Answered step by step

Verified Expert Solution

Question

1 Approved Answer

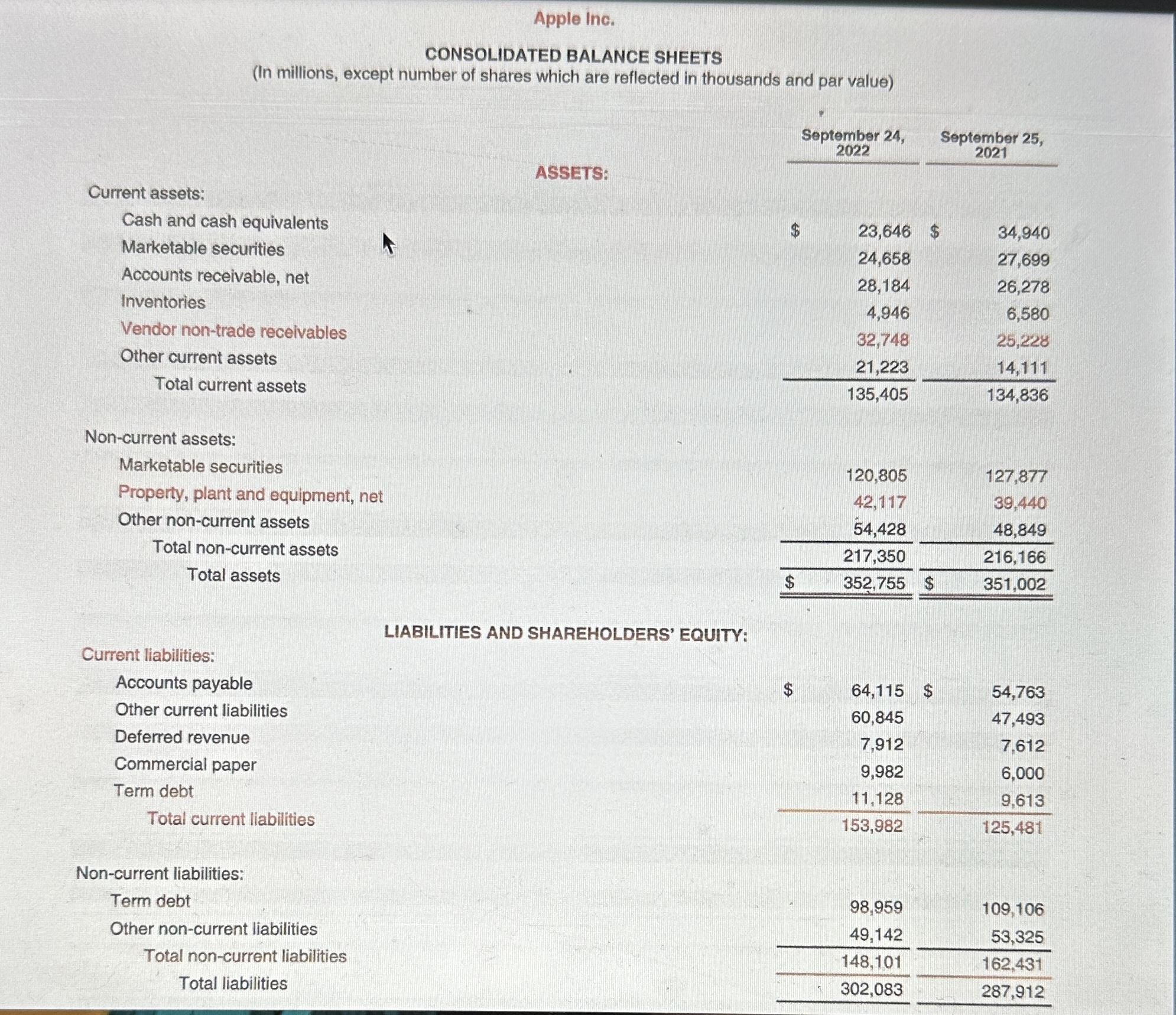

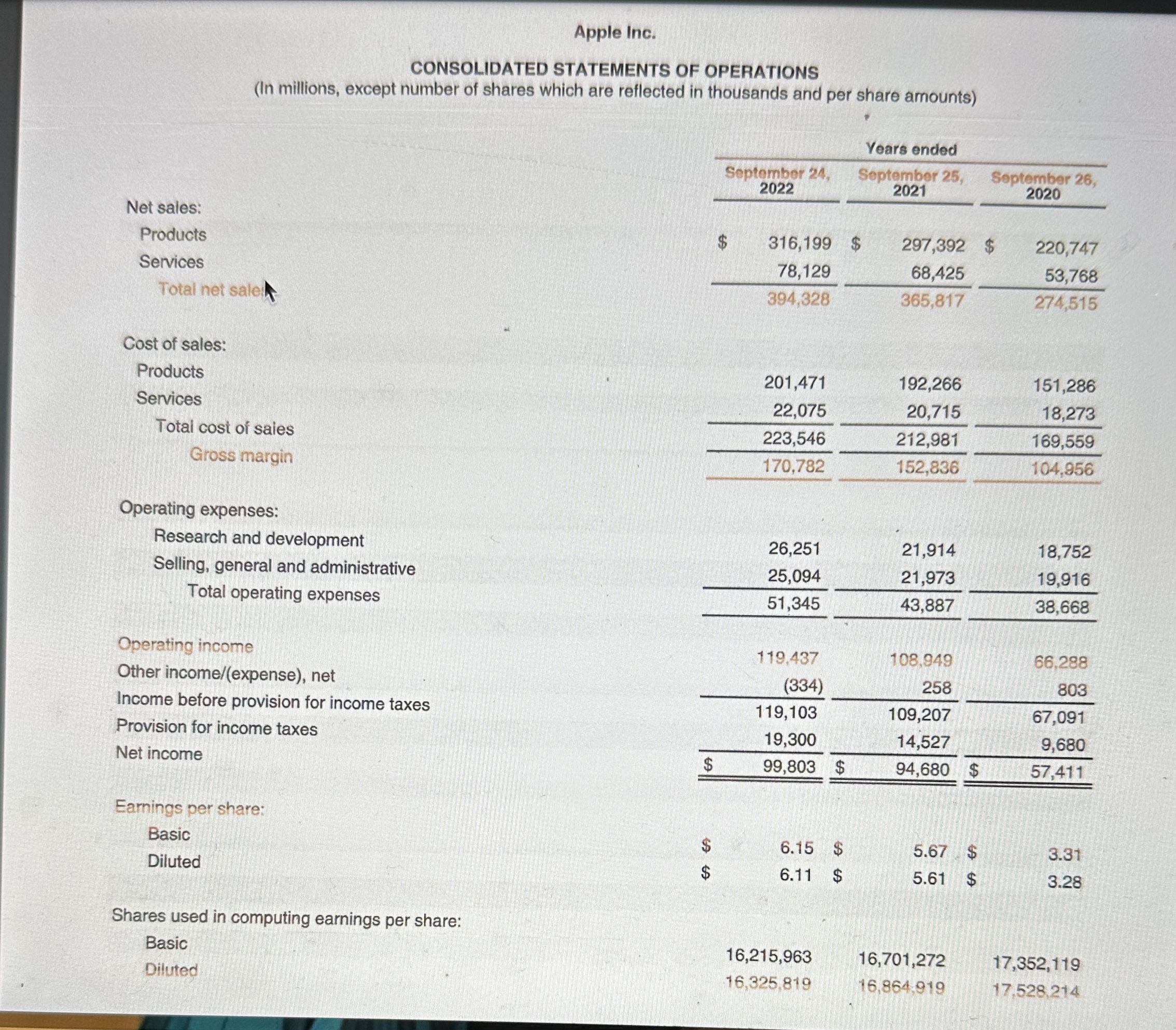

please hurry I have only 1 hour please hurry Summary: Your superior asks you to analyze Apple's financial condition (liquidity, efficiency, solvency, profitability) based on

please hurry I have only 1 hour please hurry

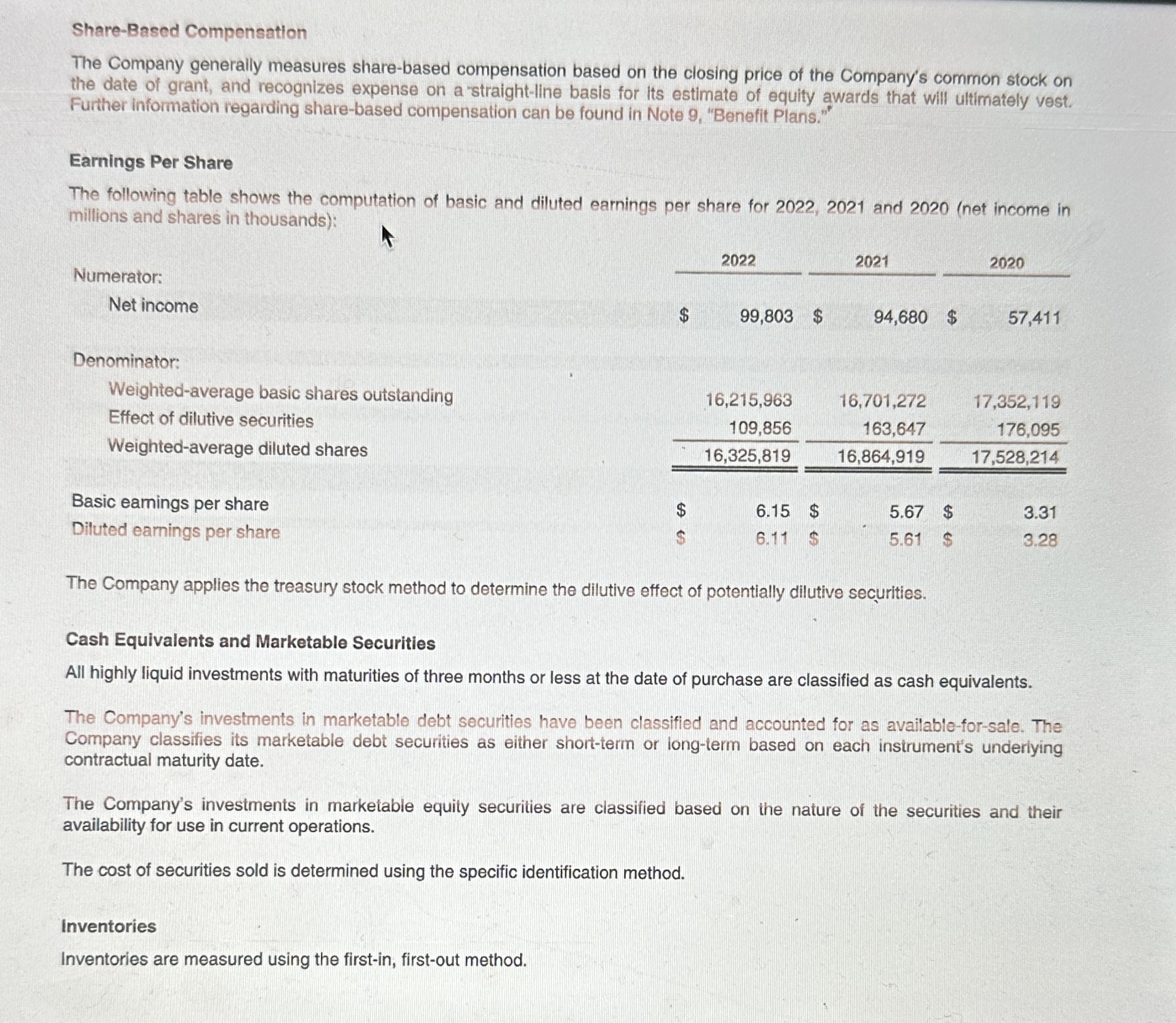

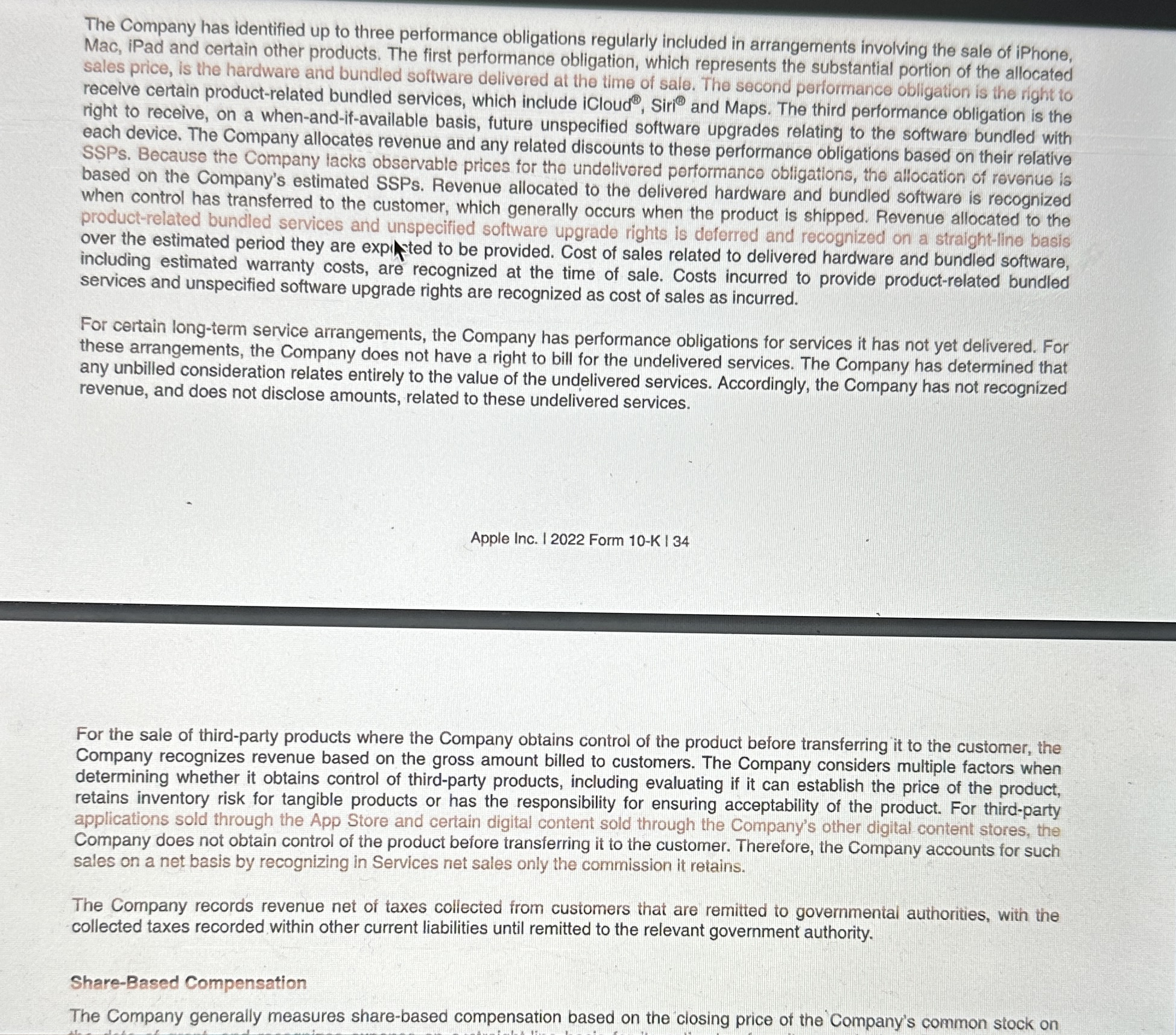

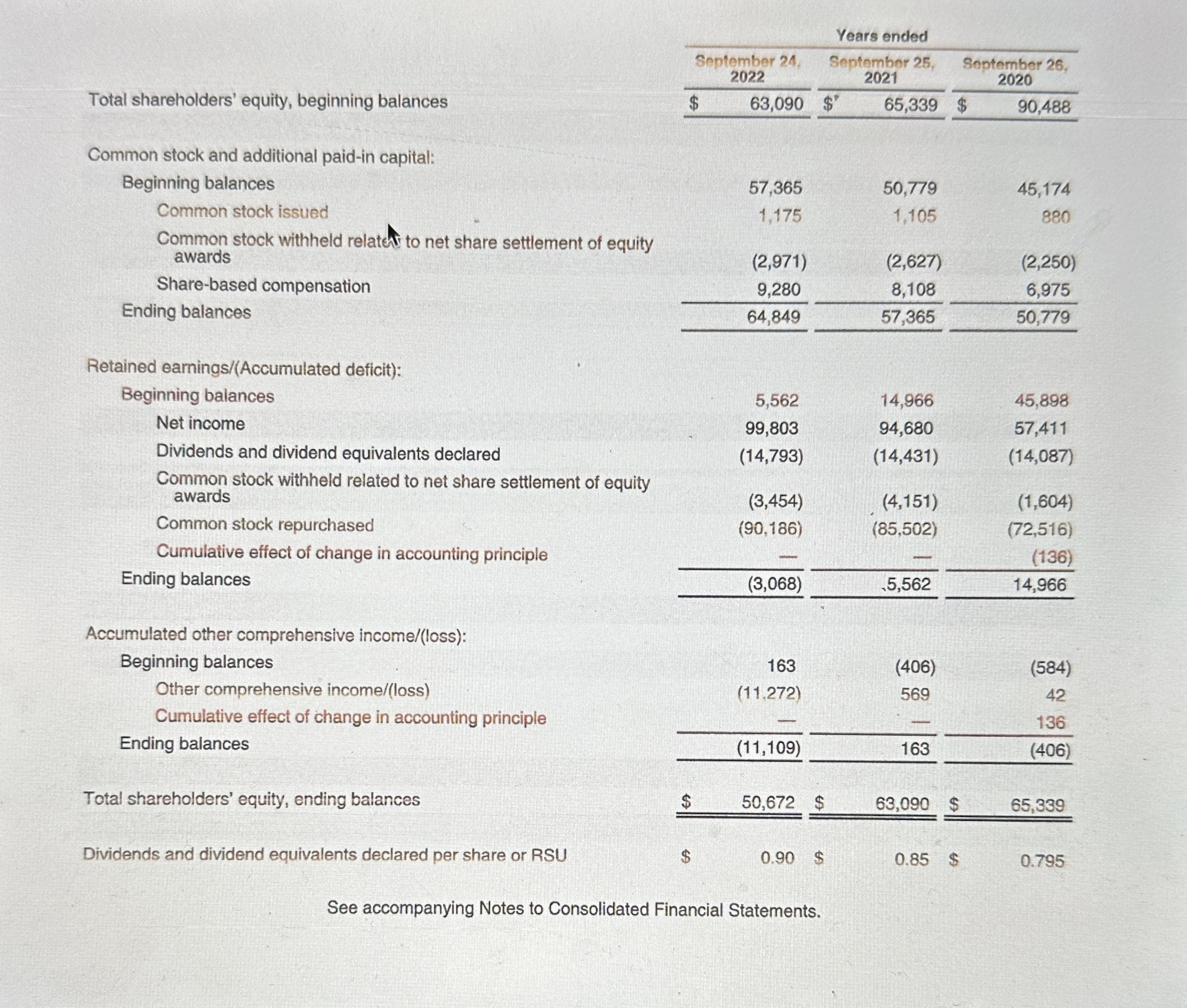

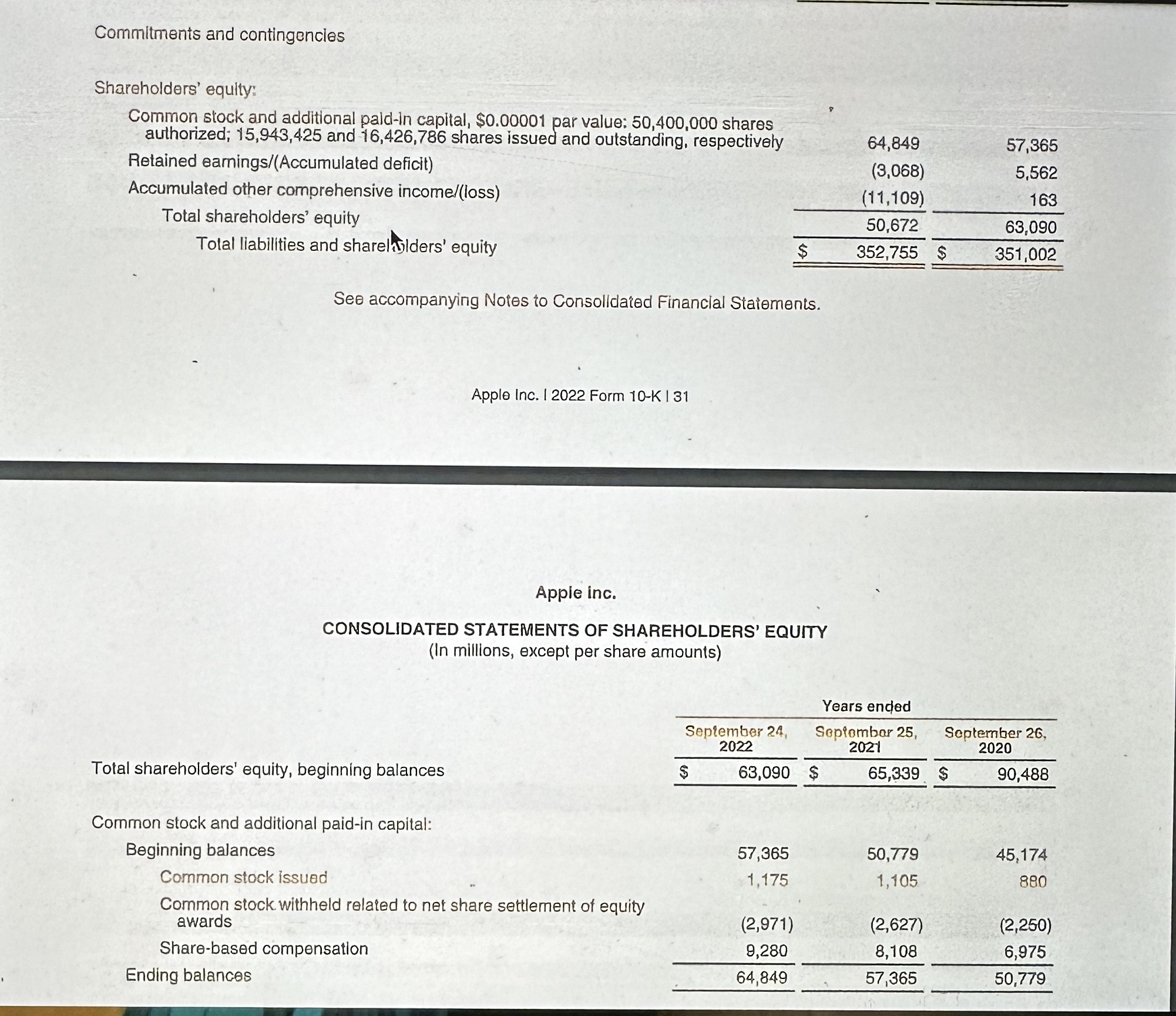

Summary: Your superior asks you to analyze Apple's financial condition (liquidity, efficiency, solvency, profitability) based on the financial statements and ratios oresented in this case. Would you recommend it as a worthy investment (yes or no)? Support your opinion using five answers from questions \#29 36 above. Your response should be at least 56 sentences. Market Price, Dividend Yield \& Price-Earnings Ratios (pages 504-505) a. What is the current market price of the stock? (Give the date that you found this price). (This is not in the financial statements provided.) It is noted on Apple's website or go to www.yahoofinance.com to get the quote. The ticker symbol for Apple is AAPL. b. Calculate the Dividend Yield. (SHOW YOUR WORK. Calculate ratio to three decimal places.) c. Calculate the Price-Earnings Ratio. Use Basic Earnings Per Share. (SHOW YOUR WORK. Calculate ratio to three decimal places.) d, If analysts give a range of higher than 2025 for a stock to be considered overpriced and less than 58 for a stock to be considered underpriced, how is Apple doing? Debt-to-Equity Ratio: (text book pages 502-503, 505) a. Calculate the Debt-to-Equity ratio. (SHOW YOUR WORK. Calculate ratio to three decimal places.) b. What does this ratio tell you about Apple's capital structure and risk? Debt Ratio: (text book pages 502-503, 505) a. Calculate the Debt ratio. (SHOW YOUR WORK. Calculate ratio to three decimal places.) b. What does this ratio tell you about Apple's risk? Total Asset Turnover (text book pages 502, 505) Calculate the Total Asset Turnover ratio. (SHOW YOUR WORK. Calculate ratio to three decimal places.) Inventory Turnover and Days' Sales in Inventory (text book pages 501-502, 505) Use Total Cost of Sales for Cost of Goods Sold. a. Calculate the Inventory Turnover ratio. (SHOW YOUR WORK. Calculate ratio