Question

Please help! You have been hired by a midsize copper smelting company in northern Canada to act as a consultant to help the executive team

Please help!

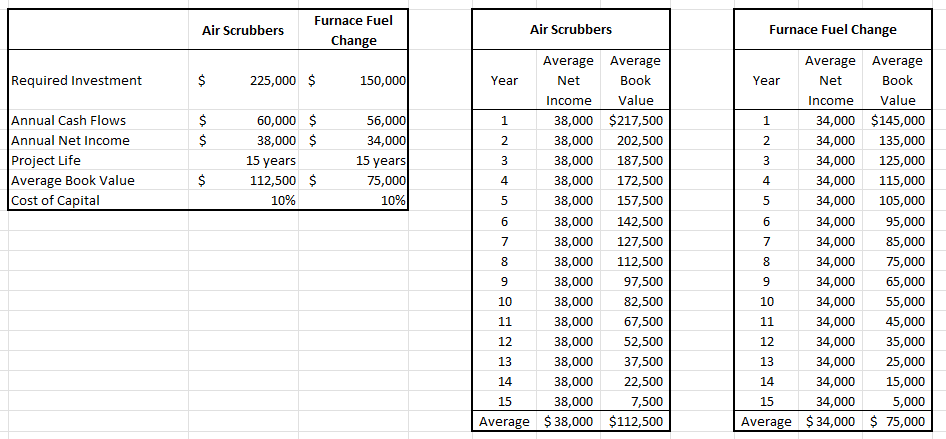

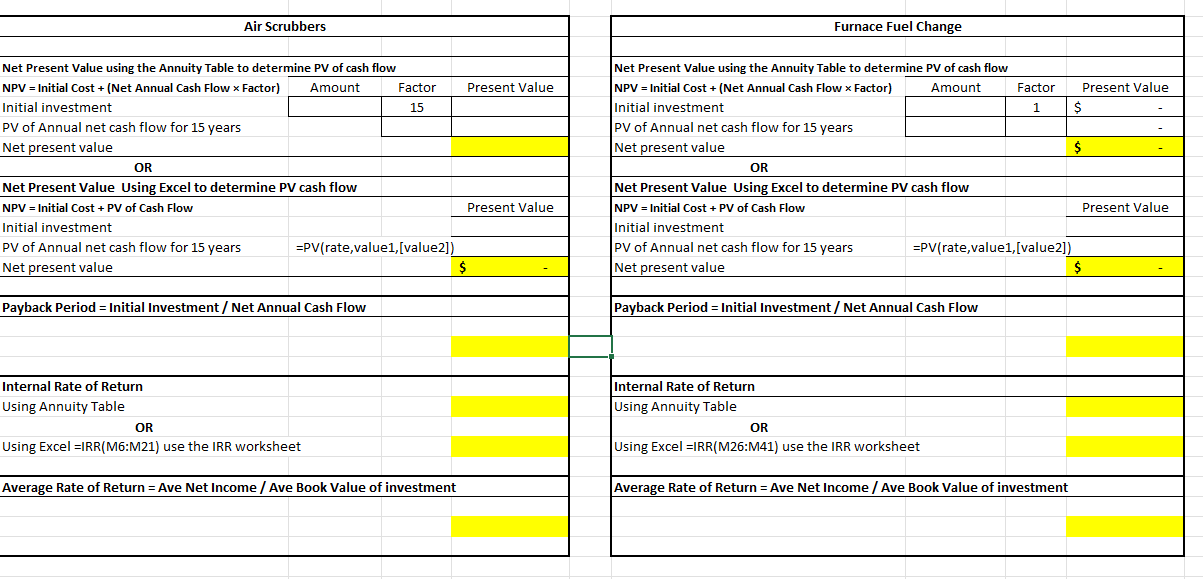

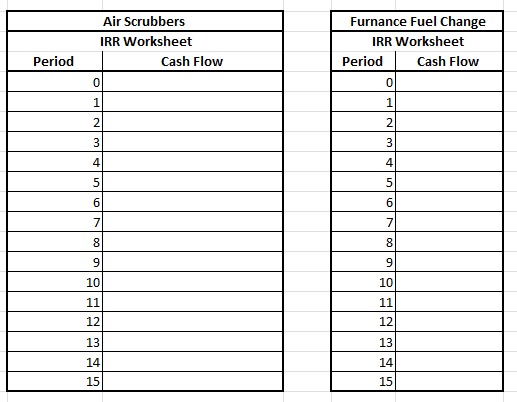

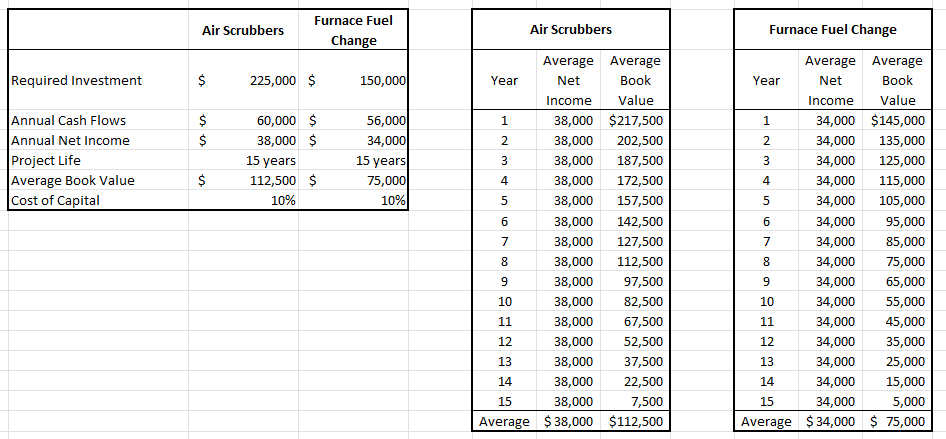

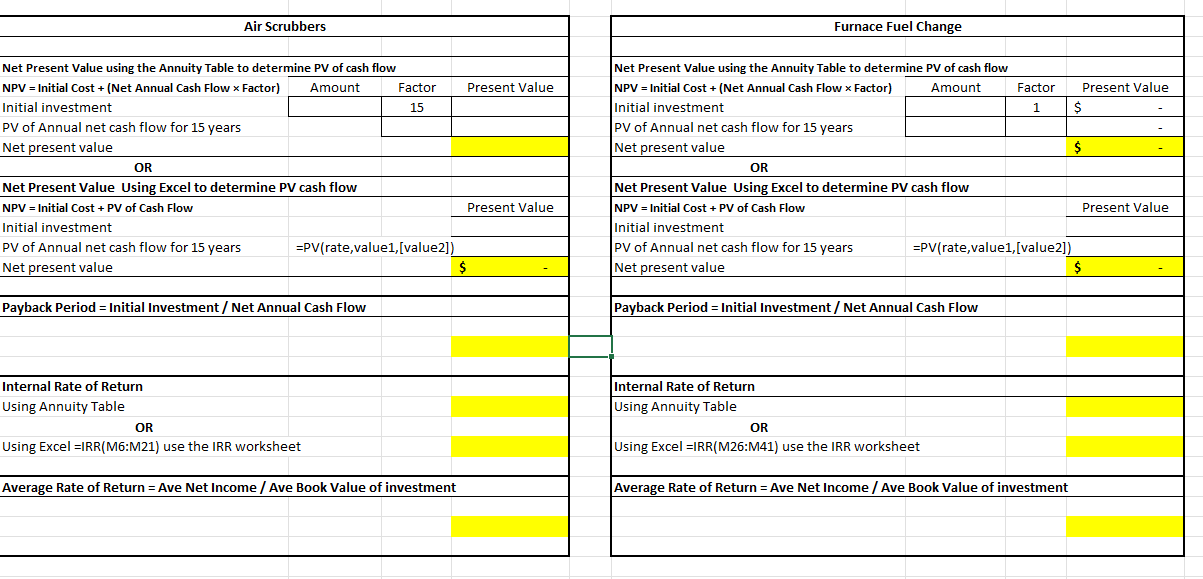

You have been hired by a midsize copper smelting company in northern Canada to act as a consultant to help the executive team to determine its best course of action on a major decision. Due to some recent changes to the local environmental air quality laws, the company's large coal-fueled smelting furnace is now operating out of compliance due to high levels of pollutants in the exhaust gases. The regulatory agency has given the company 12 months to demonstrate compliance, after which it will be fined a $1,000 per day until the operations meets the regulation. The company has two alternatives. The first alternative is to install air-scrubbers to reduce the output pollutant levels. The second alternative is to convert the smelting furnace from coal to natural gas. Both alternatives will meet the current regulatory requirements, but there is a slight concern that the air-scrubber solution may not meet future regulatory restrictions. The executive team wants you to perform a financial performance analysis on both alternatives using several different capital budgeting methodologies. The team also is seeking guidance on non-financial considerations regarding the company's ethical and social responsibilities related to this decision.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started