Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help :) You decide to purchase a struggling retail center for $850,000. You are able to finance the purchase at a 70% Loan to

please help :)

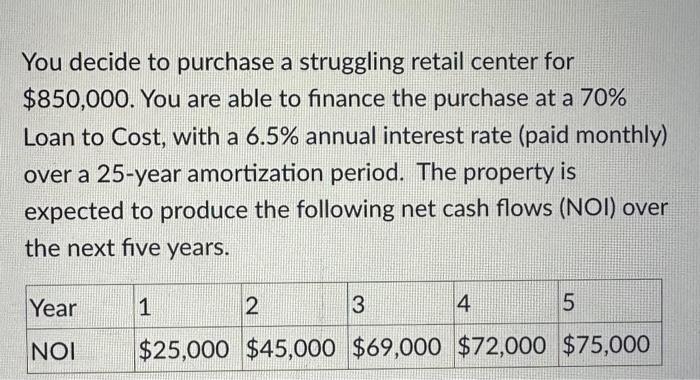

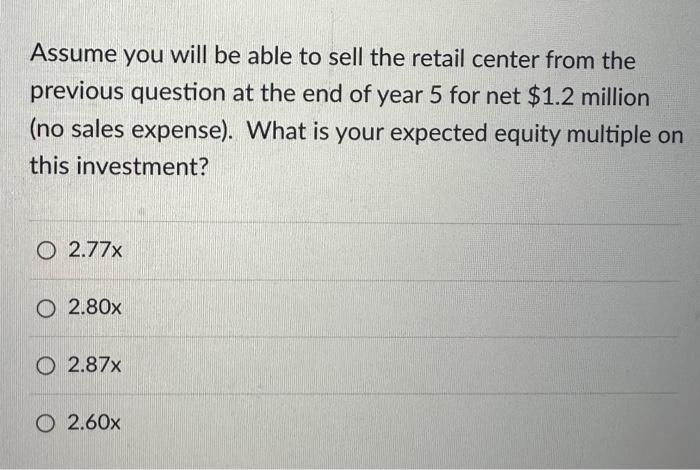

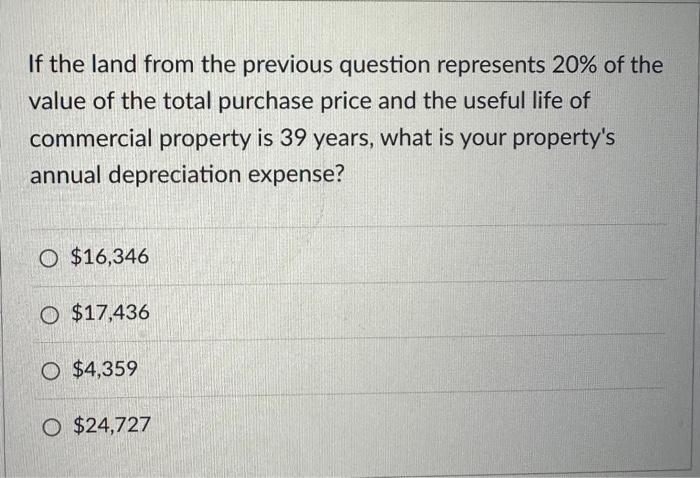

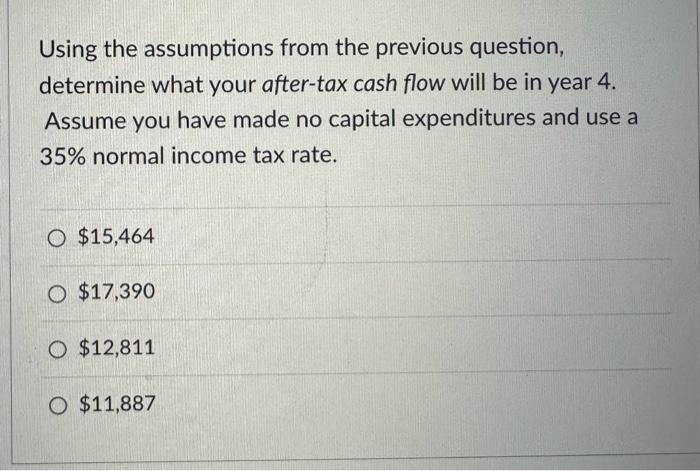

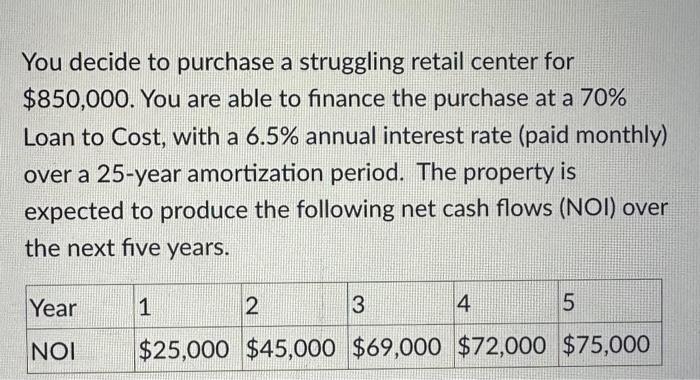

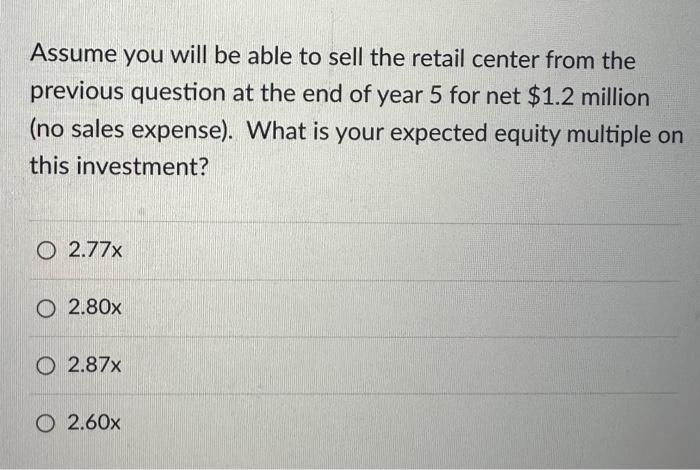

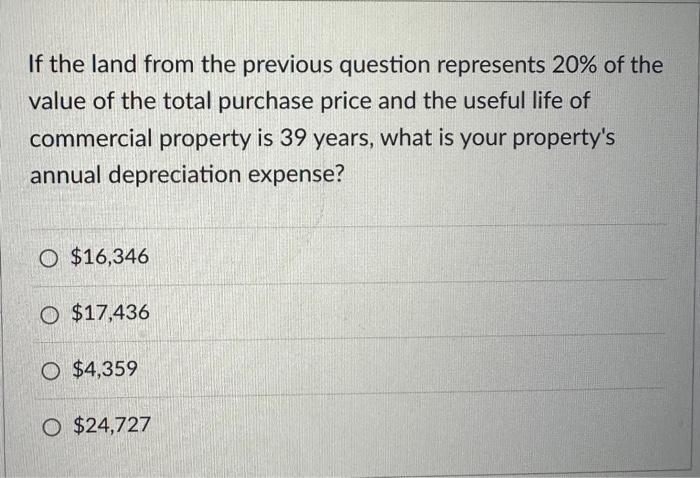

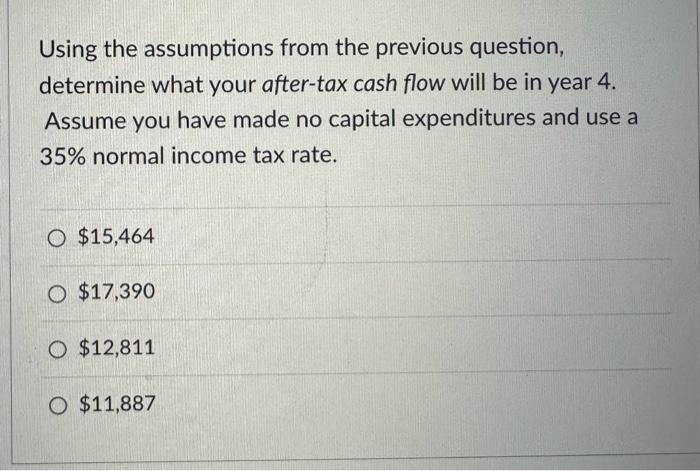

You decide to purchase a struggling retail center for $850,000. You are able to finance the purchase at a 70% Loan to Cost, with a 6.5% annual interest rate (paid monthly) over a 25-year amortization period. The property is expected to produce the following net cash flows (NOI) over the next five years. Assume you will be able to sell the retail center from the previous question at the end of year 5 for net $1.2 million (no sales expense). What is your expected equity multiple on this investment? 2.77x 2.80x 2.87x 2.60x If the land from the previous question represents 20% of the value of the total purchase price and the useful life of commercial property is 39 years, what is your property's annual depreciation expense? $16,346 $17,436 $4,359 $24,727 Using the assumptions from the previous question, determine what your after-tax cash flow will be in year 4 . Assume you have made no capital expenditures and use a 35% normal income tax rate. $15,464 $17,390 $12,811 $11,887

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started