Please Help!

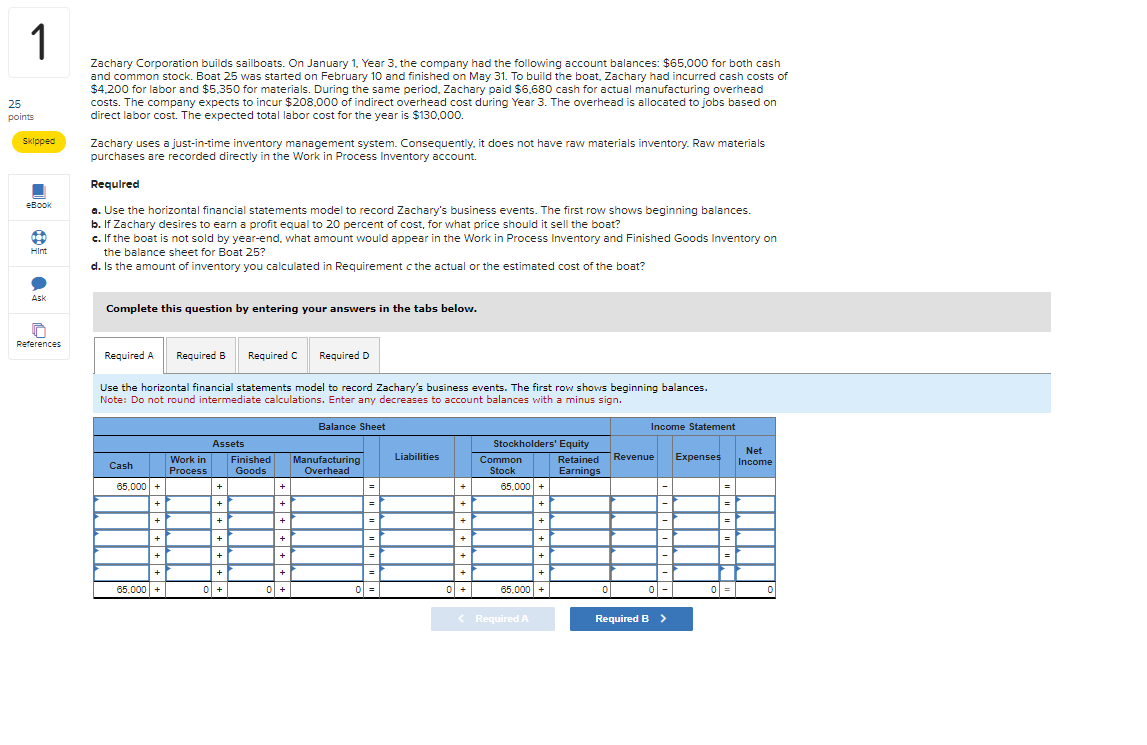

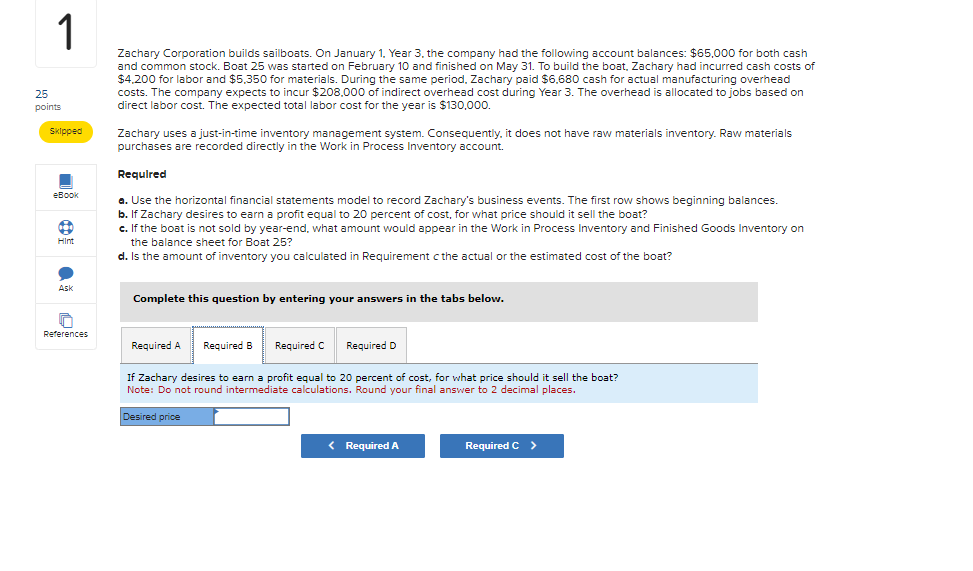

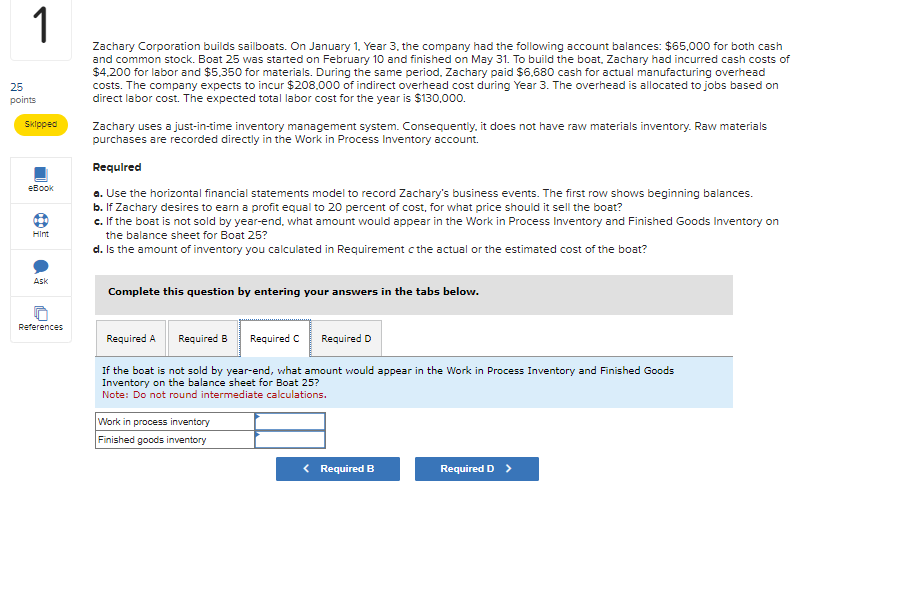

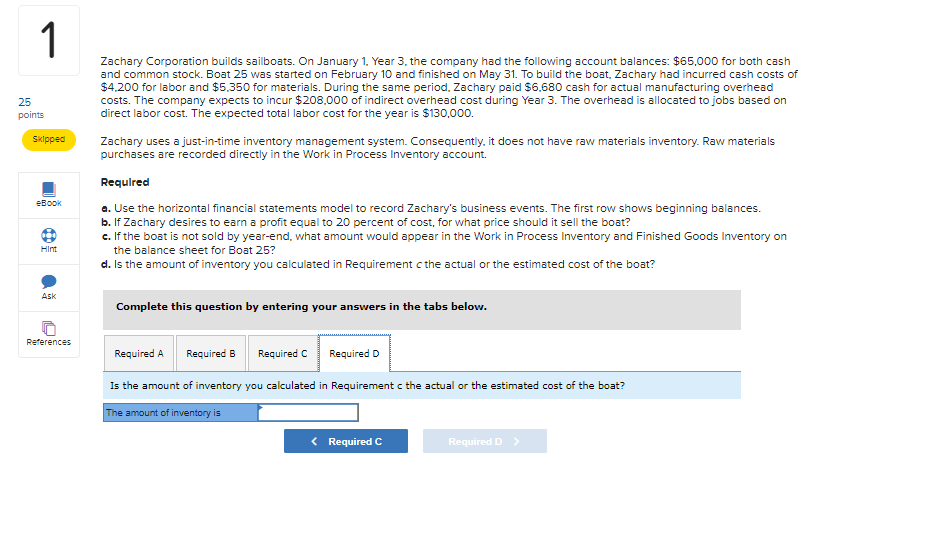

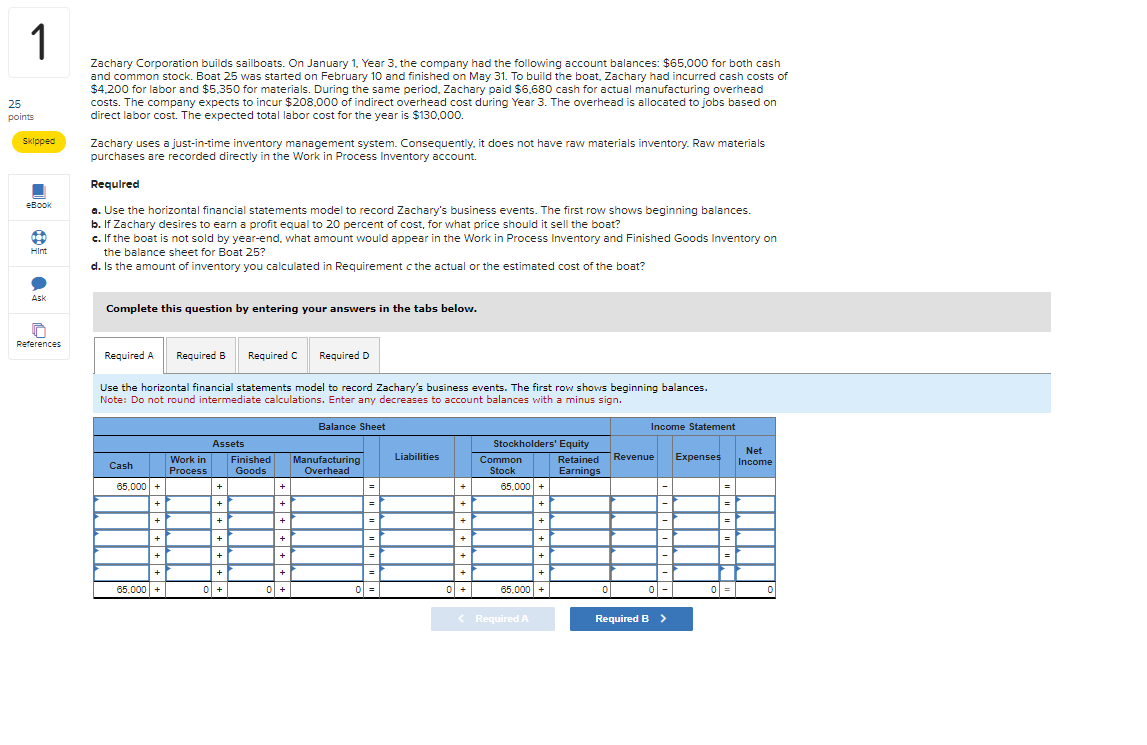

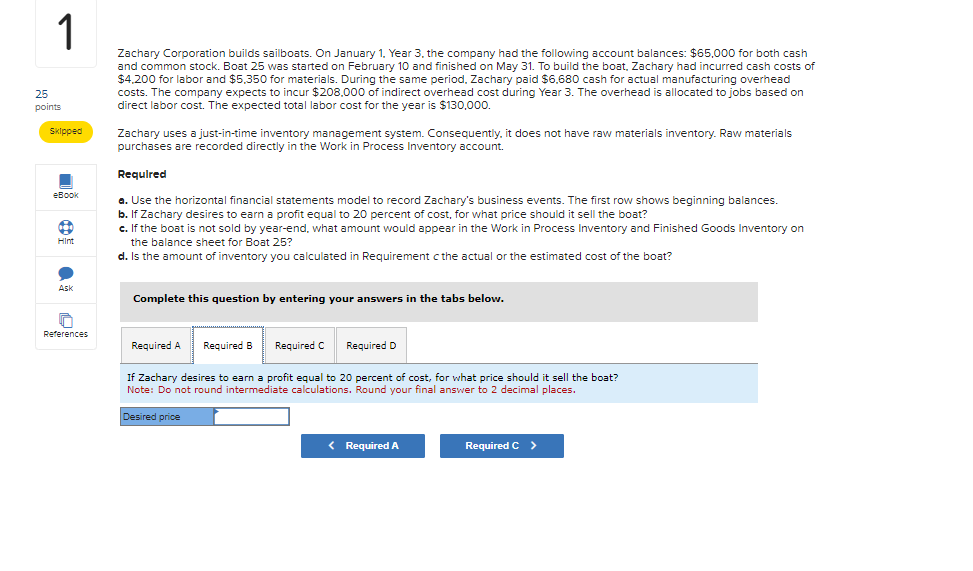

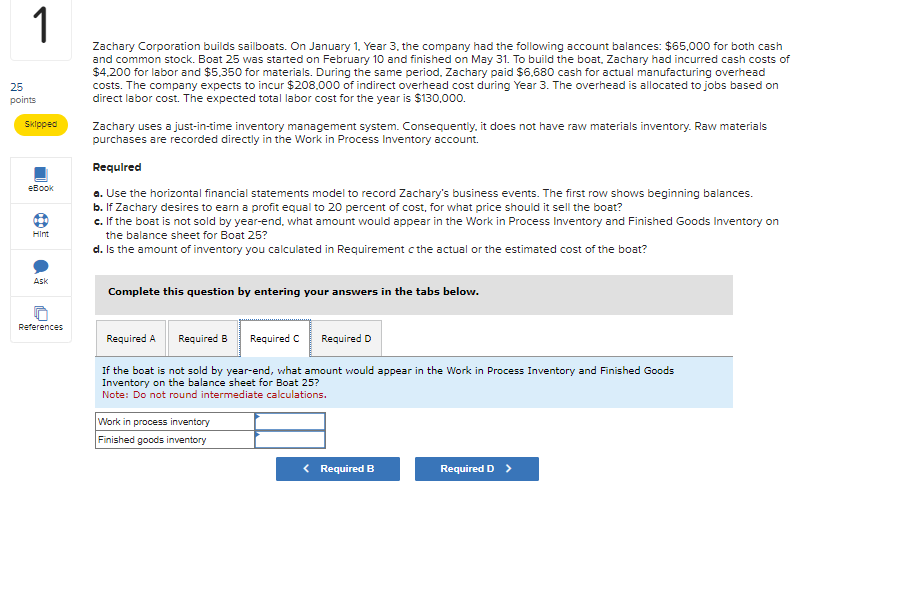

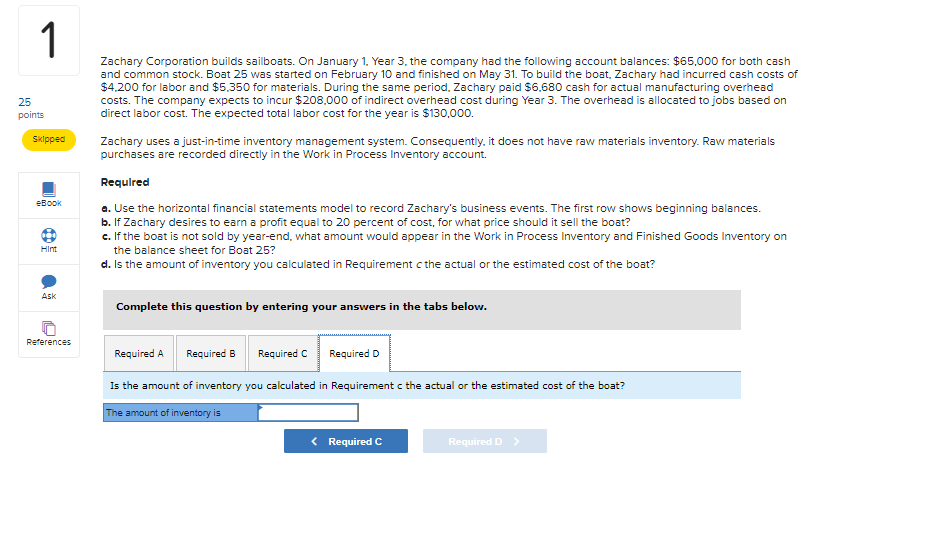

Zachary Corporation builds sailboats. On January 1, Year 3, the company had the following account balances: $65,000 for both cash and common stock. Boat 25 was started on February 10 and finished on May 31. To build the boat, Zachary had incurred cash costs of $4,200 for labor and $5,350 for materials. During the same period. Zachary paid $6,680 cash for actual manufacturing overhead costs. The company expects to incur $208,000 of indirect overhead cost during Year 3 . The overhead is allocated to jobs based on direct labor cost. The expected total labor cost for the year is $130,000. Zachary uses a just-in-time inventory management system. Consequently, it does not have raw materials inventory. Raw materials purchases are recorded directly in the Work in Process Inventory account. Required a. Use the horizontal financial statements model to record Zachary's business events. The first row shows beginning balances. b. If Zachary desires to earn a profit