Answered step by step

Verified Expert Solution

Question

1 Approved Answer

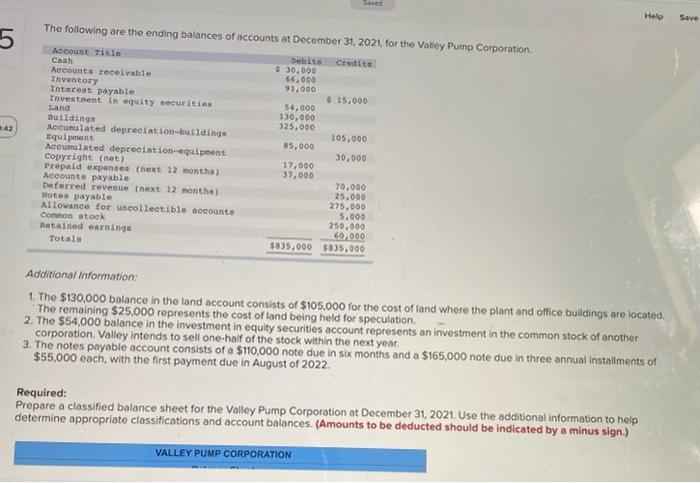

PLEASE HURRY, i dont Have that much time S Helo Save 5 The following are the ending balances of accounts at December 31, 2021, for