to three decimal places.) b. Calculate the Days' Sales in Inventory ratio. (SHOW YOUR WORK. Calculate ratio to three decimal places.) Does this ratio appear favorable or unfavorable? Why? Accounts Receivable Turnover and Days' Sales Uncollected (text book pages 501-502, 505) a. Calculate the Accounts Receivable Turnover ratio. (SHOW YOUR WORK. Calculate ratio to three decimal places.) b. Calculate the Days' Sales Uncollected ratio. (SHOW YOUR WORK. Calculate ratio to three decimal places.) Does this ratio appear favorable or unfavorable? Why? Share-Based Compensation The Company generally measures share-based compensation based on the closing price of the Company's common stock on the date of grant, and recognizes expense on a 'straight-line basis for its estimate of equity awards that will ultimately vest. Further information regarding share-based compensation can be found in Note 9, "Benefit Plans." Earnings Per Share The following table shows the computation of basic and diluted earnings per share for 2022,2021 and 2020 (net income in millions and shares in thousands): The Company applies the treasury stock method to determine the dilutive effect of potentially dilutive securities. Cash Equivalents and Marketable Securities All highly liquid investments with maturities of three months or less at the date of purchase are classified as cash equivalents. The Company's investments in marketable debt securities have been classified and accounted for as available-for-sale. The Company classifies its marketable debt securities as either short-term or long-term based on each instrument's underlying contractual maturity date. The Company's investments in marketable equity securities are classified based on the nature of the securities and their availability for use in current operations. The cost of securities sold is determined using the specific identification method. inventories Inventories are measured using the first-in, first-out method. The Company has identified up to three performance obligations regularly included in arrangements involving the sale of iPhone, Mac, iPad and certain other products. The first performance obligation, which represents the substantial portion of the allocated sales price, is the hardware and bundled software delivered at the time of sale. The second performance obligation is the right to receive certain product-related bundled