please how how you go the answers.

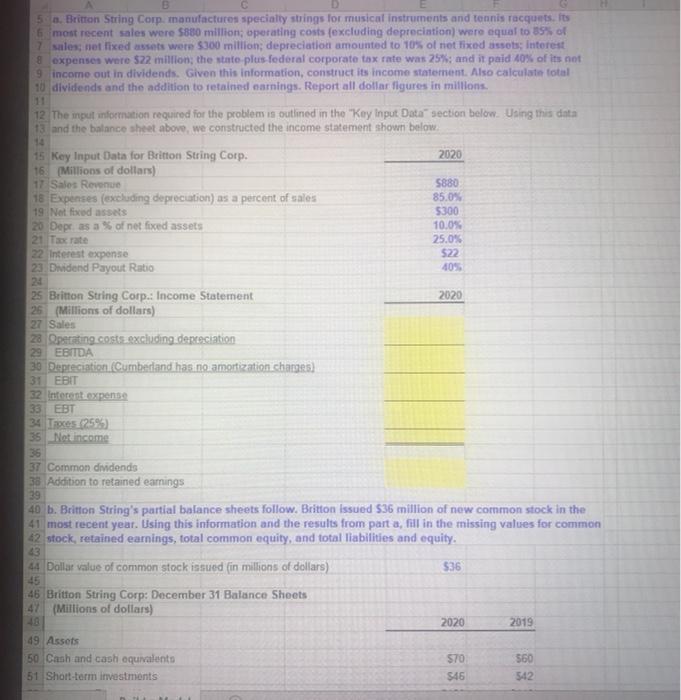

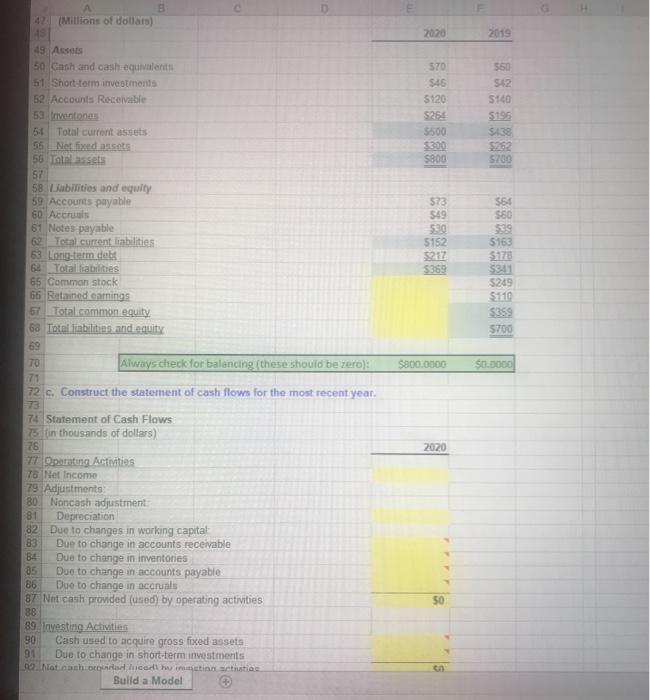

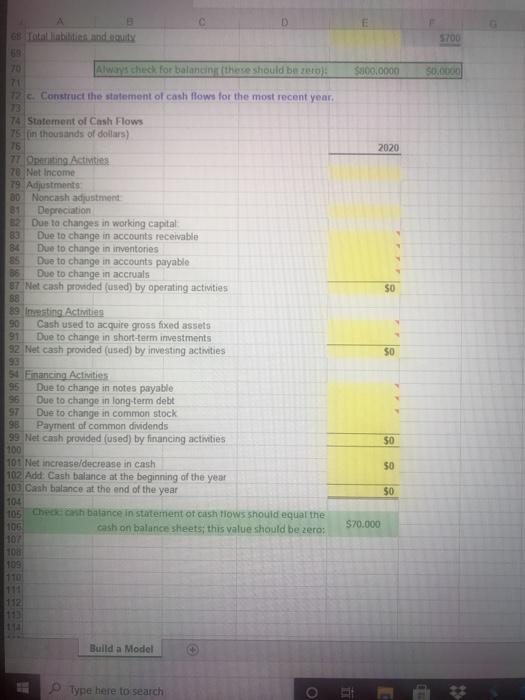

B 50. Britton String Corp. manufactures specialty strings for musical instruments and tennis racquets its 6 most recent sales were $800 million operating costs (excluding depreciation) were equal to 35% of 7 sales; net lixed assets were $300 million; depreciation amounted to 10% of net fixed assets; interest & expenses were 522 million; the state plus federal corporate tax rate was 25%; and it paid 40% of its not 9 income out in dividends. Given this information, construct its income statement. Also calculate total 10 dividends and the addition to retained earnings. Report all dollar figures in millions 12 The input information required for the problem is outlined in the "Key Input Daca section below. Using this data 13 and the balance sheet above, we constructed the income statement shown below 19 15 Key Input Data for Britton String Corp. 2020 16 (Millions of dollars) 17 Sales Revenue 5880 18 Expenses (excluding depreciation) as a percent of sales 85.0% 19 Not fixed assets $300 20 Depr as a % of net fixed assets 10.0% 21 Tax rate 25.0% 22 Interest expense 522 23 Dividend Payout Ratio 40% 24 25 Britton String Corp.: Income Statement 2020 26 (Millions of dollars) 27 Sales za Operating costs excluding depreciation 29 EBITDA 30 Depreciation (Cumberland has no amortization changes) 31 EBIT 32 Interexpense 33 EBT 34 Troes (25%) 35 Not income 36 37 Common dividends 38 Addition to retained earnings 39 40 b. Britton String's partial balance sheets follow. Britton issued 536 million of new common stock in the 41 most recent year. Using this information and the results from part a, fill in the missing values for common 42 stock, retained earnings, total common equity, and total liabilities and equity. 43 44 Dallar value of common stock issued fin millions of dollars) $36 46 Britton String Corp: December 31 Balance Sheets 47 (Millions of dollars) 2020 2019 49 Assets 50 Cash and cash equivalent 51 Short-term investments 570 $46 560 542 2020 2019 570 546 5120 $250 5500 $300 5800 550 542 5140 5195 5138 $752 5700 $73 $49 564 $80 5152 $217 5369 5163 $1728 $35 5249 51110 5359 5700 47 Millions of dollars) 19 43. Assos 50 