Answered step by step

Verified Expert Solution

Question

1 Approved Answer

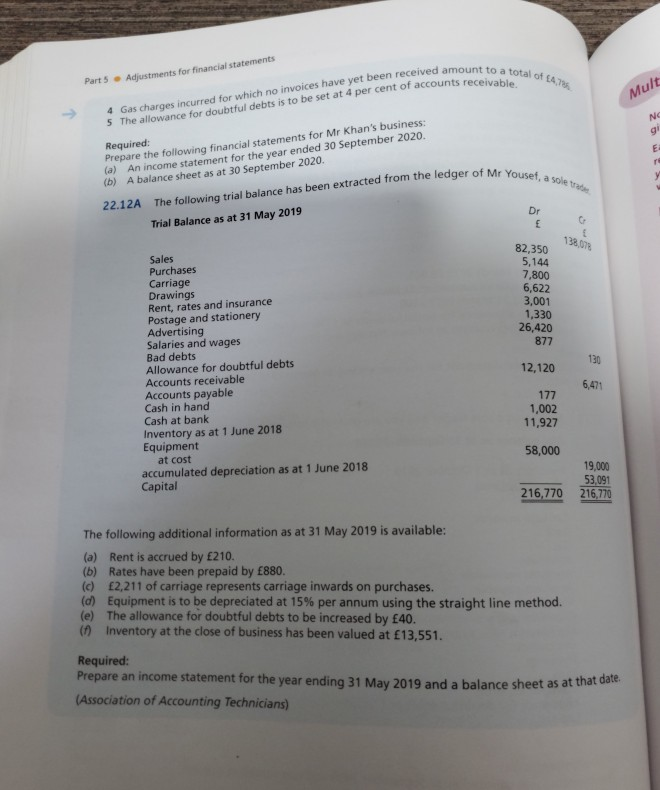

please helps!can anyone gives me a detailed explanation to solve 22.12a?thank you! a total of 175 Adjustments for financial statements Part 5 ccounts receivable. Mult

please helps!can anyone gives me a detailed explanation to solve 22.12a?thank you!

a total of 175 Adjustments for financial statements Part 5 ccounts receivable. Mult 4 Gas charges incurred for which no invoices have yet been received amou 5 The allowance for doubtful debts is to be set at 4 per cent of accounts recer Required: Prepare the following financial statements for Mr Khan's business: (a) An income statement for the year ended 30 September 2020. (b) A balance sheet as at 30 September 2020. Mr Yousef, a soletra 22.12A The following trial balance has been extracted from the ledger of Mr Yo Trial Balance as at 31 May 2019 82,350 5,144 7,800 6,622 3,001 1,330 26,420 877 12,120 Sales Purchases Carriage Drawings Rent, rates and insurance Postage and stationery Advertising Salaries and wages Bad debts Allowance for doubtful debts Accounts receivable Accounts payable Cash in hand Cash at bank Inventory as at 1 June 2018 Equipment at cost accumulated depreciation as at 1 June 2018 Capital 177 1,002 11,927 58,000 19,000 53,091 216,770 216,770 The following additional information as at 31 May 2019 is available: (a) Rent is accrued by 210. (b) Rates have been prepaid by 880. (c) 2,211 of carriage represents carriage inwards on purchases (d) Equipment is to be depreciated at 15% per annum using the straight line method. (e) The allowance for doubtful debts to be increased by 40. (1) Inventory at the close of business has been valued at 13,551. Required: Prepare an income statement for the year ending 31 May 2019 and a balance sheet as at that (Association of Accounting Technicians)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started