services, which include iCloud ,Sir and Maps. The third performance obligation is the right to receive, on a when-and-if-available basis, future unspecified software upgrades relating to the software bundled with each device. The Company allocates revenue and any related discounts to these performance obligations based on their relative SSPs. Because the Company lacks observable prices for the undelivered performanco obligations, the allocation of revenue is based on the Company's estimated SSPs. Revenue allocated to the delivered hardware and bundled software is recognized when control has transferred to the customer, which generally occurs when the product is shipped. Revenue allocated to the product-related bundled services and unspecified software upgrade rights is deferred and recognized on a straight-line basis over the estimated period they are expinted to be provided. Cost of sales related to delivered hardware and bundled software, including estimated warranty costs, are recognized at the time of sale. Costs incurred to provide product-related bundled services and unspecified software upgrade rights are recognized as cost of sales as incurred. For certain long-term service arrangements, the Company has performance obligations for services it has not yet delivered. For these arrangements, the Company does not have a right to bill for the undelivered services. The Company has determined that any unbilled consideration relates entirely to the value of the undelivered services. Accordingly, the Company has not recognized revenue, and does not disclose amounts, related to these undelivered services. Apple Inc. 12022 Form 10-K I 34 For the sale of third-party products where the Company obtains control of the product before transferring it to the customer, the Company recognizes revenue based on the gross amount billed to customers. The Company considers multiple factors when determining whether it obtains control of third-party products, including evaluating if it can establish the price of the product, retains inventory risk for tangible products or has the responsibility for ensuring acceptability of the product. For third-party applications sold through the App Store and certain digital content sold through the Company's other digital content stores, the Company does not obtain control of the product before transferring it to the customer. Therefore, the