equal to 20 percent of cost, for what price should it sell the boat? e. If the boat is not sold by year-end, what amount would appear in the Work in Process Inventory and Finished Goods Inventory on the balance sheet for Boat 25 ? d. Is the amount of inventory you calculated in Requirement c the actual or the estimated cost of the boat? Complete this question by entering your answers in the tabs below. Use the horizontal financial statements model to record Zachary's business events. The first row shows beginning balances. Note: Do not round intermediate calculations. Enter any decreases to account balances with a minus sign. Zachary Corporation builds sailboats. On January 1, Year 3, the company had the following account balances: $65,000 for both cash and common stock. Boat 25 was started on February 10 and finished on May 31 . To build the boat, Zachary had incurred cash costs of $4,200 for labor and $5,350 for materials. During the same period. Zachary paid $6,680 cash for actual manufacturing overhead costs. The company expects to incur $208,000 of indirect overhead cost during Year 3 . The overhead is allocated to jobs based on direct labor cost. The expected total labor cost for the year is $130,000. Zachary uses a just-in-time inventory management system. Consequently, it does not have raw materials inventory. Raw materials purchases are recorded directly in the Work in Process Inventory account. Requlred a. Use the horizontal financial statements model to record Zachary's business events. The first row shows beginning balances. b. If Zachary desires to earn a profit equal to 20 percent of cost, for what price should it sell the boat? e. If the boat is not sold by year-end, what amount would appear in the Work in Process Inventory and Finished Goods Inventory on the balance sheet for Boat 25 ? d. Is the amount of inventory you calculated in Requirement c the actual or the estimated cost of the boat? Complete this question by entering your answers in the tabs below. If Zachary desires to earn a profit equal to 20 percent of cost, for what price should it sell the boat? Note: Do not round intermediate calculations. Round your final answer to 2 decimal places. Zachary Corporation builds sailboats. On January 1, Year 3, the company had the following account balances: $65,000 for both cash and common stock. Boat 25 was started on February 10 and finished on May 31 . To build the boat, Zachary had incurred cash costs of $4,200 for labor and $5,350 for materials. During the same period. Zachary paid $6,680 cash for actual manufacturing overhead costs. The company expects to incur $208,000 of indirect overhead cost during Year 3 . The overhead is allocated to jobs based on direct labor cost. The expected total labor cost for the year is $130,000. Zachary uses a just-in-time inventory management system. Consequently, it does not have raw materials inventory. Raw materials purchases are recorded directly in the Work in Process Inventory account. Required a. Use the horizontal financial statements model to record Zachary's business events. The first row shows beginning balances. b. If Zachary desires to earn a profit equal to 20 percent of cost, for what price should it sell the boat? c. If the boat is not sold by year-end, what amount would appear in the Work in Process Inventory and Finished Goods Inventory on the balance sheet for Boat 25 ? d. Is the amount of inventory you calculated in Requirement c the actual or the estimated cost of the boat? Complete this question by entering your answers in the tabs below. If the boat is not sold by year-end, what amount would appear in the Work in Process Inventory and Finished Goods Inventory on the balance sheet for Boat 25 ? Note: Do not round intermediate calculations. Zachary Corporation builds sailboats. On January 1, Year 3, the company had the following account balances: $65,000 for both cash and common stock. Boat 25 was started on February 10 and finished on May 31 . To build the boat, Zachary had incurred cash costs of $4,200 for labor and $5,350 for materials. During the same period. Zachary paid $6,680 cash for actual manufacturing overhead costs. The company expects to incur $208.000 of indirect overhead cost during Year 3 . The overhead is allocated to jobs based on direct labor cost. The expected total labor cost for the year is $130,000. Zachary uses a just-in-time inventory management system. Consequently, it does not have raw materials inventory. Raw materials purchases are recorded directly in the Work in Process Inventory account. Requlred a. Use the horizontal financial statements model to record Zachary's business events. The first row shows beginning balances. b. If Zachary desires to earn a profit equal to 20 percent of cost, for what price should it sell the boat? c. If the boat is not sold by year-end, what amount would appear in the Work in Process Inventory and Finished Goods Inventory on the balance sheet for Boat 25 ? d. Is the amount of inventory you calculated in Requirement c the actual or the estimated cost of the boat? Complete this question by entering your answers in the tabs below. Is the amount of inventory you calculated in Requirement c the actual or the estimated cost of the boat