Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please hurry Mark contributed $7,000 a year for 2005 to 2019 to a spousal RRSP. In 2022 , he and his spouse divorced and she

please hurry

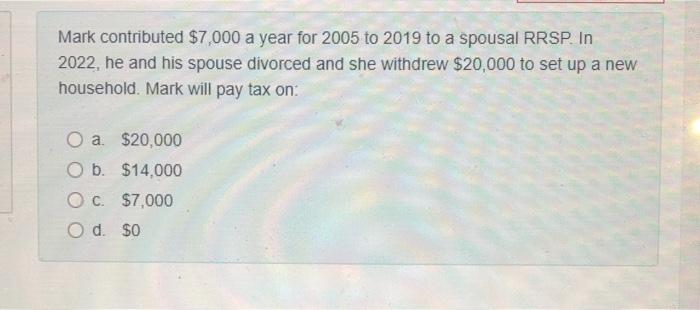

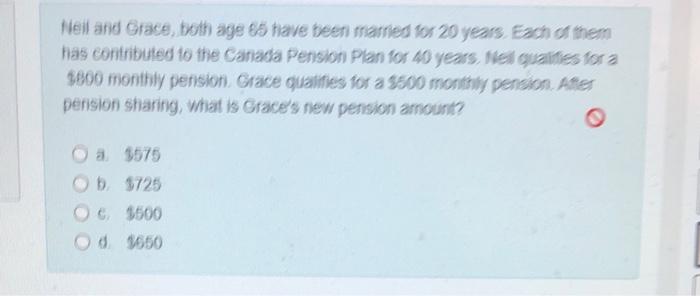

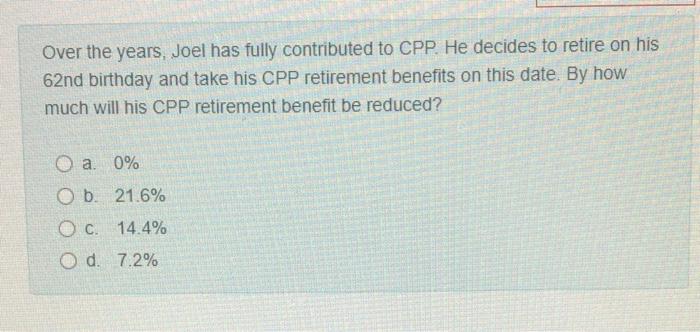

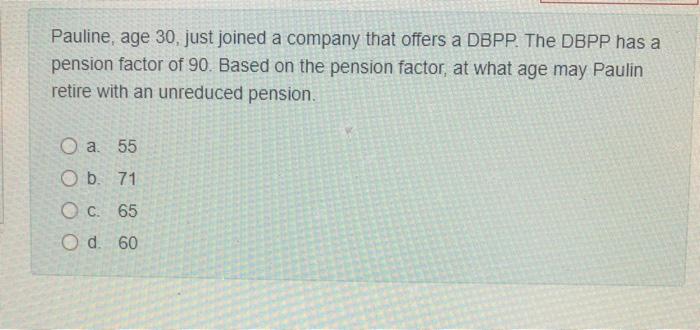

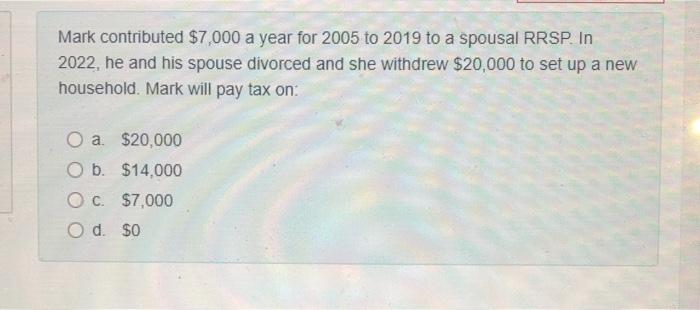

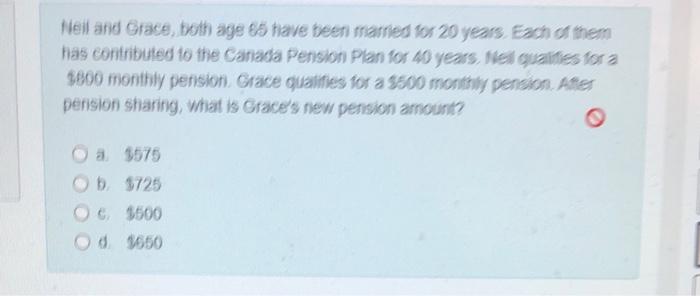

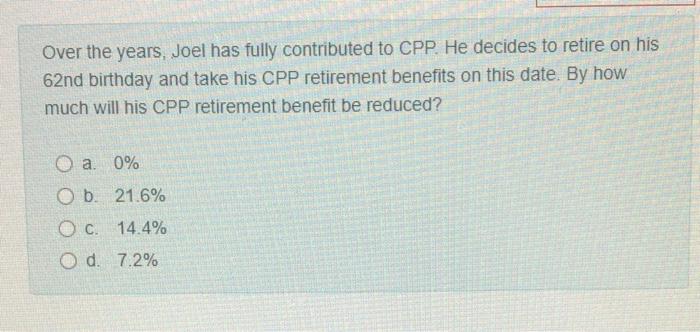

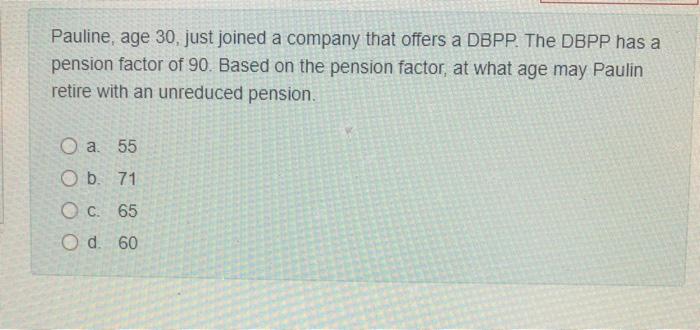

Mark contributed $7,000 a year for 2005 to 2019 to a spousal RRSP. In 2022 , he and his spouse divorced and she withdrew $20,000 to set up a new household. Mark will pay tax on: a. $20,000 b. $14,000 c. $7,000 d. $0 Heil and Grace, both age 65 have been mamed tor 20 years. Each of them has contributed to the Canada Pension Plan for 40 years. Niel qualifies for a 8800 monthily pension. Gace qualifies for a 8500 monthly penaion. Afer pension sharing, what is Grace's new pension amount? a. 3575 b. 3725 c. 8500 d 1650 Over the years, Joel has fully contributed to CPP. He decides to retire on his 62 nd birthday and take his CPP retirement benefits on this date. By how much will his CPP retirement benefit be reduced? a. 0% b. 21.6% C. 14.4% d. 7.2% Pauline, age 30 , just joined a company that offers a DBPP. The DBPP has a pension factor of 90 . Based on the pension factor, at what age may Paulin retire with an unreduced pension. a. 55 b. 71 C. 65 d. 60

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started