Company accounts for such sales on a net basis by recognizing in Services net sales only the commission it retains. The Company records revenue net of taxes collected from customers that are remitted to governmental authorities, with the collected taxes recorded within other current liabilities until remitted to the relevant government authority. Share-Based Compensation The Company generally measures share-based compensation based on the closing price of the Company's common stock on Total shareholders' equity, beginning balances Common stock and additional paid-in capital: \begin{tabular}{lrrr} Beginning balances & 57,365 & 50,779 & 45,174 \\ Common stock issued & 1,175 & 1,105 & 880 \\ Common stock withheld relathr to net share settlement of equity & & \\ awards & (2,971) & (2,627) & (2,250) \\ Share-based compensation & 9,280 & 8,108 & 6,975 \\ \hline Ending balances & 64,849 & 57,365 \\ \hline \end{tabular} Retained earnings/(Accumulated deficit): Beginning balances Net income Dividends and dividend equivalents declared Common stock withheld related to net share settlement of equity awards Common stock repurchased Cumulative effect of change in accounting principle Ending balances Accumulated other comprehensive income/(loss): Beginning balances Other comprehensive income/(loss) Cumulative effect of change in accounting principle Ending balances \begin{tabular}{rcc} 163 & (406) & (584) \\ (11.272) & 569 & 42 \\ - & - & 136 \\ \hline(11,109) \\ \hline \end{tabular} Total shareholders' equity, ending balances \( \stackrel{\$ \quad 50,672}{=} \stackrel{\$ \quad 63,090}{=} \stackrel{\$ \quad 65,339}{\hline} \) Dividends and dividend equivalents declared per share or RSU See accompanying Notes to Consolidated Financial Statements. See accompanying Noies to Consolldaied Financlal Staiements. Apple Inc. I 2022 Form 10-K | 31 Appie inc. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (In millions, except per share amounts) CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except number of shares which are reflected in thousands and per share amounts) Net sales: Cost of sales: Products Services Total cost of saies Gross margin Operating expenses: Research and development Selling, general and administrative Total operating expenses \begin{tabular}{rrr} 26,251 & 21,914 & 18,752 \\ 25,094 \\ \hline 51,345 \\ \hline \end{tabular} Other