please help.thank you!

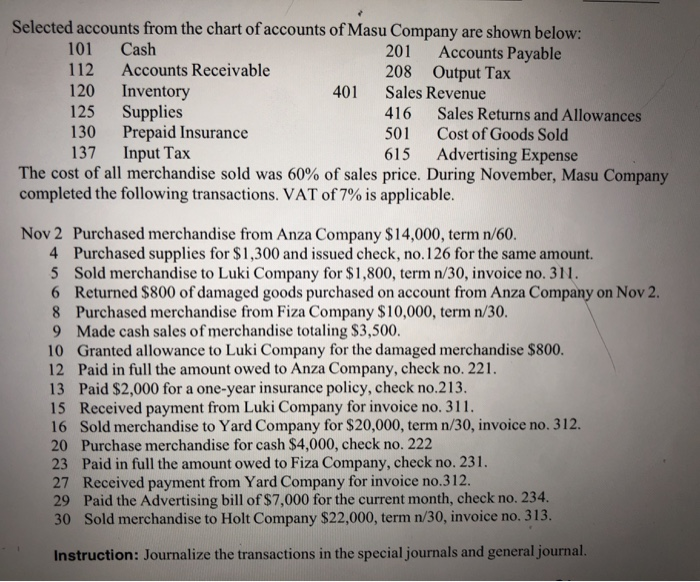

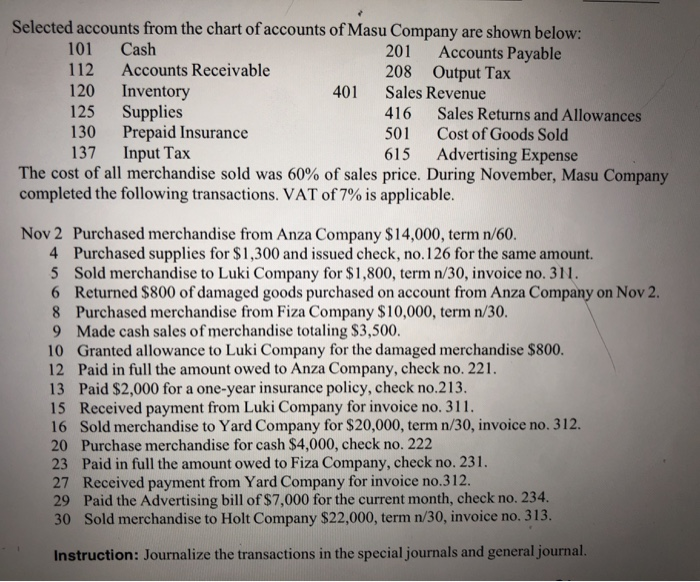

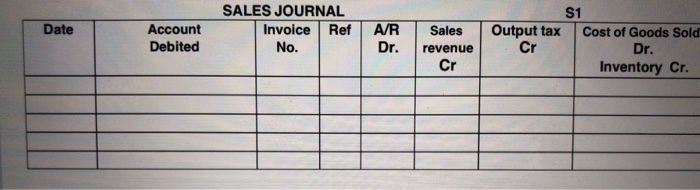

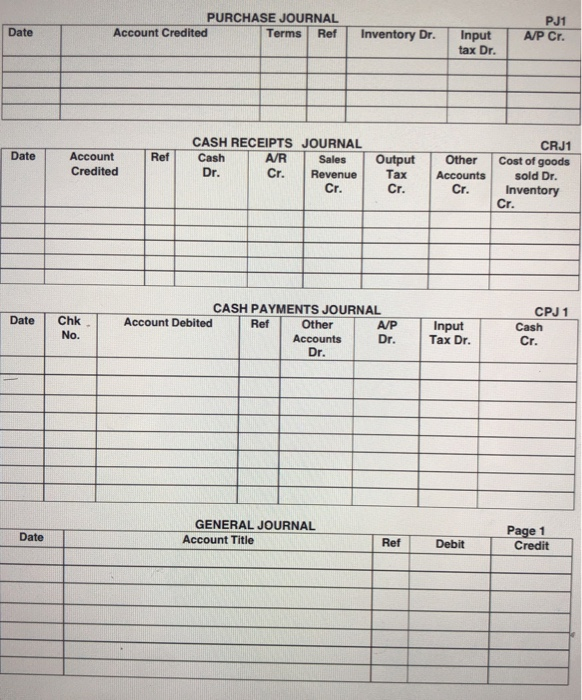

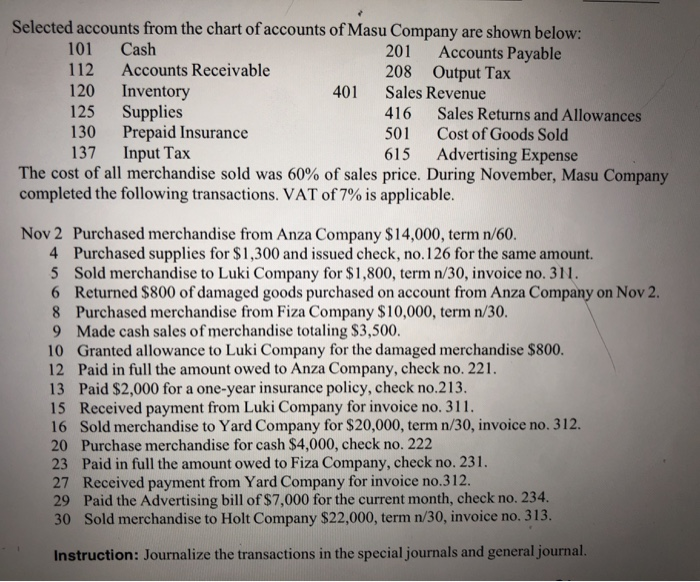

401 Selected accounts from the chart of accounts of Masu Company are shown below: 101 Cash 201 Accounts Payable 112 Accounts Receivable 208 Output Tax 120 Inventory Sales Revenue 125 Supplies 416 Sales Returns and Allowances 130 Prepaid Insurance 501 Cost of Goods Sold 137 Input Tax 615 Advertising Expense The cost of all merchandise sold was 60% of sales price. During November, Masu Company completed the following transactions. VAT of 7% is applicable. Nov 2 Purchased merchandise from Anza Company $14,000, term n/60. 4 Purchased supplies for $1,300 and issued check, no. 126 for the same amount. 5 Sold merchandise to Luki Company for $1,800, term n/30, invoice no. 311. 6 Returned $800 of damaged goods purchased on account from Anza Company on Nov 2. 8 Purchased merchandise from Fiza Company $10,000, term n/30. 9 Made cash sales of merchandise totaling $3,500. 10 Granted allowance to Luki Company for the damaged merchandise $800. 