Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help You are working as an intern at Sheridan Products, a privately owned manufacturing company. You got into a discussion with the Chief Financial

Please help

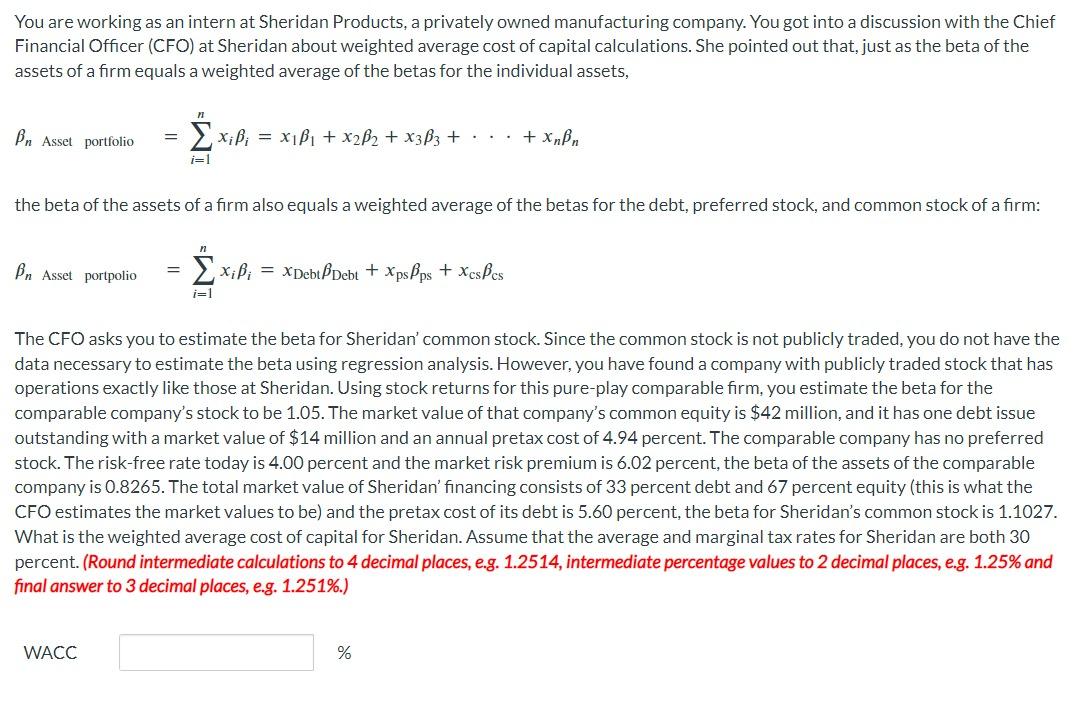

You are working as an intern at Sheridan Products, a privately owned manufacturing company. You got into a discussion with the Chief Financial Officer (CFO) at Sheridan about weighted average cost of capital calculations. She pointed out that, just as the beta of the assets of a firm equals a weighted average of the betas for the individual assets, nAssetportfolio=i=1nxii=x11+x22+x33++xnn the beta of the assets of a firm also equals a weighted average of the betas for the debt, preferred stock, and common stock of a firm: nAssetportpolio=i=1nxii=xDebtDebt+xpsps+xcscs The CFO asks you to estimate the beta for Sheridan' common stock. Since the common stock is not publicly traded, you do not have the data necessary to estimate the beta using regression analysis. However, you have found a company with publicly traded stock that has operations exactly like those at Sheridan. Using stock returns for this pure-play comparable firm, you estimate the beta for the comparable company's stock to be 1.05. The market value of that company's common equity is $42 million, and it has one debt issue outstanding with a market value of $14 million and an annual pretax cost of 4.94 percent. The comparable company has no preferred stock. The risk-free rate today is 4.00 percent and the market risk premium is 6.02 percent, the beta of the assets of the comparable company is 0.8265. The total market value of Sheridan' financing consists of 33 percent debt and 67 percent equity (this is what the CFO estimates the market values to be) and the pretax cost of its debt is 5.60 percent, the beta for Sheridan's common stock is 1.1027. What is the weighted average cost of capital for Sheridan. Assume that the average and marginal tax rates for Sheridan are both 30 percent. (Round intermediate calculations to 4 decimal places, e.g. 1.2514, intermediate percentage values to 2 decimal places, e.g. 1.25% and final answer to 3 decimal places, e.g. 1.251\%.) WACC % You are working as an intern at Sheridan Products, a privately owned manufacturing company. You got into a discussion with the Chief Financial Officer (CFO) at Sheridan about weighted average cost of capital calculations. She pointed out that, just as the beta of the assets of a firm equals a weighted average of the betas for the individual assets, nAssetportfolio=i=1nxii=x11+x22+x33++xnn the beta of the assets of a firm also equals a weighted average of the betas for the debt, preferred stock, and common stock of a firm: nAssetportpolio=i=1nxii=xDebtDebt+xpsps+xcscs The CFO asks you to estimate the beta for Sheridan' common stock. Since the common stock is not publicly traded, you do not have the data necessary to estimate the beta using regression analysis. However, you have found a company with publicly traded stock that has operations exactly like those at Sheridan. Using stock returns for this pure-play comparable firm, you estimate the beta for the comparable company's stock to be 1.05. The market value of that company's common equity is $42 million, and it has one debt issue outstanding with a market value of $14 million and an annual pretax cost of 4.94 percent. The comparable company has no preferred stock. The risk-free rate today is 4.00 percent and the market risk premium is 6.02 percent, the beta of the assets of the comparable company is 0.8265. The total market value of Sheridan' financing consists of 33 percent debt and 67 percent equity (this is what the CFO estimates the market values to be) and the pretax cost of its debt is 5.60 percent, the beta for Sheridan's common stock is 1.1027. What is the weighted average cost of capital for Sheridan. Assume that the average and marginal tax rates for Sheridan are both 30 percent. (Round intermediate calculations to 4 decimal places, e.g. 1.2514, intermediate percentage values to 2 decimal places, e.g. 1.25% and final answer to 3 decimal places, e.g. 1.251\%.) WACC %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started