Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help your PM to evaluate the sensitivity of your bond to relatively large interest rate (or yield) movements on the market! We have the

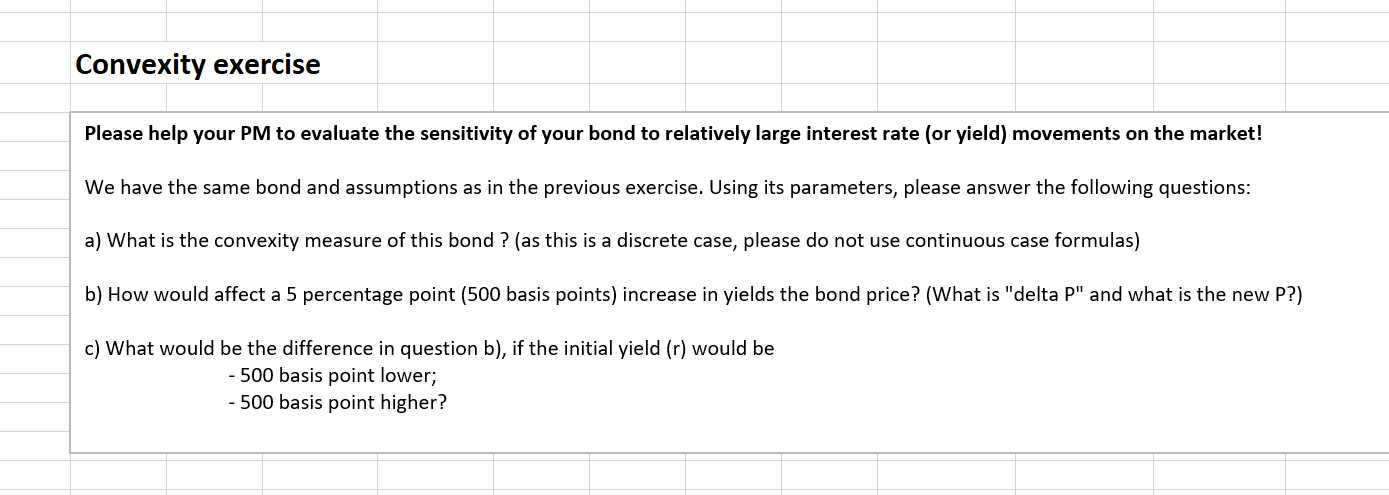

Please help your PM to evaluate the sensitivity of your bond to relatively large interest rate (or yield) movements on the market! We have the same bond and assumptions as in the previous exercise. Using its parameters, please answer the following questions: a) What is the convexity measure of this bond? (as this is a discrete case, please do not use continuous case formulas) b) How would affect a 5 percentage point ( 500 basis points) increase in yields the bond price? (What is "delta P" and what is the new P?) c) What would be the difference in question b), if the initial yield ( r ) would be - 500 basis point lower; - 500 basis point higher

Please help your PM to evaluate the sensitivity of your bond to relatively large interest rate (or yield) movements on the market! We have the same bond and assumptions as in the previous exercise. Using its parameters, please answer the following questions: a) What is the convexity measure of this bond? (as this is a discrete case, please do not use continuous case formulas) b) How would affect a 5 percentage point ( 500 basis points) increase in yields the bond price? (What is "delta P" and what is the new P?) c) What would be the difference in question b), if the initial yield ( r ) would be - 500 basis point lower; - 500 basis point higher Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started