Cash and cash equivalent 51 Short-term investments 52 Accounts Receivable 53 Crventos 51 Total current assets 55 Netfixed as 56 Total assets 57 58 abilities and equity 59 Accounts payable 60 Accrois 61 Notes payable Total current liabilities 63 Long-term det 64 Total liabilities 65 Common stock 66 Retained earnings 67 Total common equity 6a Totabilities and equity 69 70 Always check for balancing (these should be zero): 71 72 c. Construct the statement of cash flows for the most recent year. 74 Statement of Cash Flows 75 (in thousands of dollars) 76 71 Operating Activities 76 Net Income 79 Adjustments 80 Noncash adjustment 81 Depreciation 82 Due to changes in working capital 83 Due to change in accounts receivable 34 Due to change in inventories 85 Due to change in accounts payable 86 Due to change in accruals 87 Net cash provided (used) by operating activities 88 89 Investing Activities 90 Cash used to acquire gross fixed assets Due to change in short-term investments 2 Natasha luced into custa Build a Model $800.0000 $0.0000 2020 50 91 D E A GB rotallibilities and bounty 5700 $100,0000 50.000 Always check for balancin (there should be zero 71 12. Construct the statement of cash flows for the most recent year 2020 50 74 Statement of Cash Flows 75 (in thousands of dollars) 76 77 Opening Activities 70 Net Income 79 Adjustments 00 Noncash adjustment 81 Depreciation 32 Due to changes in working capital 83 Due to change in accounts receivable 84 Due to change in inventories 85 Due to change in accounts payable 08 Due to change in accruals 97 Net cash prouded (used) by operating activities 88 89 Investing Activities 90 Cash used to acquire gross fixed assets 91 Due to change in short-term investments 92 Net cash provided (used) by investing activities 93 5. Einancing Activities 95 Due to change in notes payable Due to change in long-term debt 97 Due to change in common stock 98 Payment of common dividends 99 Net cash provided (used) by financing activities 100 101 Net increase/decrease in cash 102 Add Cash balance at the beginning of the year 100 Cash balance at the end of the year 104 105 Cho balance in statement of cash flows should equal the 105 cash on balance sheets; this value should be zero: 107 108 109 110 $0 50 $0 $0 $70.000 112 Build a Model Type here to search