PLEASE HURRY, i dont Have that much time

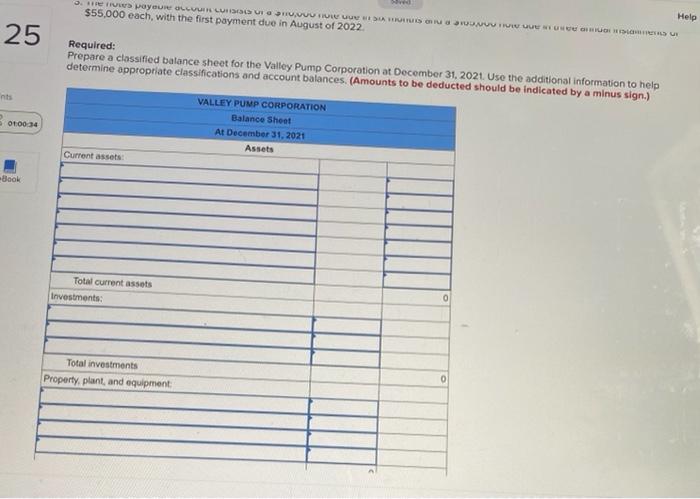

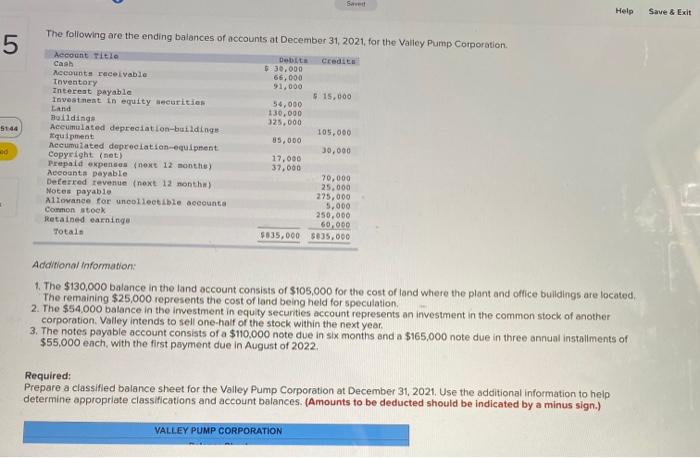

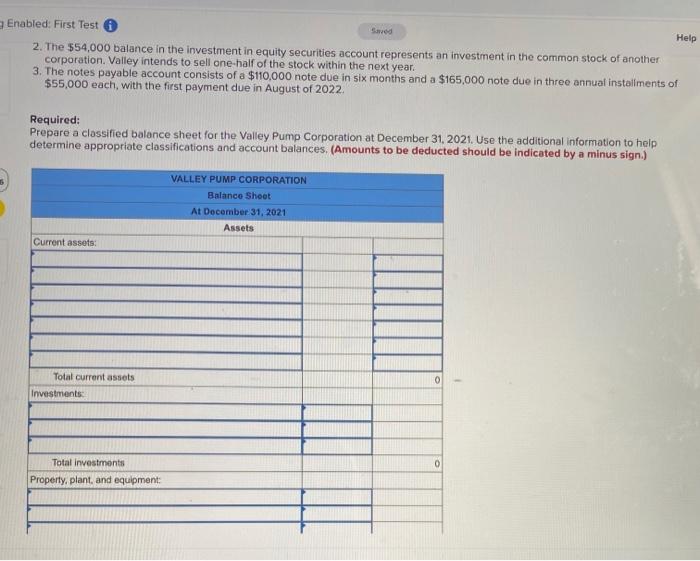

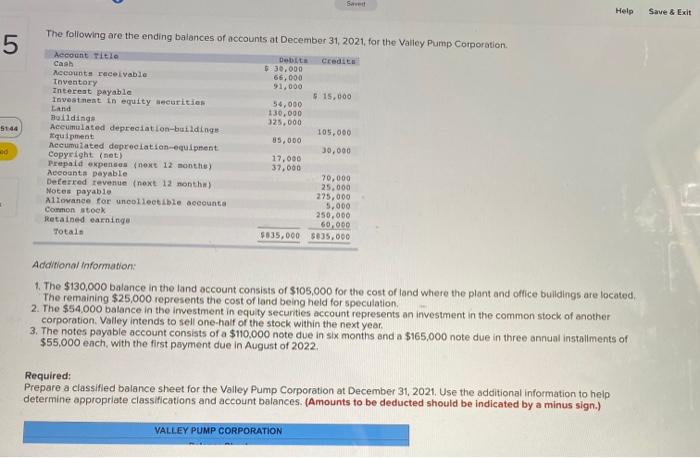

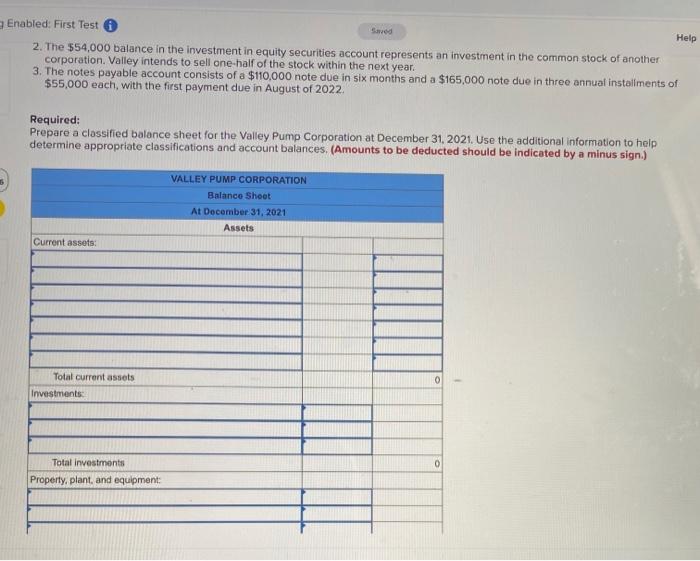

S Helo Save 5 The following are the ending balances of accounts at December 31, 2021, for the Valley Pump Corporation Account Title bebits Credits Cash $ 30.000 Accounts receivable 66,000 Inventory 91.000 Interest payable $15.000 Tavestment in equity securities 54,000 Land 130.000 Buildings 325,000 Mecumulated depreciation-buildings 105,000 Equipment 35,000 Accumulated depreciation equipment 30.000 Copyright (net) 12,000 prepaid expenses (next 12 months) 37.000 Accounts payable 70,000 Deferred revenue (next 12 months) 25,000 Notes payable 275,000 Allowance for uncollectible accounts 5,000 Common stock 250,000 Retained earnings 60.000 Totals 5035,000 5835.000 Additional Information: 1. The $130,000 balance in the land account consists of $105,000 for the cost of tand where the plant and office buildings are located. The remaining $25,000 represents the cost of land being held for speculation 2. The $54,000 balance in the investment in equity securities account represents an investment in the common stock of another corporation Valley intends to sell one-half of the stock within the next year. 3. The notes poyable account consists of a $10,000 note due in six months and a $165,000 note due in three annual installments of $55,000 each with the first payment due in August of 2022. Required: Prepare a classified balance sheet for the Valley Pump Corporation at December 31, 2021. Use the additional information to help determine appropriate classifications and account balances. (Amounts to be deducted should be indicated by a minus sign.) VALLEY PUMP CORPORATION w poyeur OCCUERCUS USUARIOS HOGUE $55,000 each, with the first payment due in August of 2022 Help 25 Required: Prepare a classified balance sheet for the Valley Pump Corporation at December 31, 2021. Use the additional information to help determine appropriate classifications and account balances (Amounts to be deducted should be indicated by a minus sign.) nts oto 34 VALLEY PUMP CORPORATION Balance Sheet At December 31, 2021 Assets Current assets Book Total current assets Investments: Total investments Property, plant, and equipment 0 Save Help Save & Exit 5 5144 The following are the ending balances of accounts at December 31, 2021, for the Valley Pump Corporation Account Title Debt Credits Cash $ 30,000 Accounts receivable 66,000 Inventory 91,000 Interest payable $ 15,000 Investment in equity securities 54,000 Land 130.000 Buildings 325,000 Accumulated depreciation-buildings 105.000 Aquipment 85.000 Accumulated depreciation equipment 30.000 Copyright (net) 17.000 Prepaid expenses next 12 months 37,000 Accounts payable 70,000 Deferred revenue next 12 months) 25.000 Notes payable 275,000 Allowance for uncollectible account 5.000 Common stock 250.000 Retained earning 60.000 Total $$35,000 35.000 Additional Information: 1. The $130,000 balance in the land account consists of $105,000 for the cost of tand where the plant and office buildings are located, The remaining $25,000 represents the cost of land being held for speculation 2. The $54,000 balance in the investment in equity securities account represents an investment in the common stock of another corporation. Valley intends to sell one-half of the stock within the next year. 3. The notes payable account consists of a $110.000 note due in six months and a $165.000 note due in three annual installments of $55,000 each with the first payment due in August of 2022. Required: Prepare a classified balance sheet for the Valley Pump Corporation at December 31, 2021. Use the additional information to help determine appropriate classifications and account balances. (Amounts to be deducted should be indicated by a minus sign.) VALLEY PUMP CORPORATION Swed Help Enabled: First Test 2. The $54,000 balance in the investment in equity securities account represents an investment in the common stock of another corporation. Valley intends to sell one-half of the stock within the next year. 3. The notes payable account consists of a $110,000 note due in six months and a $165,000 note due in three annual installments of $55,000 each with the first payment due in August of 2022 Required: Prepare a classified balance sheet for the Valley Pump Corporation at December 31, 2021. Use the additional information to help determine appropriate classifications and account balances. (Amounts to be deducted should be indicated by a minus sign.) VALLEY PUMP CORPORATION Balance Sheet At December 31, 2021 Assets Current assets: O Total current assets Investments 0 Total investments Property, plantand equipment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started