Answered step by step

Verified Expert Solution

Question

1 Approved Answer

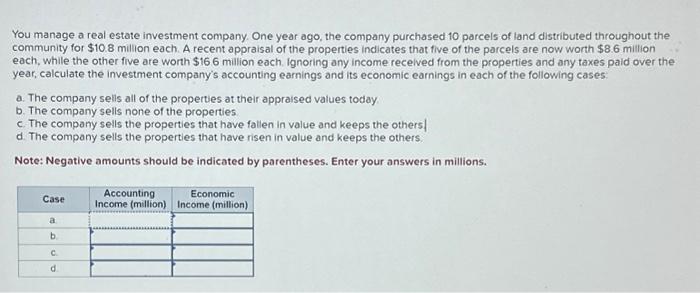

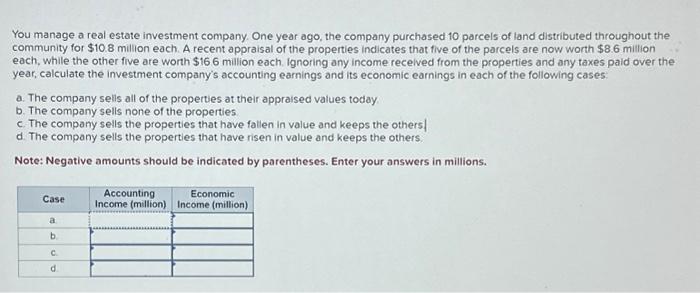

please help! You manage a real estate investment company. One year ago, the company purchased 10 parcels of land distributed throughout the community for $10.8

please help!

You manage a real estate investment company. One year ago, the company purchased 10 parcels of land distributed throughout the community for $10.8 million each. A recent appraisal of the properties indicates that five of the parcels are now worth $8.6 million each, while the other five are worth $166 milion each. Ignoring any income recelved from the properties and any taxes paid over the year, calculate the investment company's accounting earnings and its economic earnings in each of the following cases. a. The company selis all of the properties at their appraised values today b. The company sells none of the properties c. The company sells the properties that have fallen in value and keeps the others! d. The company sells the properties that have risen in value and keeps the others. Note: Negative amounts should be indicated by parentheses. Enter your answers in millions. You manage a real estate investment company. One year ago, the company purchased 10 parcels of land distributed throughout the community for $10.8 million each. A recent appraisal of the properties indicates that five of the parcels are now worth $8.6 million each, while the other five are worth $166 milion each. Ignoring any income recelved from the properties and any taxes paid over the year, calculate the investment company's accounting earnings and its economic earnings in each of the following cases. a. The company selis all of the properties at their appraised values today b. The company sells none of the properties c. The company sells the properties that have fallen in value and keeps the others! d. The company sells the properties that have risen in value and keeps the others. Note: Negative amounts should be indicated by parentheses. Enter your answers in millions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started