12 Paid in full the amount owed to Anza Company, check no. 221. 13 Paid $2,000 for a one-year insurance policy, check no.213. 15 Received payment from Luki Company for invoice no. 311. 16 Sold merchandise to Yard Company for $20,000, term n/30, invoice no. 312. 20 Purchase merchandise for cash $4,000, check no. 222 23 Paid in full the amount owed to Fiza Company, check no. 231. 27 Received payment from Yard Company for invoice no.312. 29 Paid the Advertising bill of $7,000 for the current month, check no. 234. 30 Sold merchandise to Holt Company $22,000, term n/30, invoice no. 313. Instruction: Journalize the transactions in the special journals and general journal. Date Account Debited SALES JOURNAL Invoice Ref No. A/R Dr. Sales revenue Cr S1 Output tax Cost of Goods Sold Cr Dr. Inventory Cr. PURCHASE JOURNAL Account Credited Terms Ref Date Inventory Dr. PJ1 A/P Cr. Input tax Dr. Date Ref Account Credited CASH RECEIPTS JOURNAL Cash A/R Sales Dr. Cr. Revenue Cr. Output Tax Cr. Other Accounts Cr. CRJ1 Cost of goods sold Dr. Inventory Cr. Date Chk No. CASH PAYMENTS JOURNAL Account Debited Ref Other A/P Accounts Dr. Dr. Input Tax Dr. CPJ 1 Cash Cr. Date GENERAL JOURNAL Account Title Ref Debit Page 1 Credit