income/(expense), net Income before provision for income taxes Provision for income taxes Net income Earnings per share: Basic Diluted Shares used in computing earnings per share: Basic Diluted 16,215,96316,325,81916,701,27216,864,91917,352,11917,528,214 Summary: Your superior asks you to analyze Apple's financial condition (liquidity, efficiency, solvency, profitability) based on the financial statements and ratios oresented in this case. Would you recommend it as a worthy investment (yes or no)? Support your opinion using five answers from questions \#29 36 above. Your response should be at least 56 sentences. Market Price, Dividend Yield \& Price-Earnings Ratios (pages 504-505) a. What is the current market price of the stock? (Give the date that you found this price). (This is not in the financial statements provided.) It is noted on Apple's website or go to www.yahoofinance.com to get the quote. The ticker symbol for Apple is AAPL. b. Calculate the Dividend Yield. (SHOW YOUR WORK. Calculate ratio to three decimal places.) c. Calculate the Price-Earnings Ratio. Use Basic Earnings Per Share. (SHOW YOUR WORK. Calculate ratio to three decimal places.) d, If analysts give a range of higher than 2025 for a stock to be considered overpriced and less than 58 for a stock to be considered underpriced, how is Apple doing? Debt-to-Equity Ratio: (text book pages 502-503, 505) a. Calculate the Debt-to-Equity ratio. (SHOW YOUR WORK. Calculate ratio to three decimal places.) b. What does this ratio tell you about Apple's capital structure and risk? Debt Ratio: (text book pages 502-503, 505) a. Calculate the Debt ratio. (SHOW YOUR WORK. Calculate ratio to three decimal places.) b. What does this ratio tell you about Apple's risk? Total Asset Turnover (text book pages 502, 505) Calculate the Total Asset Turnover ratio. (SHOW YOUR WORK. Calculate ratio to three decimal places.) Inventory Turnover and Days' Sales in Inventory (text book pages 501-502, 505) Use Total Cost of Sales for Cost of Goods Sold. a. Calculate the Inventory Turnover ratio. (SHOW YOUR WORK. Calculate ratio to three decimal places.) b. Calculate the Days' Sales in Inventory ratio. (SHOW YOUR WORK. Calculate ratio to three decimal places.) Does this ratio appear favorable or unfavorable? Why? Accounts Receivable Turnover and Days' Sales Uncollected (text book pages 501-502, 505) a. Calculate the Accounts