Please Helpp!!!!

Please Helpp!!!!

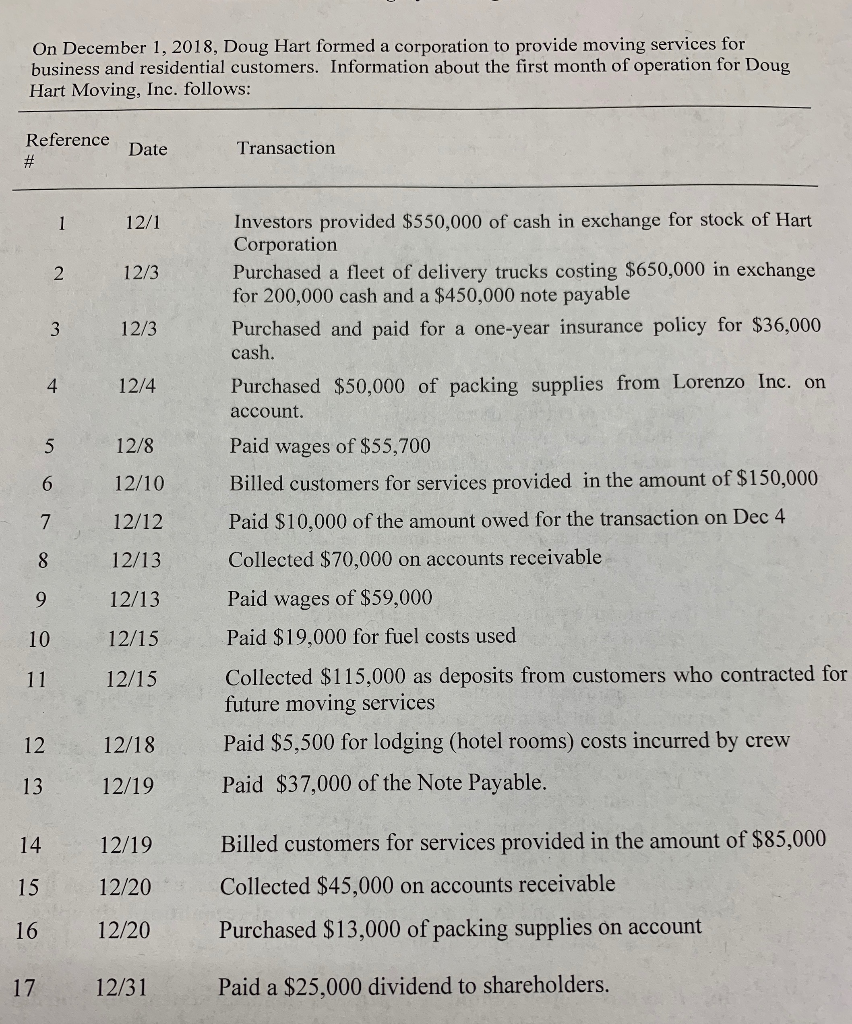

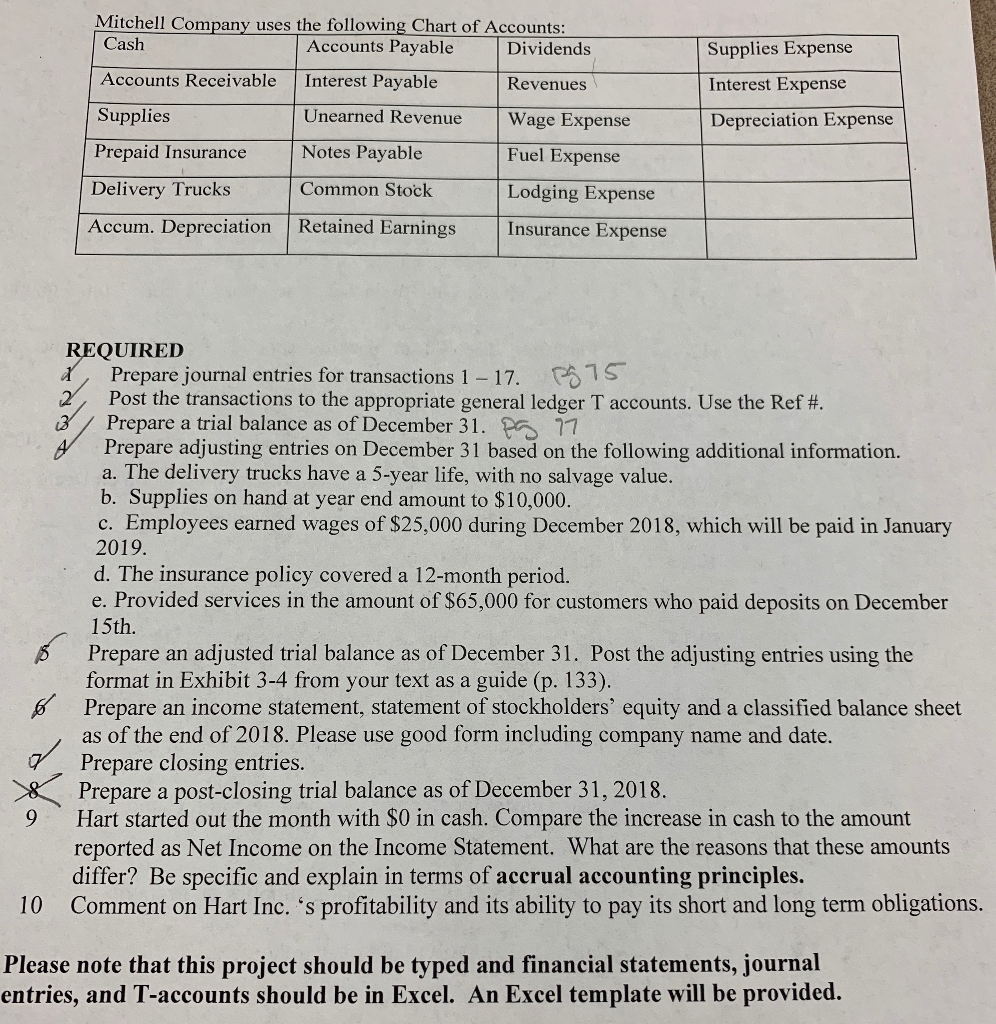

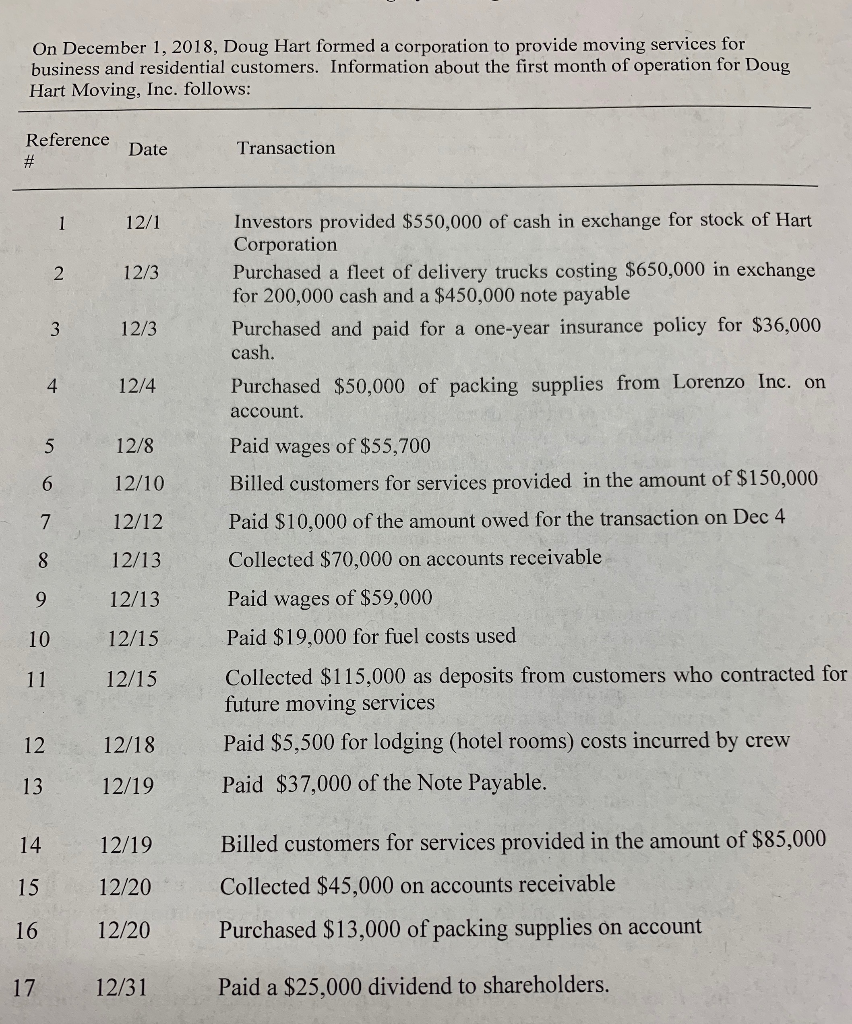

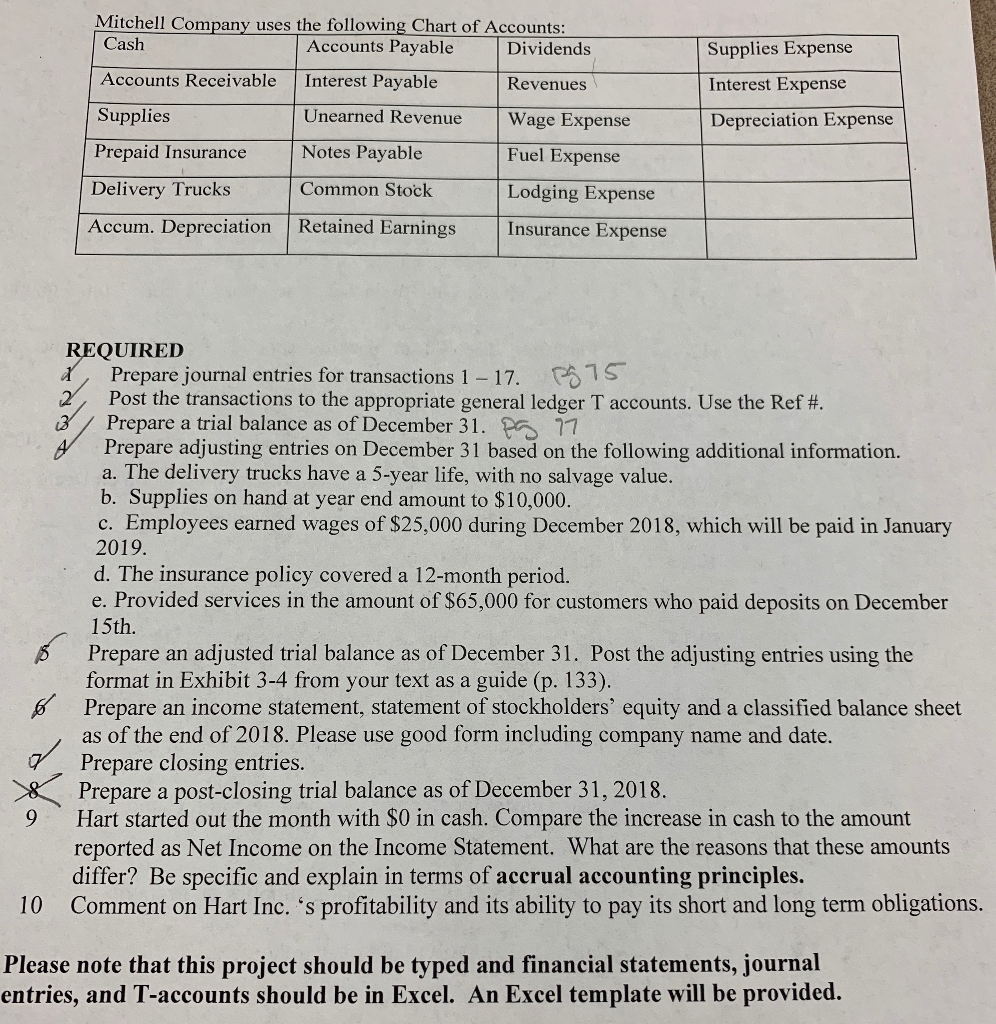

On December 1, 2018, Doug Hart formed a corporation to provide moving services for business and residential customers. Information about the first month of operation for Doug Hart Moving, Inc. follows: Reference Date Transaction 12/1 12/3 12/3 12/4 12/8 12/10 Investors provided $550,000 of cash in exchange for stock of Hart Corporation Purchased a fleet of delivery trucks costing $650,000 in exchange for 200,000 cash and a $450,000 note payable Purchased and paid for a one-year insurance policy for $36,000 cash. Purchased $50,000 of packing supplies from Lorenzo Inc. on account. Paid wages of $55,700 Billed customers for services provided in the amount