Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please hurry there are 8 answers for this question PART B (17 marks) Marcia, age 56 , is starting to think about retirement. She plans

please hurry there are 8 answers for this question

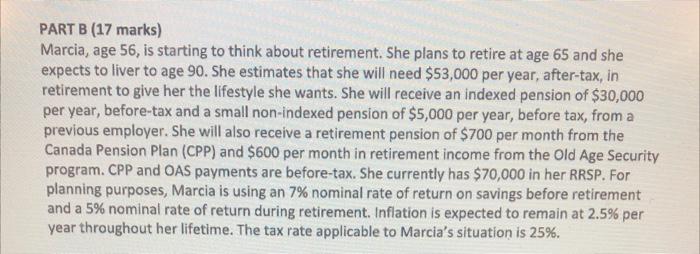

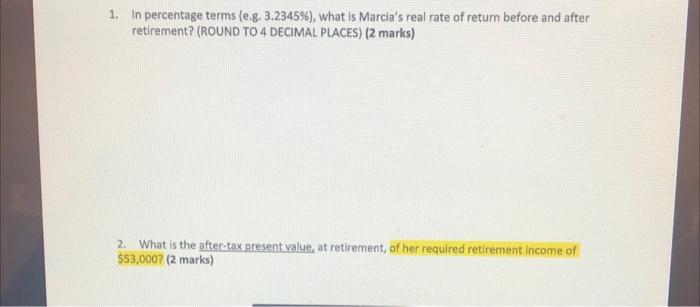

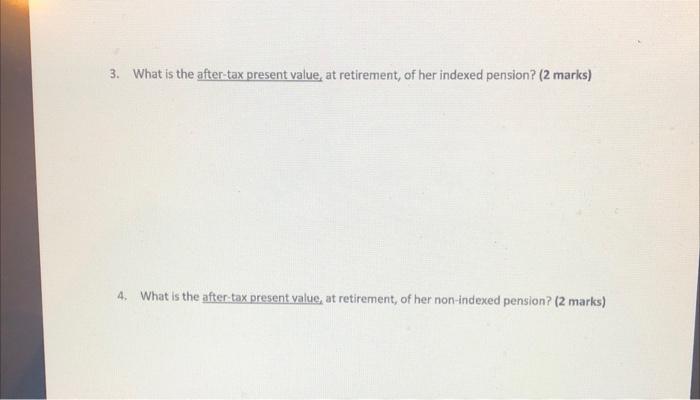

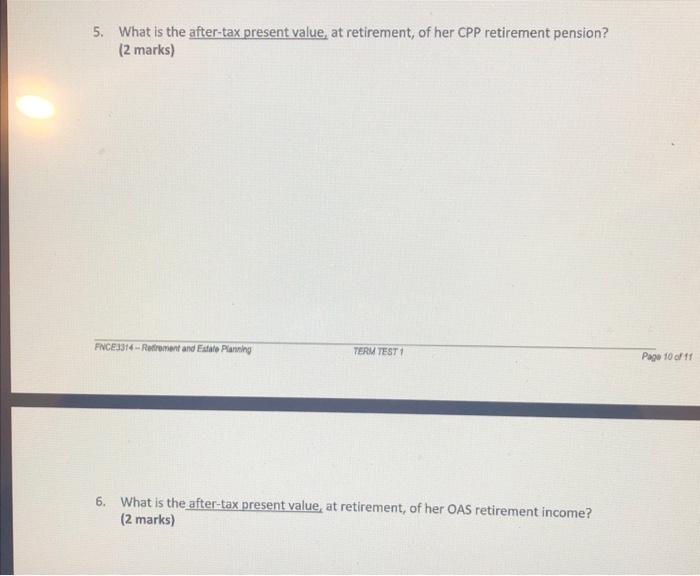

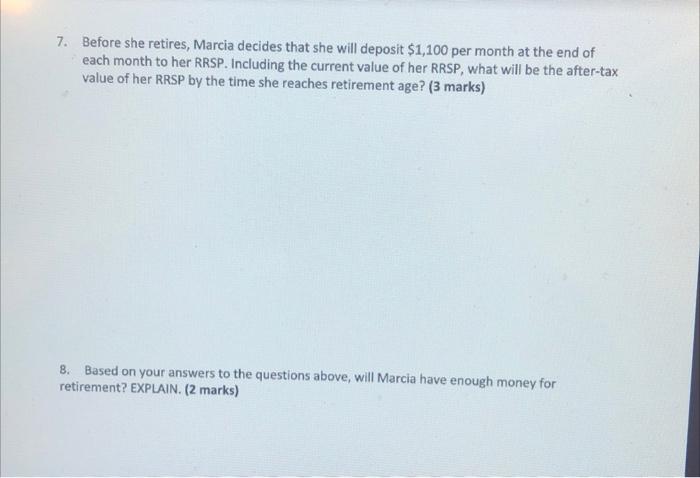

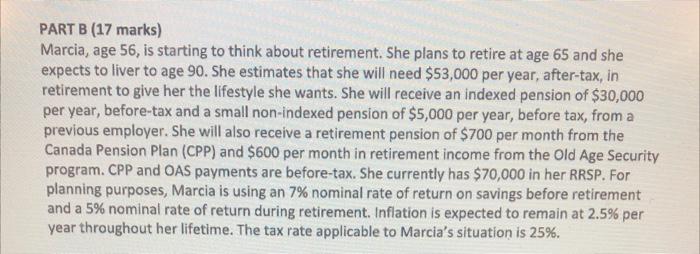

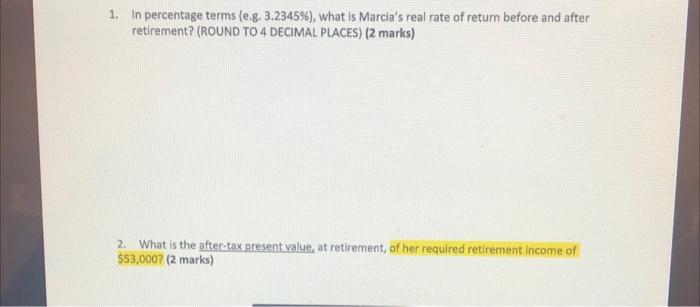

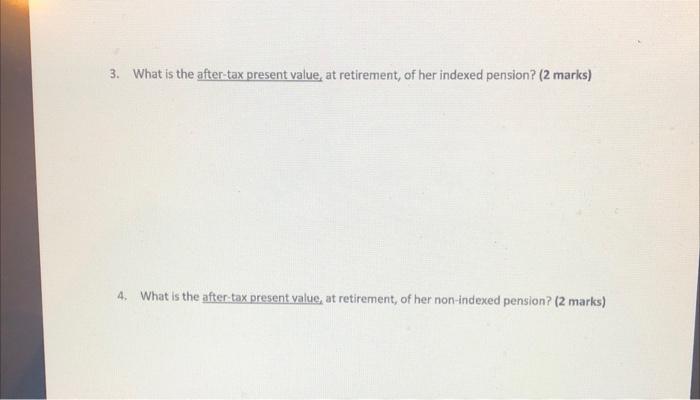

PART B (17 marks) Marcia, age 56 , is starting to think about retirement. She plans to retire at age 65 and she expects to liver to age 90 . She estimates that she will need $53,000 per year, after-tax, in retirement to give her the lifestyle she wants. She will receive an indexed pension of $30,000 per year, before-tax and a small non-indexed pension of $5,000 per year, before tax, from a previous employer. She will also receive a retirement pension of $700 per month from the Canada Pension Plan (CPP) and $600 per month in retirement income from the Old Age Security program. CPP and OAS payments are before-tax. She currently has $70,000 in her RRSP. For planning purposes, Marcia is using an 7% nominal rate of return on savings before retirement and a 5% nominal rate of return during retirement. Inflation is expected to remain at 2.5% per year throughout her lifetime. The tax rate applicable to Marcia's situation is 25%. 1. In percentage terms (e.g. 3,2345\%), what is Marcia's real rate of return before and after retirement? (ROUND TO 4 DECIMAL PLACES) (2 marks) 2. What is the after-tax present value, at retirement, of her required retirement income of $53,000 ? (2 marks) 3. What is the after-tax present value, at retirement, of her indexed pension? ( 2 marks) 4. What is the after-tax present value, at retirement, of her non-indexed pension? (2 marks) 5. What is the after-tax present value, at retirement, of her CPP retirement pension? ( 2 marks) FNCE3314 - Redirement and Eitale Planing TERM TESTI 6. What is the after-tax present value, at retirement, of her OAS retirement income? (2 marks) 7. Before she retires, Marcia decides that she will deposit $1,100 per month at the end of each month