Receivable Turnover ratio. (SHOW YOUR WORK. Calculate ratio to three decimal places.) b. Calculate the Days' Sales Uncollected ratio. (SHOW YOUR WORK. Calculate ratio to three decimal places.) Does this ratio appear favorable or unfavorable? Why? Share-Based Compensation The Company generally measures share-based compensation based on the closing price of the Company's common stock on the date of grant, and recognizes expense on a 'straight-line basis for its estimate of equity awards that will ultimately vest. Further information regarding share-based compensation can be found in Note 9, "Benefit Plans." Earnings Per Share The following table shows the computation of basic and diluted earnings per share for 2022,2021 and 2020 (net income in millions and shares in thousands): The Company applies the treasury stock method to determine the dilutive effect of potentially dilutive securities. Cash Equivalents and Marketable Securities All highly liquid investments with maturities of three months or less at the date of purchase are classified as cash equivalents. The Company's investments in marketable debt securities have been classified and accounted for as available-for-sale. The Company classifies its marketable debt securities as either short-term or long-term based on each instrument's underlying contractual maturity date. The Company's investments in marketable equity securities are classified based on the nature of the securities and their availability for use in current operations. The cost of securities sold is determined using the specific identification method. inventories Inventories are measured using the first-in, first-out method. The Company has identified up to three performance obligations regularly included in arrangements involving the sale of iPhone, Mac, iPad and certain other products. The first performance obligation, which represents the substantial portion of the allocated sales price, is the hardware and bundled software delivered at the time of sale. The second performance obligation is the right to receive certain product-related bundled services, which include iCloud ,Sir and Maps. The third performance obligation is the right to receive, on a when-and-if-available basis, future unspecified software upgrades relating to the software bundled with each device. The Company allocates revenue and any related discounts to these performance