of $150,000 Paid $10,000 of the amount owed for the transaction on Dec 4 Collected $70,000 on accounts receivable Paid wages of $59,000 Paid $19,000 for fuel costs used Collected $115,000 as deposits from customers who contracted for future moving services Paid $5,500 for lodging (hotel rooms) costs incurred by crew Paid $37,000 of the Note Payable. 12/12 12/13 12/13 12/15 11 12/15 12/18 12/19 Billed customers for services provided in the amount of $85,000 14 15 16 12/19 12/20 12/20 12/31 Collected $45,000 on accounts receivable Purchased $13,000 of packing supplies on account 17 Paid a $25,000 dividend to shareholders. Mitchell Company uses the following Chart of Accounts: Cash Accounts Payable Dividends Supplies Expense Accounts Receivable Interest Payable Revenues Interest Expense Unearned Revenue Wage Expense Depreciation Expense Notes Payable Supplies Prepaid Insurance Delivery Trucks Accum. Depreciation Fuel Expense Lodging Expense Common Stock Retained Earnings Insurance Expense REQUIRED 1. Prepare journal entries for transactions 1 - 17. is Post the transactions to the appropriate general ledger T accounts. Use the Ref #. Prepare a trial balance as of December 31. Pa 77 Prepare adjusting entries on December 31 based on the following additional information. a. The delivery trucks have a 5-year life, with no salvage value. b. Supplies on hand at year end amount to $10,000. c. Employees earned wages of $25,000 during December 2018, which will be paid in January 2019. d. The insurance policy covered a 12-month period. e. Provided services in the amount of $65,000 for customers who paid deposits on December 15th. Prepare an adjusted trial balance as of December 31. Post the adjusting entries using the format in Exhibit 3-4 from your text as a guide (p. 133). Prepare an income statement, statement of stockholders' equity and a classified balance sheet as of the end of 2018. Please use good form including company name and date. Prepare closing entries. Prepare a post-closing trial balance as of December 31, 2018. Hart started out the month with $0 in cash. Compare the increase in cash to the amount reported as Net Income on the Income Statement. What are the reasons that these amounts differ? Be specific and explain in terms of accrual accounting principles. Comment on Hart Inc.'s profitability and its ability to pay its short and long term obligations. 6 10 Please note that this project should be typed and financial statements, journal entries, and T-accounts should be in Excel. An Excel template will be provided

Please Helpp!!!!

Please Helpp!!!!