Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please helpppp? Cash budget, NPV and IRR required to be calculated. Details of the task CASE STUDY 1-Solution to Food Wastage Upcycling promises to turn

Please helpppp?

Cash budget, NPV and IRR required to be calculated.

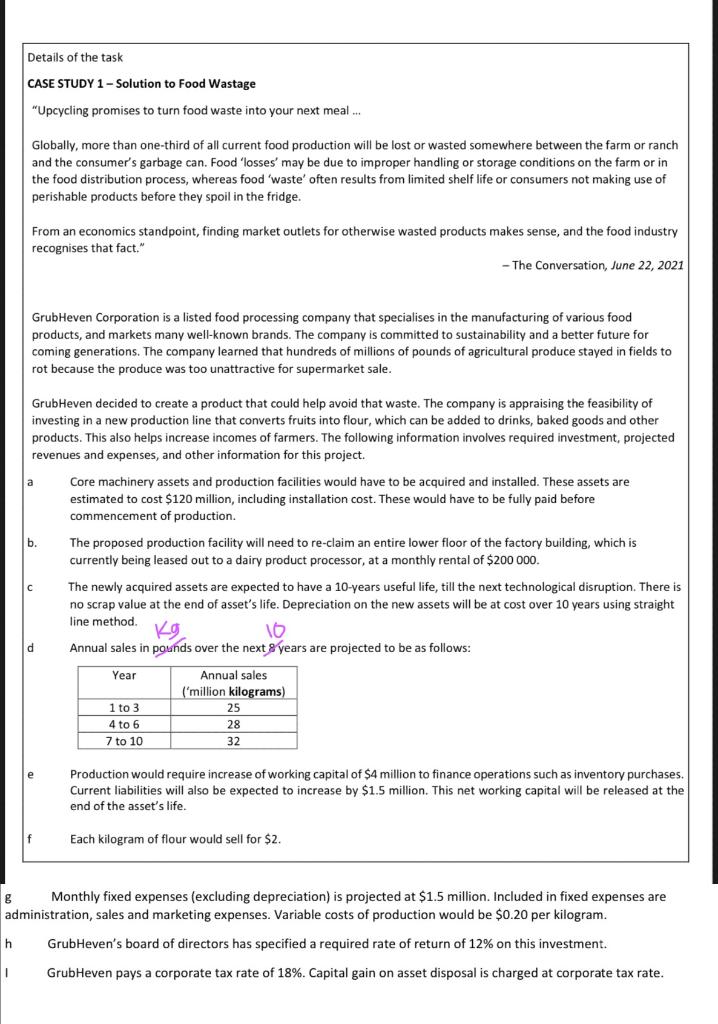

Details of the task CASE STUDY 1-Solution to Food Wastage "Upcycling promises to turn food waste into your next meal... Globally, more than one-third of all current food production will be lost or wasted somewhere between the farm or ranch and the consumer's garbage can. Food 'losses' may be due to improper handling or storage conditions on the farm or in the food distribution process, whereas food 'waste' often results from limited shelf life or consumers not making use of perishable products before they spoil in the fridge. From an economics standpoint, finding market outlets for otherwise wasted products makes sense, and the food industry recognises that fact." - The Conversation, June 22, 2021 GrubHeven Corporation is a listed food processing company that specialises in the manufacturing of various food products, and markets many well-known brands. The company is committed to sustainability and a better future for coming generations. The company learned that hundreds of millions of pounds of agricultural produce stayed in fields to rot because the produce was too unattractive for supermarket sale. GrubHeven decided to create a product that could help avoid that waste. The company is appraising the feasibility of investing in a new production line that converts fruits into flour, which can be added to drinks, baked goods and other products. This also helps increase incomes of farmers. The following information involves required investment, projected revenues and expenses, and other information for this project. a Core machinery assets and production facilities would have to be acquired and installed. These assets are estimated to cost $120 million, including installation cost. These would have to be fully paid before commencement of production. b. The proposed production facility will need to re-claim an entire lower floor of the factory building, which is currently being leased out to a dairy product processor, at a monthly rental of $200 000. The newly acquired assets are expected to have a 10-years useful life, till the next technological disruption. There is no scrap value at the end of asset's life. Depreciation on the new assets will be at cost over 10 years using straight line method. Kg 10 d Annual sales in pounds over the next 8 years are projected to be as follows: Year Annual sales ('million kilograms) 1 to 3. 25 4 to 6 28 7 to 10 32 e Production would require increase of working capital of $4 million to finance operations such as inventory purchases. Current liabilities will also be expected to increase by $1.5 million. This net working capital will be released at the end of the asset's life. f Each kilogram of flour would sell for $2. g Monthly fixed expenses (excluding depreciation) is projected at $1.5 million. Included in fixed expenses are administration, sales and marketing expenses. Variable costs of production would be $0.20 per kilogram. h GrubHeven's board of directors has specified a required rate of return of 12% on this investment. || GrubHeven pays a corporate tax rate of 18%. Capital gain on asset disposal is charged at corporate tax rate. Details of the task CASE STUDY 1-Solution to Food Wastage "Upcycling promises to turn food waste into your next meal... Globally, more than one-third of all current food production will be lost or wasted somewhere between the farm or ranch and the consumer's garbage can. Food 'losses' may be due to improper handling or storage conditions on the farm or in the food distribution process, whereas food 'waste' often results from limited shelf life or consumers not making use of perishable products before they spoil in the fridge. From an economics standpoint, finding market outlets for otherwise wasted products makes sense, and the food industry recognises that fact." - The Conversation, June 22, 2021 GrubHeven Corporation is a listed food processing company that specialises in the manufacturing of various food products, and markets many well-known brands. The company is committed to sustainability and a better future for coming generations. The company learned that hundreds of millions of pounds of agricultural produce stayed in fields to rot because the produce was too unattractive for supermarket sale. GrubHeven decided to create a product that could help avoid that waste. The company is appraising the feasibility of investing in a new production line that converts fruits into flour, which can be added to drinks, baked goods and other products. This also helps increase incomes of farmers. The following information involves required investment, projected revenues and expenses, and other information for this project. a Core machinery assets and production facilities would have to be acquired and installed. These assets are estimated to cost $120 million, including installation cost. These would have to be fully paid before commencement of production. b. The proposed production facility will need to re-claim an entire lower floor of the factory building, which is currently being leased out to a dairy product processor, at a monthly rental of $200 000. The newly acquired assets are expected to have a 10-years useful life, till the next technological disruption. There is no scrap value at the end of asset's life. Depreciation on the new assets will be at cost over 10 years using straight line method. Kg 10 d Annual sales in pounds over the next 8 years are projected to be as follows: Year Annual sales ('million kilograms) 1 to 3. 25 4 to 6 28 7 to 10 32 e Production would require increase of working capital of $4 million to finance operations such as inventory purchases. Current liabilities will also be expected to increase by $1.5 million. This net working capital will be released at the end of the asset's life. f Each kilogram of flour would sell for $2. g Monthly fixed expenses (excluding depreciation) is projected at $1.5 million. Included in fixed expenses are administration, sales and marketing expenses. Variable costs of production would be $0.20 per kilogram. h GrubHeven's board of directors has specified a required rate of return of 12% on this investment. || GrubHeven pays a corporate tax rate of 18%. Capital gain on asset disposal is charged at corporate tax rateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started