obligations based on their relative SSPs. Because the Company lacks observable prices for the undelivered performanco obligations, the allocation of revenue is based on the Company's estimated SSPs. Revenue allocated to the delivered hardware and bundled software is recognized when control has transferred to the customer, which generally occurs when the product is shipped. Revenue allocated to the product-related bundled services and unspecified software upgrade rights is deferred and recognized on a straight-line basis over the estimated period they are expinted to be provided. Cost of sales related to delivered hardware and bundled software, including estimated warranty costs, are recognized at the time of sale. Costs incurred to provide product-related bundled services and unspecified software upgrade rights are recognized as cost of sales as incurred. For certain long-term service arrangements, the Company has performance obligations for services it has not yet delivered. For these arrangements, the Company does not have a right to bill for the undelivered services. The Company has determined that any unbilled consideration relates entirely to the value of the undelivered services. Accordingly, the Company has not recognized revenue, and does not disclose amounts, related to these undelivered services. Apple Inc. 12022 Form 10-K I 34 For the sale of third-party products where the Company obtains control of the product before transferring it to the customer, the Company recognizes revenue based on the gross amount billed to customers. The Company considers multiple factors when determining whether it obtains control of third-party products, including evaluating if it can establish the price of the product, retains inventory risk for tangible products or has the responsibility for ensuring acceptability of the product. For third-party applications sold through the App Store and certain digital content sold through the Company's other digital content stores, the Company does not obtain control of the product before transferring it to the customer. Therefore, the Company accounts for such sales on a net basis by recognizing in Services net sales only the commission it retains. The Company records revenue net of taxes collected from customers that are remitted to governmental authorities, with the collected taxes recorded within other current liabilities