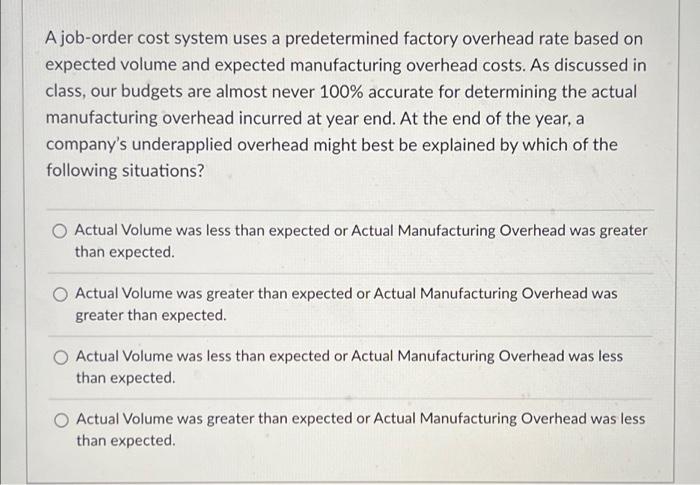

You are a manager of a large firm, and your bonus depends on achieving a positive variance between the budgeted costs and the actual costs. The static budget for the year estimated the year's costs to be $80,000. The actual costs for the year were $72,000. Given the figures above, you would expect to receive a bonus if: Under none of the provided scenarios would you expect to receive a bonus. Actual production equaled budgeted production, and costs are variable. Actual production was 90% of the budgeted production, and costs are variable Actual production was 80% of the budgeted production, and costs are variable. The cost is a discretionary fixed cost and was not under the plant manager's control. Which account would you debit to write off the difference between your actual and applied overhead amounts within your manufacturing overhead account when you have under-applied overhead using the write-off approach? Manufacturing Overhead (MOH) o Work in Process (WIP) Cost of Goods Manufactured (COGM) None of the provided solutions are correct. O Cost of Goods Sold (COGS) A job-order cost system uses a predetermined factory overhead rate based on expected volume and expected manufacturing overhead costs. As discussed in class, our budgets are almost never 100% accurate for determining the actual manufacturing overhead incurred at year end. At the end of the year, a company's underapplied overhead might best be explained by which of the following situations? Actual Volume was less than expected or Actual Manufacturing Overhead was greater than expected. Actual Volume was greater than expected or Actual Manufacturing Overhead was greater than expected. Actual Volume was less than expected or Actual Manufacturing Overhead was less than expected. Actual Volume was greater than expected or Actual Manufacturing Overhead was less than expected

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started