to her RRSP. Including the current value of her RRSP, what will be the after-tax value of her RRSP by the time she reaches retirement age? ( 3 marks) 8. Based on your answers to the questions above, will Marcia have enough money for retirement? EXPLAIN. (2 marks) PART B (17 marks) Marcia, age 56 , is starting to think about retirement. She plans to retire at age 65 and she expects to liver to age 90 . She estimates that she will need $53,000 per year, after-tax, in retirement to give her the lifestyle she wants. She will receive an indexed pension of $30,000 per year, before-tax and a small non-indexed pension of $5,000 per year, before tax, from a previous employer. She will also receive a retirement pension of $700 per month from the Canada Pension Plan (CPP) and $600 per month in retirement income from the Old Age Security program. CPP and OAS payments are before-tax. She currently has $70,000 in her RRSP. For planning purposes, Marcia is using an 7% nominal rate of return on savings before retirement and a 5% nominal rate of return during retirement. Inflation is expected to remain at 2.5% per year throughout her lifetime. The tax rate applicable to Marcia's situation is 25%. 1. In percentage terms (e.g. 3,2345\%), what is Marcia's real rate of return before and after retirement? (ROUND TO 4 DECIMAL PLACES) (2 marks) 2. What is the after-tax present value, at retirement, of her required retirement income of $53,000 ? (2 marks) 3. What is the after-tax present value, at retirement, of her indexed pension? ( 2 marks) 4. What is the after-tax present value, at retirement, of her non-indexed pension? (2 marks) 5. What is the after-tax present value, at retirement, of her CPP retirement pension? ( 2 marks) FNCE3314 - Redirement and Eitale Planing TERM TESTI 6. What is the after-tax present value, at retirement, of her OAS retirement income? (2 marks) 7. Before she retires, Marcia decides that she will deposit $1,100 per month at the end of each month to her RRSP. Including the current value of her RRSP, what will be the after-tax value of her RRSP by the time she reaches retirement age? ( 3 marks) 8. Based on your answers to the questions above, will Marcia have enough money for retirement? EXPLAIN. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started