until remitted to the relevant government authority. Share-Based Compensation The Company generally measures share-based compensation based on the closing price of the Company's common stock on Total shareholders' equity, beginning balances Common stock and additional paid-in capital: \begin{tabular}{lrrr} Beginning balances & 57,365 & 50,779 & 45,174 \\ Common stock issued & 1,175 & 1,105 & 880 \\ Common stock withheld relathr to net share settlement of equity & & \\ awards & (2,971) & (2,627) & (2,250) \\ Share-based compensation & 9,280 & 8,108 & 6,975 \\ \hline Ending balances & 64,849 & 57,365 \\ \hline \end{tabular} Retained earnings/(Accumulated deficit): Beginning balances Net income Dividends and dividend equivalents declared Common stock withheld related to net share settlement of equity awards Common stock repurchased Cumulative effect of change in accounting principle Ending balances Accumulated other comprehensive income/(loss): Beginning balances Other comprehensive income/(loss) Cumulative effect of change in accounting principle Ending balances \begin{tabular}{rcc} 163 & (406) & (584) \\ (11.272) & 569 & 42 \\ - & - & 136 \\ \hline(11,109) \\ \hline \end{tabular} Total shareholders' equity, ending balances \( \stackrel{\$ \quad 50,672}{=} \stackrel{\$ \quad 63,090}{=} \stackrel{\$ \quad 65,339}{\hline} \) Dividends and dividend equivalents declared per share or RSU See accompanying Notes to Consolidated Financial Statements. See accompanying Noies to Consolldaied Financlal Staiements. Apple Inc. I 2022 Form 10-K | 31 Appie inc. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (In millions, except per share amounts) CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except number of shares which are reflected in thousands and per share amounts) Net sales: Cost of sales: Products Services Total cost of saies Gross margin Operating expenses: Research and development Selling, general and administrative Total operating expenses \begin{tabular}{rrr} 26,251 & 21,914 & 18,752 \\ 25,094 \\ \hline 51,345 \\ \hline \end{tabular} Other income/(expense), net Income before provision for income taxes Provision for income taxes Net income Earnings per share: Basic Diluted Shares used in computing earnings per share: Basic Diluted 16,215,96316,325,81916,701,27216,864,91917,352,11917,528,214 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started